Anubhav Sahu

Moneycontrol Research

Astral Poly Technik is merging with Rex Polyextrusion, a leading pipe manufacturer in the double-walled corrugated pipes (DWC) space. The deal gives the company a head start in the high growth and relatively less crowded plastic piping segment.

Transaction multiple: EV/EBITDA at 7 times

The company will acquire 51 percent stake via cash (Rs 75.2 crore) with the balance through exchange of shares. The enterprise value for the latter is pegged at Rs 190 crore (equity: Rs 147 crore, debt: Rs 43 crore) translating to a trailing enterprise value-to-earnings before interest, tax, depreciation and amortisation of 7 times.

Post-amalgamation, the promoter shareholding pattern would change to 58.49 percent (from 58.14 percent). Compared to the existing trading valuation multiple of other established companies, the transaction multiple appears inexpensive. If the company would have chosen the organic expansion route, the replacement cost could have been in the same range as the acquisition cost. Via this deal, it gets ready capacity (26,900 tonne) and distribution reach.

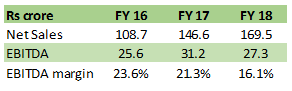

Rex Polyextrusion's financials

Source: Company

Growth potential in DWC segment

The merger marks a strategic step in diversifying into high growth segments of the pipe industry like urban infrastructure (sewage, drainage, rainwater) and cable ducting in telecom. In the urban infrastructure space, the growth potential is high due to shift in preference for corrugated pipes from cement pipes in both government and private sectors.

Compared to the conventional plastic pipes sector, the technology barrier is higher for corrugated pipes. The management said there are only 4-5 players in this segment, of which, Supreme Industries and Prince Pipes are among the major ones.

Synergy

Synergistic benefits accrues from utilising Rex Polyextrusion’s manufacturing base and dealer network for distribution of Astral Poly’s own products. Similarly, the latter’s own dealership network and reach could be instrumental in gaining market share in the DWC segment.

Exposure to the agri market

Rex Polyextrusion’s main plant is at Sangli, which is near a key agricultural market. The management claims the acquisition also opens growth opportunities in the agriculture pipes market.

Operating leverage

The company has expanded its manufacturing capacity last year from 16,000 tonne to 26,900 tonne. Currently, Rex Polyextrusion operates at 45-50 percent capacity utilisation due to which there exist scope for operating leverage as Astral Poly should be able to ramp up production.

Threat

Competitive intensity would still remain the key risk. In the case of DWC, the number of players are limited at present but the declining margin profile of the target company needs to be watched.

Read: Astral Poly Q4: Premium play on the CPVC volume growth and high margin adhesive business.

Premium valuation though earnings visibility is intact Astral Poly’s foray into the DWC pipe segment helps it diversify and enter newer end markets. We expect the management to leverage its distribution reach and expand volumes in the DWC segment. Investors will need to monitor a new set of raw materials (high-density polyethylene versus polyvinyl chloride used till now) required in the DWC business and ability to maintain operating margin at current levels.

Excluding this inorganic growth opportunity, we continue to expect Astral Poly to witness 15 percent volume growth backed by capacity expansion and better capacity utilisation in FY19. Higher contribution from adhesive businesses (Resinova Chemie and Seal It Services divisions) are expected to aid margins.

While the stock remains at a premium and trades at multiples (57 times FY19e earnings) closer to the fast moving consumer goods sector, earnings growth visibility remains high. Considering the growth opportunity, long term investors can consider accumulating this stock on a decline.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!