Highlights:

Revenue growth led by better pricing

New capacity of Thionyl Chloride to ramp up in FY20

Better product mix and increasing backward integration positive for margins

Rs 1,200 crore diversification and expansion plan announced

Diversification adds to new avenues of growth; international avenues broaden growth opportunities

Dye major Bodal Chemicals’ subdued Q4 saw margins taking a hit from high cost raw material inventory. However, key strategic announcements on diversification and vertical integration sound positive.

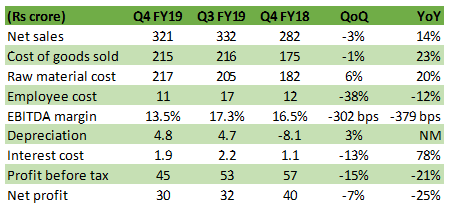

Standalone Q4 financials

Source: Company

Key positives

Sales improved by 14 percent YoY, mainly led by higher pricing of dyes, dye intermediates and better product mix than last year. Volume growth was flat with total production at 60,145 tonnes. In the recent past, product prices have stabilised although there was a short term surge due to a major accident in a chemical plant in China.

Furthermore, the company has started trial production of the recently commissioned Thionyl Chloride (TC) plant with a capacity of 36,000 tonnes. The desired product quality has been achieved, which should lead to capacity utilisation of 50 percent in FY20. Historically, TC commands an EBITDA margin of 20-25 percent. The company expects 30 percent of TC production for captive utilisation in the Vinyl Sulphone value chain, which aids in margins.

Additionally, the company remains on track with its periodic capacity addition. It has added 6,000 tonnes of capacity for dyestuff, taking the total capacity to 35,000 tonnes.

Sequentially, there is an improved performance for subsidiary SPS Processors. However, here the regulatory permission for feedstock supply for Vinyl Sulphone is still pending.

Key negatives

EBITDA margins contracted sequentially mainly on account of inventory loss (Rs 5-7 crore) after a sharp volatility in crude oil prices during Q3 FY19.

Among the key risks to track is the performance of subsidiary business, Trion Chemicals, which is yet to break even.

Key observations

Increasing international presence

In FY19, exports sales surged 71 percent YoY and now contribute 44 percent of sales as against 31 percent in FY18. This is on account of the company’s increasing geographical reach as it has been establishing trading/local units in different geographies.

In the earlier quarter, the firm had incorporated two subsidiaries, one each in India and China to reach clients directly. It is attempting similar arrangements in other regions as well.

Pursuant to that, the company is acquiring 80 percent stake in Turkish company Sener Boya for Rs 32 crore (EV/Sales: 0.5x). This acquisition provides a ready marketing base in Turkey and nearby markets.

Diversification and expansion

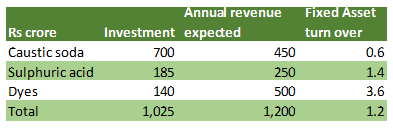

Additionally, the company has also marked diversification plans of 300 tonnes per day in Chlor Alkali plant and 1,000 tonnes per day in its Sulphuric Acid plant. A sum of 35 percent of Caustic Soda and 55 percent of Chlorine produced in Chlor Alkali plant would be used internally, particularly for water treatment chemical business (Trion chemicals). The Sulphuric Acid plant would also help in integrating Chlor Alkali business.

The company is also expanding dyestuff capacity by 24,000 tonnes over 36 months. This includes setting up of turquoise blue dyestuff capacity of 4,800 tonnes. Total cost of these projects, along with the acquisition in Turkey, comes to Rs 1,200 crore, of which about 58 percent would be funded by debt and the rest by internal accruals and preferential shares. Peak debt to equity ratio during the capex cycle is expected to reach 0.8x.

Outlook

We remain positive on the improving product mix, its vertical integration and international presence. In FY19, dyestuff sales contribution has improved to 36 percent of sales, from 32 percent. Further, a higher export share underscores company’s reach in global market amid China supply reforms.

Chart: New capacities fixed asset turnover

Source: Company, Moneycontrol research

In the medium term, we expect operating margins to be 18- 20 percent. As far as long-term projects are concerned, the company guides for a potential revenue addition of about Rs 1,200 crore in the next two years partially offset by increase in captive consumption of dyes intermediates. While the dye maker officially targets doubling of revenue in the next five years, we expect such realisations to happen in a shorter timeframe, given the new strategic initiatives and a formidable position in the dye industry. Earnings growth should grow faster due to vertical integration and operating leverage in the recent capacity additions as well as subsidiaries.

However, the re-positioning of the company comes with a cost of about 12 percent equity dilution and a sharp increase in interest cost in FY21. Taking account all these, the stock trades at a reasonable 7.6x FY21 estimated earnings.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!