The correction in technology stocks and weak global cues ahead of US inflation numbers weighed down the market on July 11 as the BSE Sensex corrected 87 points to close at 54,395. However, the benchmark index showed smart recovery of more than 300 points from day's low, thanks to buying in banking & financial services, auto, metal, pharma, and select FMCG stocks.

The Nifty50 fell 4.6 points to 16,216 and formed a bullish candle on the daily charts as the closing was higher than opening levels.

"A long bull candle was formed on the daily chart after opening lower. This pattern signals a consolidation in the market after a recent sharp upmove. This is positive indication and signal lack of selling participation in the market at the hurdle of 16,200-16,300 levels," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Shetti feels the short-term uptrend status of Nifty remains intact and the market is taking temporary halt before showing further upmove in the near term. Hence, the current range movement within 16,100-16,250 levels is likely to extend for the next session, and a sustainable move above 16,300 could be viewed as strengthening of upside momentum, the market expert said.

The Nifty Midcap 100 and Smallcap 100 indices performed better than benchmarks, rising nearly one percent each, while the volatility index India VIX declined further by 0.14 percent to 18.37 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,138, followed by 16,060. If the index moves up, the key resistance levels to watch out for are 16,271 and 16,326.

Nifty Bank traded strong on Monday and outperformed the broader market trend, rising 346 points to close at 35,470. The important pivot level, which will act as crucial support for the index, is placed at 35,136, followed by 34,803. On the upside, key resistance levels are placed at 35,673 and 35,876 levels.

Maximum Call open interest of 24.05 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16,500 strike, which holds 21.36 lakh contracts, and 16,000 strike, which has accumulated 15.97 lakh contracts.

Call writing was seen at 16,100 strike, which added 2.94 lakh contracts, followed by 16,200 strike which added 1.63 lakh contracts and 17,000 strike which added 1 lakh contracts.

Call unwinding was seen at 15,700 strike, which shed 2.01 lakh contracts, followed by 16,500 strike which shed 88,600 contracts and 16,000 strike which shed 85,500 contracts.

Maximum Put open interest of 32.54 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the July series.

This is followed by 15,500 strike, which holds 27.66 lakh contracts, and 16,000 strike, which has accumulated 18.65 lakh contracts.

Put writing was seen at 16,100 strike, which added 3.12 lakh contracts, followed by 16,200 strike, which added 2.25 lakh contracts and 15,100 strike which added 98,800 contracts.

Put unwinding was seen at 15,800 strike, which shed 1.66 lakh contracts, followed by 15,600 strike which shed 1.22 lakh contracts, and 15,700 strike which shed 1 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Axis Bank, Crompton Greaves Consumer Electricals, Ambuja Cements, ICICI Bank, and HDFC Bank, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Intellect Design Arena, Nippon Life India, Eicher Motors, and Granules India, in which a long build-up was seen.

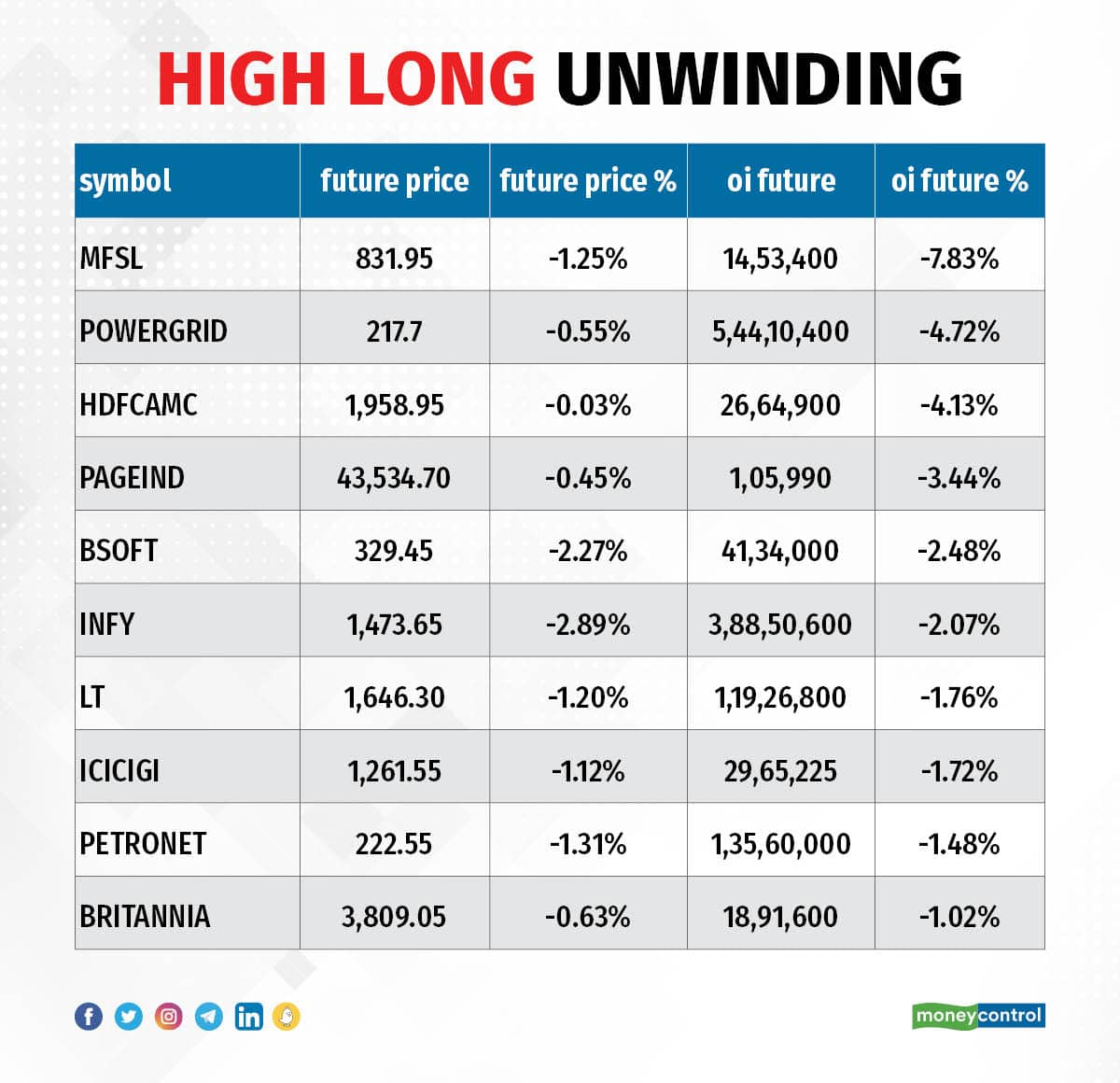

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Max Financial Services, Power Grid Corporation of India, HDFC AMC, Page Industries, and Birlasoft, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks including TCS, Bharti Airtel, Nifty, HCL Technologies, and Rain Industries, in which a short build-up was seen.

52 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Bandhan Bank, Aarti Industries, NBCC, ONGC, and Ipca Laboratories, in which short-covering was seen.

(For more bulk deals, click here)

HCL Technologies, Delta Corp, Anand Rathi Wealth, Artson Engineering, Sterling and Wilson Renewable Energy, Trident Texofab, Virinchi, Goa Carbon, Plastiblends India, Roselabs Finance, Shree Ganesh Remedies, and Swiss Military Consumer Goods will be in focus ahead quarterly earnings.

Stocks in News

Dhruv Consultancy Services: The company has received Letter of Acceptance (LOA) for the independent engineering services during development and operation of road project - Sikar - Bikaner section of NH-11, in Rajasthan through Public Private Partnership on design, build, finance, operate and transfer (DBFOT). Dhruv Consultancy Services received this contract in association with G-Square Infra Projects. Independent engineering services fees for the said project will be Rs 4.14 crore and the contract period will be of 36 months.

SecureKloud Technologies: Healthcare Triangle Inc, USA, a step-down subsidiary of the company has entered into a definitive agreement with a single institutional investor for the issuance and sale of 60.97 lakh shares of its common stock in a private placement. The private placement is expected to close on or about July 13.

5paisa Capital: The company reported a 2.6 percent year-on-year growth in consolidated profit at Rs 7.39 crore in quarter ended June 2022. Revenue from operations grew by 40 percent YoY to Rs 84.03 crore during the quarter.

HFCL: The company has received the purchase orders of Rs 59.22 crore, from one of the leading private telecom operators of the country, for providing services to rollout their fiber to the home (FTTH) network and long distance fiber network in various telecom circles.

Satin Creditcare Network: The company said the board of directors approved raising of funds by way of issuance of non-convertible debentures (NCDs) upto Rs 5,000 crore on private placement basis, in one or more tranches. The funds will be raised within a period of one year from the date of shareholders' approval.

Ahluwalia Contracts (India): The company has secured a new order for construction work of Amity Campus Bengaluru, worth to Rs 150 crore, from Ritnand Balved Education Foundation. The total order inflow during the FY23 stood at Rs 863 crore

Techno Electric & Engineering Company: The company said the board of directors approved the proposal to buy back of shares up to Rs 130 crore at a price up to Rs 325 per share.

Fund Flow

Foreign institutional investors (FIIs) have offloaded shares worth Rs 170.51 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 296.99 crore on July 11, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock under its F&O ban list for July 12 as well. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.