The markets ended the week ended February 26, 2021, on a bearish note. The decline on Friday was substantial enough to trigger losses of 3.02 percent on the Nifty and 2.90 percent on the Bank Nifty on a WoW basis.

Notably, the selling persisted till the fag end of the trading session. Being the first day of the new derivatives series of March it put further pressure on the bulls as they paid cost of carry to roll over their longs which are under water. The cost of carry is a major pain point for real world traders as it adds up month after month and raises the buying cost. The hurdle rate for the bulls just got higher.

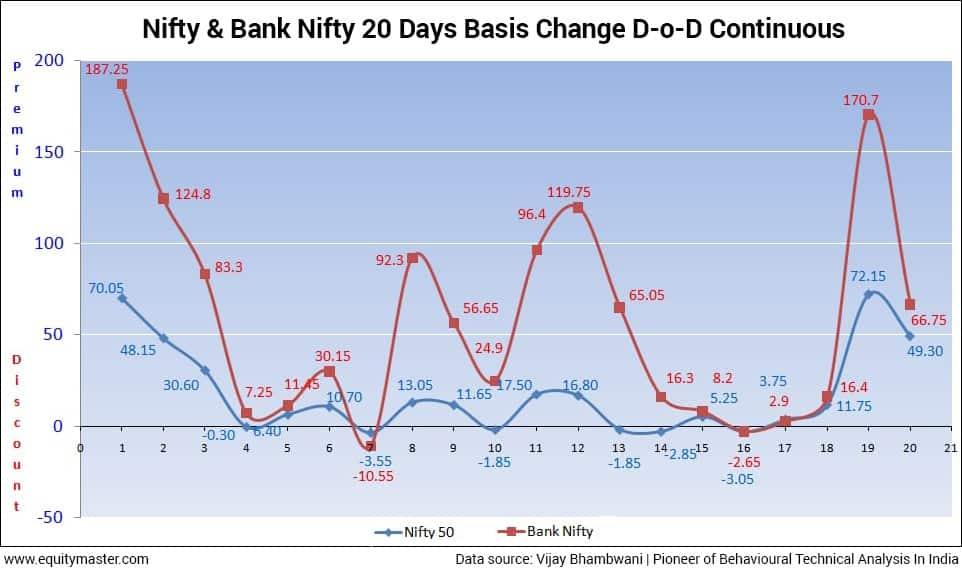

Look at the basis chart below. It denotes the futures premium over spot. Note how the basis has fallen sharply on Friday. Do note that tis also impacts options premia especially for the call options buyers. Traders who have taken the options route to go long have seen sizeable erosion in the call option premiums.

The problems of the stock and index futures buyers are more extreme. They are liable to make good mark-to-market losses and span margins. If the markets fall further they will have to cough up more money. Brokers will trigger margin calls (demand additional mark-to-market margin money) which can trigger unwinding of leveraged long positions under duress.

The problems of the stock and index futures buyers are more extreme. They are liable to make good mark-to-market losses and span margins. If the markets fall further they will have to cough up more money. Brokers will trigger margin calls (demand additional mark-to-market margin money) which can trigger unwinding of leveraged long positions under duress.

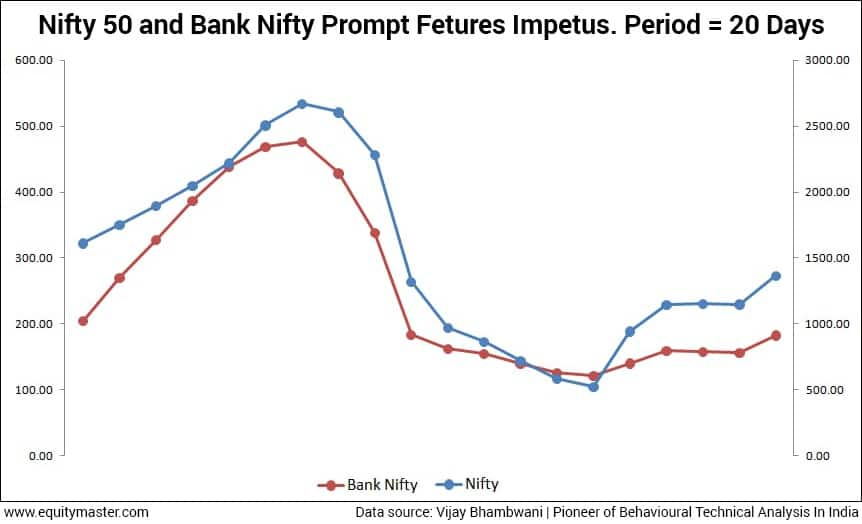

Take a look at the impetus (velocity of price movement) chart below. The momentum has gained traction on the day of biggest decline of the week. The volumes zoomed on Friday to Rs 1,15,760.30 crore in NSE spot segment and 7,33,800 lots & 11,11,447 lots in cumulative series index and stock futures respectively. The NSE lost Rs 5,36,635 crore in market capitalization on Friday alone. This means selling spilt over to the delivery segment as well.

These figures tell me that selling pressure was intense.

Of late bond yields have been in the news. The Indian 10 year benchmark bond yields have climbed to 6.30%. It was in a range between 5.90% – 5.95% three weeks ago. This is significant because rising yields indicate a possibility of rising interest rates. Low cost funds act as mother’s milk to a bull market. Raise interest rates and money flows from equities into fixed income instruments like bank FDs. The markets are nervous about that.

Of late bond yields have been in the news. The Indian 10 year benchmark bond yields have climbed to 6.30%. It was in a range between 5.90% – 5.95% three weeks ago. This is significant because rising yields indicate a possibility of rising interest rates. Low cost funds act as mother’s milk to a bull market. Raise interest rates and money flows from equities into fixed income instruments like bank FDs. The markets are nervous about that.

The other aspect is the USDINR. The dollar shot up suddenly and that is a worry for net importing nations like India. Everything from imported fuel to electronics and capital goods will become expensive. This is called ‘Imported Inflation.’ Rising oil price is likely to have a multiplier effect too as everything from fruits, milk, vegetables to grains can turn expensive.

As far as action on sectors is concerned all industries which are interest rate sensitive can get impacted. Consumer goods, automobiles, NBFCs, banks, real estate and infrastructure development companies may feel the heat.

Investors holding long portfolios with a multi-year view can remain invested. Short to medium term traders should exit weak stocks and hold blue chips primarily. Protecting your portfolio by deploying the “Tail Risk” strategy will help. It simply means buying (deeply) out of money put options to insulate yourself against further declines. This is also known as a “Hacienda Hedge” in professional options traders’ parlance.

I would suggest traders cut back on exposure and trade light. Focus on capital preservation as a priority.

Have a profitable week ahead.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!