The 50-share NSE Nifty which started with a big gap on the downside on Monday managed to recoup some losses but closed with a loss of nearly 100 points from Friday’s close, forming a bullish candle on an intraday basis as the closing level was higher than the opening level.

The index witnessed a strong recovery in the trading session but the sentiment still remained bearish. The Nifty has strong support near 10,600-10,500 levels.

The Nifty50 which opened at 10,604 slipped to an intraday low of 10,586. It closed below its crucial 50-day exponential moving average (DEMA). Hence, a pullback could be on cards as 50-DEMA has usually lent a strong support to the index in the past.

The index bounced back after falling below 10,600 to hit an intraday high of 10,702 before closing 94 points lower at 10,666 levels. The index is likely to remain choppy or consolidate further ahead of the Reserve Bank of India’s 2-days policy meet.

“Huge gap-down opening was bought into by the market participants as Nifty50 recouped almost 100 points from intraday low of 10,586 which resulted in bullish candle on intraday basis but still remained a bearish formation as it closed in negative terrain when compared to last session’s close,” Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

“Monday’s gap down area of 10,702–10,736 shall offer resistance for next couple of days and a close above 10,736 shall be considered as an initial sign of strength for short term,” he said.

Mohammad further added that as the market is heading into RBI event it may remain choppy for the next two sessions post which major directional clues shall emerge for this market which as of now are on the downside. “Short term support is available around 10,550 whereas critical support is placed at 10,394,” he said.

We have collated the top fifteen data points to help you spot profitable trade:

Key Support & Resistance Level for Nifty:

The Nifty closed at 10,666.50 on Monday. According to Pivot charts, the key support level is placed at 10,601.27, followed by 10,536.03. If the index starts to move higher, key resistance levels to watch out are 10,717.27 and 10,768.03.

Nifty Bank:

The Nifty Bank closed at 26,098.75, down 1.33 percent. Important Pivot level, which will act as crucial support for the index, is placed at 25,939.23, followed by 25,779.67. On the upside, key resistance levels are placed at 26,236.73, followed by 26,374.67.

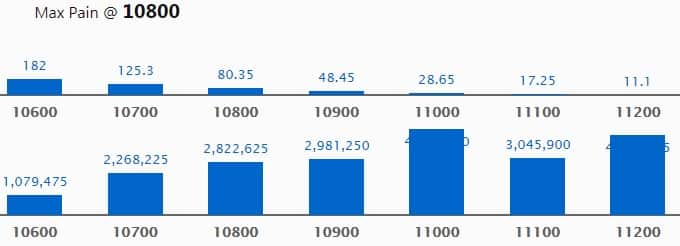

Call Options Data:

Maximum call open interest (OI) of 45.64 lakh contracts stands at strike price 11,000, which will be a crucial base for the February series, followed by 11,200, which now holds 42.39 lakh contracts in open interest, and 11,100, which has accumulated 30.45 lakh contracts in OI.

Call writing was seen at the strike price of 10,700, which saw the addition of 9.66 lakh contracts along with 10,600, which added 5.1 lakh contracts, along with 10,800, which saw the addition of 4.29 lakh contracts.

Call unwinding was seen at the strike of 11,000, which shed 1.45 lakh shares, followed by 11,100, which shed 0.23 lakh contracts.

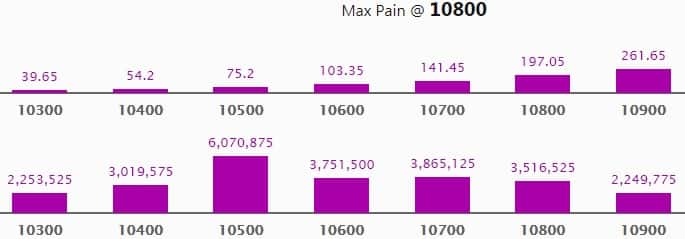

Put Options Data:

Maximum put OI of 60.7 lakh contracts was seen at strike price 10,500, which will act as a crucial base for February series, followed by 10,700, which now holds 38.65 lakh contracts and 10,600 which has now accumulated 37.5 lakh contracts in open interest.

Maximum Put writing was seen at the strike price of 10,600, which saw the addition of 11.34 lakh contracts, followed by 10,400, which added 8.4 lakh contracts and 10,200, which added 7.6 lakh contracts.

Put unwinding was seen at 11,000, which shed 7.99 lakh contracts, followed by 10,800, which shed 7.1 lakh contracts and 10,900, which shed 5.1 lakh contracts.

FII & DII Data:

Foreign institutional investors (FIIs) have net sold shares worth Rs 1,263.57 crore, while domestic institutional investors (DIIs) bought shares worth Rs 1,163.64 crore in the Indian equity market on Monday, as per provisional data available on the NSE.

Fund Flow Picture:

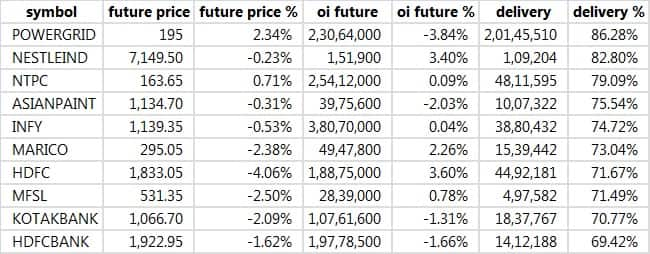

Stocks with high delivery percentage:

High delivery percentage suggests that investors are accepting the delivery of the stock, which means that investors are bullish on the stock.

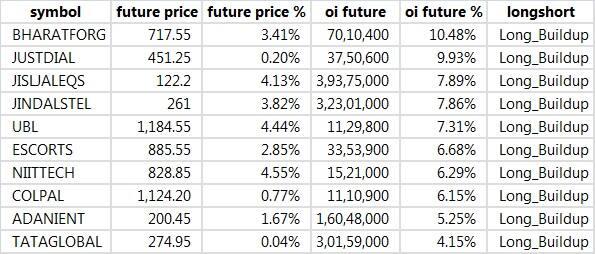

39 stocks saw long build-up:

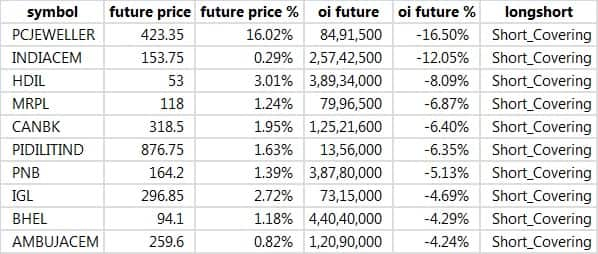

68 stocks saw short covering:

A decrease in open interest along with an increase in price mostly indicates short covering.

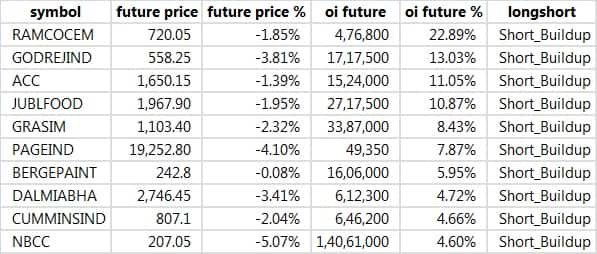

49 stocks saw short build-up:

An increase in open interest along with a decrease in price mostly indicates short positions being built up.

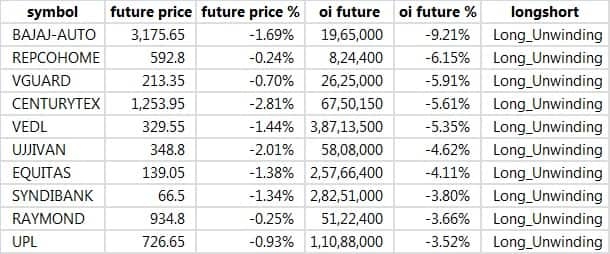

55 stocks saw long unwinding:

Long unwinding happens when there is a decrease in OI as well as in price.

Bulk Deals:

Bhushan Steel Limited: EARC Trust SC 283 sold 46,79,854 shares at Rs 42.21 per share

JHS Svendgaard Laboratories: Nikhil Vora bought 15,00,000 shares at Rs 62.00 per share

Manaksia Limited: Subham Capital Pvt. Ltd sold 13,77,265 shares at Rs 63.30 per share

Religare Enterprises Limited: IDBI Trusteeship Services Ltd sold 10,00,000 shares at Rs 37.05 per share

(For more bulk deals click here)

Analyst or Board Meet/Briefings:

Abbot India: A meeting of the Board of Directors of the company is scheduled to be held on February 14, 2018 to consider and approve the text of unaudited financial results for the third quarter and nine months ended on December 31, 2017.

Cera Sanitaryware: The Company will be participating in Edelweiss India Conference 2018 to be held in Mumbai on February 7, 2018.

Rolta India: A meeting of the Board of Directors will be held on February 14, 2018, to consider and take on record, the unaudited consolidated & unaudited standalone financial results for the quarter and nine months ended December 31, 2017.

Religare Enterprises: A meeting of the Board of Directors will be held on on February 14, 2018, to consider and take on record, the unaudited standalone financial results for the quarter and nine months ended December 31, 2017.

Stocks in news:

HPCL: A meeting of Board of Directors will be held on February 9, 2018 to consider the unaudited financial results for the third quarter ended December 31, 2017.

Oil India Limited: The Board may consider issue of bonus shares in the Board Meeting scheduled to be held on February 9, 2018.

Greaves Cotton Ltd: The Company has declared an interim dividend of Rs 4 per equity share of the face value of Rs 2 for the financial year ending March 31, 2018.

SIS to meet on Feb 9 to consider issue of redeemable NCDs for an amount upto Rs 500cr

Sun Pharma says fire was observed at solvent stage area at Ankaleshwar plant. No direct loss of production due to this

Mangalam Organics signs alliance to manufacture and supply Terpene Phenolic Resin. Will sell product exclusivel to DRT for distribution

Ruchi Soya announces expression of interest for investment in the Company

Tata Motors, Warburg Pincus call off USD 360 million Tata Tech deal

4 stocks under ban period on NSE

Security in ban period for the next trade date under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

The security which are banned for trading are Fortis, HDIL, India Cements, and Wockhardt.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.