Dear Readers,

As the Israel-Palestine war threatened to engulf other countries in the neighbourhood, volatility in the financial market increased. Stock market investors continued to exit on fears of the war spreading to other Middle-Eastern countries. Oil prices stayed higher as Israel continued to bombard the Gaza Strip. Indian markets also had to deal with increased foreign investor selling, resulting in a fall of around one percent for the week. The US bond yields touching the 5 percent psychological level also played into the hands of the bears.

Unfortunately, data and charts suggest the market is expected to stay under pressure.

More downside likely

After two weeks of positive closing, benchmark indices closed in negative, nullifying a powerful hammer candle formation two weeks ago. This week saw the Bulls throw in the towel.

The market is forming a classic A-B-C top formation from its September high. The market may touch a low of 18,900-18,800 in the coming weeks.

Despite the weakness in the frontline market, the smaller stocks showed strength during the week. However, if the frontline stocks continue to fall going forward, smaller stocks can witness some correction.

The average swing peaked at 75 on October 16 and started to fall. Before expecting a rebound, we must wait for the swing to touch a reading below 20 or even below 10 [extremely oversold]. In the worst-case scenario, we can expect a positive divergence before making a bottom.

Source: web.strike.money

Source: web.strike.money

The percentage of RMI buy signals also peaked at 74 and presently trades at 50. It must still travel some distance before it touches an oversold level below 20. Since the curve is pointing downwards, it suggests more stocks are participating in the move downwards.

Source: web.strike.money

Source: web.strike.money

FIIs continue to hold their shorts

FIIs sold over Rs 13,400 crore in the cash market and are holding on to their short position even as the market continues to fall. Since we have not seen any profit booking by FIIs, it is fair to assume that they expect the market to fall further. As the market goes lower, they may even add to their shorts.

In the last bull run, their shorts did not go above 30k contracts on average, but this time, they are much higher at 89k contracts. In the last few years, readings over 125k contacts were seen as extreme and closer to the bottom. The data shows there is still room for more shorts to pile up before it becomes a crowded trade.

Source: web.strike.money

Source: web.strike.money

Options data points towards weakness

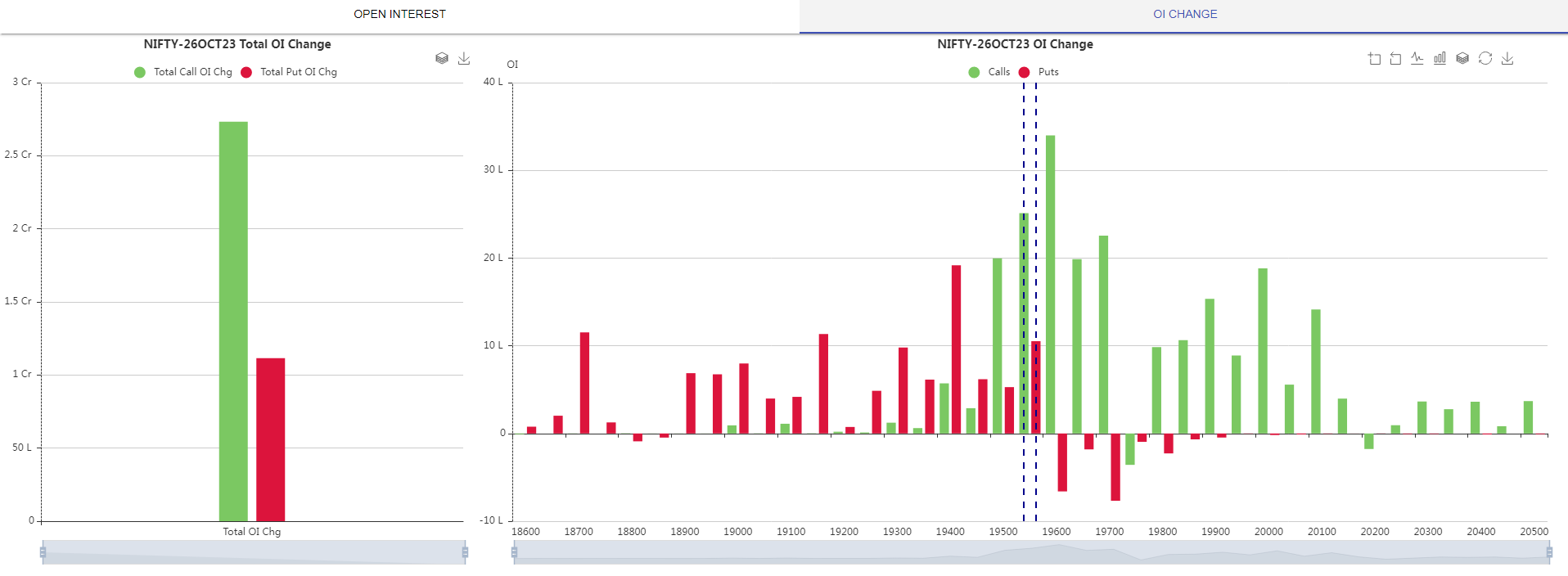

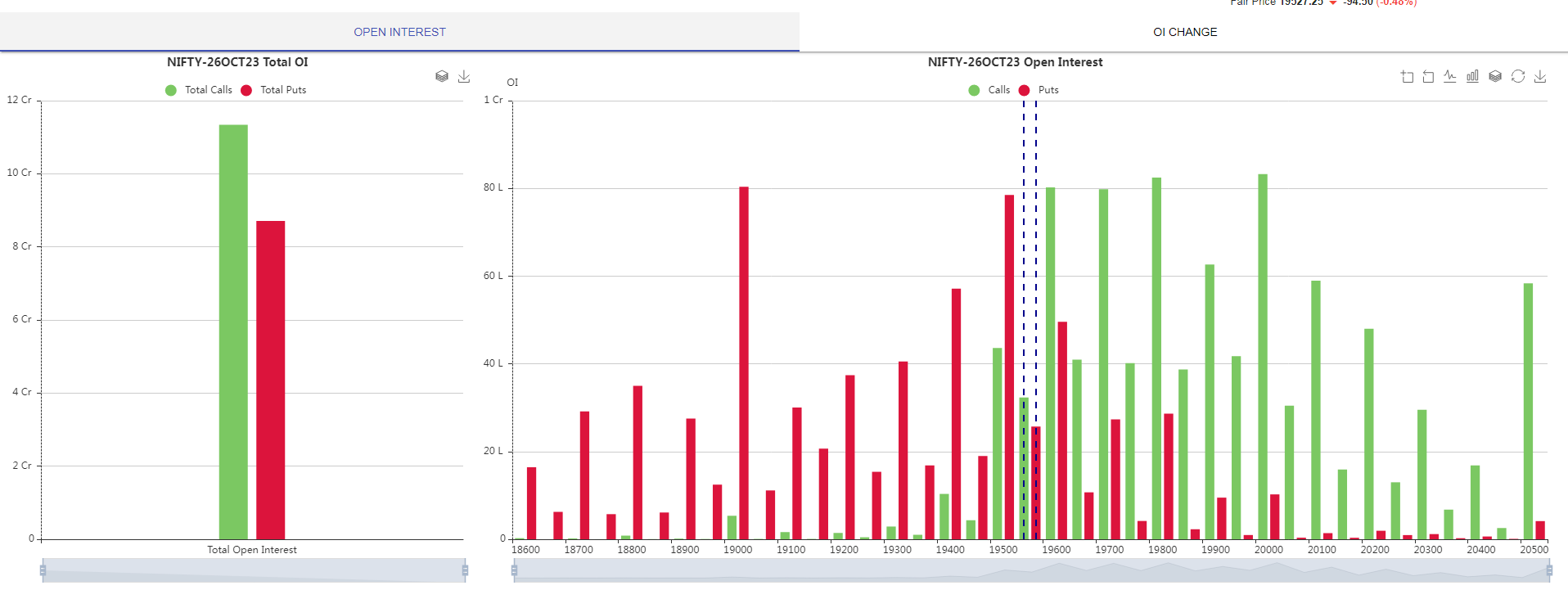

More call contracts have been written during the week, even as markets continued to fall. The chart below shows a sharp increase in Call options sold (indicating weakness) compared to put options.

Source: icharts.in

Source: icharts.in

As we enter into a truncated expiry week, the call option writers have the upper hand, as seen from their overall Nifty position.

Source: icharts.in

Source: icharts.in

Indices and Market Breadth

During the week, BSE Sensex shed 1.33 percent while Nifty50 lost 1.05 percent. BSE Small-cap index outperformed as it ended flat, but the Mid-cap index lost one percent.

A weak start to the earnings season after IT companies posted poor numbers added to the market pressure. After the Supreme Court judgement in the telecom sector, the telecom index lost two percent, while the power, Capital Goods and FMCG sector indices lost one percent each. Auto index, however, gained 0.5 percent during the week.

Among the sectors, Nucleus Software Exports gained 28.84 percent, Shakti Pumps (India) 24.40 percent and Ion Exchange (India) gained 24.27 percent. Among the losers was NMDC Steel shedding 15.77 percent, MMTC losing 14.92 percent and HUDCO dropping by 14.14 percent.

Global Markets

Most global markets closed in red because of the war in the Middle East. US indices Dow Jones Industrial Average fell 1.7 percent, S&P 500 dropped by 2.39 percent and the Nasdaq Composite lost 2.9 percent in value during the week because of rising bond market yields and the war.

In Europe, red was the colour for the week, with the pan-European Stoxx 600 index falling 3.44 percent, FTSE dropping 3.12 percent, DAX by 2.56 percent, and CAC by 2.67 percent.

Asian markets followed the world markets, with Japan losing over three percent, Shanghai losing 3.4 percent and Hang Seng falling the most by 3.6 percent. During the week, Japan’s government bond yields rose to their highest level in 10 years. China's largest real estate company, Country Garden, announced that despite a 30-day grace period, it could not meet its overseas debt obligations.

Stocks to Watch

With markets expected to remain negative, few stocks are showing strength. Among these are MCX, Persistent, Bajaj Auto, Nestle, SBI Life, and TVS Motors.

Bajaj Finance, Axis Bank, and ICICI Bank offer a good risk-reward ratio.

Cheers, Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.