Highlights

Order inflows remained healthy across electrification, motion, automation, and robotics, supported by demand from data centres, renewables, green hydrogen, railways, and electronics. Large project delays in metals and mining are cyclical, and the management expects margins to normalise once QCO approvals come through.

Q3CY25: Financial Performance

During the quarter, revenue increased by 14 percent YoY, aided by solid execution of short-cycle orders and broad-based traction across business divisions.

Profitability was temporarily under pressure. The EBITDA margin came in at 15.1 percent, near the lower end of ABB’s preferred band. The decline in margins was on account of pricing pressure and higher input cost primarily on some imported products.

This 7 percent decline in the EBITDA also impacted net profits, which were down in this quarter by 7 percent YoY. ABB chose to maintain higher inventory (cash balance of Rs 5,000 crore remains intact) to avoid supply disruptions.

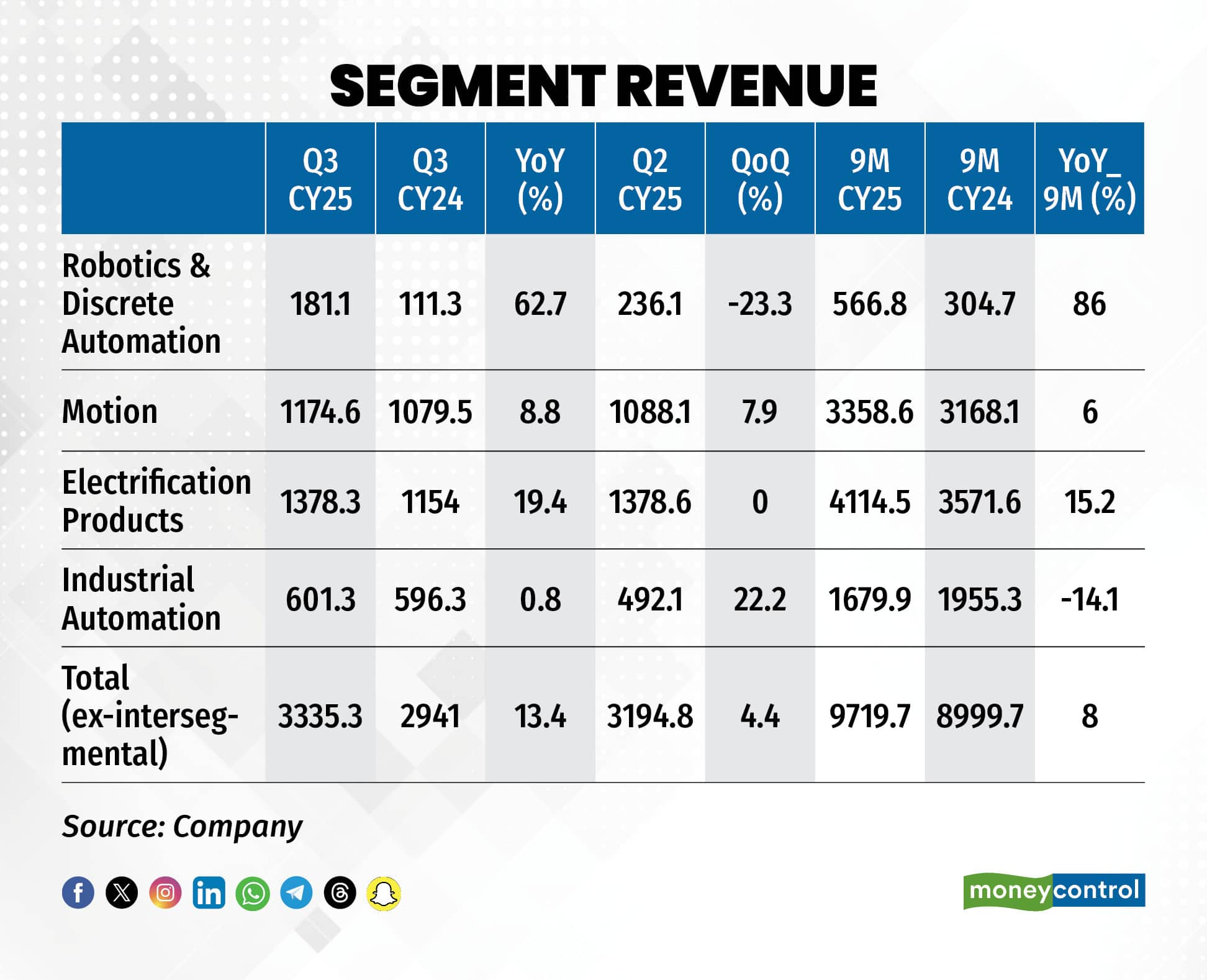

Segment Performance

Electrification

In terms of segments, its biggest business, electrification, orders remained strong even after adjusting for last year’s exceptional large order (Rs 560 crore). Margin headwinds persisted due to a shift towards lower-margin categories, greater pricing competition, and costly imports. The management quantified margin compression thus: mix impact (1 percent), pricing pressure (1-1.5 percent), costly imports (0.75 percent), and forex (0.6 percent).

Motion Business

Demand stayed firm, including one large order (Rs 150 crore). Higher exposure to core industrial segments increased pricing competition, and margins took a 4.5-5 percent knock owing to mix, costly imports, and forex.

Process Automation

Large capex decisions in cyclical industries remain delayed. But revenue trajectory remains stable, and margins resilient, given a higher services contribution (30 percent). Moreover, the business remains largely insulated from cost issues.

Robotics & Discrete Automation

During the quarter, this segment reported the highest growth and orders grew strongly (Rs 245 crore), driven by auto, electronics, EV, and general industry. However, margins softened temporarily due to lower services revenue mix in recent quarters.

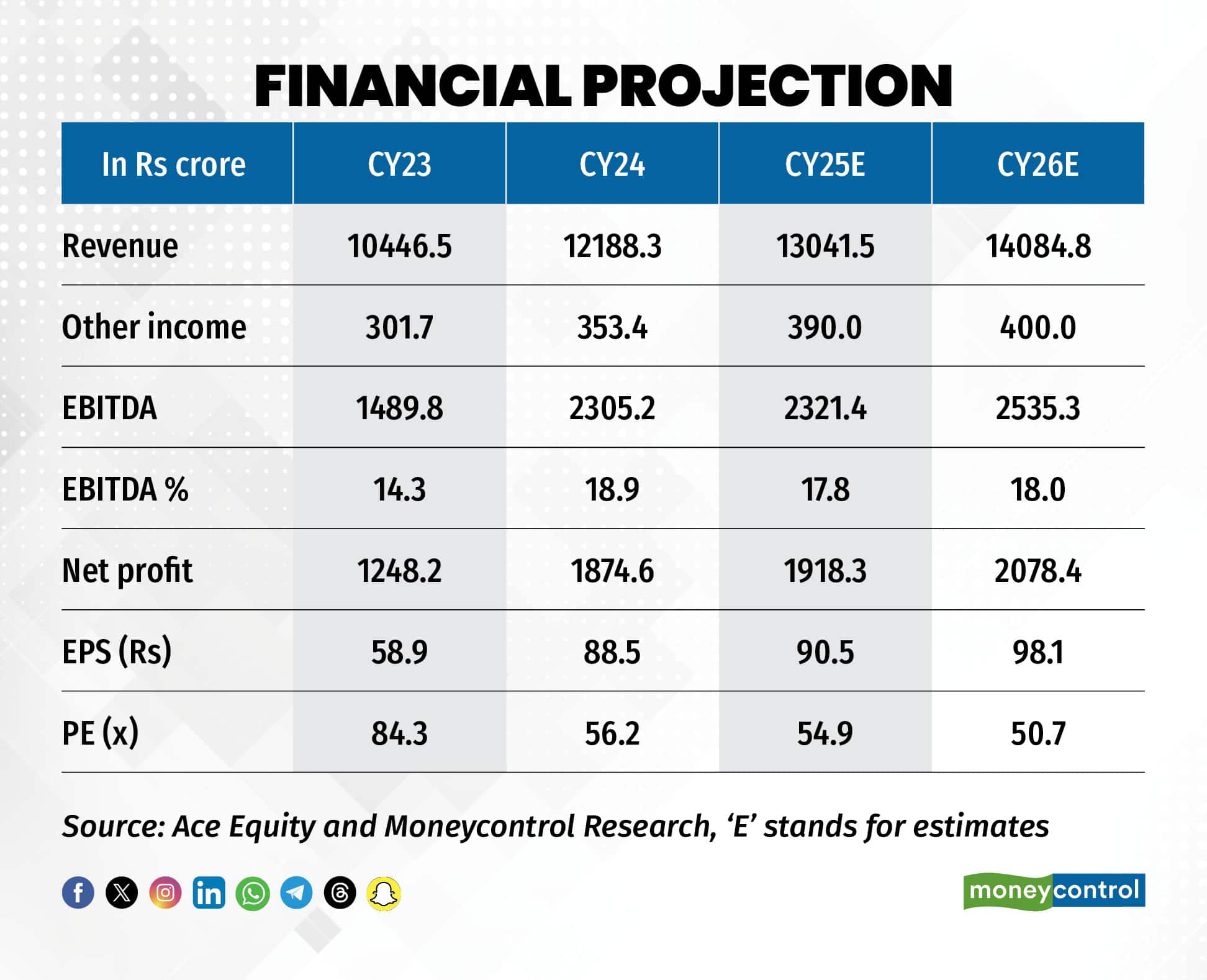

Earnings Outlook

The company indicated that demand remains strong across data centres, renewables and energy storage, green hydrogen, railways, metros, electronics, and infrastructure. Metals, mining, and textiles continue to defer large capex — a cyclical issue rather than structural.

Thankfully, the order backlog remained strong at Rs 9,900 crore, with nearly 70 percent being base orders, providing superior revenue visibility over the next few quarters.

Supported by the short-cycle nature of orders, diversified sector participation, and the introduction of premium efficiency products, the overall earnings visibility remains good. ABB expects stability in base orders and margin recovery over the next 2-3 quarters, contingent on higher-cost imports. New energy themes (data centres, green hydrogen, battery storage) provide a good multi-year structural growth opportunity.

Valuations

ABB is well-positioned structurally, but the valuation reflects expectations of margin recovery and capex revival. It is trading at 51 times one-year forward earnings. For investors, the trigger to watch is margin stabilisation in the next 2-3 quarters plus base-order growth translating into higher profitability. If those don’t play out, the current valuation leaves less cushion.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!