The market remained under major selling pressure for the second consecutive session on August 22 with the Nifty50 closing below the 17,500 mark as the downtrend was seen across sectors. The rising fear of more interest rate hikes by the US Federal Reserve in coming policy meetings to tame inflation weighed on sentiment.

The BSE Sensex plunged 872 points or 1.5 percent to 58,774, while the Nifty50 fell 268 points or 1.5 percent to 17,491 and formed a bearish candlestick pattern on the daily charts, following the formation of a bearish engulfing pattern in the previous session.

"The long bear candle of the last two sessions signal a faster downside retracement of the last 5-6 sessions of upmove of August 10-18. This is a negative indication and signal that bears are in a driver's seat," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Hence, the short-term trend of the Nifty continues to be down and the overall bearish chart pattern signal more weakness ahead, Shetti feels.

The next supports to be watched are around 17,330 (23.6 percent Fibonacci retracement of June to August rising leg) in the next few sessions. On the move below, the next support of 38.2 percent retracement is placed at 16,900 levels. Immediate resistance is at 17,600 levels, the market expert said.

The Nifty Midcap 100 and Smallcap 100 indices were also under pressure, falling 2 percent and 1.6 percent, respectively while the volatility index (India VIX) increased further, up by 4.11 percent to 19.04 levels, making bulls more uncomfortable.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,409, followed by 17,327. If the index moves up, the key resistance levels to watch out for are 17,631 and 17,772.

The Nifty Bank tanked 688 points or 1.77 percent to 38,298 and formed bearish candle on the daily charts on Monday. The important pivot level, which will act as crucial support for the index, is placed at 38,119, followed by 37,940. On the upside, key resistance levels are placed at 38,605 and 38,912 levels.

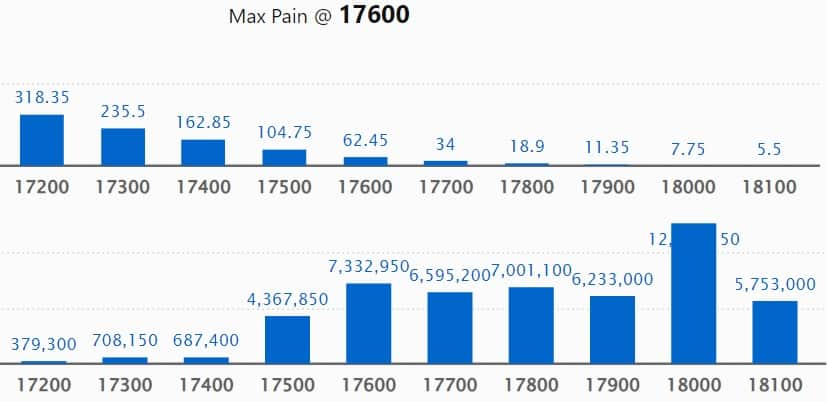

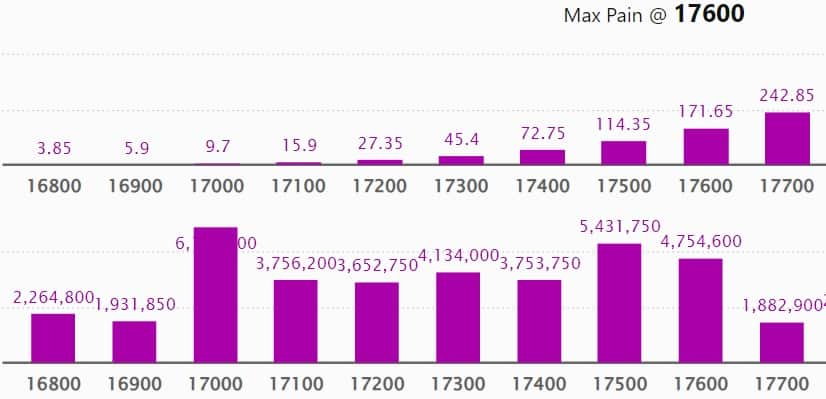

Maximum Call open interest of 1.27 crore contracts was seen at 18,000 strike, which will act as a crucial resistance level in the August series.

This is followed by 18,200 strike, which holds 80.35 lakh contracts, and 18,500 strike, which has accumulated 74.31 lakh contracts.

Call writing was seen at 17,600 strike, which added 63.91 lakh contracts, followed by 17,700 strike which added 49.52 lakh contracts, and 17,500 strike which added 34.21 lakh contracts.

Call unwinding was seen at 18,600 strike, which shed 36.39 lakh contracts, followed by 17,900 strike which shed 28.05 lakh contracts and 18,400 strike which shed 20.65 lakh contracts.

Maximum Put open interest of 61.52 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the August series.

This is followed by 17,500 strike, which holds 54.31 lakh contracts, and 17,600 strike, which has accumulated 47.54 lakh contracts.

Put writing was seen at 17,100 strike, which added 10.1 lakh contracts, followed by 17,400 strike, which added 8.38 lakh contracts and 17,600 strike which added 6.94 lakh contracts.

Put unwinding was seen at 17,800 strike, which shed 19.18 lakh contracts, followed by 17,700 strike which shed 14.24 lakh contracts, and 17,900 strike, which shed 13.43 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in ICICI Bank, HCL Technologies, TCS, Bajaj Auto, and HDFC, among others.

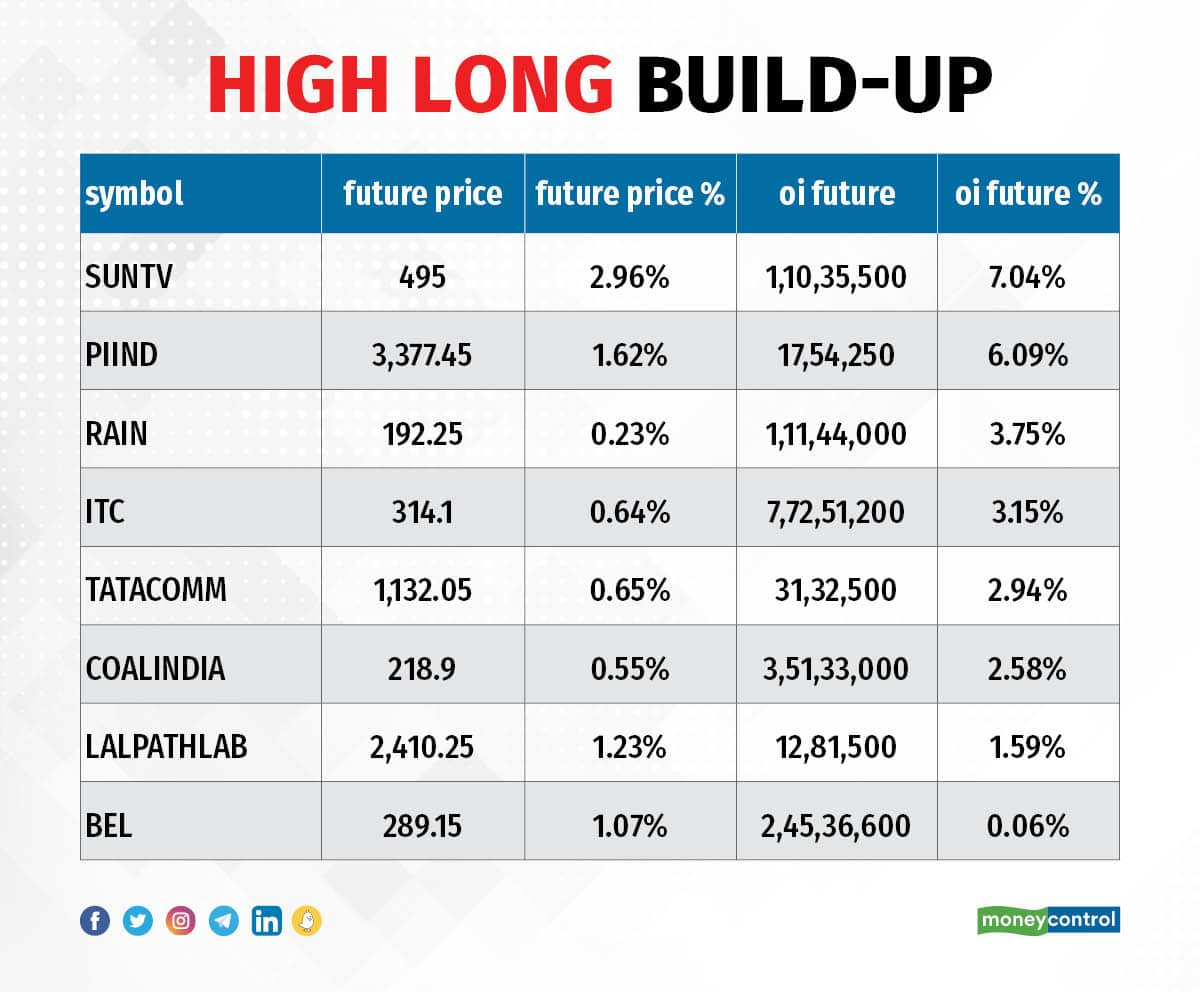

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the 8 stocks including Sun TV Network, PI Industries, Rain Industries, ITC, and Tata Communications, in which a long build-up was seen.

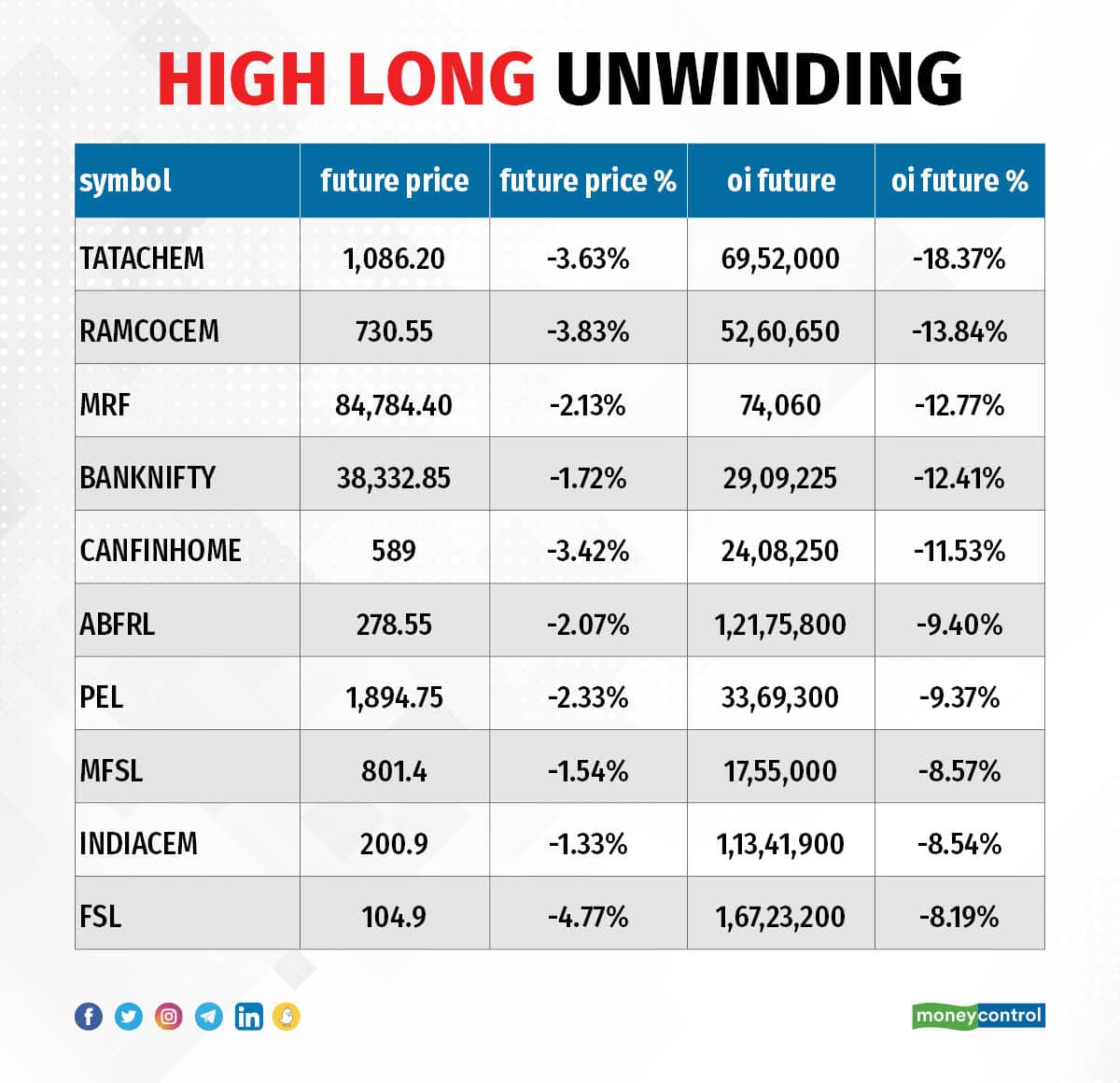

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Tata Chemicals, Ramco Cements, MRF, Bank Nifty, and Can Fin Homes, in which long unwinding was seen.

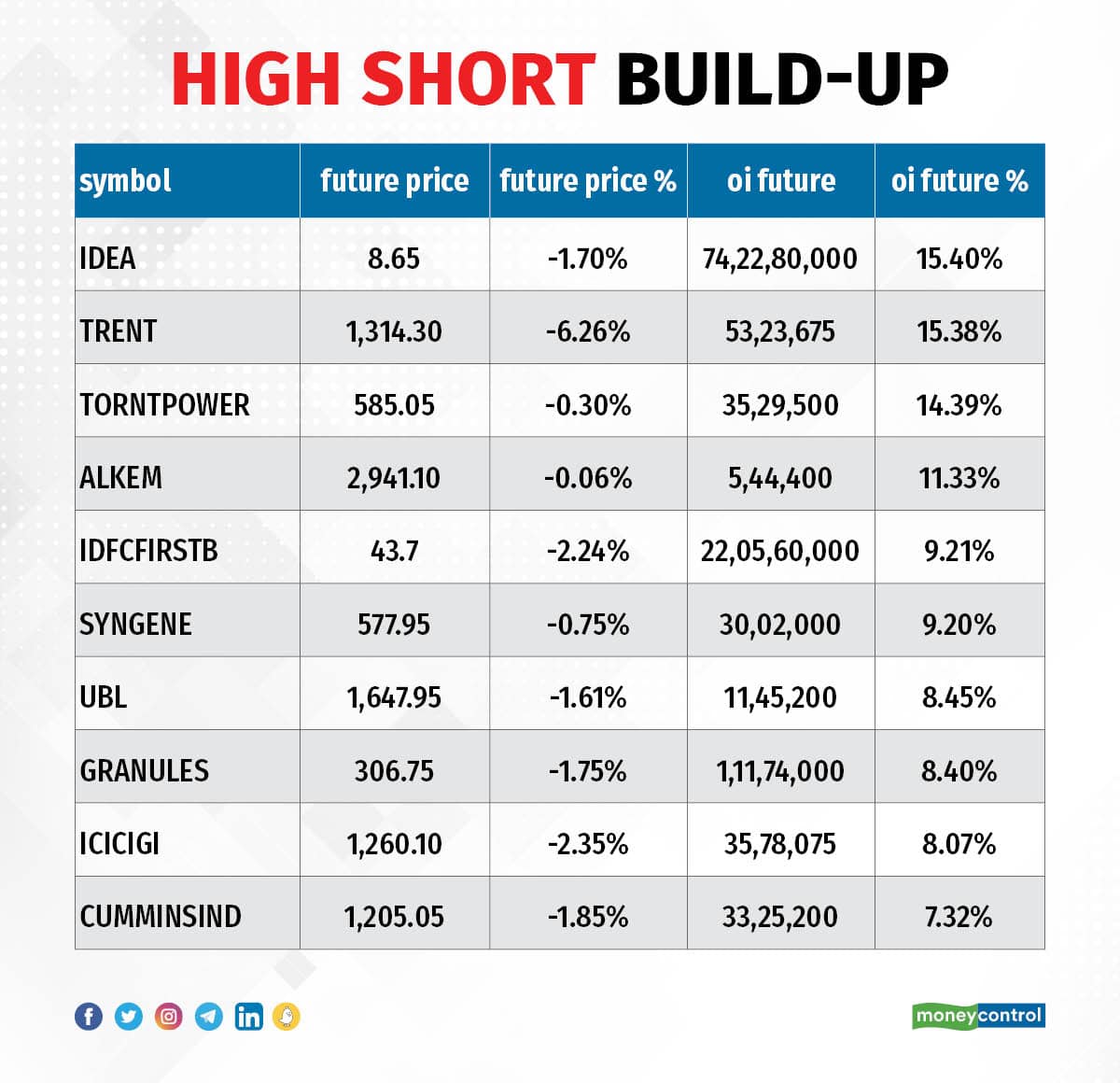

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Vodafone Idea, Trent, Torrent Power, Alkem Laboratories, and IDFC First Bank, in which a short build-up was seen.

10 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the 10 stocks including Nippon Life India, Gujarat Gas, ICICI Prudential Life, Balrampur Chini Mills, and Delta Corp, in which short-covering was seen.

MEP Infrastructure Developers: Promoter A J Tolls sold 13.15 lakh equity shares in the company via open market transactions at an average price of Rs 16.95 per share. However, Sandeep Kumar Hisaria acquired 15 lakh shares in the company at same price.

(For more bulk deals, click here)

Investors Meetings on August 23

Can Fin Homes: Officials of the company will attend ICICI Securities 'Bengaluru Corporate Day'.

IIFL Finance: Officials of the company will meet Mirae Asset.

Zydus Wellness, Aarti Industries: Officials of companies will attend DART India Annual Conference 2022 "The Challenge of Change".

Lemon Tree Hotels: Officials of the company will be participating in the corporate roadshow in Singapore organized by Motilal Oswal Securities.

HealthCare Global Enterprises: Officials of the company will meet investors and analysts.

Aptus Value Housing Finance India: Officials of the company will meet Uluwatu Capital.

Infibeam Avenues: Officials of the company will meet Locus Investment Group.

CMS Info Systems, RateGain Travel Technologies, PVR: Officials of companies will attend DAM Capital: Virtual MidCap Investor Conference 2022.

Tata Consumer Products: Officials of the company will be participating in ICICI Securities Bengaluru Conference.

Supreme Industries: Officials of the company will meet several investors and fund houses.

Metro Brands: Officials of the company will meet ICICI Prudential Life.

Cera Sanitaryware: Officials of the company will meet Yes Securities Conference.

Stocks in News

IIFL Finance: The company said the board of directors of its subsidiary IIFL Home Finance approved the allotment of its 53,76,457 equity shares to the subsidiary of Abu Dhabi Investment Authority. After the said transaction, the investor will hold 20% shareholding in IIFL Home Finance. The company received Rs 2,200 crore from investor against the said transaction.

TVS Electronics: The company executed business transfer agreement with GTID Solutions Development Private Limited for acquiring their business and intellectual property rights. With this agreement, TVS enters into mobile POS software solutions and authentication solutions space, offering hardware along with required applications, digital payment solutions, cloud computing software solutions etc. to segments like retail, banks and government. The cost of acquisition is Rs 2.25 crore.

RBL Bank: The private sector lender will be in focus as the board of directors has approved issue of debt securities on private placement basis, upto an amount of Rs 3,000 crore. This is subject to the approval of the members of the bank at the ensuing Annual General Meeting.

NTPC: The power generation company has declared first part capacity of 10 MW out of 20 MW Gandhar Solar PV project at Gandhar, Gujarat, on commercial operation. With this, standalone installed and commercial capacity of NTPC will become 55099 MW, while group installed and commercial capacity of NTPC will become 69464 MW.

Lemon Tree Hotels: The company has signed a License Agreement for a 65 room hotel at Hubli, Karnataka under its brand 'Lemon Tree Hotel'. The hotel is expected to be operational by May, 2023. Its hotel management subsidiary Carnation Hotels will be operating this hotel.

Fund Flow

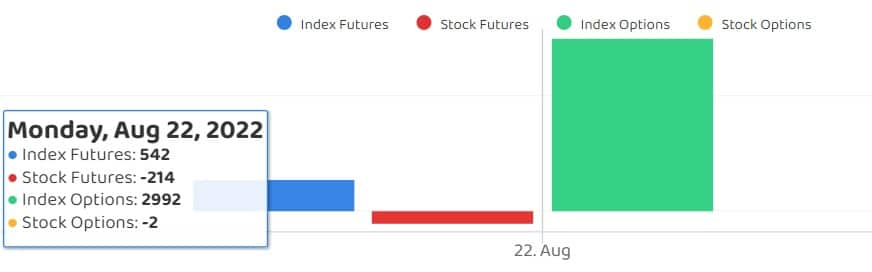

Foreign institutional investors (FIIs) have net sold shares worth Rs 453.77 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 85.06 crore on August 22, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Tata Chemicals - is under the NSE F&O ban list for August 23. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.