The market on November 29 ended at a record closing high for yet another session, continuing its northward journey for the sixth straight trading day, tracking positive global cues.

The BSE Sensex rose 177 points to 62,682, while the Nifty50 closed above the 18,600 mark for the first time, climbing 55 points to 18,618 and forming a bullish candlestick pattern which resembles the Bullish Marubozu Opening kind of pattern on the daily charts, making higher high for fifth consecutive session.

"On the daily charts, the Nifty formed a Bullish Opening Marubozu candle at Life Time High levels. The Bullish Opening Marubozu candle means Open and Low of the candle are same, indicating bullish sentiments," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

The momentum indicator RSI (relative strength index) is showing a bullish reversal, reflecting a strong momentum build-up for the shorter term.

As per the overall price structure and evidence provided by indicators, the market expert feels that the Nifty is in strong upward momentum and can go higher to the level of 18,700.

However, the broader markets underperformed frontline indices as the Nifty Midcap 50, Midcap 100 and Smallcap 100 indices fell half a percent each.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 18,568, followed by 18,538 & 18,490. If the index moves up, the key resistance levels to watch out for are 18,664 followed by 18,694 and 18,742.

The Nifty Bank closed at 43,053 with 33 points gain and formed a small-bodied bullish candle on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 42,975, followed by 42,900 and 42,777 levels. On the upside, key resistance levels are placed at 43,220 followed by 43,295 and 43,418 levels.

We have continued to see the maximum Call open interest at 19,000 strike, with 36.47 lakh contracts, which can act as a crucial resistance level in the December series.

This is followed by 20,000 strike, which holds 25.66 lakh contracts, and 18,500 strike, which have more than 22.07 lakh contracts.

Call writing was seen at 18,800 strike, which added 3.89 lakh contracts, followed by 18,700 strike, which added 2.17 lakh contracts, and 19,500 strike which added 1.76 lakh contracts.

Call unwinding was seen at 18,500 strike, which shed 1.93 lakh contracts, followed by 18,400 strike which shed 89,550 contracts and 20,000 strike which shed 67,000 contracts.

We have seen a maximum Put open interest at 18,000 strike, with 40.26 lakh contracts which can act as a crucial support level in the December series.

This is followed by 17,000 strike, which holds 30.07 lakh contracts, and an 18,500 strike, which has accumulated 27.46 lakh contracts.

Put writing was seen at 18,600 strike, which added 4.57 lakh contracts, followed by 18,500 strike, which added 3.45 lakh contracts, and 18,700 strike which added 2.96 lakh contracts.

Put unwinding was seen at 17,700 strike, which shed 86,250 contracts, followed by 17,100 strike which shed 71,450 contracts and 17,400 strike which shed 22,400 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in ICICI Bank, HDFC, HDFC Bank, HDFC Life Insurance Company, and Bosch, among others.

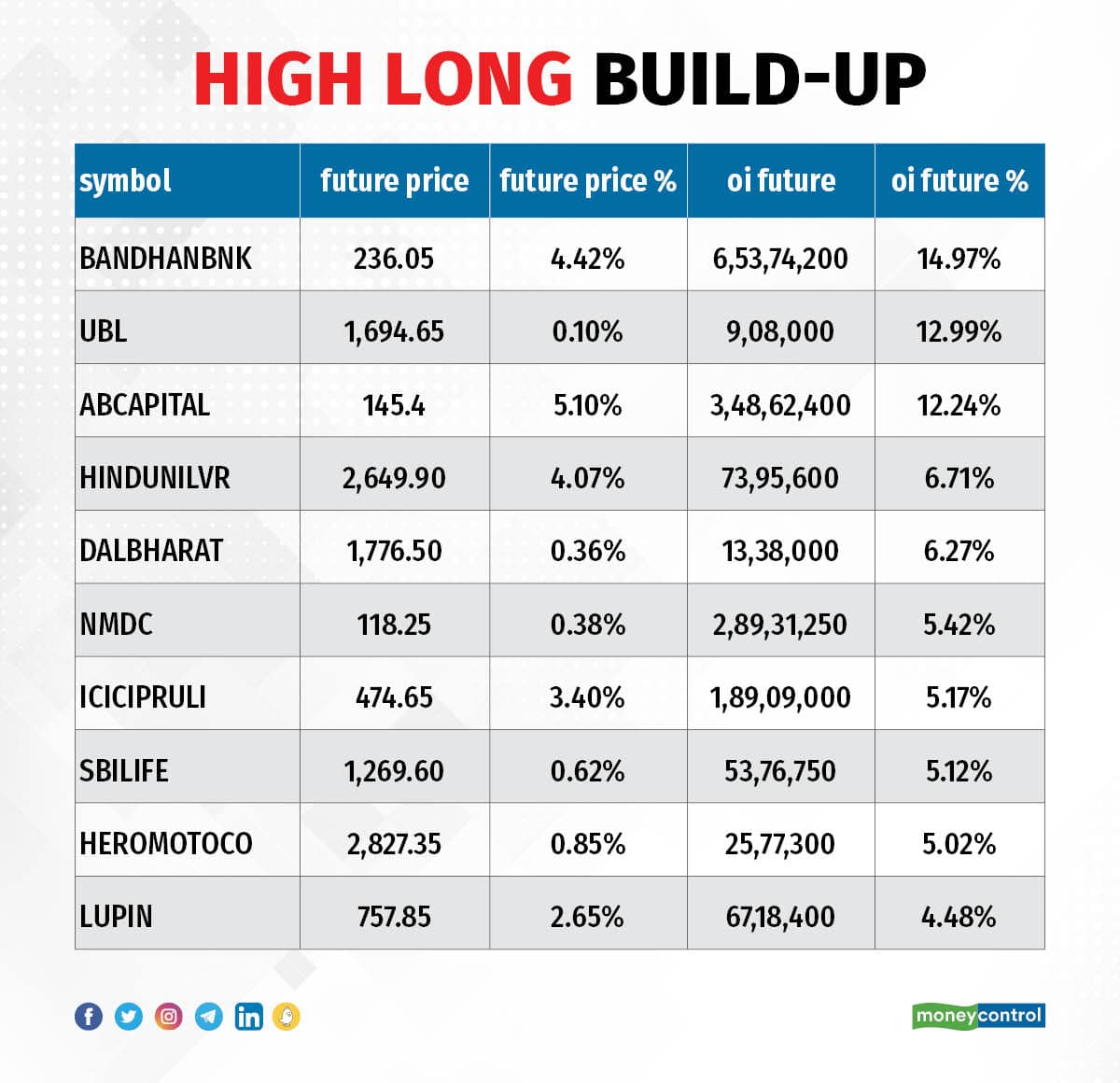

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, we have seen a long build-up in 42 stocks including Bandhan Bank, United Breweries, Aditya Birla Capital, Hindustan Unilever, and Dalmia Bharat.

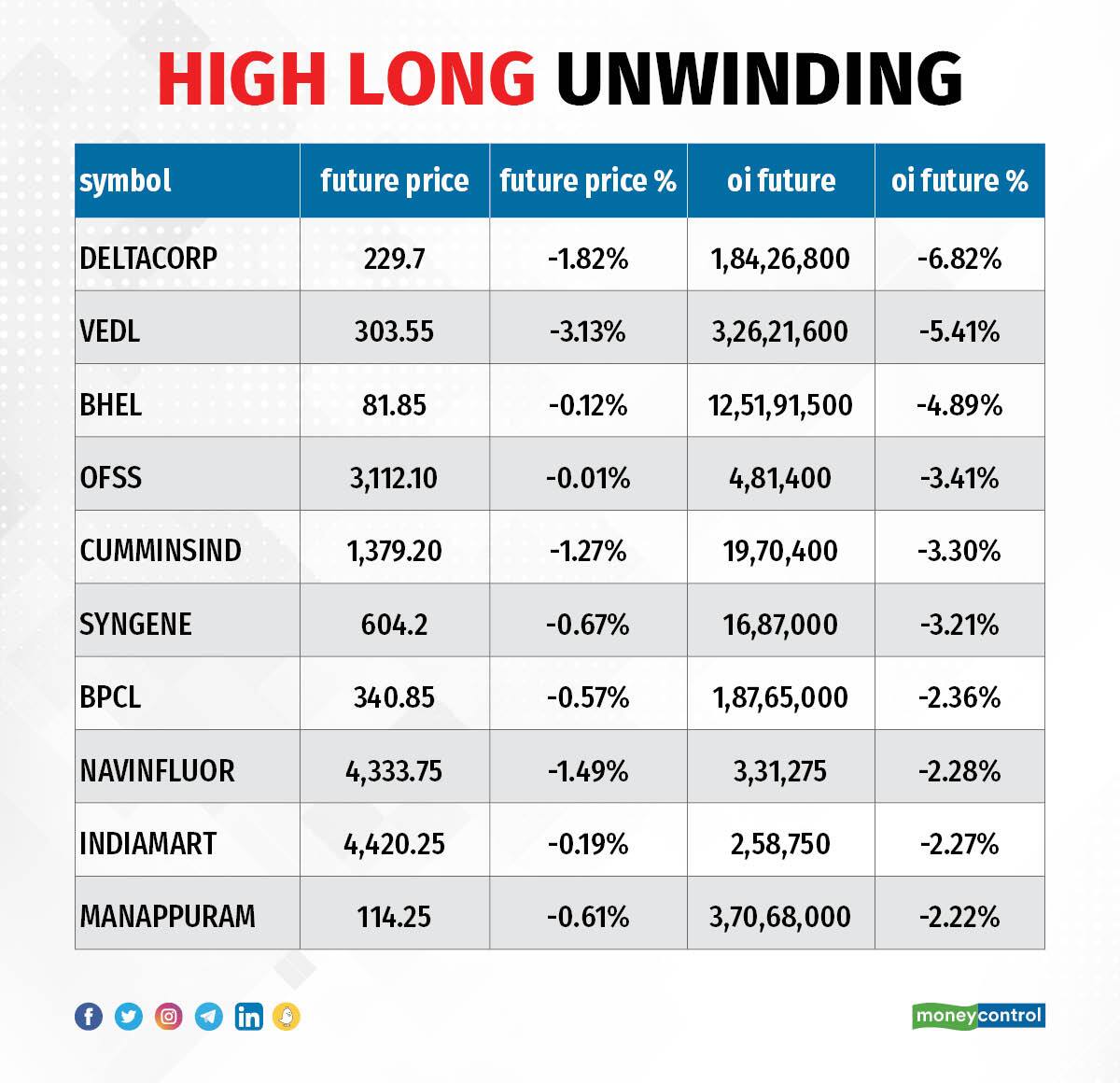

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, 45 stocks have seen a long unwinding on Tuesday, including Delta Corp, Vedanta, BHEL, Oracle Financial, and Cummins India.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, we have seen a short build-up in 69 stocks on Tuesday, including Laurus Labs, ABB India, Shriram Transport Finance, Coal India, and Dr Lal PathLabs.

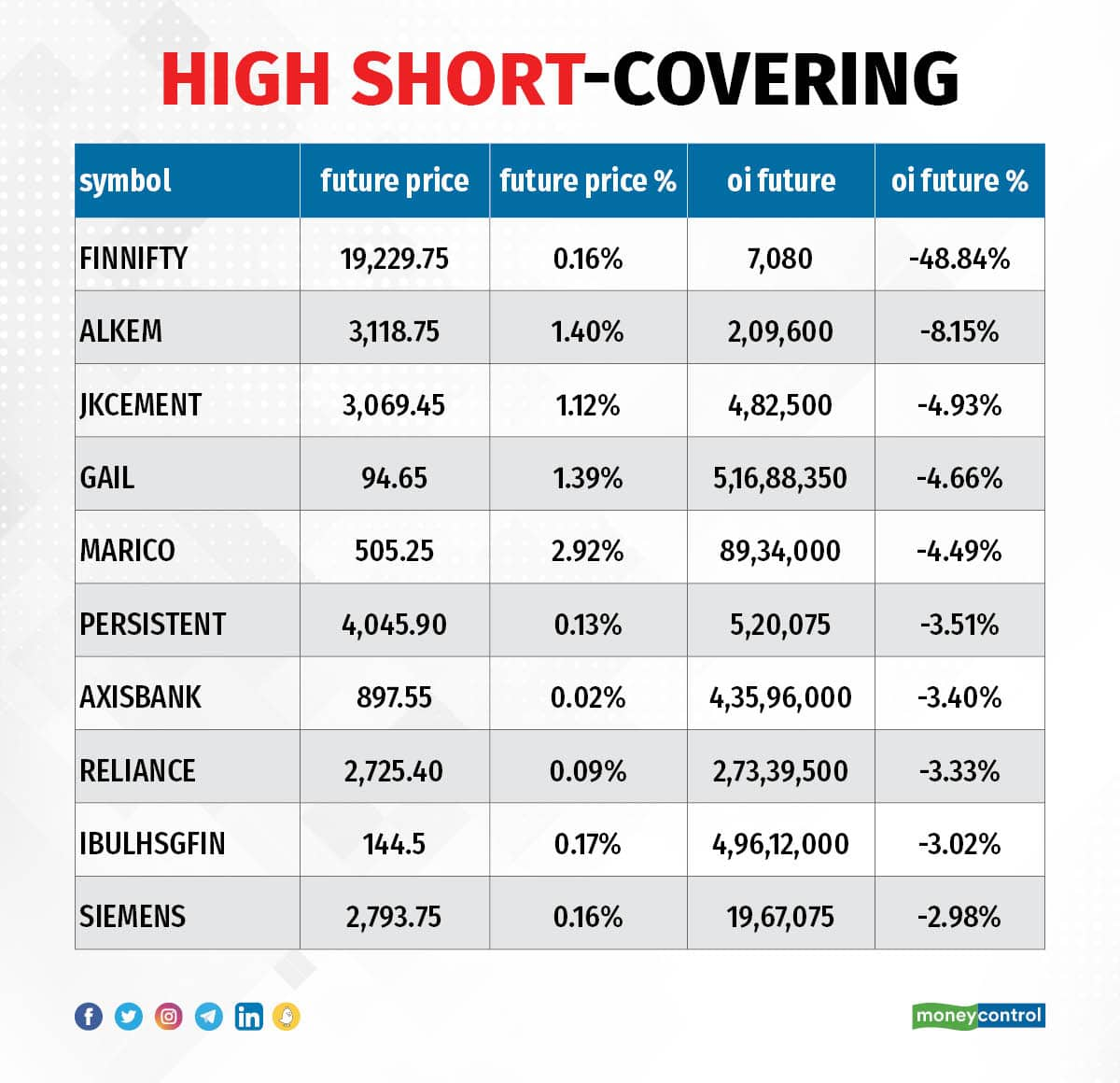

38 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, we have 58 stocks on the short-covering list, including Nifty Financial, Alkem Laboratories, JK Cement, GAIL India, and Marico.

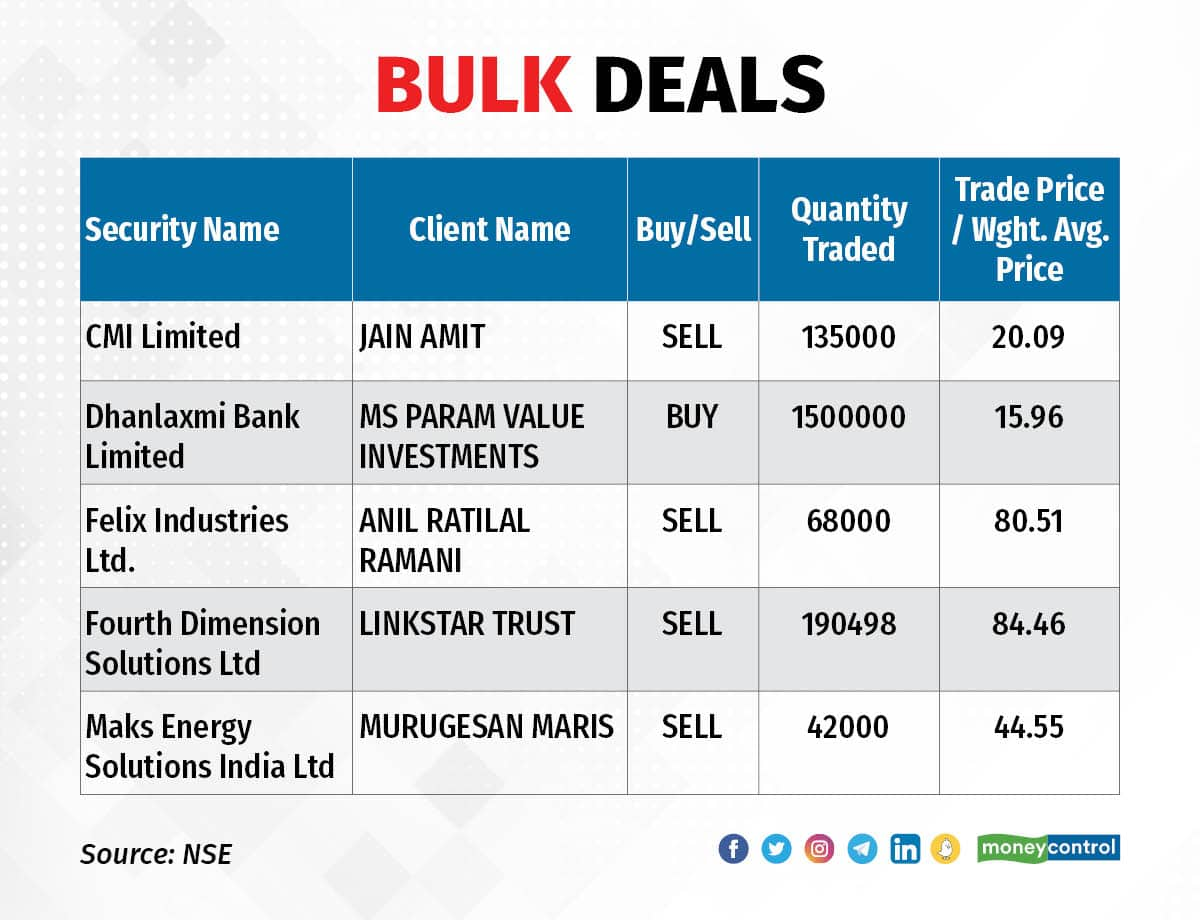

Dhanlaxmi Bank: MS Param Value Investments acquired 15 lakh equity shares or 0.6 percent stake in the lender at an average price of Rs 15.96 per share. The stock surged nearly 9 percent to close at Rs 16.25 on Tuesday.

(For more bulk deals, click here)

Investors Meetings on November 30

One 97 Communications: The company will host an analyst and investor meeting in Mumbai.

Navin Fluorine International, Aegis Logistics, Havells India: Officials of the company will attend IIFL's Invest India conference.

EKI Energy Services: Officials of the company will interact with HSBC Securities, JM Financial, Mission Holdings, and Aditya Birla Sun Life AMC.

JK Cement: Officials of the company will interact with investors.

Hindustan Zinc: Officials of the company will interact with prospective investors via non-deal road shows, for disinvestment of residual government's shareholding in the company.

Indiabulls Housing Finance: The company holds virtual brokers and analyst meetings for the announcement of the public issue of NCDs.

Voltas: Officials of the company will interact with Bank of America Securities.

HPL Electric & Power: Officials of the company will interact with PI Square Investments.

Paras Defence and Space Technologies: Officials of the company will interact with analysts and institutional investors in Antique Singapore non-deal roadshows.

Alkem Laboratories: Officials of the company will interact with Phillip Capital PMS.

Infibeam Avenues: Officials of the company will interact with Credit Suisse India Wealth Management, and DAM Capital.

Hindware Home Innovation: The management of the company would be meeting investors from Nalanda Capital Pte. Ltd.

Fine Organic Industries: Officials of the company will be attending the investor conference hosted by Prabhudas Lilladhar.

Stocks in News

IDFC: Market watchdog Sebi has approved the change in control of IDFC Mutual Fund. In April 2022, the board of directors of IDFC and IDFC Financial Holding Company had approved the divestment of IDFC Asset Management Company and IDFC AMC Trustee Company to the consortium. The consortium comprised Bandhan Financial Holding, Lathe Investment Pte. Ltd. (affiliate of GIC), Tangerine Investments, and Infinity Partners (affiliates of ChrysCapital).

Biocon: Biocon Biologics and its subsidiary completed the acquisition of the biosimilars businesses and assets of Viatris Inc. Biocon subsidiaries acquired businesses through the purchase of 100 percent stake in Biosimilar NewCo (BNCL), a company incorporated in the United Kingdom; and subscription to 100% stake in Biosimilar Collaborations Ireland (BCIL), a company incorporated in Ireland. With this, BNCL and BCIL have become step-down subsidiaries of Biocon Biologics and indirect subsidiaries of Biocon. The multi-billion-dollar and value accretive transaction included upfront cash payment of $2 billion and issuance of CCPS worth $1 billion.

Usha Martin: Promoter Peterhouse Investment Ltd and PACs offloaded 2.5 lakh shares or 0.08 percent stake in Usha Martin via open market transactions on November 29. With this, its shareholding in the company reduced to 1.13 percent, down from 1.21 percent earlier.

Kilpest India: Subsidiary 3B BlackBio Biotech India signed a non-binding letter of intent to acquire 100 percent stake in a Europe-based life science products manufacturer. An exclusivity period of 60 days has been agreed upon between the parties to complete due diligence.

Gland Pharma: The pharma company through its wholly owned subsidiary Gland Pharma International PTE. Ltd, Singapore, has entered into a Put Option Agreement to acquire 100 percent of Cenexi Group. Cenexi Group will be acquired for an equity value of up to 120 million euro. Cenexi, along with its subsidiaries, is engaged primarily in the business of contract development and manufacturing organisation (CDMO) of pharmaceutical products with expertise in sterile liquid and lyophilized fill finished drugs.

Bharat Bijlee: Life Insurance Corporation of India sold a 2.15 percent stake in Bharat Bijlee via open market transactions. With this, LIC's shareholding in the company reduced to 4.54 percent, from 6.69 percent earlier.

Inox Green Energy Services: Inox Wind and its subsidiary Inox Green Energy Services, as part of the strategic initiative to deleverage their respective balance sheets, have recently paid Rs 250 crore and Rs 161 crore (aggregating to Rs 411 crore) towards reducing their debt. Consequently, the corporate guarantees given by Gujarat Fluorochemicals, have also got reduced to that extent. Both companies are in the process of further reducing their debt in due course.

Fund Flow

Foreign institutional investors (FIIs) have net-bought shares worth Rs 1,241.57 crore, while domestic institutional investors (DIIs) net-sold shares worth Rs 744.42 crore on November 29, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added Punjab National Bank, and retained BHEL, Delta Corp and Indiabulls Housing Finance, under its F&O ban list for November 30. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.