Neha DaveMoneycontrol Research

The current market capitalisation of Indian equities is around $2.3 trillion (Rs 148 trillion). The value of listed firms typically moves in tandem with economic growth. India will be one of the world's growth engines with gross domestic product (GDP) likely to touch $5 trillion (Rs 340 trillion) by 2025, which will reflect in the performance of its stock markets. As per Morgan Stanley, the mcap of Indian equities is likely to hit $6.7 trillion (Rs 456 trillion)by 2027.

Going forward, Indian exchanges will continue to gain scale and depth. BSE will be one of the beneficiary of the growth in equity markets, making the stock worth a consideration.

Exchanges have a unique and durable business model

Volumes traded on a platform forms the backbone of any exchange. By attracting high participation, an exchange is able to offer trade execution at a lower cost, which in turns boost liquidity. The latter is sticky. Hence, liquidity is a virtuous spiral which an exchange aims to achieve and that becomes its key differentiator. Also, liquidity acts as an effective barrier to competition as it can’t be migrated or acquired easily. In addition to high entry barriers, a large portion of the exchange’s revenues are recurring which gives stability even during uncertain times.

After the initial set up, there is no major capex in the lifecycle of the exchange. The latter also enjoys negative working capital in the form of client margin money. The exchange’s business model also offers high operating leverage as higher proportion of operating cost is fixed in nature. Annuity kind of business with high operating leverage and strong cash flows makes exchanges a unique proposition.

Steady traditional businesses

BSE’s product offering is spread across many asset classes: equity for delivery, equity derivatives, currency derivatives, exchange traded funds, mutual funds and debt. However, equity contributes around 95 percent of total revenues.

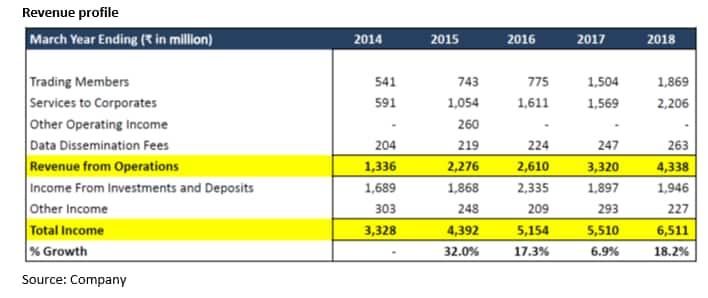

Since the exchange provides a platform for listing and trading of securities, its key revenue stream includes fees from: 1) Services to corporates, and 2) Trading members. In addition to the primary lines of business, it collects fees from data and sale and licensing of information products. Interest income on cash balances is the other major revenue source.

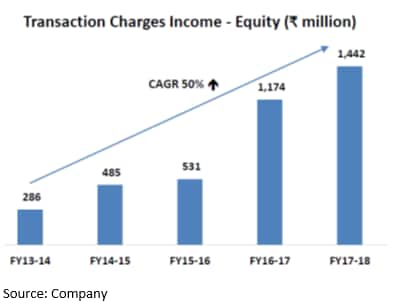

The National Stock Exchange (NSE) continues to be the invincible leader in the equity delivery segment with around 86 percent market share. Despite this fact, BSE’s cash delivery business remains its key revenue driver and has grown at 50 percent CAGR (compounded annual growth rate) in the past four years. This was on the back of a smart pricing strategy adopted by the exchange.

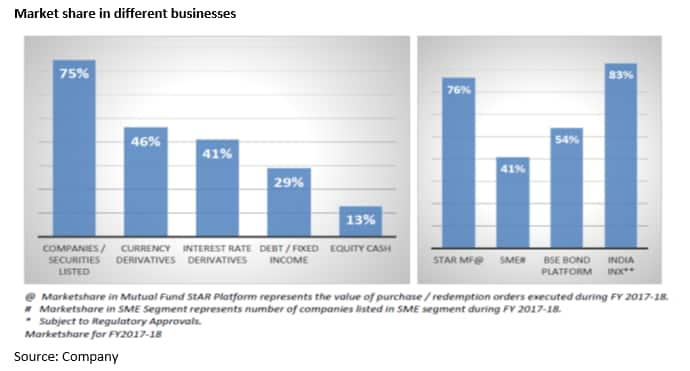

BSE has 5,828 companies listed as at end of March, which is the highest globally. Its immediate peer NSE has around 1,900 listed companies. This means that over 2,000 companies are exclusively listed on the BSE, which gives it a monopoly in terms of pricing on these entities.

The exchange has initiated two pricing actions: 1) Significantly increased transaction charges for exclusive securities, and 2) Recently waived transaction charges on 30 stocks that form part of the Sensex.

The first action of increasing charges has yielded results without adversely impacting volumes as exclusive segment volumes are slightly inelastic to charges. We aren’t too sure of the second action as it may not attract volumes just on lower pricing. While its trading platforms are technologically advanced, the lack of liquidity is a major deterrent. As discussed earlier, liquidity attracts more liquidity and it is difficult to break that pattern.

New businesses gaining traction

The company’s effort to recoup market share in the equities segment has met with little success. However, we are encouraged by its foray into the new segments where it is fast gaining traction. For instance, BSE Star MF, platform for mutual fund distributors (MFDs) to purchase and redeem mutual fund units on behalf of their clients, will start contributing to revenue. Recently, around 32 asset management companies agreed to pay BSE for its platform. Star MF has around 76 percent market share and with increased turnover on this platform, we can expect decent revenue from this platform in FY19.

BSE’s market share in segments other than equity trading is respectable. Except for Star MF, other segments are still in a nascent stage and are not yet contributing to revenues.

What will drive future growth?-

-Mcap has room for improvement as India’s mcap-to-GDP ratio at 90 percent is still below the world average and pre-financial crisis levels of 151 percent. Also, mcap is expected to increase in sync with GDP.

-Retail participation in equities can rise as equity savings in India as a percentage of financial savings at 5 percent is substantially lower than other countries.

-The gradual but steady shift of household savings away from physical to financial assets will increase flows into the MF industry. This in turn will drive activity in the secondary market (trading segment).

-India is among the top investment destination for foreign institutional investors. Continued flows will drive volumes in equities.

-Primary markets are expected to remain vibrant in a conducive liquidity environment, enabling companies to raise funds and list new securities.

We see multiple growth drivers aiding trading volumes, with equities continuing to be a significant component of BSE’s revenues. We are particularly enthused by traction in the small and medium enterprise (SME) listing segment and mutual fund distribution platform. Also, information services (data access fees) generally accounts for 10-25 percent of total revenues for exchanges in developed economies. At present, information services constitute 6 percent of BSE’s operating revenue and can rise with big data implementation.

Valuations reasonable

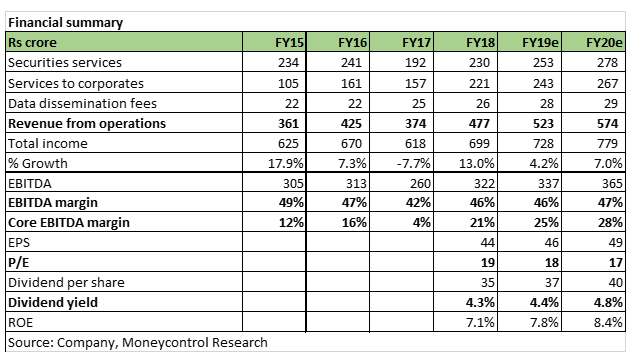

In an oligopolistic market, we see BSE as a beneficiary of buoyant capital market conditions. Despite a being distant second in the equities segment, we expect it to garner substantial revenues as the market size increases and due to its pricing power in the exclusive segment.

BSE enjoys strong financials. Certain revenue streams like listings fees are recurring in nature not impacted by market activity. Since all its major costs are fixed in nature, there can be a huge operating leverage benefit visible in BSE’s earnings as it gains scale and scope with the widening and deepening of capital markets. Increasing revenues, high operating leverage with earnings before interest, tax, depreciation and amortisation (EBITDA) margins of over 40 percent and limited capital needs will translate into strong free cash flows. Large cash flows are expected to be returned to the shareholders by way of higher dividend pay-outs and buybacks.

The stock is currently trading at a price-to-earnings of 18 times FY19e EPS which is reasonable in the light of BSE’s financial strength and future growth levers. The stock offers a value proposition of low risk and high return potential making it a worthy buy.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!