Nifty is trading at a record high at 22,300. The next target is set at 23,500 in the coming days, according to Santosh Pasi, Founder of Pasi Technologies. He expects another 2-3 percent rise in Nifty in this week.

"We are in a complete bull run. Post exit polls, there is usually a rally, and we have already seen a portion of the movement today. Tomorrow, if the market aligns with the exit polls, it can definitely move up. However, whether it will continue to rise afterward is uncertain," said Kirubakaran Rajendran, derivatives trader and Founder of Squareoffbots.com.

"Tomorrow's expectation could be similar to the 2019 gap up, where the market moved up initially and then started going down with trades going flat. If you are an options trader, try to profit from the IV crush, which is the VIX falling. VIX is expected to crash by 20-30 percent for tomorrow and the coming days. Option selling to benefit trades the next few sessions" Rajendran added.

For options sellers, Rajendran recommends an Iron Condor strategy. "They can short 500-1000 points away from OTM options and buy a hedge 100 points away from the current Nifty price," he said.

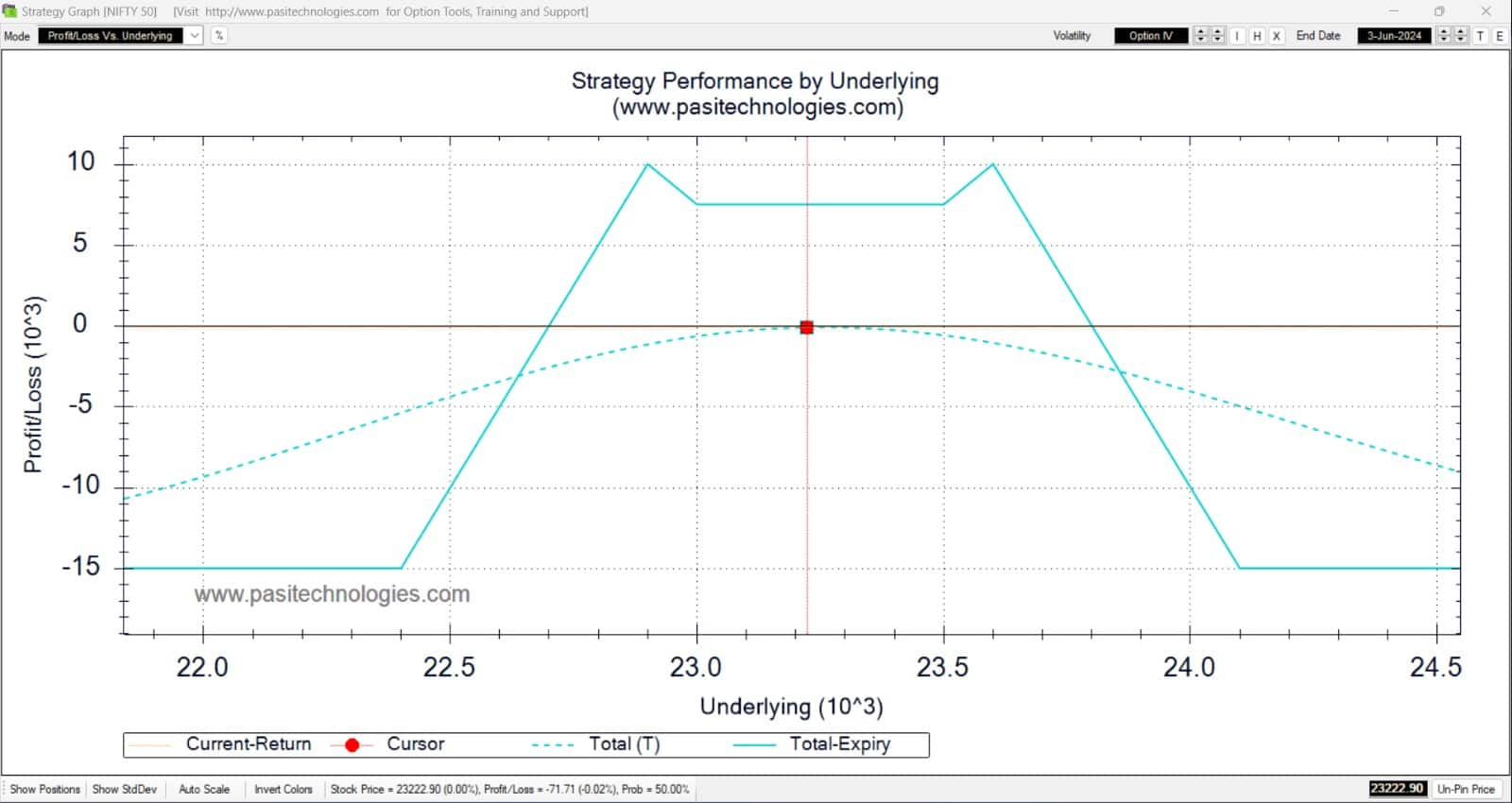

Derivative Strategies for the expected upmoveStrategy for Nifty Expiry by Santosh Pasi: Double Ratio Spread (Asymmetrical) for June 06 Expiry:Long PUT 22400 (2 lots)

Short PUT 22900 (3 lots)

Long PUT 23000 (1 lot)

Long CALL 23500 (1 lot)

Short CALL 23600 (3 lots)

Long CALL 24100 (2 lots)

Lower Breakeven: 22700

Upper Breakeven: 23800

Margin Requirement: Around Rs 92,000

Max Profit Potential: Around Rs 10,000

Max Loss Risk: Rs 15,000

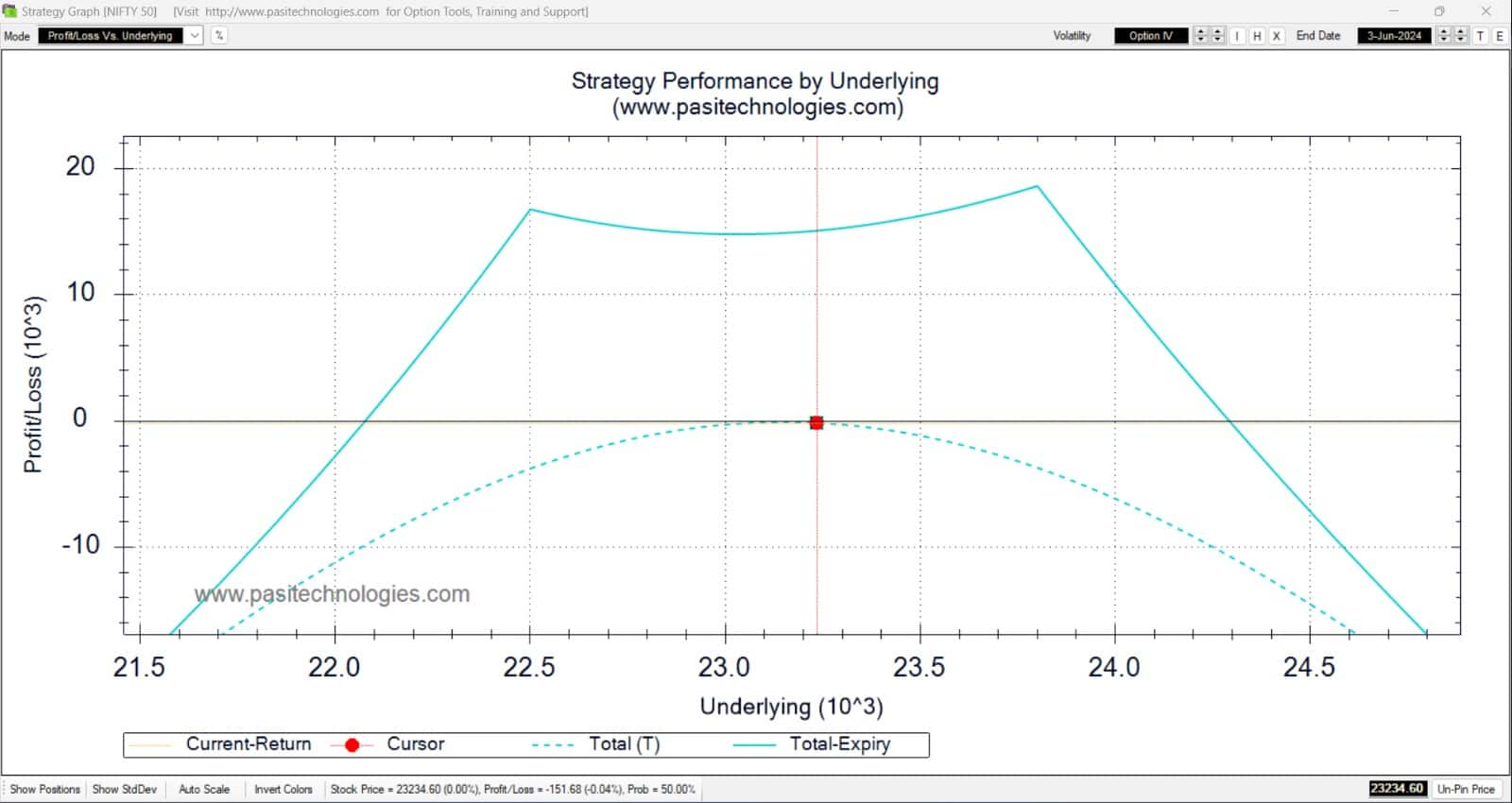

.Strategy for the Month by Santosh Pasi: Diagonal Ratio Spread (Asymmetrical) for June 27 Expiry:

.Strategy for the Month by Santosh Pasi: Diagonal Ratio Spread (Asymmetrical) for June 27 Expiry:Short PUT 22500 (2 lots for Jun 27)

Short CALL 23800 (2 lots for Jun 27)

Long PUT 22300 (1 lot for Jul 25)

Long CALL 24000 (1 lot for Jul 25)

Lower Breakeven: 22,070

Upper Breakeven: 24,299

Margin Requirement: Around Rs 1,12,000

Max Profit Potential: Around Rs 18,000

Max Loss Risk: Unlimited (exit if MTM loss exceeds Rs 7,500)

Long PUT 22350 (1 lot)

Short PUT 22550 (1 lot)

Short CALL 22550 (1 lot)

Long CALL 22750 (1 lot)

Lower Breakeven: 22,330

Upper Breakeven: 22,670

Margin Requirement: Around Rs 92,000

Max Profit Potential: Around Rs 7,000

Max Loss Risk: Rs 1,200

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.