The Nifty50 failed to push the momentum on Tuesday but bulls were not in the mood to give up that easy. They pushed the index towards its opening level and it closed just 5 points lower at 9,121.

The Nifty50 made a hammer-like pattern on the daily candlestick charts. Formation of a hammer type pattern after a bearish belt hold in the previous session is a positive sign for investors.

It suggests that market is attempting to determine a bottom. Investors can create long positions on dips for a target of 9,218-9,250, which was its recent record high.

We have put together the top ten data points on how to help you in spotting profitable trade:

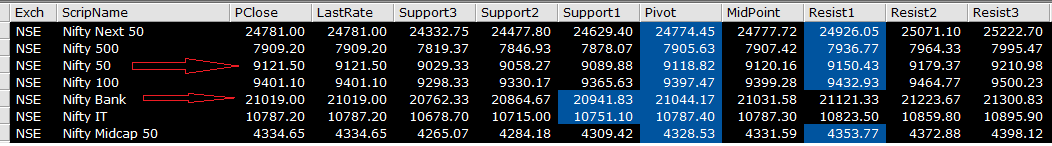

Key Support & Resistance Level:

The Nifty50 consolidated for the third day in a row but bounced back from its short-term average, 5-days Exponential Moving Average (EMA). According to Pivot charts, the key support level for Nifty50 is placed at 9,089, followed by 9,058, and 9,029.

If the index starts to move higher then key resistance levels to watch out are 9,150, followed by 9,179.22, and 9,210.

Bank Nifty closed 91 points lower at 21,019. Important Pivot level which will act as crucial support for the index are 20,941, followed by 20,864, and 20,762. On the upside, key resistance level are 21,121, followed by 21,223 and 21,300.

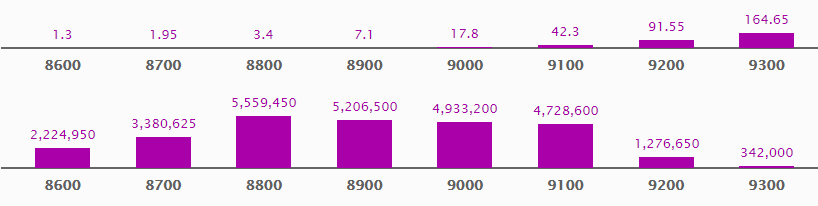

Call Options Data:

On the options front, maximum Call open interest (OI) of 63 lakh contracts stands at a strike price 9,200 which will act as a crucial resistance level for the index, followed by 9,300 which now holds 48 lakh contracts in open interest and 9,100 which has accumulated 36 lakh contracts in OI.

Call Writing was seen at strike prices 9,200 (3.1 lakh contracts added), followed by 9,300 (5.1 lakh contracts were added) and 9400 (4.6 lakh contracts were added).

Call unwinding was seen at strike prices 9,500 (6.4 lakh contracts were shed), followed by 9,000 (2.04 lakh contracts were shed).

Put Options Data:

Maximum Put OI of 56 lakh contracts was seen at strike price pf 8,800 which will act as a crucial base for the index, followed by 8,900 which has accumulated 52.07 lakh contracts, and 9,000 which now holds 49.33 lakh contracts in OI.

There was hardly any Put writing while unwinding was seen at strike prices 8,900 (3.4 lakh contracts shed), followed by 9,000 (5.9 lakh contracts were shed), and 9,200 (3.3 lakh contracts were shed).

“Fresh Put writing was seen at 8950 strikes while Call writing at 9200, 9150 and 9100 strikes,” Chandan Taparia, Derivatives and Technical Analyst at Motilal Oswal Securities told Moneycontrol.

“Put writing is holding the index on declines but intact Call writing is keeping the range bound market movement,” he said.

FII & DII Data:

The foreign institutional investors (FIIs) bought shares worth Rs 1,663 crore compared to domestic institutional investors, which sold Rs 799 crore in the Indian equity market.

India VIX:

The India Volatility Index (VIX), a gauge of the market's short-term expectation of volatility, slipped by 0.6 percent to 11.94 compared to the previous close of 12.01.

Volatility Index is a measure of market's expectation of volatility over the near term. Usually, during periods of market volatility, market moves steeply up or down and the volatility index tends to rise.

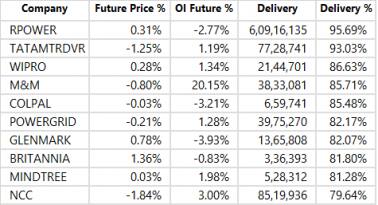

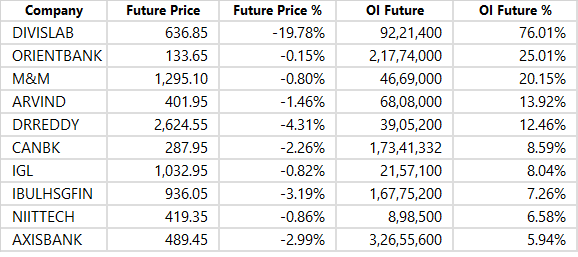

Stocks with high delivery %

High delivery percentage suggests that investors are accepting the delivery of the stock which means that investors are bullish on the stock.

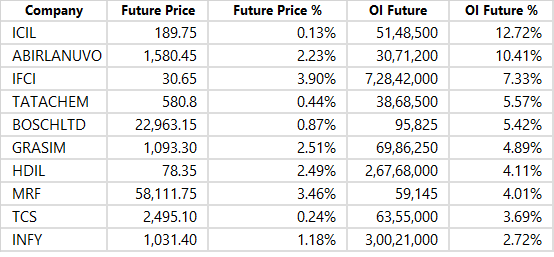

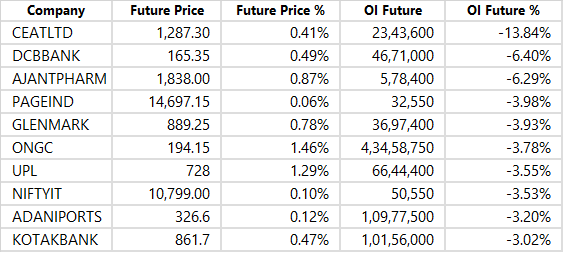

33 stocks saw Long Buildup:

30 stocks where short covering was seen:

Short covering is seen when price moves higher but OI reduces.

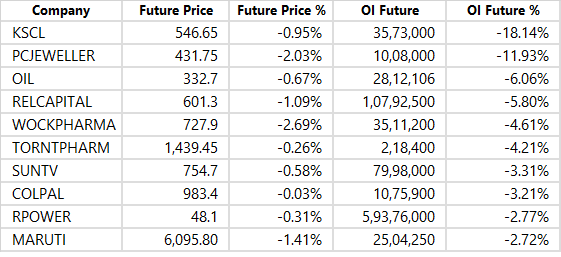

38 stocks saw Long Unwinding:

Long Unwinding happens when there is a decrease in OI as well as in price.

75 stocks saw Short Buildup:

Short Buildup was seen in stocks where there is an increase in open interest along with a decrease in price.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.