Weak global cues, muted results from India Inc, zero sales from top auto manufacturers in April, an extension of lockdown by another two-weeks and contraction in manufacturing activity led to profit-taking on D-Street on May 4 after a sharp 14 percent rally seen in benchmark indices in April.

The Sensex plunged 2,002 points to 31,715 and the Nifty fell 566 points to close at 9293.

Investors lose nearly Rs 6 lakh crore in a single trading session. The average market capitalisation of the BSE-listed companies fell from Rs 129.41 lakh crore recorded on April 30 to Rs 123.69 lakh crore on May 4.

"The abrupt end of the recovery has certainly caught the participants completely off-guard and we might see the index drifting lower ahead," Ajit Mishra, VP - Research, Religare Broking, said.

"With no major development on the local front, we feel the global cues would continue to dictate the market trend. However, any news on a stimulus package for ailing sectors may provide a breather.

Besides, earnings announcement would continue to induce stock-specific volatility so participants should plan their trades accordingly," he added.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for Nifty

According to pivot charts, the key support level for Nifty is placed at 9,195.8, followed by 9,098.1. If the index starts moving up, key resistance levels to watch out for are 9,462.35 and 9,631.2.

Nifty Bank

The Nifty Bank closed 8.32 percent down at 19,743.75. The important pivot level, which will act as crucial support for the index, is placed at 19,414.8, followed by 19,085.8. On the upside, key resistance levels are placed at 20,301.6 and 20,859.4.

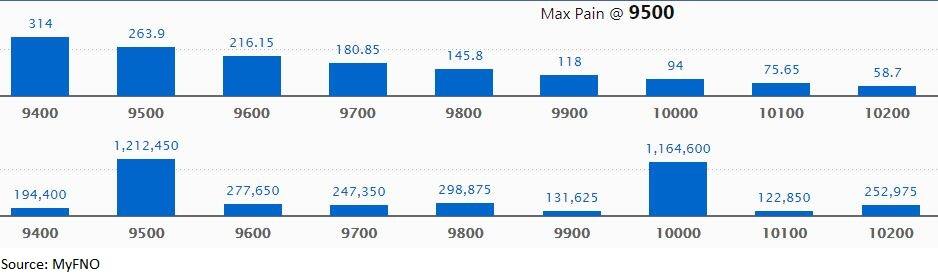

Call option data

Maximum call OI of 12.12 lakh contracts was seen at the 9,500 strike. It will act as crucial resistance in the May series.

This is followed by 10,000, which holds 11.65 lakh contracts, and 9,800 strikes, which has accumulated nearly 3 lakh contracts.

Significant call writing was seen at the 9,500, which added 3.27 lakh contracts, followed by 10,000 strikes that added 2.61 lakh contracts.

Call unwinding was witnessed at 10,300, which shed 22,575 contracts, followed by 9,900 strikes, which shed 7,650 contracts.

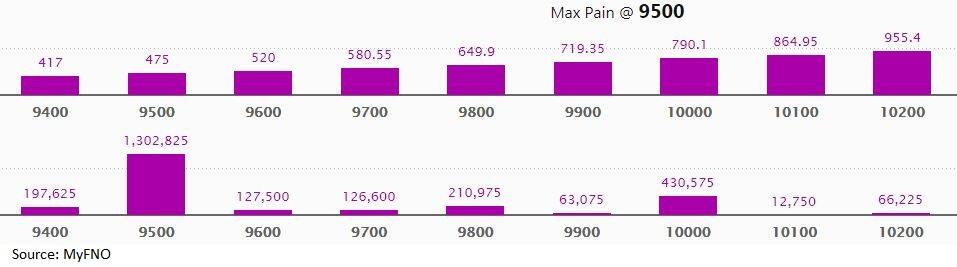

Put option data

Maximum put OI of 13.03 lakh contracts was seen at 9,500 strike, which will act as crucial support in the May series.

This is followed by 10,000, which holds 4.31 lakh contracts, and 9,800 strikes, which has accumulated 2.11 lakh contracts.

No put writing was seen on May 4.

Put unwinding was seen at 9,800, which shed 1.40 lakh contracts, followed by 10,000 strikes that shed 1.28 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

13 stocks saw long build-up

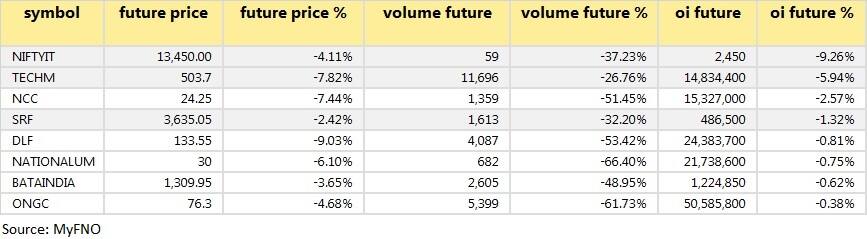

8 stocks saw long unwinding

Based on OI future percentage, here are the top 10 stocks in which long unwinding was seen.

124 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on OI future percentage, here are the top 10 stocks in which short build-up was seen.

No stock witnessed short-covering A decrease in OI, along with an increase in price, mostly indicates a short-covering. Not a single stock witnessed short-covering on May 4.

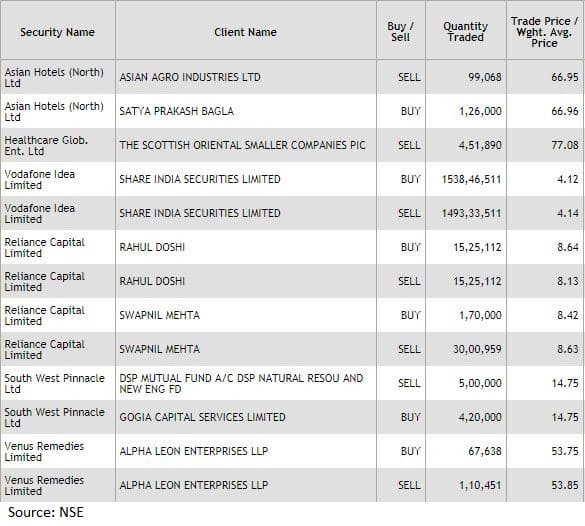

Bulk deals

(For more bulk deals, click here)

Board meetings

Results on May 5: Adani Ports, NIIT Technologies, SBI Life Insurance, Varun Beverages, Persistent Systems, Astec Lifesciences, Tata Coffee, and Rallis India.

Aruna Hotels:The board will meet on May 5 for general purposes.

Punjab & Sind Bank:The board will meet on May 5 for general purposes.

Stocks in news Lupin:Company announced positive topline result from Phase 3 study of Single-Dose Solosec for trichomoniasis treatment.

Marico Q4:Profit fell 50.6 percent to Rs 199 crore, revenue down 7 percent YoY to Rs 1,496 crore.

Graphite India starting manufacturing operations at various plants.

Automotive Axles resumed operations of factories and offices at Mysuru and Rudrapur.

Ceat partially resumed functioning at plants in Nasik, Nagpur (Maharashtra) and Halol (Gujrat).

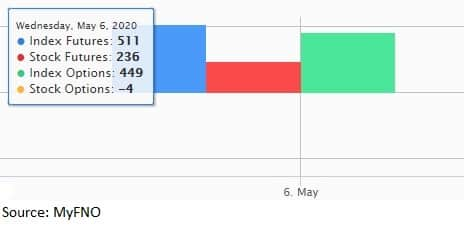

Fund flow

FII and DII data

Foreign (FIIs) and domestic institutional investors (DIIs) sold shares worth Rs 1,373.98 crore and Rs 1,661.61 crore, respectively, in the Indian equity market on May 4, provisional data available on the NSE showed.

Stock under F&O ban on NSE

No security is under the F&O ban for May 5. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!