Key Indian indices fell on September 22 as concerns over the second wave of virus infection weighed down investor sentiment.

Sensex closed 300 points, or 0.79 percent, lower at 37,734.08 while Nifty ended at 11,153.65 with a loss of 97 points or 0.86 percent.

BSE Midcap and Smallcap indices closed 1.70 percent and 1.61 percent lower, respectively.

"The second wave of infections in Europe and other countries has raised fear of re-imposition of lockdown. In such a scenario, markets will continue to take cues from global peers," said Ajit Mishra, VP - Research, Religare Broking.

"Having said that, we may see a pause or a bounce after the recent fall but the bias would remain on the negative side till Nifty holds below 11,400. Traders should focus more on risk management as we expect volatility to remain high due to scheduled derivatives," Mishra added.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,058.2, followed by 10,962.7. If the index moves up, the key resistance levels to watch out for are 11,275.7 and 11,397.7.

Nifty Bank

The Bank Nifty fell 228 points or 1.07 percent to close at 21,139.10. The important pivot level, which will act as crucial support for the index, is placed at 20,907.23, followed by 20,675.37. On the upside, key resistance levels are placed at 21,422.13 and 21,705.17.

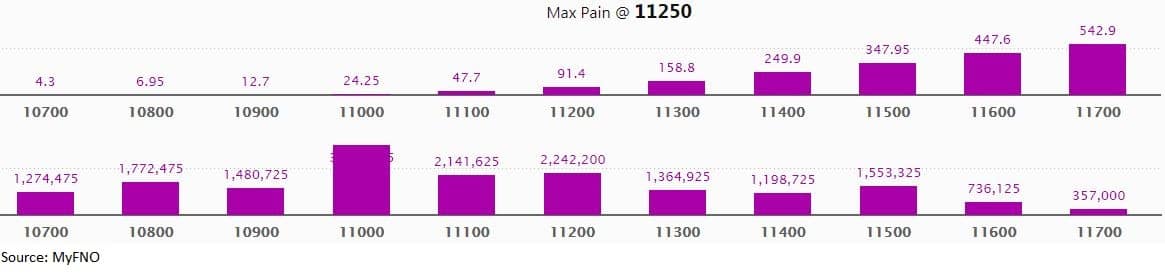

Call option data

Maximum Call open interest of 49.5 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the September series.

This is followed by 11,600 strike, which holds 38.7 lakh contracts, and 11,300 strike, which has accumulated 36.8 lakh contracts.

Call writing was seen at 11,200 strike, which added 19.24 lakh contracts, followed by 11,300, which added 16.92 lakh contracts, and 11,400 strike, which added 7.9 lakh contracts.

Call unwinding was seen at 11,600 strike, which shed 10.05 lakh contracts, followed by 11,700 strike, which shed 9.14 lakh contracts and 11,500 strike which shed 3.89 lakh contracts.

Put option data

Maximum Put open interest of 37.15 lakh contracts was seen at 11,000 strike, which will act as crucial support in the September series.

This is followed by 11,200 strike, which holds 22.42 lakh contracts, and 11,100 strike, which has accumulated 21.42 lakh contracts.

Put writing was seen at 11,100 strike, which added 6.18 lakh contracts, followed by 11,000 strike, which added 5.17 lakh contracts.

Put unwinding was witnessed at 11,300 strike, which shed 12.74 lakh contracts, followed by 11,500 strike which shed 5.21 lakh contracts and 11,400 strike which shed 4.02 lakh contracts.

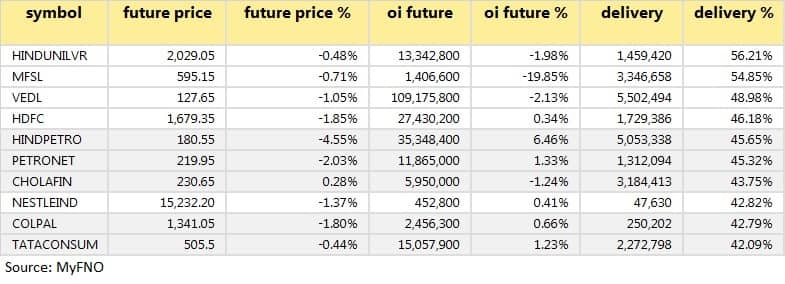

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

14 stocks saw long build-up

53 stocks saw long unwinding

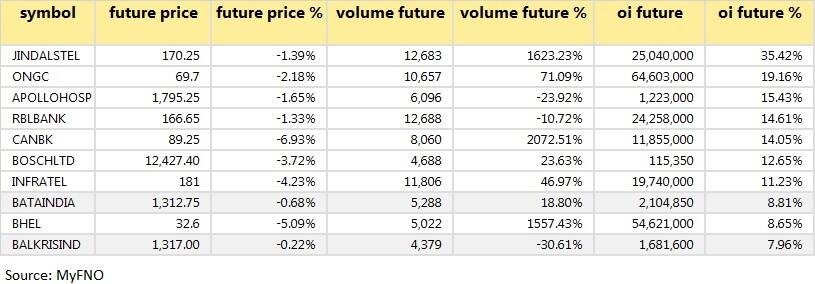

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

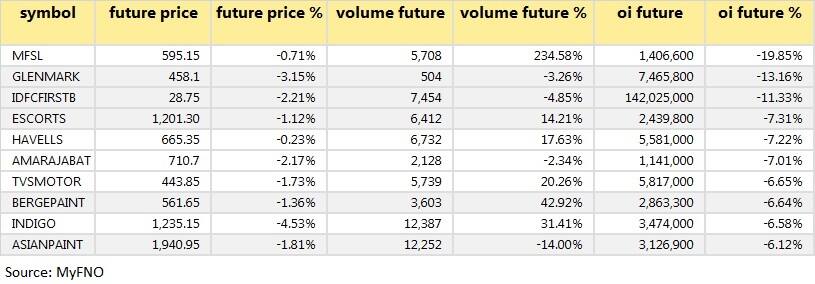

55 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

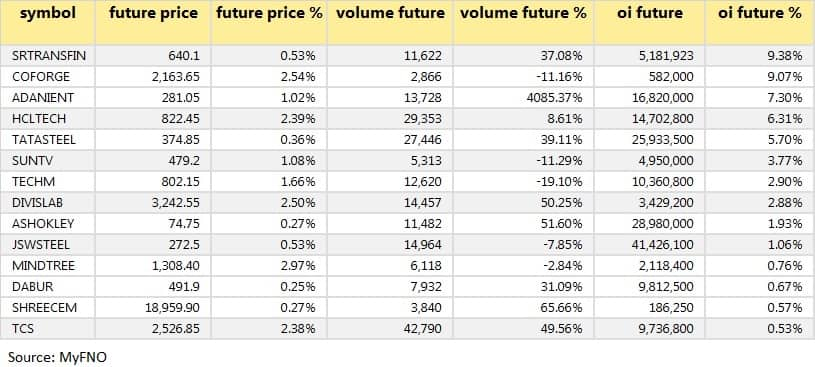

15 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering.

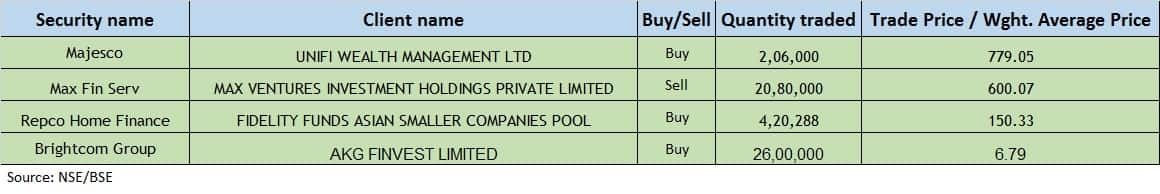

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Sunraj Diamond Exports:The board will meet on September 23 to consider and approve quarterly results.

SAT Industries: The board will meet on September 23 to consider the scheme of amalgamation.

Crestchem: The board will meet on September 23 for general purposes.

Stocks in the news

HCC: The company completed its 100 percent sale of Farakka-Raiganj Highways Limited to Cube Highways and Infrastructure II Pte Ltd.

Indian Oil: The board has approved the implementation of the Petrochemical and Lube Integration Project at Indian Oil's Gujarat Refinery at an estimated cost of Rs 17,825 crore.

TCS: The company said it has deployed AI-powered software to enable a safe return to work for its employees.

Jindal Steel:ICRA, has removed its 'rating watch' with 'negative implications' on the bank facilities and non-convertible debentures (NCDs) of Jindal Steel and Power and assigned a "stable" outlook.

Punj Lloyd:18th meeting of Committee of Creditors of Punj Lloyd Limited is scheduled to be held on Thursday, September 24.

PNB Gilts: The company fully redeemed and paid the redemption proceeds of the commercial paper for Rs 400 crore.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,072.76 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 878.91 crore in the Indian equity market on September 22, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Four stocks -- Glenmark Pharmaceuticals, Indiabulls Housing Finance, Vodafone Idea and Vedanta-- are under the F&O ban for September 23. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!