The market was volatile and managed to eke out moderate gains due to recovery in the last couple of hours of trade on August 2. Hence, there was a continuation in the uptrend for the fifth consecutive session.

The BSE Sensex rose 21 points to 58,136, while the Nifty50 increased 5.5 points to 17,345.50 and formed a Doji kind of indecisive pattern on the daily charts on Tuesday, with higher high-higher low formation for the fourth straight session.

"On the daily charts, the Nifty formed Doji candle pattern near an important resistance zone of 17,415 levels, indicating short-term indecisiveness of the Index. The Nifty could not close above the previous day's high which shows the bulls are facing exhaustion after the strong rally of the Nifty of around 1,000 points in just five days," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

He further said the momentum indicator RSI is turning down at overbought levels, indicating that the index is losing momentum.

The Nifty has an immediate resistance level at 17,415 (key resistance) followed by 17,665 (key resistance) and on the other side, it has a strong support level at 17,217 (day low) followed by 17,000 (key support).

As per the overall chart pattern, Vidnyan feels the Nifty is in the indecisive zone. "If the Nifty sustains above 17,415 levels, then it will move towards 17,665 followed by 17,779 levels. However, if the Nifty breaches the 17,217 mark on the downside then it may slip till 17,000 in the near future," the market expert said.

The outperformance by the broader space continued for yet another session. The Nifty Midcap 100 and Smallcap 100 indices gained a third of a percent and seven-tenth of a percent respectively, but the volatility index India VIX increased by 5.97 percent to 18.53 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,244, followed by 17,143. If the index moves up, the key resistance levels to watch out for are 17,418 and 17,492.

The Nifty Bank climbed 121 points to 38,024 and formed a bullish candlestick pattern on the daily charts on Tuesday. The important pivot level, which will act as crucial support for the index, is placed at 37,711, followed by 37,398. On the upside, key resistance levels are placed at 38,258 and 38,493 levels.

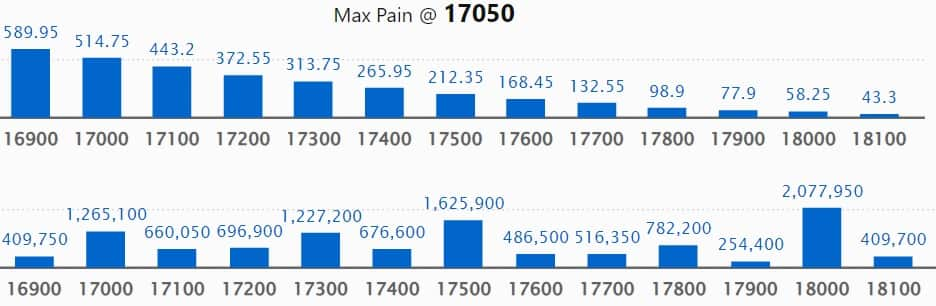

Maximum Call open interest of 20.77 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the August series.

This is followed by 17,500 strike, which holds 16.25 lakh contracts, and 17,000 strike, which has accumulated 12.65 lakh contracts.

Call writing was seen at 17,300 strike, which added 4.95 lakh contracts, followed by 17,400 strike which added 2.06 lakh contracts, and 18,500 strike which added 1.66 lakh contracts.

Call unwinding was seen at 17,000 strike, which shed 1.6 lakh contracts, followed by 17,100 strike which shed 1.47 lakh contracts and 16,800 strike which shed 1.26 lakh contracts.

Maximum Put open interest of 24.07 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the August series.

This is followed by 17,000 strike, which holds 20.64 lakh contracts, and 16,000 strike, which has accumulated 19.64 lakh contracts.

Put writing was seen at 17,300 strike, which added 5.37 lakh contracts, followed by 17,200 strike, which added 1.39 lakh contracts and 16,100 strike which added 1.22 lakh contracts.

Put unwinding was seen at 16,500 strike, which shed 2.12 lakh contracts, followed by 16,000 strike which shed 79,350 contracts, and 18,000 strike which shed 62,500 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in HCL Technologies, Power Grid Corporation of India, HDFC Bank, Coromandel International, and Ambuja Cements, among others.

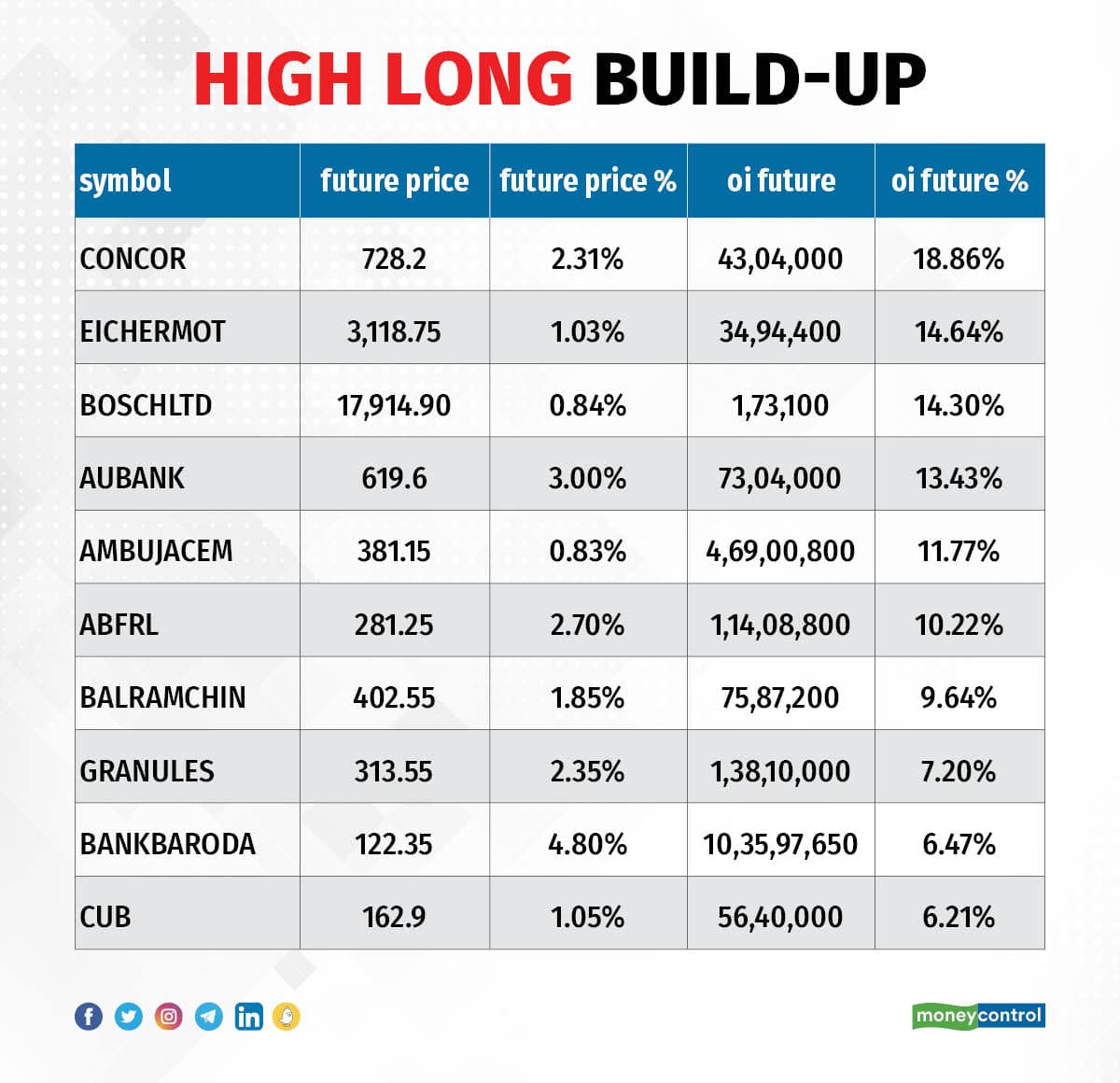

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Container Corporation of India, Eicher Motors, Bosch, AU Small Finance Bank, and Ambuja Cements, in which a long build-up was seen.

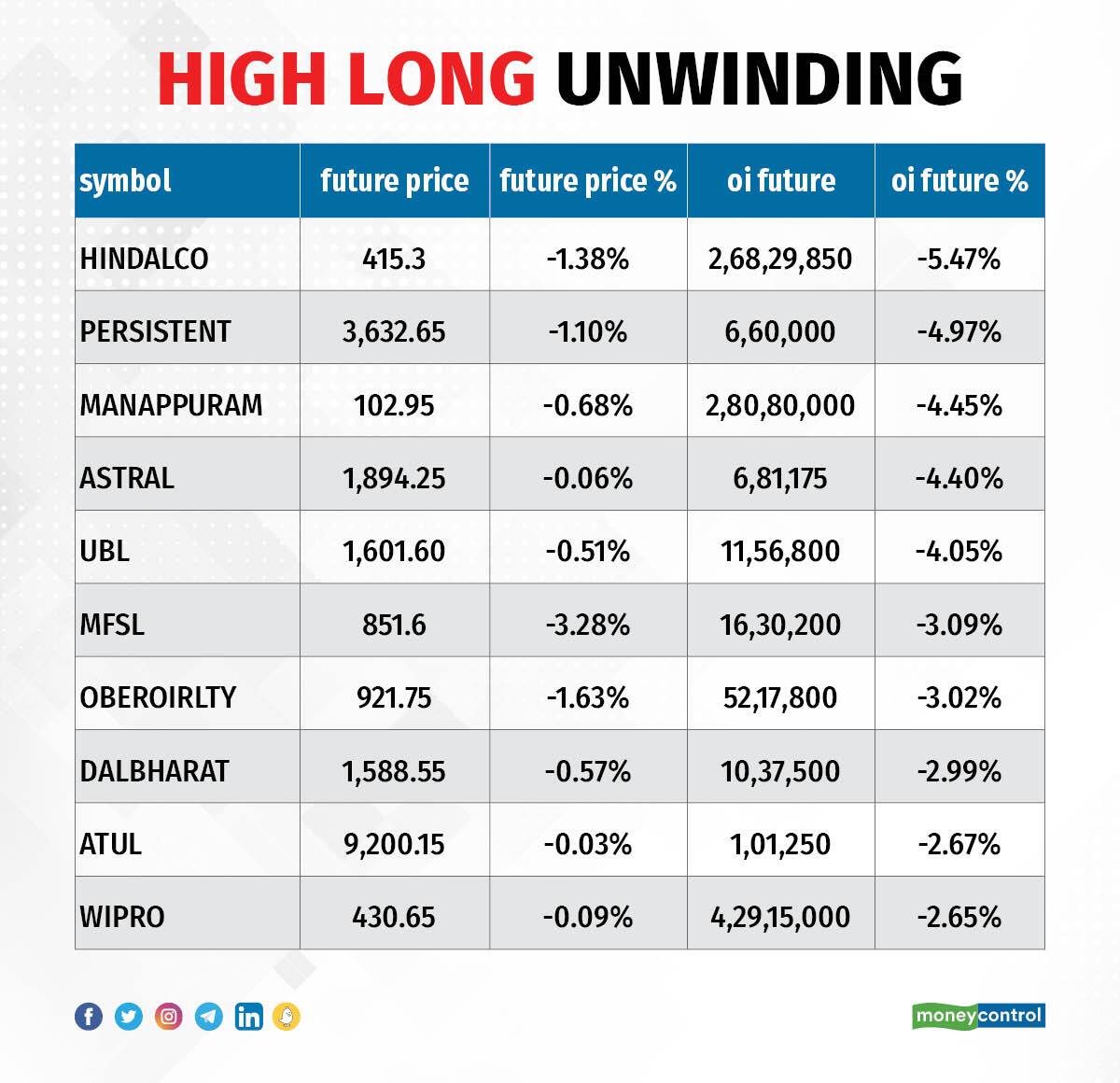

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Hindalco Industries, Persistent Systems, Manappuram Finance, Astral, and United Breweries, in which long unwinding was seen.

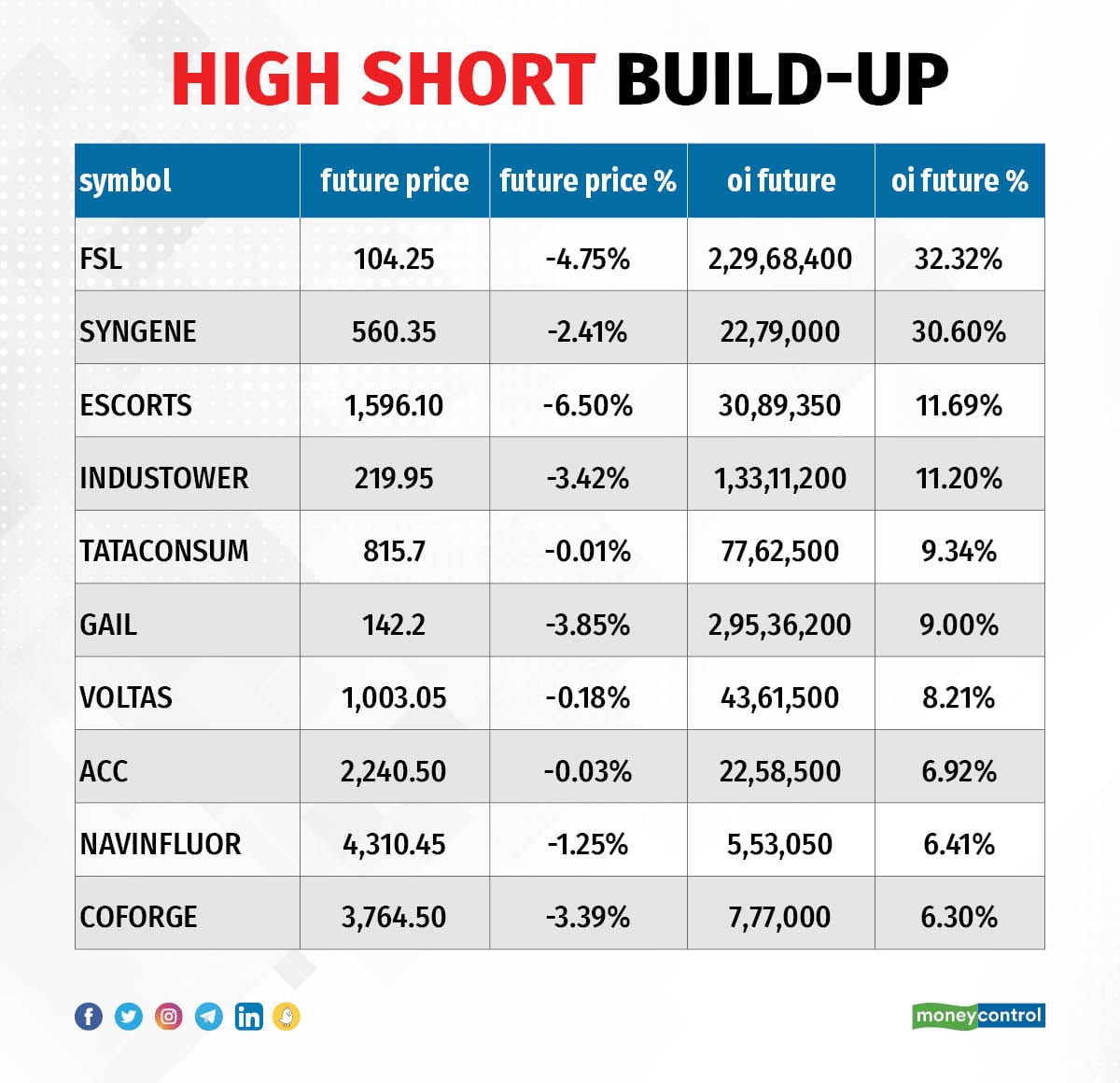

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Firstsource Solutions, Syngene International, Escorts, Indus Towers, and Tata Consumer Products, in which a short build-up was seen.

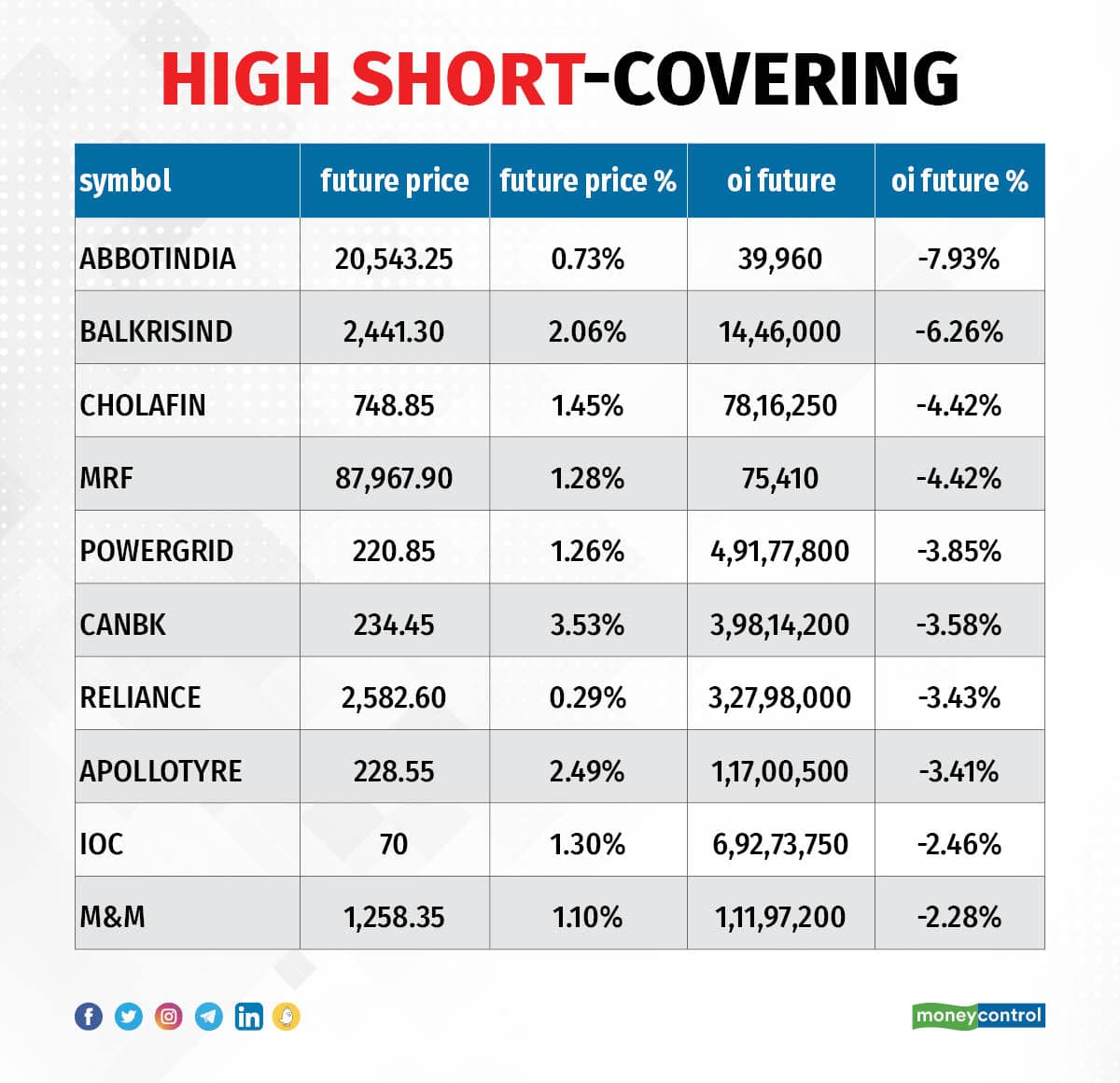

40 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Abbott India, Balkrishna Industries, Cholamandalam Investment, MRF, and Power Grid Corporation, in which short-covering was seen.

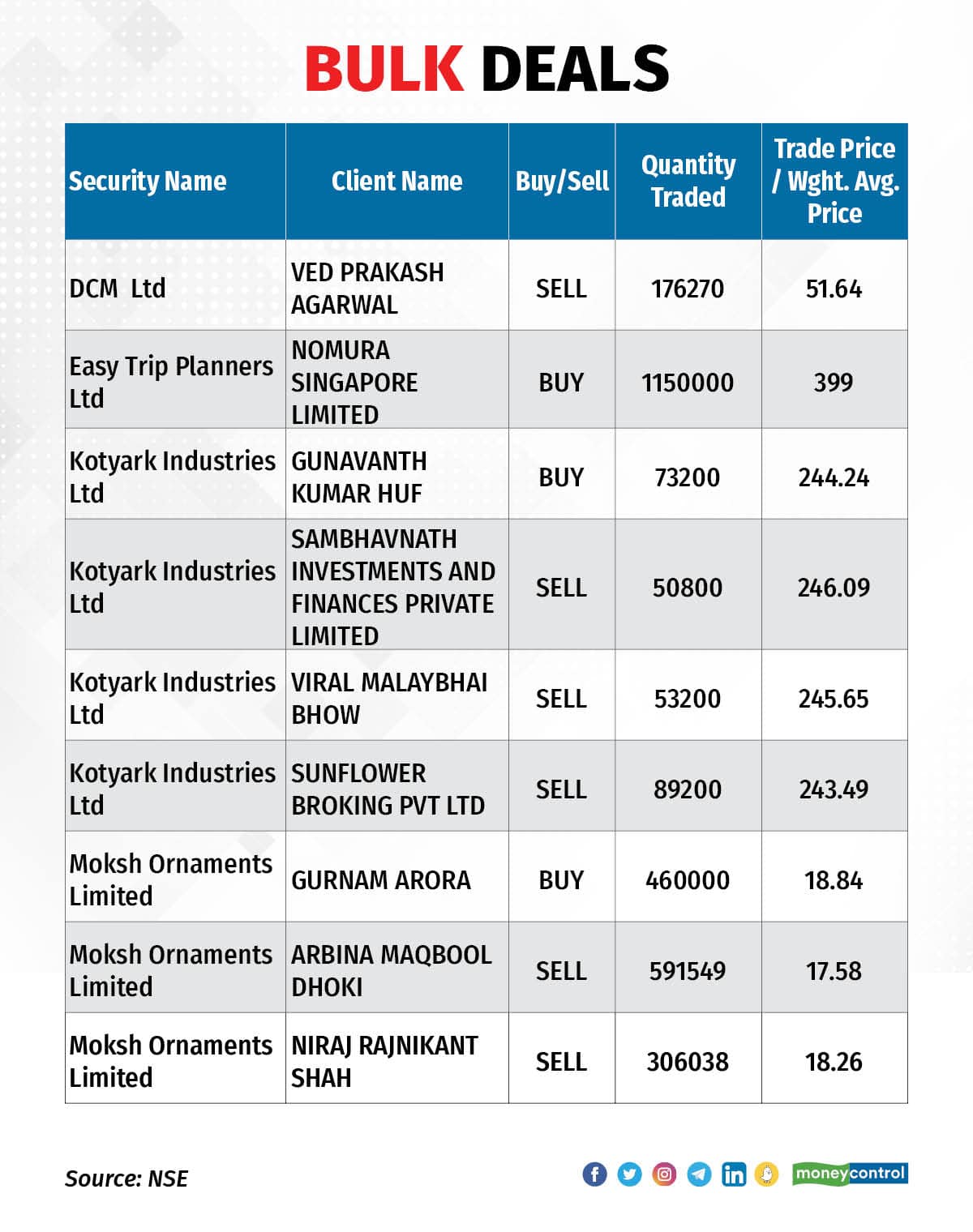

Easy Trip Planners: Nomura Singapore acquired 11.5 lakh equity shares in the company via open market transactions at an average price of Rs 399 per share.

(For more bulk deals, click here)

Lupin, Adani Power, InterGlobe Aviation, Vodafone Idea, Godrej Consumer Products, Aditya Birla Capital, Adani Transmission, Adani Wilmar, BASF India, Birlasoft, Chambal Fertilisers, Devyani International, Firstsource Solutions, Gujarat Gas, Inox Leisure, KEC International, Paras Defence and Space Technologies, PI Industries, Sandhar Technologies, Satin Creditcare Network, Speciality Restaurants, Tata Coffee, and Zuari Agro Chemicals will be in focus ahead of June quarter earnings on August 3.

Stocks in News

Subex: Jio Platforms announced a partnership with Subex for its AI Orchestration Platform, HyperSense, which can enable telcos to deliver on the promise of AI across the data value chain. Jio Platforms will offer its Cloud Native 5G Core to telecom companies globally along with Subex's HyperSense for enabling closed-loop network automation, product performance and customer experience analytics.

Paradeep Phosphates: The company reported a 4.7 percent year-on-year increase in consolidated profit at Rs 62.77 crore for the quarter ended June 2022, impacted by higher finance cost, and input cost but supported by top line. Revenue from operations grew by 85 percent YoY to Rs 2,434.66 crore during the same period.

Voltas: The company registered a 10 percent year-on-year decline in profit at Rs 110 crore for the quarter ended June 2022 dented by other income. Revenue grew by 50 percent YoY to Rs 2,795 crore during the same period largely driven by the unitary cooling products segment that grew 125 percent YoY.

eClerx Services: The company said the board of directors will hold a meeting on August 9 to consider the issuance of bonus equity shares. The board will also consider un-audited financial results (consolidated and standalone) of the company for the quarter ended June 2022, on the same date.

Adani Green Energy: The company reported a 2.3 percent YoY decline in consolidated profit at Rs 214 crore for the quarter ended June 2022, dented by lower other income, and forex loss. Revenue grew by 58 percent YoY to Rs 1,701 crore during the same period. Robust growth in revenue and EBITDA from power supply is backed by capacity addition, improved solar and wind CUF and high hybrid CUF, while the consistent EBITDA margin (flat at 92 percent YoY), is backed by high solar, wind and hybrid CUF and cost efficiencies brought in through real-time centralised monitoring through energy network operation centre.

Aurobindo Pharma: The API non-antibiotic manufacturing facility in Andhra Pradesh has received a 'Form 483' with 3 observations, but none of these observations is related to data integrity. The USFDA inspected the company's Unit XI, an API non-antibiotic manufacturing facility from July 25 to August 2. Earlier, the said Unit was classified as OAI on May 17, 2019, and subsequently given a warning letter dated June 20, 2019.

Jubilant Pharmova: The USFDA has issued six observations to the company's solid dosage manufacturing facility at the Roorkee plant. The USFDA concluded an audit of this facility of Jubilant Generics, a subsidiary of its wholly owned subsidiary Jubilant Pharma.

ITC: The company has exited its lifestyle retailing business following a strategic review of its business portfolio.

Mahindra & Mahindra Financial Services: The company said in July 2022, against the backdrop of a positive macro environment, the business continued its momentum with the disbursement of approximately Rs 3,912 crore delivering a 63 percent YoY growth and a 3 percent sequential MoM growth. The YTD disbursement at approximately Rs 13,385 crore registered a YoY growth of 114 percent. The collection efficiency (CE) was at 97 percent for July 2022, better than the CE of 95 percent for July 2021.

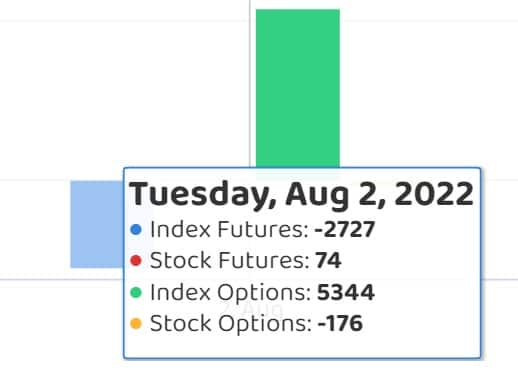

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 825.18 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 117.79 crore on August 2, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added Escorts under its F&O ban list for August 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.