After rallying for three months starting June, bears took control of D-Street in September, particularly in the second half of the month. The Nifty50 rose more than 7 percent each in June and July and nearly 3 percent in August.

The volatility in September pushed the Nifty50 lower by over 1 percent. The index has displayed signs of a slowdown in momentum for the first time since April as it formed a lower high-low on the monthly chart.

Technical chart patterns indicating a pause in upward momentum after recording over 50 percent rally was seen over the past five months. Experts feel that markets could consolidate in October.

“We believe the index is undergoing a secondary corrective phase that forms part of the larger degree uptrend. Going forward, we expect the index to extend the time-wise consolidation in coming weeks as we enter the Q2FY21 result season while price-wise correction will be limited,” ICICIDirect said in a report authored by Dharmesh Shah, Head – Technical, ICICI direct.

“We believe the Nifty has immediate support at 200-Days SMA around 10800. Only a breach below 10800 would lead to an extended breather. However, we do not expect the index to breach the key support threshold of 10500-10600,” he said.

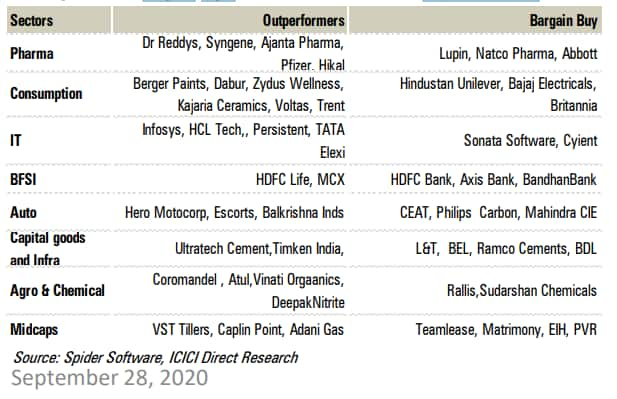

If investors are looking to invest in October, ICICIdirect handpicks over 20 stocks across 8 sectors, including Lupin, Natco Pharma, Abbott, HUL, CEAT, BEL, Bandhan Bank, and Rallis India.

Since March, the intermediate corrections to the tune of 11 percent have formed a part of the large degree uptrend and presented an incremental buying opportunity. The upside will still be remain capped at last week’s high of 11500.

Empirically, since 2009, post a sharp rally of more than 25 percent in the Nifty midcap index, in the next five to six weeks average intermediate correction has been to the tune of 12 percent.

In the current scenario, over the past four weeks, the Nifty midcap index has corrected 9 percent from August high of 17555. “We expect the index to maintain the same rhythm by arresting ongoing correction around 15500 (12% from August high) and maintain its relative outperformance,” said the report.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.