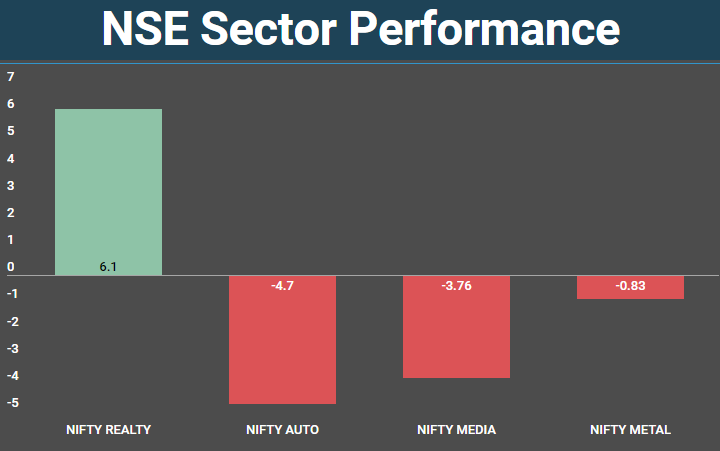

The Indian market remained rangebound in the truncated week that ended March 22 as Sensex and Nifty posted a gain of 0.36 percent and 0.26 percent respectively largely supported by realty, FMCG and energy stocks.

However, Nifty failed to hold the 11,500 level after Fitch downgraded India's GDP growth forecast for FY20 to 6.8 percent from its previous estimate of 7 percent.

Nifty gained 30 points, while Sensex rose 140 points in the truncated week ended March 22. The Indian markets were shut on March 21 on account of Holi.

A doji or a high wave type candle pattern was formed in the Nifty as per weekly time frame chart. The formation of such a weekly pattern, post the sharp up move of the previous week could signal a possibility of consolidation or minor downward correction for the next week. Immediate supports to be watched at 11,410 levels, said Nagaraj Shetti, Senior Technical & Derivative Analyst, HDFC securities.

On a weekly basis, the rupee gained 14 paise to end at 68.95 on March 22 against March 15 closing of 69.09.

The foreign institutional investors (FIIs) has bought equities worth Rs 7,101.53 crore, while on the other hand domestic institutions investors (DIIs) sold Rs 4521.12 crore worth of equities in the last week.

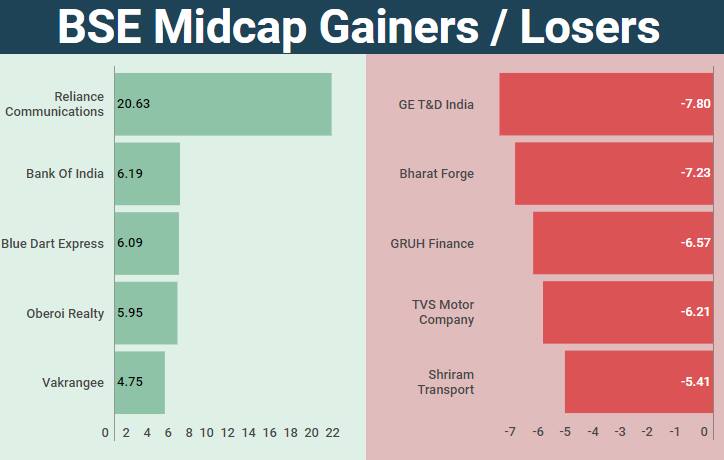

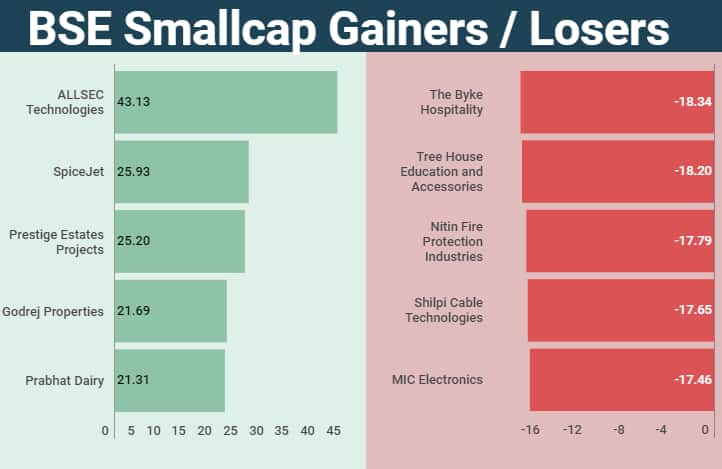

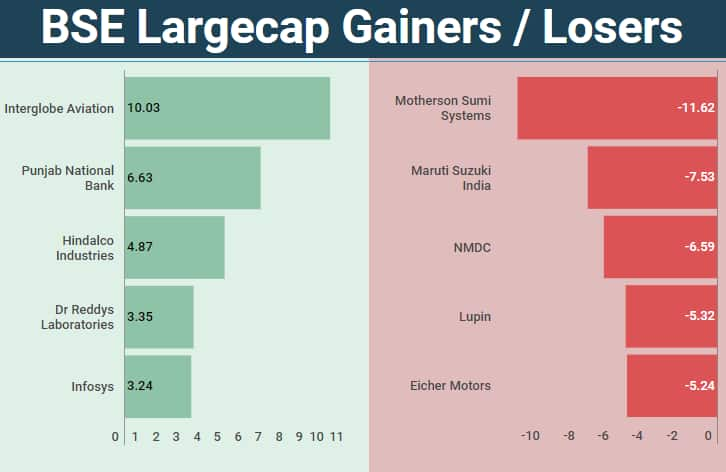

In the last week, the S&P BSE Largecap Index ended marginally higher, while S&P BSE Midcap index and Smallcap Index fell 0.62 percent and 0.53 percent, respectively.

The Nifty realty index has outperformed other sectoral indices with gains of 6.1 percent during the week.

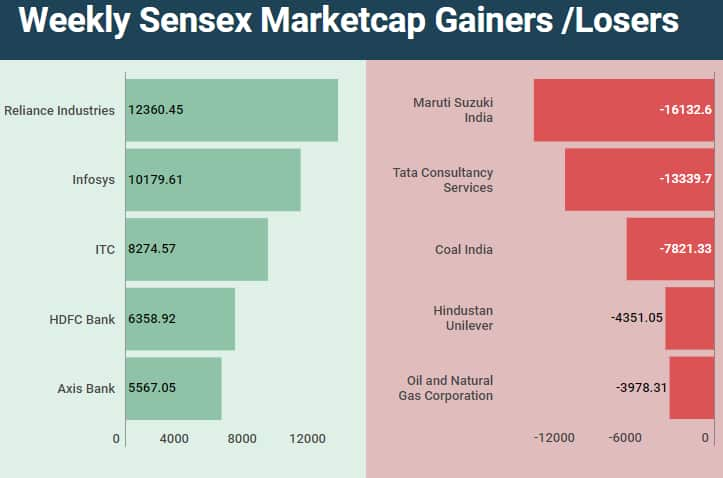

On the BSE, Reliance Industries gained the most in terms of market value followed by Infosys and ITC. On the other hand, Maruti Suzuki lost the most in terms of market value.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.