Benchmark indices posted marginal gains in the week ahead of the earnings session and the 2019 Lok Sabha elections. The market remained positive for the first two days of the first week of April, while Skymet's below normal monsoon prediction and RBI's rate cut put some pressure on indices.

The Sensex and Nifty touched all-time highs of 39,270.14 and 11,761, respectively during the week.

Weather forcaster Skymet predicted that monsoon will be below normal in 2019. The reason was cited as the developing El Nino phenomenon that occurs due to a rise in the temperature in the equatorial Pacific Ocean.

Meanwhile, RBI in its first policy meeting of the current financial year cut repo rate by 25 basis points and kept the monetary policy stance neutral.

The Nifty, as per the weekly time-frame formed a doji-type candle pattern at the new all-time high of 11,761. Technically, doji type candle formation at the new high/resistance could be a signal of confused state of mind among investors. This could act as an impending reversal pattern at the highs, on the confirmation, said Nagaraj Shetti – Senior Technical & Derivative Analyst, HDFC Securities.

Nifty was up 42 points, while Sensex rose 189 points in the week ended April 5.

On a weekly basis, the rupee ended marginally lower at 69.22 on April 5 against the March 29 closing of 69.15.

Foreign institutional investors (FIIs) bought equities worth Rs 973.38 crore, while domestic institutional investors (DIIs) sold Rs 670.76 crore worth of equities in the past week.

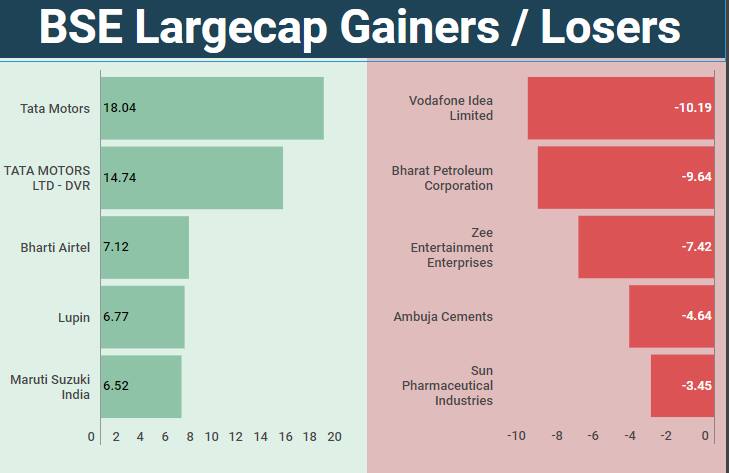

The S&P BSE Largecap Index rose 0.35 percent, while S&P BSE Midcap index and Smallcap Index added 0.19 percent and 0.12 percent, respectively.

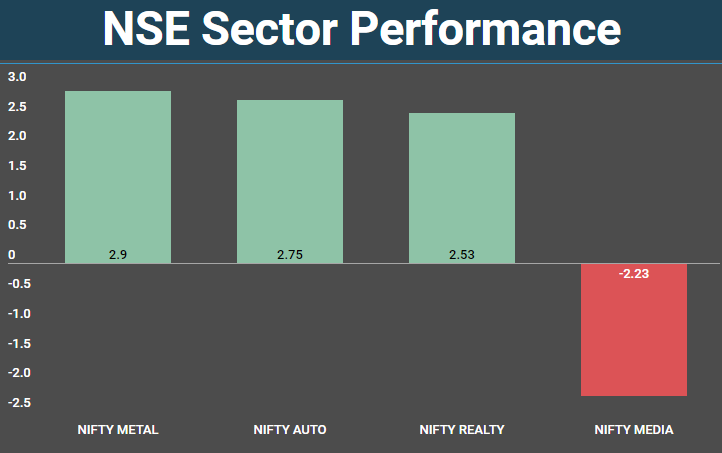

The Nifty metal index outperformed sectoral indices with gains of 2.9 percent during the week.

On the BSE, TCS gained the most in terms of market value followed by HDFC and Maruti Suzuki, on the other side, HUL lost the most in terms of market value.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.