Nitin AgrawalMoneycontrol Research

Amid weakness in the midcap space due to uncertainty over outcome of the Karnataka election, stellar earnings of some not so well known names may have missed investor attention. We feel these companies should be on investors’ radar.

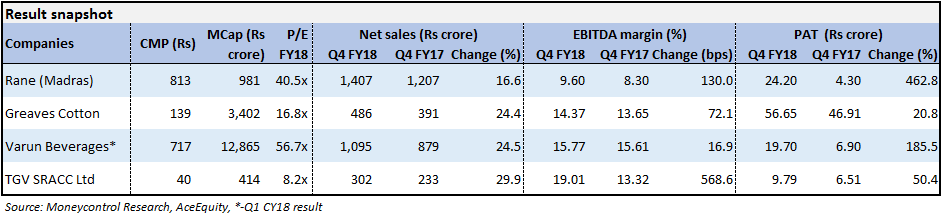

First on the list is Rane (Madras), a manufacturer of steering, suspension products and die casting components. On the back of strong growth from original equipment manufacturers (OEMs) and aftermarket, the company posted a strong set of Q4 FY18 numbers. Net revenue witnessed a year-on-year (YoY) growth of 16.6 percent. Earnings before interest, tax, depreciation and amortisation (EBITDA) registered a significant YoY growth of 130 percent. The strong performance was on the back of robust growth from the steering and linkages business across vehicle segments and castings.

EBITDA margin witnessed a 130bps expansion led by higher volumes. Profit after tax (PAT) grew 462.8 percent YoY on the back of higher other income.

We expect the business to continue to perform well because of robust growth from OEMs and transition to organised players due to GST, which augurs well for aftermarket. The management’s focus on new contracts and turning around of international subsidiaries would also aid business growth going forward.

Next on the list is Greaves Cotton, a leading manufacturer and marketer of petrol and diesel engines and generator and pump sets. It is a dominant player (75 percent market share) in the three-wheeler market and is making inroads in the small commercial vehicle (SCV) segment as well.

In Q4 FY18, the company posted 24 percent YoY growth in net revenue on the back of robust growth from auto and aftermarket segments. This also led to a 33 percent YoY growth in EBITDA. EBITDA margin witnessed a marginal 72.1bps YoY expansion due to lower employee and operating costs which was partially offset by rise in raw material prices. PAT grew 21 percent YoY.

On the back of strong clientele, leadership position in the 3W segment, foray into SCVs and readiness towards upcoming electric vehicles (EV), the company deserves investors’ attention.

Earnings of Varun Beverages, a key player in the beverage industry, also caught our attention. It is the second largest franchisee in the world (outside US) of carbonated soft drinks and non-carbonated beverages sold under trademarks owned by PepsiCo.

The company posted a strong set of numbers in Q1 CY18. Net revenue grew 24.5 percent YoY driven by volume (19.7 percent) and value growth (4.8 percent). Value growth was led by the addition of higher value products such as Sting and Tropicana. EBITDA mirrored topline performance and margin expanded 16.9bps YoY. PAT rose 186.3 percent YoY due to gradual turnaround in loss making foreign subsidiaries.

The company is in a sweet spot on the back of high brand recall of PepsiCo, new product launches, PepsiCo’s focus on health drinks and acquisitions. The company is focusing on strengthening its balance sheet by repaying debt, thereby reducing its interest burden.

Last on our list is TGV SRAAC (erstwhile Sree Rayalaseema Alkalies), a leading producer of chlor-alkali products. The company manufactures castor derivatives and fatty acids. It has an installed capacity of 156,950 mtpa for caustic soda, 23,100 mtpa for potassium hydroxide and 41,250 mtpa for chloromethane.

TGV is riding well on tailwinds from the chlor-alkali industry. It posted a 29.9 percent YoY growth in net sales. EBIDTA margin expanded by a whopping 568.8 bps YoY on the back of a fall in the raw material prices, which was partially offset by a rise in operating and manufacturing expenses and electricity, power and fuel cost. The company’s PAT witnessed a YoY growth of 50.4 percent.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!