The Indian market started the week on a negative note as a sharp surge in global crude oil prices and a strong fall in rupee dealt a strong blow to investor sentiment.

The drone attacks on key oil producer Saudi Arabia's crude facilities over the weekend spooked investors as it triggered fresh worries of geopolitical tension and raised concerns of supply disruption in the global market, making oil prices see their biggest surge since 1991.

The 30-share Sensex ended the day 262 points, or 0.70 percent down, at 37,123.31, with only six stocks in the green on September 16.

Nifty managed to hold the psychologically important level of 11,000. The index settled 72 points, or 0.65, percent down at 11,003.50, with 14 stocks in the green and 36 in the red.

Analysts feel the developments at the geopolitical front will remain on the top of the minds of investors alongwith the US Fed meet outcome on September 18.

"Investors will keep a close watch on geo-political developments as any further escalation could take oil prices even higher and it would be detrimental for the Indian market and economy. Moreover, the FOMC meet (September 17-18) would also be on investors’ radar wherein there are expectations for a rate cut. Commentary on growth and rate outlook would be a key factor to watch out for," said Ajit Mishra, Vice President - Research at Religare Broking.

While the recent announcements by the government are seen as positive by market observers, the expectations of GST rate cut for the auto sector are high.

"Given the current scenario, domestic, as well as global factors, will keep the market volatile in the near term," Mishra added.

On the technical front, Nifty formed a Doji pattern on the daily chart on September 16. The formation of a Doji candle after a bullish candle indicates there is some indecisiveness among the bulls as well as the bears.

"Technically, Nifty should close above 11,085 to rally further, till then it would remain range-bound between 11,085 and 10,930. Below 10,930, the index would gradually fall to 10,830 level," said Shrikant Chouhan, Senior Vice-President - Equity Technical Research at Kotak Securities.

We have collated 15 data points to help you spot profitable trades:Key support and resistance level for NiftyAccording to the pivot charts, key support level for Nifty is placed at 10,963.57, followed by 10,923.63. If the index starts moving up, key resistance levels to watch out for are 11,048.07 and 11,092.63.

Nifty BankThe Nifty Bank closed at 27,855, down 0.87 percent on September 16. The important pivot level, which will act as crucial support for the index, is placed at 27,746.97, followed by 27,638.94. On the upside, key resistance levels are placed at 28,014.87 and 28,174.73.

Call options dataMaximum call open interest (OI) of 31.01 lakh contracts was seen at the 11,200 strike price. It will act as a crucial resistance level in the September series.

This is followed by 11,300 strike price, which now holds 23.87 lakh contracts in open interest, and 11,500, which has accumulated 23.86 lakh contracts in open interest.

Significant call writing was seen at the 11,200 strike price, which added 5.05 lakh contracts, followed by 11,100 strike price that added 3.06 lakh contracts and 11,000 strike which added 2.81 lakh contracts.

A nominal call unwinding was seen at 10,600 strike price, which shed 1,650 contracts.

Maximum put open interest of 30.23 lakh contracts was seen at 10,800 strike price, which will act as crucial support in September series.

This is followed by 11,000 strike price, which holds 29.51 lakh contracts in open interest, and 10,600 strike price, which has accumulated 27.12 lakh contracts in open interest.

Put writing was seen at the 10,500 strike price, which added 65,325 contracts, followed by 10,600 strike, which added 61,650 contracts.

Put unwinding was seen at the 10,900 strike price, which shed 2.08 lakh contracts, followed by 10,700 strike which shed 1.77 lakh contracts.

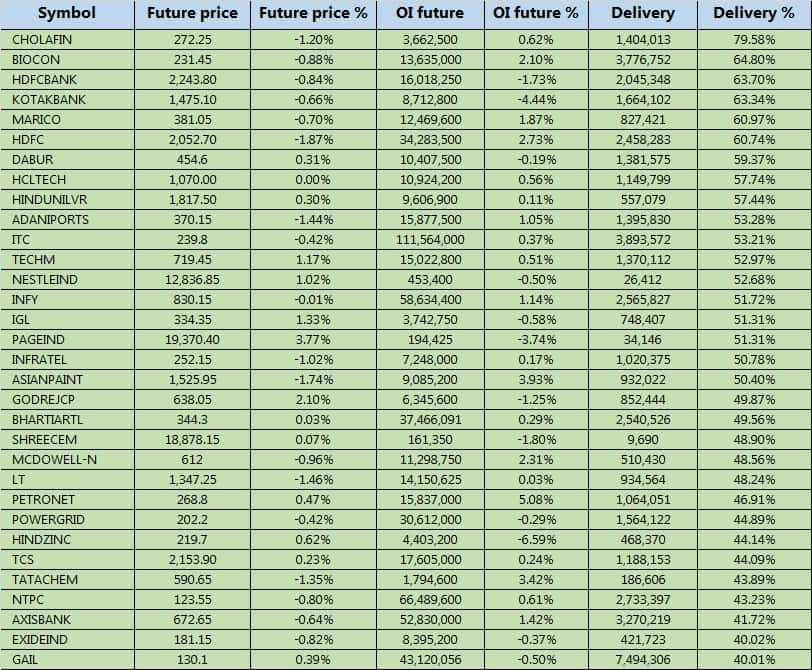

A high delivery percentage suggests that investors are showing interest in these stocks.

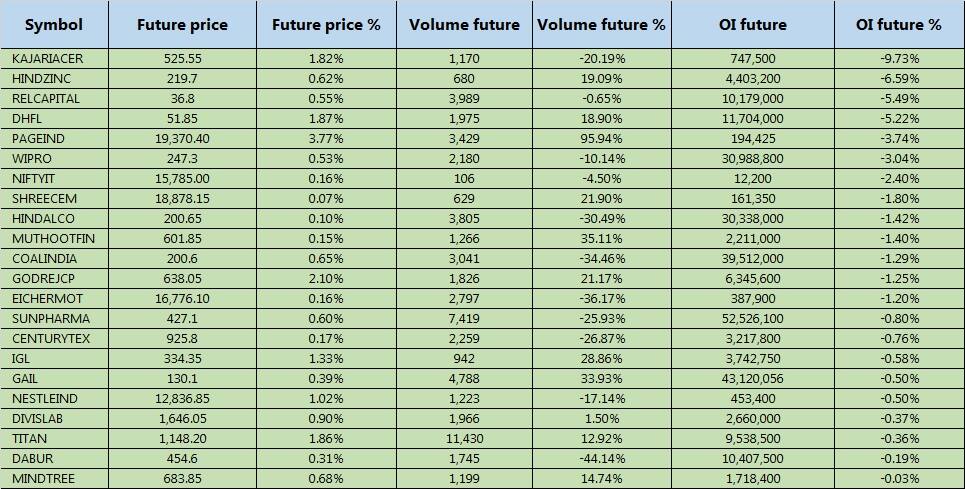

A decrease in open interest, along with an increase in price, mostly indicates a short covering.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions.

L&T Finance Holdings: The board of directors will meet on September 17 to approve the issuance of cumulative compulsorily redeemable (CCR) non-convertible preference shares on a private placement basis.

NHPC: The board of directors will meet on September 17 to consider the proposal for raising of debt up to Rs 2,500 crore during the financial year 2019-20 through the issuance of corporate bonds in one or more series or tranches on private placement basis.

Advani Hotels & Resorts (India): The board of directors is scheduled to meet on September 17 to consider the declaration of interim dividend for the financial year 2019-2020.

Bajaj Finance: The board of directors will meet on September 17 for general purpose.

Balmer Lawrie and Company: The board of directors will meet on September 17 to consider the issuance of bonus shares.

Stocks in news:Aavas Financiers: The company has received an investment of Rs 345 crore from IFC, a member of the World Bank Group.

NBCC (India): The company has signed an MoU with Utkal University, Bhubaneswar, Odisha, for the construction of various infrastructure buildings in the existing campus of the University at Bhubneswar and the new campus at Chandikhol, Odisha. The approximate cost of work would be Rs 390 crore.

Piramal Enterprises: The company said the board of directors approved the allotment of 6,900 secured, unrated, unlisted redeemable non-convertible debentures, each having a face value of Rs 10,00,000, on private placement basis.

IL&FS Engineering and Construction Company: The Exchange has sought clarification from the company regarding the change in auditors of the company. The company is required to clarify on the brief profile in case of appointment of M/s. M. Bhaskara Rao & Co.

Wipro: The company announced its strategic partnership with lndustries 4.0 Maturity enter GmbH (I4.0MC), Germany, to drive digital transformation in manufacturing companies.

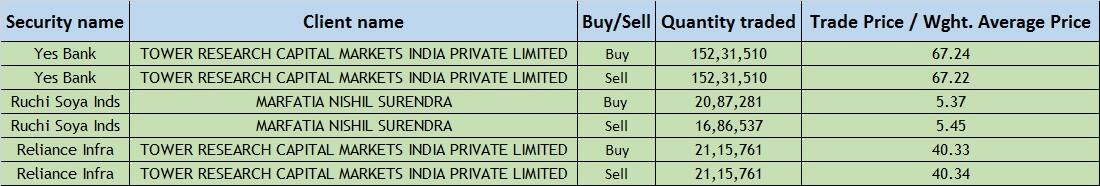

Yes Bank: The lender said it has allotted 22,300 shares of the face value of Rs 2 each on September 16, 2019 under ESOP plans JESOP V and PESOP II- 2010.

Hinduja Global Solutions : The company made an announcement about the launching of HGS Digital, a new practice focused on providing high-end digital strategy and transformative digital-first solutions.

IDBI Bank: The bank said it received Rs 4,557 crore from the Government of India.

L&T Financial Services: The committee of directors approved the allotment of 1,00,00,000 compulsorily redeemable non-convertible preference shares (CRPS) of the face value of Rs 100 each on a private placement basis to identified investors.

Mindtree: The company has signed an agreement with Atotech to help manage their SAP landscape. As part of this new agreement, Mindtree will provide the application managed services for the globally deployed SAP ERP and business warehouse systems of the Atotech Group.

GE T&D India: The company said Gaurav Manoher Negi, the Whole-time Director & CFO of the company has resigned with effect from October 01, 2019. He will continue as the non-Executive Director on the board of directors of the company.

Thangamayil Jewellery: ICRA has reaffirmed "MA-" on the company's fixed deposit programme of Rs 59 crore and "BBB+" on the long term facility worth Rs 300 crore. For short term facilities, ICRA has reaffirmed "A2" rating.

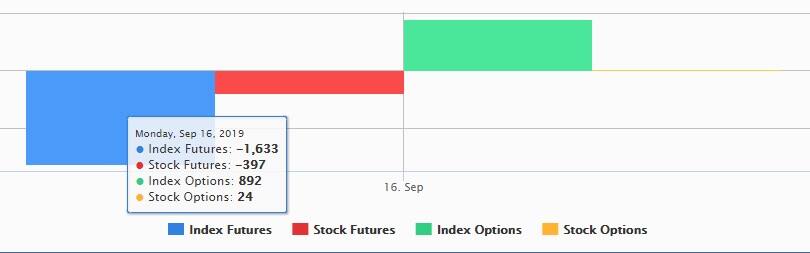

FII & DII dataForeign institutional investors (FIIs) sold shares worth Rs 751.26 crore, while domestic institutional investors (DIIs) bought Rs 308.56 crore worth of shares in the Indian equity market on September 16, as per provisional data available on the NSE.

Fund flow

For September 17, there is no stock under F&O ban. Securities in ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!