Highlights:- Strong jump in realisation drove quarterly earnings - Volume growth moderated further to three percent in Q4 FY19 - Railways haulage charges to remain fixed for FY20 - Dedicated freight corridor to trigger earnings growth --------------------------------------------------

Rail freight transporter Container Corporation of India's (Concor) Q4 FY19 earnings rode piggyback on a healthy growth in realisations across business segments. While headline numbers look optically strong, moderation in volume growth remained a worry as the company reported a second successive quarter of low single-digit volume growth.

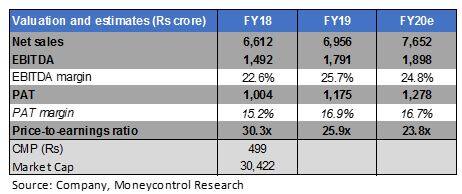

Result highlights - For the quarter-ended March, revenue increased 12 percent year-on-year (YoY) to Rs 1,750 crore. Total revenue was also boosted by SEIS (Service Exports from India Scheme)-related income incentives of Rs 84 crore.

- Adjusted operating margin, excluding SEIS income, for the quarter improved 150 bps YoY to 21.9 percent. Increase in number of double-stack trains, along with decline in empty running charges, was the primary reason for the expansion in operating margin.

- Volume growth softened further to just three percent in Q4, with weakness across business segments. The volume trajectory remained strong during the first half of FY19, but has weakened significantly during the second half of the year, resulting in single-digit volume growth in each of the last two quarters.

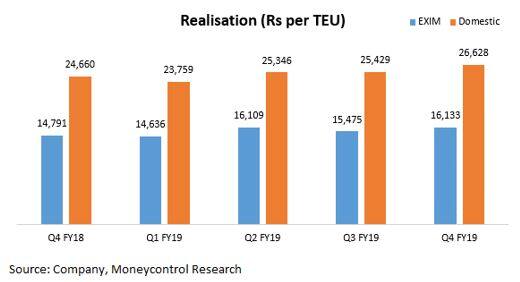

- Overall realisations came in stronger by nine percent in Q4 on the back of a richer business mix, while the costs were lower as the company benefited from Indian Railways’ 25 percent discount offering on empty containers. Lead distance continued to remain stable on a sequential basis.

- Concor is also exploring various opportunities both on the domestic as well as international front to tap into the freight and logistics market and emerge as an integrated container rail solutions provider. The company has recently entered into agreement with JSC RZD Logistics, a Russia-based multi-modal logistics operator, for exploring logistics opportunities in Russia, India and international corridor. The company also initiated coastal shipping operations in Q4 as indicated at the start of the fiscal.

- The management has decided to make an upfront advance freight payments of nearly Rs 3,000 crore to Indian Railways to insulate itself from haulage hikes in FY20 and is now offering fixed tariffs from April to its customers across multiple segments. Through this strategy, the management expects to garner a higher share of freight volumes, but profitability could suffer as the company would need to raise debt to manage cash outflows.

Read: Future Supply Chain: A lucrative investment opportunity

Outlook and recommendation - Uncertainty over outcome of general elections impacted domestic volumes in the quarter gone by. EXIM volume growth tapered due to slackening global trade activity. The near-term outlook appears bleak on concerns of a global slowdown, which might lead to a subdued trade activity internationally and locally.

- For FY19, the company has clocked eight percent volume growth, lower than the management's guidance of 10-12 percent growth. For FY20, it expects a pick-up in domestic activity after the election season and anticipates 10-12 percent volume growth.

- While the business volume needs to be monitored closely, the company appears on a positive progression as the management is taking multiple initiatives to diversify its business by leveraging its core capabilities and entering new business segments through various strategic associations and partnerships.

- In terms of valuation, Concor (CMP: Rs 499; market capitalisation: Rs 30,422 crore) is trading at FY20 estimated price-to-earnings multiple of 24 times. Given the current industry dynamics, any weakness in the stock should be used for building positions in a staggered manner as the commencement of the dedicated freight corridor (expected in FY21/FY22) would be a growth catalyst in the medium to long run.

Read: A shining star from the midcap cement pack

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.