It has been the most damned stock for the last few years, but last month the stock hit Rs 400 attracting an unfair share of attention. No other stock in recent memory has been so talked about on crossing a psychological mark, which, by the way, is of little significance to investors. But then, ITC has been a subject of much ridicule as the stock underperformed miserably over the past few years when the rest of consumer companies were going through the roof notwithstanding their already high valuations. ITC was trading at around Rs 340 in July 2017, tanked all the way to 160 in March 2020 (laid low by Covid), and this year it scaled past its 2017 peak to cross Rs 400 levels in April. Currently, trading at Rs 417, the stock commands a market-cap of Rs 5.17 trillion.

What has really changed for the tobacco-to-hotels conglomerate?

If you ask ardent value investors, they’ll tell you that this is simply in the nature of stock markets, that stocks can languish for a long time before they catch the market’s fancy. Perception plays a big role in performance over the short and medium term, but in the end, earnings are the key driver of stock prices and sooner or later, if the earnings story remains intact, the stock price will catch up.

ITC’s underperformance for the longest time and its sudden surge is a blend of both perception and reality. There are at least five factors that have contributed to the turn. And the Q4 numbers announced yesterday only support the change in sentiment. ITC’s Q4 numbers beat analyst expectations on all counts: it reported a 21.4 percent year-on-year growth in standalone net profit at Rs 5,086 crore, much higher than the analyst expectation of Rs 4764 crore, revenue went up 5.6 percent to Rs 16,398 crore, against an expectation of Rs 16,152 crore. Even more, Ebitda margin showed an impressive up move at 37.9 percent, up from 33.6 percent in the year-ago period. Most analysts have re-iterated their ‘buy’ on the stock.

But let’s get back to the larger triggers beyond the recent numbers that are powering the rally in ITC.

First, the growth perception for cigarettes has changed decisively. If you look at the sales volume in cigarettes, it has been quite erratic over the past decade. Till FY20-21, cigarette volumes either showed negative or lower single digit growth (see chart). Obviously, if volumes are so erratic in a segment that is your biggest driver of profits, who is going to touch the stock?

Cigarettes contributed 68 percent to ITC’s revenue in FY13, which had come down to 60% by FY17 and 40% in FY22. It’s contribution to EBIT has also come down from 86 percent in FY17 to 78 percent in FY18. But why was the volume declining? For two main reasons. One, the government was continuously increasing the duty on cigarettes, which was eating into sales. Second, of course, Covid had an impact on sales because lockdowns meant that pan shops were shut, and availability was a problem. All outdoor businesses were affected and so were cigarette sales.

These two domestic factors only cemented the already-negative perception around tobacco companies world over, as smoking rates have been on a continuous decline due to health concerns, tighter regulations, and companies having to perennially fight litigations, especially in the US. Litigations are not a problem in India, but the negative perception has been building.

But over the past two years, ITC’s volumes have been robust. In FY21-22, cigarette volumes were up 17 percent, and in FY23 the volume is estimated to have grown 18 percent. One of the reasons for this volume comeback is that taxes have not increased much. In fact, once GST was introduced and cigarettes were kept out of it, there was a fear that the government would meddle with taxes too much and cigarette volumes would go for a toss again. But that did not happen. Instead, the reverse happened.

The rational taxes helped ITC gain market-share. First, it helped the company take away share from the unorganised segment — some of the beedi smokers now smoke cigarettes. Second, cigarette smuggling has been coming down, helping sales further.

Higher volume has obviously helped the company clock robust growth in profits. Now, will this trend continue?The thing is that smokers will continue to smoke and pay more for their cigarettes as long as they don’t feel that they are paying double the money for half a puff. A modest price increase below the general inflation level is very much acceptable because smokers are addicted anyway. So modest price increases are okay. Volumes tend to take a hit only if taxes are increased too much.

A lot of market participants now believe that the company has productively engaged with the government to impress upon them that taxes should be kept under check because as long as sales are robust, the government can earn better in terms of tax revenues as well. By hiking taxes on cigarettes, they only end up encouraging beedi sales and cigarette smuggling, neither of which contribute to the tax kitty.

Thus, if tax increases are modest, then cigarette sales should be steady, which lends stability to ITC’s overall growth, although there is no argument about the fact that tobacco is a declining business in the long run.

That’s about cigarette sales.

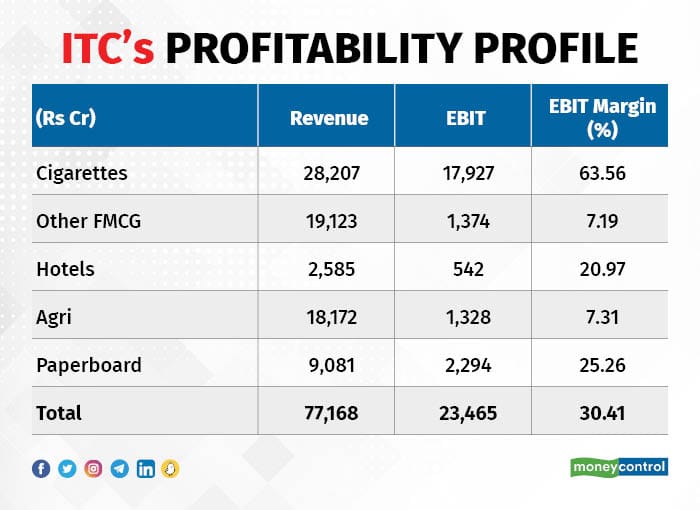

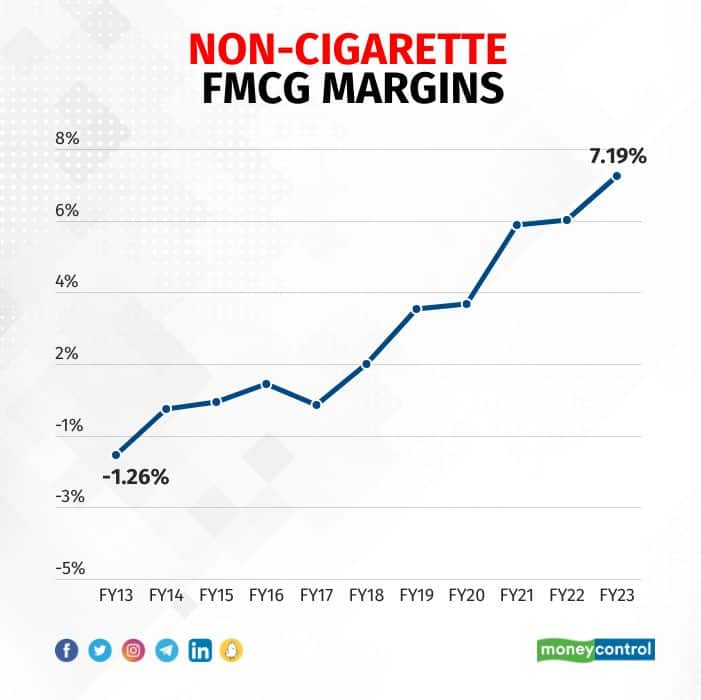

Second reason for the comeback is the company’s growing profitability in its non-cigarettes FMCG business. In FY17 EBIT margin for this segment was negligible (0.25%) and that has now moved to about 7.19%. It’s still way behind its FMCG peers but there is at least some semblance of profitability emerging here.

Now, the third reason for the stock to be back in favour is the fact that the anti-ESG trade around the world is now fading. In fact, it is as good as over. Over the last few years, if a company was into a business that was environment-unfriendly, like fossil fuels, or in socially undesirable businesses like tobacco, investors would be hesitant to touch them.

Fact is, while as a concept ESG is a noble idea, there was never any altruistic motive behind ESG investing. Here is why: if governments perceive that certain businesses or practices are undesirable, they will levy additional taxes and punish them economically or make life difficult for them in terms of regulations. So, from an investment standpoint ESG essentially means a tax on the future which will hit cash flows and profitability.

But post-Covid supply disruptions have thrown this theory out of the window. The markets do not care about ESG anymore, because markets are greedy, and they will go wherever there is money. Since they saw oil and coal prices go up, they latched on to those stocks once again. Ditto for tobacco. This fading of the ESG narrative has actually helped bring some of the unloved businesses back in favour, and ITC is one such.

Even more, news that some high-profile investors are buying into the stock creates its own momentum. For instance, last quarter’s shareholding pattern showed that Rajiv Jain of GQG Partners, who was in the news recently for buying into Adani stocks, has picked up a stake in ITC. Now, in investing be it individuals or institutions herding is quite common and as the stock gains traction it will attract more institutions.

A fourth reason is that ITC is still seen as a good defensive play. When investors want some kind of defensive positioning in their portfolio when markets look uncertain, where do they go? They load up on a stock like ITC. The fact that it is not over-owned makes it less vulnerable to any kind of drawdown. It is a consumer company where revenue and profit growth look kind of predictable now, especially as the cigarette volume story looks good.

Yet another trigger for the stock could be the de-merger of the hotels business. Hotels is a business with low return ratios and is a drag on overall ROE. The management has said it will de-merge the business, and if it does, the stock could see another round of re-rating. Not counting that, even if the company refrains from deploying incremental capital into the hotels business and takes on management contracts, as it has committed already, and keeps its balance sheet asset-light, the financial complexion will still aid the stock.

Even as the narrative turns overwhelmingly positive for ITC, it continues to be super cheap compared to other consumer companies. A P/E of 28 times trailing versus 55-80 for rivals in the consumer space — the gap is substantial, leaving room for further re-rating.

But despite the recent optimism, ITC cannot be compared to a consumer company. Currently, 37% percent of ITC’s revenue comes from tobacco, but it contributes more than 75% percent to its overall EBIT because it enjoys a margin of 63 percent. Thought the growth pangs seem over for now, it is not perceived as business that has great potential for high growth over a long period, and increasingly regulators will only look to penalise such companies. On the other hand, the rest of the businesses which contribute 63 percent of the revenues have a 11 percent margin and contribute 23 percent to profits.

Of course, as noted earlier the non-cigarette FMCG business is showing growth in profitability, which is a surely a positive. Still, the irony of ITC is that the business which enjoys superlative margins and constitutes the bulk of its profits is perceived to be a shrinking business, while the fast-growing business rivalling Levers and Britannia suffers from inferior margins and return ratios.

Still, ITC is really not a bad bet at 28 times earnings. The stock has already jumped 150 percent since the Covid lows. But be under no illusion: at the end of the day ITC is primarily a tobacco company, because that is what still brings the bulk of its profits. Thus, the valuation gap between ITC and other FMCG companies is unlikely to be bridged fully.

On the flip side, the company pays good dividends — yield is currently around 3 percent, the tobacco growth story is looking good for now, which means the near and medium-term earnings story is on track, and the sentiment has now turned in its favour. Markets have a tendency to overshoot at both ends, so it is unlikely this momentum will fade soon.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.