The market returned to positive territory on March 27 for the first time in the last three consecutive sessions, but overall, it was completely a rangebound and volatile trade for equity benchmarks amid mixed global cues. Most of the key sectors closed flat.

The BSE Sensex rose 127 points to 57,654, while the Nifty50 advanced 41 points to 16,986 and formed a Doji kind of indecisive pattern on the daily scale. Overall the index has been moving in a range of 16,900-17,100 levels for the last couple of sessions.

The trend remains bearish as the benchmark index Nifty continues to stay below the critical moving average. Besides, "the bearish crossover of the 21 EMA (exponential moving average - 17,250) and the 55 EMA (17,550) has been boosting the bearish market sentiment. Sell the rally should be the theme for traders as the rallies are getting sold into," Rupak De, Senior Technical Analyst at LKP Securities said.

On the higher end, sellers may return around 17,250, he says. The current weakness may take the Nifty towards 16,750 over the short term, he added.

However, the selling pressure was seen in broader markets due to negative breadth. The Nifty Midcap 100 index fell half a percent and Smallcap 100 index was down 1.6 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.Key support and resistance levels on Nifty

As per the pivot charts, the Nifty has support at 16,933 followed by 16,892 and 16,826. If the index moves up, the key resistance levels to watch out for are 17,064 followed by 17,105 and 17,171.

The Bank Nifty rose 36 points to 39,431, but has seen the formation of a small-bodied bearish candle with long upper and lower wicks indicating high volatility in the counter.

"The index is stuck in a broad range between 39,000 and 40,000 and a brake on either side will have trending moves. The monthly expiry has the highest open interest build-up at 40,000 Call option and any trade above this will lead to sharp short covering," Kunal Shah, Senior Technical & Derivatives Analyst at LKP Securities said.

The important pivot level, which will act as a support, is at 39,306 followed by 39,206 and 39,045. On the upside, key resistance levels are 39,628, 39,727, and 39,888.

On a monthly basis, the maximum Call open interest (OI) is at 18,000 strike, with 1.3 crore contracts, which is expected to be a crucial resistance for the Nifty in the coming sessions.

This is followed by a 17,000 strike, comprising 1.04 crore contracts, and a 17,500 strike, where there are more than 93.83 lakh contracts.

Call writing was seen at 17,800 strike, which added 24.31 lakh contracts, followed by 17,000 strike, which added 24.28 lakh contracts and 17,300 strike, which accumulated 9.2 lakh contracts.

We have seen Call unwinding at 17,100 strike, which shed 10.38 lakh contracts, followed by 16,900 strike, which shed 5.92 lakh contracts, and 17,900 strike, which shed 3.92 lakh contracts.

We have seen the maximum Put OI at 17,000 strike, with 1.21 crore contracts, which is expected to be a crucial level for the coming sessions.

This is followed by the 16,800 strike, comprising 66.15 lakh contracts, and the 16,500 strike, where we have 56.04 lakh contracts.

Put writing was seen at 17,000 strike, which added 54.6 lakh contracts, followed by 16,900 strike, which added 14.33 lakh contracts, and 16,600 strike & 16,800, which added 13.3 lakh contracts each.

We have seen Put unwinding at 17,100 strike, which shed 5.61 lakh contracts, followed by 16,500 strike, which shed 1.74 lakh contracts, and 17,500 strike, which shed 1.23 lakh contracts.

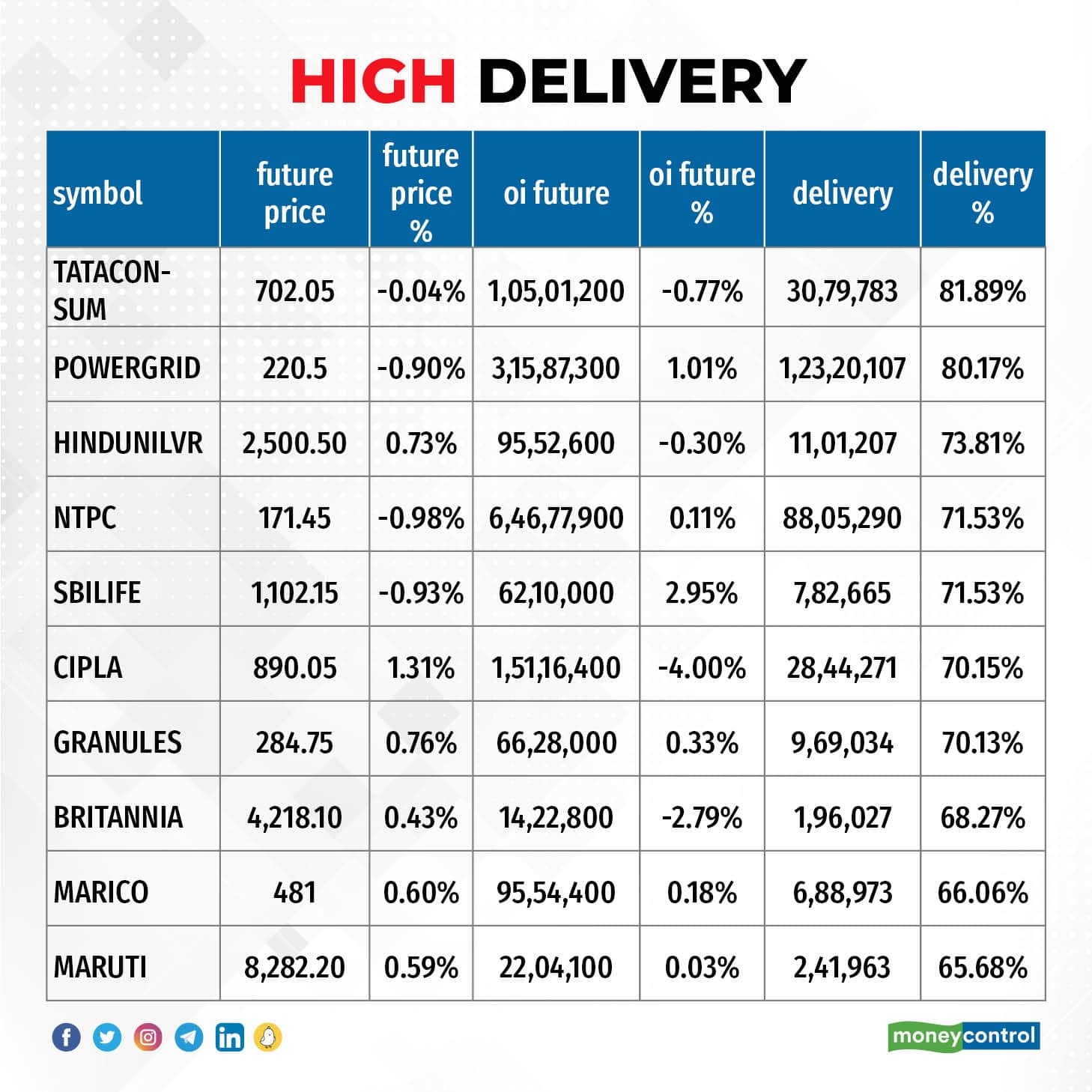

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Tata Consumer Products, Power Grid Corporation of India, Hindustan Unilever, NTPC, and SBI Life Insurance Company, among others.

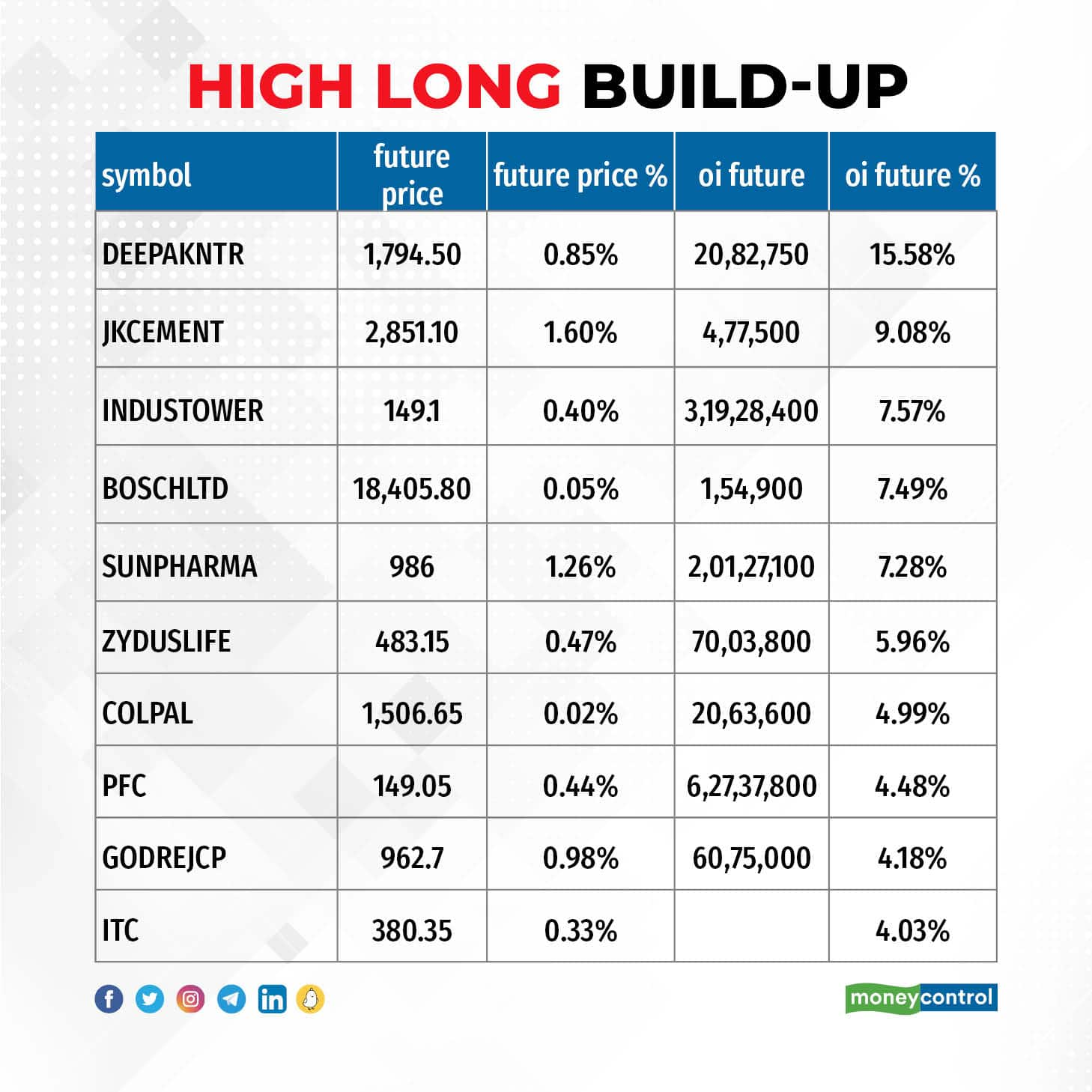

An increase in open interest (OI) and in price mostly indicates a build-up of long positions. Based on the OI percentage, 37 stocks including Deepak Nitrite, JK Cement, Indus Towers, Bosch, and Sun Pharmaceutical Industries witnessed a long build-up.

In most cases, a decline in OI and a decrease in price indicates a long unwinding. Based on the OI percentage, 49 stocks, including Navin Fluorine International, SBI Card, Torrent Power, ICICI Prudential Life Insurance, and Indiabulls Housing Finance, witnessed a long unwinding.

45 stocks see a short build-up

An increase in OI accompanied by a decrease in price mostly indicates a build-up of short positions. Based on the OI percentage, 45 stocks, including M&M Financial Services, United Breweries, IOC, Ramco Cements, and Indian Energy Exchange, saw a short build-up.

A decrease in OI along with an increase in price is an indication of short-covering. Based on the OI percentage, 62 stocks were on the short-covering list. These included Max Financial Services, Whirlpool of India, Voltas, Hindustan Aeronautics, and MCX India.

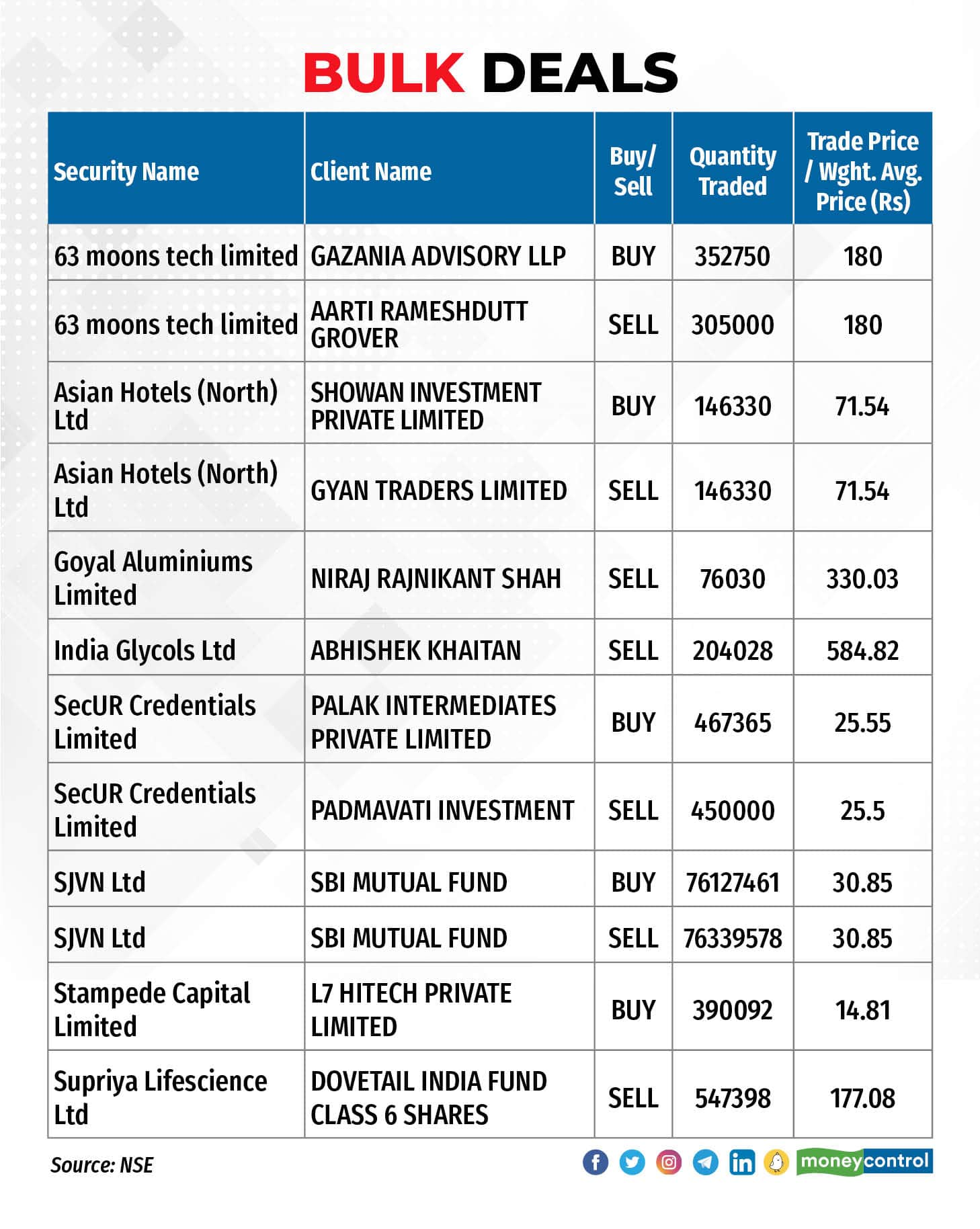

Supriya Lifescience: Dovetail India Fund Class 6 Shares has offloaded 5.47 lakh equity shares or 0.68 percent stake in the active pharmaceutical ingredient manufacturer at an average price of Rs 177.08 per share. Dovetail India held 1.81 percent or 14.59 lakh shares in the company as of December 2022.

(For more bulk deals, click here)

Investors' meetings on March 28

Sundram Fasteners: The company's officials will interact with Seraphic Management and Advisory.

Tube Investments of India: The officials of the company will interact with Stewart Investors, Singapore.

United Breweries: The company's officials will interact with Kotak Securities.

SRF: Rahul Jain, President & CFO to meet institutional investors in the US.

Stocks in the news

One 97 Communications: Paytm Payments Bank says its full KYC wallet customers will be able to make payments on every UPI QR code and online merchants where UPI payments are accepted. The NPCI announced Wallet interoperability guidelines on March 24, 2023. Now, Paytm Payments Bank will earn 1.1 percent interchange revenue when Paytm Wallet customers make payments on merchants acquired by other payment aggregators or banks.

PNC Infratech: The company has been declared as L1 (lowest) bidder in a Ministry of Road Transport & Highways' (MORT&H) highway project in Uttar Pradesh on Hybrid Annuity Mode (Package-III), for a bid project cost of Rs 819.0 crore.

Allcargo Logistics: The logistics company has signed a Share Purchase Agreement with KWE Singapore, KWE Kintetsu Express (India), Gati and Gati-Kintetsu Express (GKEPL) for the acquisition of 1.5 lakh equity shares (30 percent stake) in GKEPL, for Rs 406.7 crore.

Dilip Buildcon: The company has been declared as the L-1 bidder for the new HAM project 'Bengaluru-Vijayawada' under Bharatmala Pariyojana Phase-I (Package -7) in Andhra Pradesh. The project is worth Rs 780.12 crore, and the tender is floated by the National Highways Authority of India.

SJVN: The hydroelectric power generation company has secured GREEN Financing of JPY 15 billion (around Rs 915 crore) from Japan Bank for International Cooperation (JBIC). The loan is co-financed with Japanese private financial institutions.

Phoenix Mills: CPP Investment (an entity owned by Canada Pension Plan Investment Board) has completed its second tranche of investment of Rs 160 crore in Plutocrat Commercial Real Estate (PCREPL), a subsidiary of Phoenix Mills, on a private placement basis.

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 890.64 crore, whereas domestic institutional investors (DII) purchased shares worth Rs 1,808.94 crore on March 27, National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock to its F&O ban list for March 28. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.