Can innovation be the next big investment theme? SBI Mutual Fund, which is the largest fund house in the country with assets under management totalling Rs 10 lakh crore, certainly feels so as it launched the SBI Innovation Opportunities Fund.

The fund house is of the view that while almost 30 percent of the S&P 500 is made up of innovative companies, India too will see a similar trend emerging as they believe that the next 10 years in India will be very different from what it is today.

While speaking at the launch of the fund, officials of the AMC said that through the fund, they will be focusing on firms that are making a difference through unique approaches, technologies, and products, thereby creating substantial value for both stakeholders and consumers.

“We are looking for companies that are doing something differently,” said fund manager Prasad Padala.

Innovation as a theme

The fund's strategy is to target sectors with significant innovation, ranging from technology and healthcare to financial services and consumer goods and seeks to align with firms that are not only leading their industries but also setting new standards and trends.

As one of the largest economies aiming to become the third largest globally, SBI MF believes that India offers significant opportunities for investors.

“India's time has come, and its human capital or knowledge capital should be used for investing in our own people, our own companies, our own investors,” says Padala. This positive outlook is further bolstered by the Indian government's significant investments in research, development, and innovation, such as push for R&D and initiatives in space research and electric vehicles (EVs), he added.

*The stocks mentioned are examples on possible stocks under each theme.

*The stocks mentioned are examples on possible stocks under each theme.

The fund will focus on innovation across sectors like adtech, fintech, e-commerce, cloud computing, EVs, and clean energy.

Ecommerce

The e-commerce space is expected to grow at a CAGR of 19 percent per annum from $116 billion in 2023 to around $400 billion in 2030. India is currently the third largest online retail market in the world following China and US. Currently, e-commerce contributes to around 7.5 percent of the total sales. Within the space, the fund house sees opportunities in food delivery, online fashion, online pharmacy and cab hailing.

Adtech, Fintech

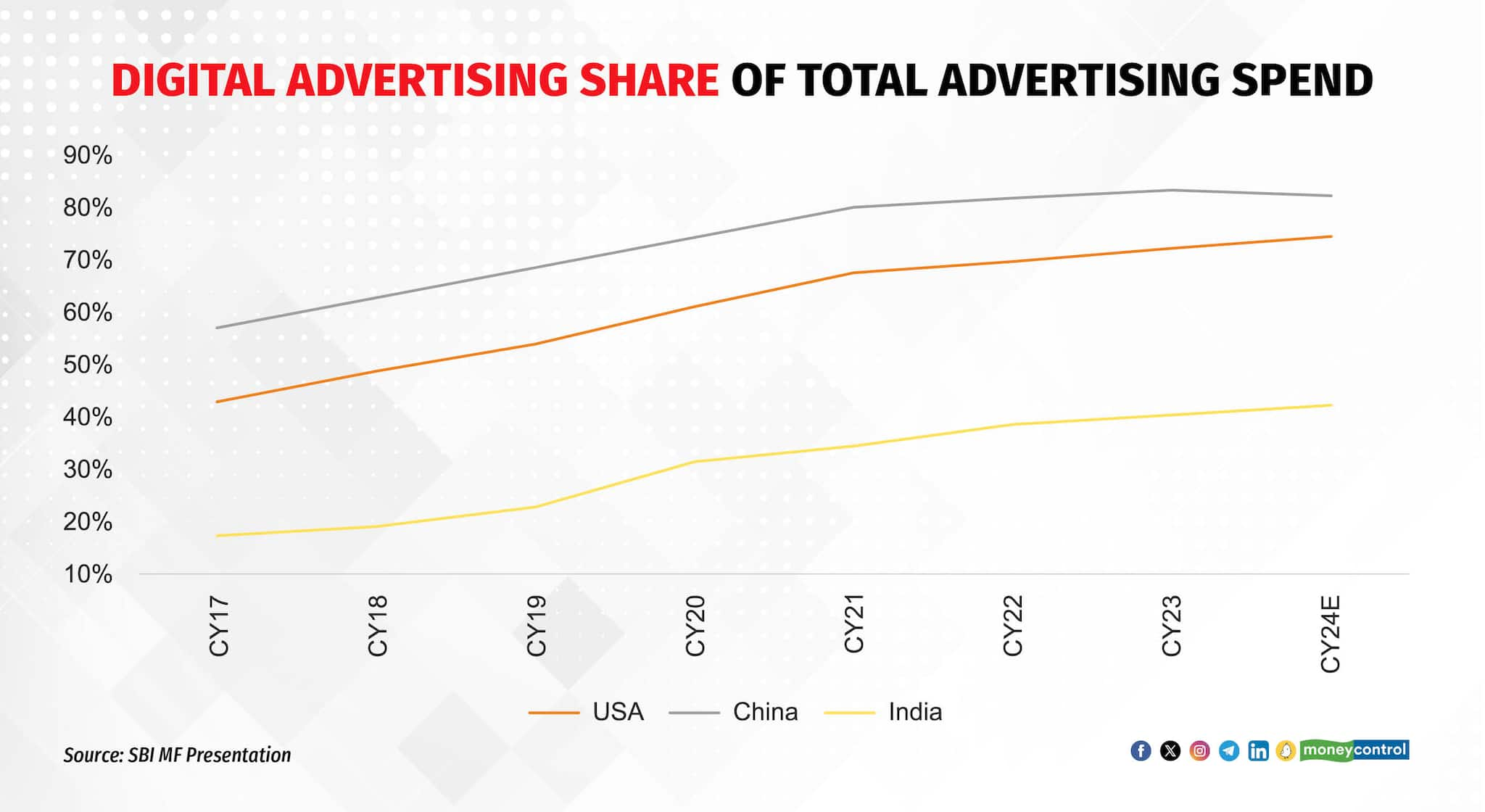

Currently, the share of digital advertising spend in India is still significantly low, the fund notes, adding that it is expected to grow at a CAGR of 25.7 percent from 2024 to 2030 as against 22.4 percent CAGR growth in global Adtech Market. SBI MF sees opportunities in global and domestic adtech firms in the coming days.

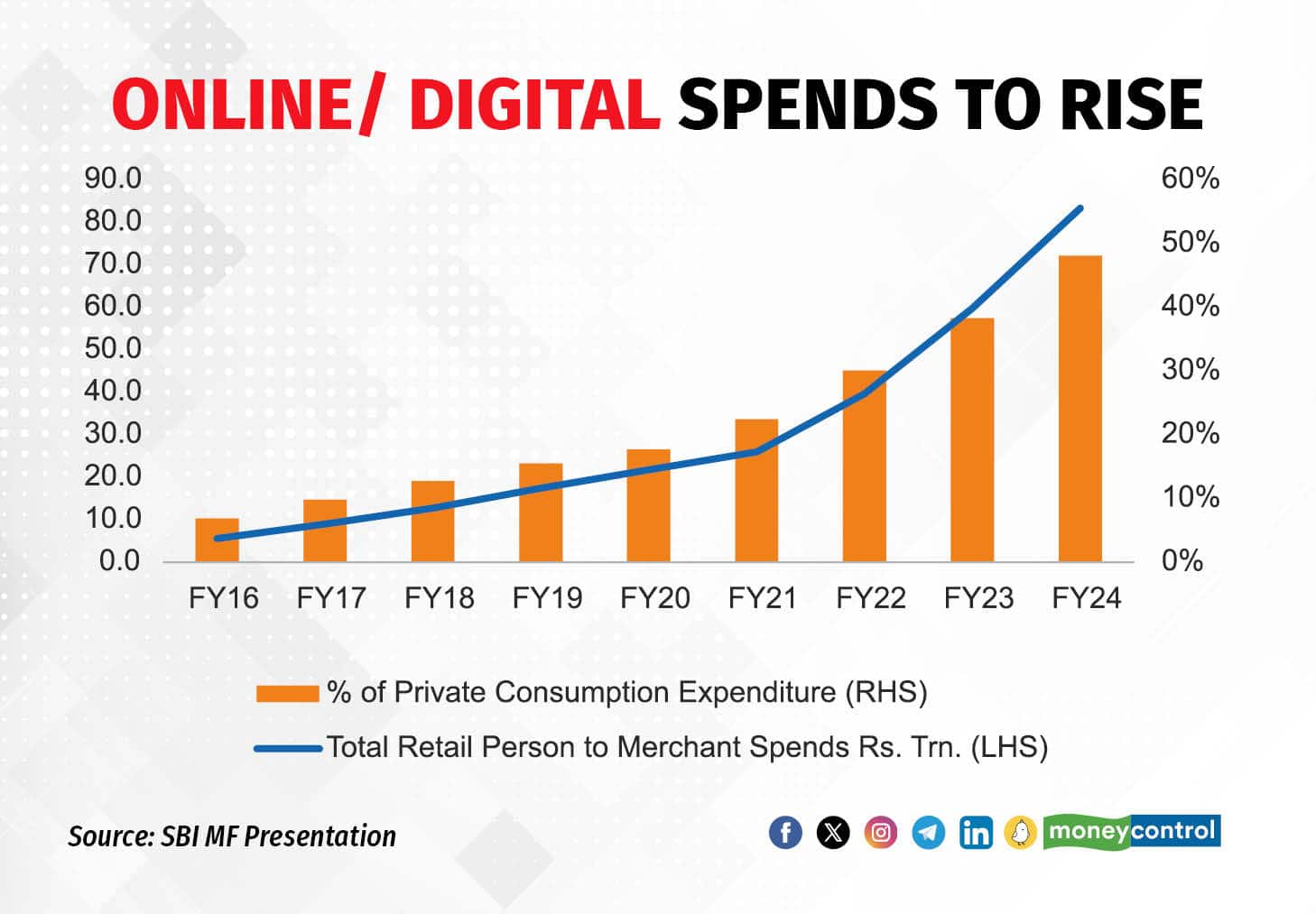

Currently, India has the third largest fintech ecosystem globally, says SBI MF adding that factors such as India Stack, JAM Trinity, Financial Inclusion and UPI payment have added to the growth of the space. The fund house is of the view that Digital Lending, InsurTech and WealthTech could benefit from growth in the space.

Cloud Computing

Spending in the cloud computing space is expected to grow to around 46 percent of the total infra spends by 2027 from around 27 percent in 2023. According to SBI MF, this growth has come as a result of increase in adoption of Gen AI and application modernisation. Companies in the space of SaaS Product Companies and Cloud Infrastructure providers could benefit from this growth, SBI MF says.

EV and Clean Energy

SBI MF notes that India has the potential to be one of the lowest cost hydrogen producers globally adding that currently India's transmission length to GW of installed capacity is higher than nearly all countries benchmarked.

Innovation, Padala notes, is not limited to the tech, IT, or software sectors. “Every sector is experiencing innovation, from automobiles with electric vehicles and self-driving cars to financial services with digital adoption. This trend is also evident in healthcare, industrial, consumer, and media sectors,” says Padala while adding that the Indian EV space is expected to grow at a CAGR of 49 percent from 2022 to 2030.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!