After two days of losses, the market not only rebounded smartly on August 23, but also showed good recovery from the day's low, which resulted into formation of somewhat Bullish Piercing kind of pattern on the daily charts on the Nifty50. This pattern is generally formed in a downtrend and is bullish reversal pattern.

The rally was despite weakness in global counterparts amid rising oil prices and the euro reaching 20-year low against US dollar.

The BSE Sensex rose 257 points to 59,031, and the Nifty50 jumped 87 points to 17,577, while the Nifty Midcap and Smallcap 100 indices gained more than 1 percent each, but the volatility remained on higher side, with India VIX rising by 0.06 percent to 19.05 levels.

"On the daily charts, the Nifty formed Piercing Line candle pattern which is a bullish reversal candle pattern which has formed at important support level of 17,350 mark," said Vidnyan Sawant, AVP - Technical Research at GEPL Capital.

The momentum indicator RSI (relative strength index) has turned up indicating the Index is gaining positive momentum once again.

The Nifty has an immediate resistance levels at 17,625 (day high) followed by 17,758 (key resistance) and on the other side, it has strong support level placed at 17,460 (key support) followed by 17,350 (cluster of support).

As per the overall chart pattern and indicator set up, Sawant feels that if the Nifty sustains above Tuesday's high of 17,625 level then it will move up towards 17,758 followed by 18,000 mark in the coming future. "Our positive view will be negated if it sustains above 17,350 levels on the downside."

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,407, followed by 17,236. If the index moves up, the key resistance levels to watch out for are 17,687 and 17,796.

The Nifty Bank rallied 400 points to 38,698 and formed Bullish Engulfing candle on the daily charts on Tuesday. The important pivot level, which will act as crucial support for the index, is placed at 38,142, followed by 37,587. On the upside, key resistance levels are placed at 39,061 and 39,425 levels.

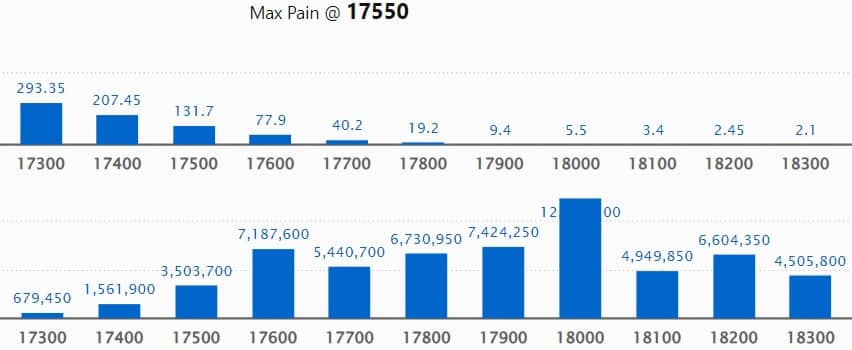

Maximum Call open interest of 1.23 crore contracts was seen at 18,000 strike, which will act as a crucial resistance level in the August series.

This is followed by 17,900 strike, which holds 74.24 lakh contracts, and 17,600 strike, which has accumulated 71.87 lakh contracts.

Call writing was seen at 17,900 strike, which added 11.91 lakh contracts, followed by 17,400 strike which added 8.74 lakh contracts.

Call unwinding was seen at 18,200 strike, which shed 14.31 lakh contracts, followed by 17,700 strike which shed 11.54 lakh contracts and 18,500 strike which shed 11.53 lakh contracts.

Maximum Put open interest of 77.99 lakh contracts was seen at 17,500 strike, which will act as a crucial support level in the August series.

This is followed by 17,000 strike, which holds 74.23 lakh contracts, and 17,400 strike, which has accumulated 65.9 lakh contracts.

Put writing was seen at 16,800 strike, which added 42.97 lakh contracts, followed by 17,400 strike, which added 28.36 lakh contracts and 17,500 strike which added 23.68 lakh contracts.

Put unwinding was seen at 17,800 strike, which shed 5.92 lakh contracts, followed by 17,100 strike which shed 4.57 lakh contracts, and 18,000 strike, which shed 3.08 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in JK Cement, United Breweries, Crompton Greaves Consumer Electricals, Divis Laboratories, and Oracle Financial, among others.

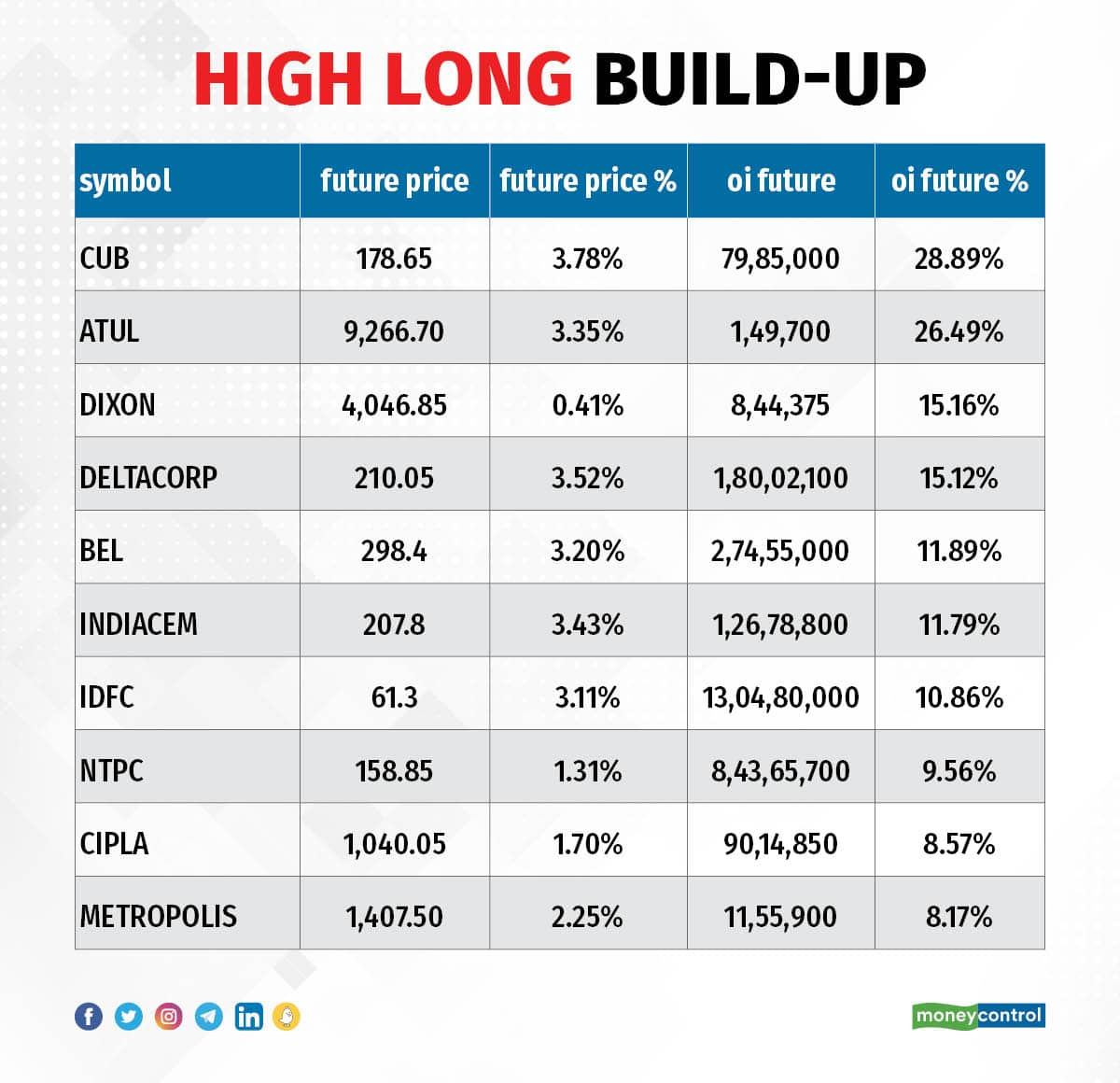

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including City Union Bank, Atul, Dixon Technologies, Delta Corp, and Bharat Electronics, in which a long build-up was seen.

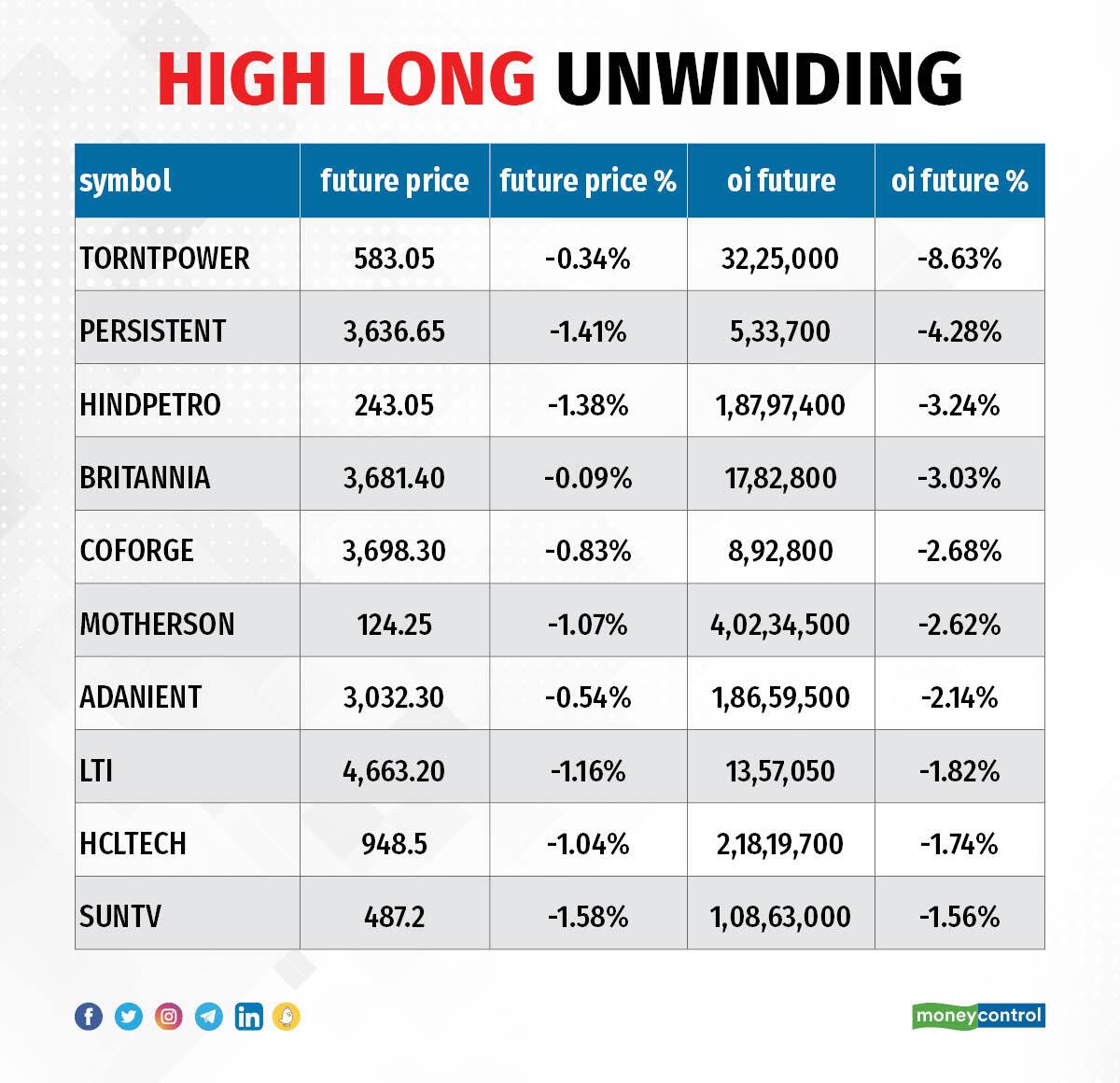

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Torrent Power, Persistent Systems, Hindustan Petroleum Corporation, Britannia Industries, and Coforge, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including United Breweries, Crompton Greaves Consumer Electricals, Max Financial Services, Divis Laboratories, and ICICI Lombard General Insurance, in which a short build-up was seen.

85 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Syngene International, Voltas, Tata Chemicals, Polycab India, and Indus Towers, in which short-covering was seen.

Cigniti Technologies: PMK Holdings Private Limited acquired additional 1,50,802 equity shares in the company at an average price of Rs 597 per share. As of June 2022, PMK held 1.56 percent stake or 4.26 lakh shares in the company.

Devyani International: Dunearn Investments (Mauritius) Pte Ltd sold 2,63,29,516 equity shares or 2.18 percent stake in the company via open market transactions at an average price of Rs 183.11 per share. Dunearn held 8.13 percent stake or 9.8 crore equity shares in the company as of June 2022.

(For more bulk deals, click here)

Investors Meetings on August 24

Sonata Software: Officials of the company will meet IDBI Capital Markets & Securities.

UltraTech Cement: Officials of the company will meet TT International, Aberdeen PLC, Schroder Investment Management UK.

Sobha: Officials of the company will meet Jefferies.

Mahindra Holidays & Resorts India: Officials of the company will meet IIFL.

Blue Star: Officials of the company will meet IIFL Securities.

Orient Electric, Carborundum Universal: Officials of companies will attend DAM Capital: Virtual MidCap Investor Conference 2022.

Nazara Technologies, Aptus Value Housing Finance India, Inox Leisure, Zee Entertainment Enterprises, Polycab India, CSB Bank, PSP Projects: Officials of companies will attend DART India Annual Conference 2022 "The Challenge of Change".

PI Industries: Officials of the company will meet M&G, Singapore, and Franklin Templeton MF.

Advanced Enzyme Technologies: Officials of the company will meet Eternity Capital.

Asian Paints: Officials of the company will meet J P Morgan Asset Management.

Lemon Tree Hotels: Officials of the company will be participating in the corporate roadshow in Singapore organized by Motilal Oswal Securities.

Wipro: Officials of the company will participate in HDFC Securities IT sector conference.

Supreme Industries: Officials of the company will meet Vaughan Nelson Investment Management.

Marksans Pharma: Officials of the company will meet several analysts including Discovery Capital, Enam Holding, Max Life Insurance, and Rare Enterprise.

Persistent Systems: Officials of the company will interact with Grandeur Peak Global.

Stocks in News

Adani Enterprises: The Adani Group company's indirect subsidiary Vishvapradhan Commercial (VCPL) exercised certain warrants for acquiring 99.5 percent shareholding in RRPR Holding (RRPR), a promoter company of New Delhi Television Limited (NDTV). The acquisition will result in VCPL acquiring control of RRPR. RRPR holds 29.18 percent stake in NDTV. VCPL, along with AMG Media Networks (AMNL) & Adani Enterprises will launch an open offer to acquire up to 26 percent stake in NDTV.

Ugro Capital: The company said its Investment and Borrowing Committee will meet on August 26 to approve raising of funds by way of issuance of non-convertible debentures through private placement basis.

Chennai Petroleum Corporation: Chennai Petroleum has decided to form a joint venture company along with Indian Oil Corporation and other seed equity investors (Axis Bank, HDFC Life Insurance Company, ICICI Bank, ICICI Prudential Life Insurance Company and SBI Life Insurance Company for implementing the 9 MMTPA refinery project at Cauvery basin refinery, at estimated cost of Rs 31,580 crore. Chennai Petroleum received board approval for equity investment of upto Rs 2,570 crore in the joint venture, towards its contribution of 25 percent.

Arvind SmartSpaces: The company has executed the agreements, as a promoter, in relation to the new platform. Arvind SmartSpaces, and HDFC Capital Advisors (as investment manager of HDFC Capital Affordable Real Estate Fund - 3 will make investments in company's wholly owned subsidiary Arvind SmartHomes for acquisition and construction of real estate projects (platform funding). Arvind SmartSpaces will invest Rs 300 crore and HDFC Capital Advisors will invest Rs 600 crore in Arvind SmartHomes.

Nava: The company has decided to discontinue the production of high carbon ferro chrome for TATA Steel Mining at the end of October 2022. The company will undertake a scheduled maintenance of the Odisha smelters in November 2022 and switch over to production of manganese alloys in Odisha Works. The company has geared up for this additional production in Odisha, besides that in Telangana, aggregating to a rated capacity of 1,80,000 MT of manganese alloys per annum. The switchover would provide the company better economies of scale and improved market share in the manganese alloys segment. The agreement for production of high carbon ferro chrome for TATA Steel Mining was for the period up to March, 2025.

Monarch Networth Capital: The company through Monarch Alternative Investment Fund raised Rs 252 crore in its second Cat-3 AIF. It plans to infuse Rs 1,000 crore in its existing and new businesses over the next three years. It has received interest from sovereign funds and family offices.

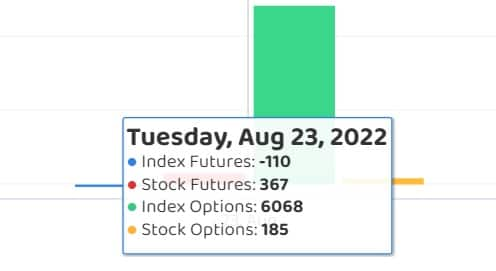

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 563 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 215.20 crore on August 23, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock in its F&O ban list for August 24. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.