Positive global cues and buying in most sectors helped benchmark indices gain eight-tenth of a percent on June 27, thereby extending their uptrend for the third consecutive session.

The BSE Sensex jumped 433 points to 53,161, while the Nifty50 rose 133 points to 15,832 and formed a bearish candle which resembles a Bearish Belt Hold kind of pattern on the daily charts.

"Technically, this action signals a choppy movement in the market after a gap up opening. The crucial overhead resistance of 15,800 levels (previous swing lows, as per the concept of change in polarity) has been taken out on the upside. But, the lack of further upside post upside breakout and a formation of rangebound action subsequently after the opening could dampen the effort of bulls to sustain the highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Display of lack of strength to sustain the highs during upside breakout is likely to result in further consolidation or downward correction from the highs, the market expert said.

On the other side, a decisive upmove above 15,900 could lead to further upside towards another hurdle of 16,200 levels, Shetti said.

The broader space also participated in the rally, with the Nifty Midcap 100 index rising 1 percent and Smallcap 100 index climbing 2 percent on positive market breadth. However, experts said having volatility above 20 levels could keep the trend more favourable for bears than bulls. India VIX, the fear index, rose by 2.2 percent to 21 levels.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,789, followed by 15,746. If the index moves up, the key resistance levels to watch out for are 15,901 and 15,970.

Nifty Bank rallied 184 points to close at 33,811 on Monday. The important pivot level, which will act as crucial support for the index, is placed at 33,649, followed by 33,486. On the upside, key resistance levels are placed at 34,061 and 34,310 levels.

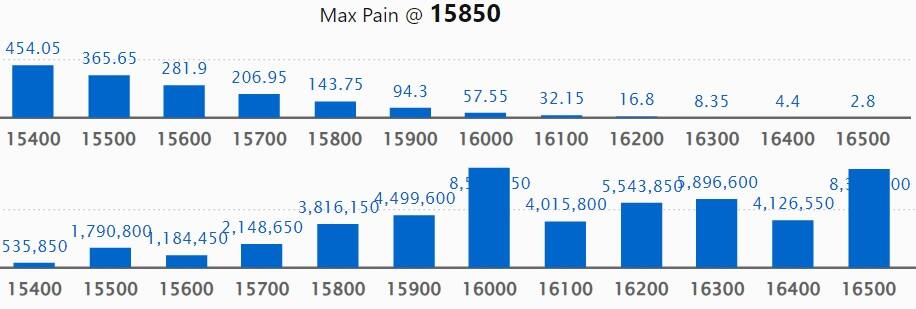

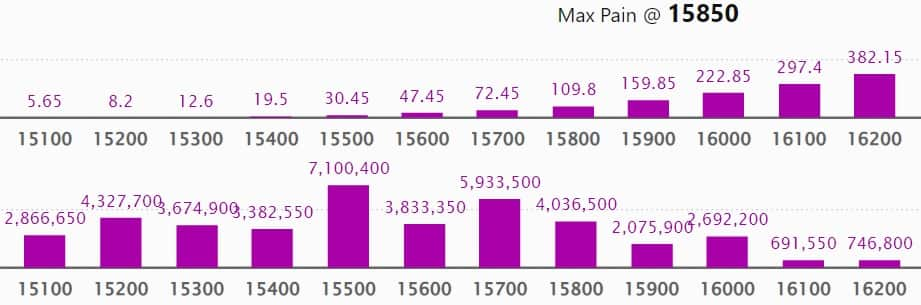

Maximum Call open interest of 85.73 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 16,500 strike, which holds 83.74 lakh contracts, and 16,300 strike, which has accumulated 58.96 lakh contracts.

Call writing was seen at 16,200 strike, which added 20.33 lakh contracts, followed by 16,300 strike which added 19.22 lakh contracts and 16,500 strike which added 18.54 lakh contracts.

Call unwinding was seen at 15,700 strike, which shed 23.24 lakh contracts, followed by 15,600 strike which shed 7.18 lakh contracts and 15,500 strike which shed 5.74 lakh contracts.

Maximum Put open interest of 86.03 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the June series.

This is followed by 15,500 strike, which holds 71 lakh contracts, and 15,700 strike, which has accumulated 59.33 lakh contracts.

Put writing was seen at 15,000 strike, which added 33.53 lakh contracts, followed by 15,700 strike, which added 27.3 lakh contracts and 15,800 strike which added 27.13 lakh contracts.

Put unwinding was seen at 14,600 strike, which shed 3.89 lakh contracts, followed by 15,400 strike which shed 3.03 lakh contracts, and 14,700 strike which shed 1.67 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in HDFC, Power Grid Corporation, Ambuja Cements, Colgate Palmolive, and Bata India, among others.

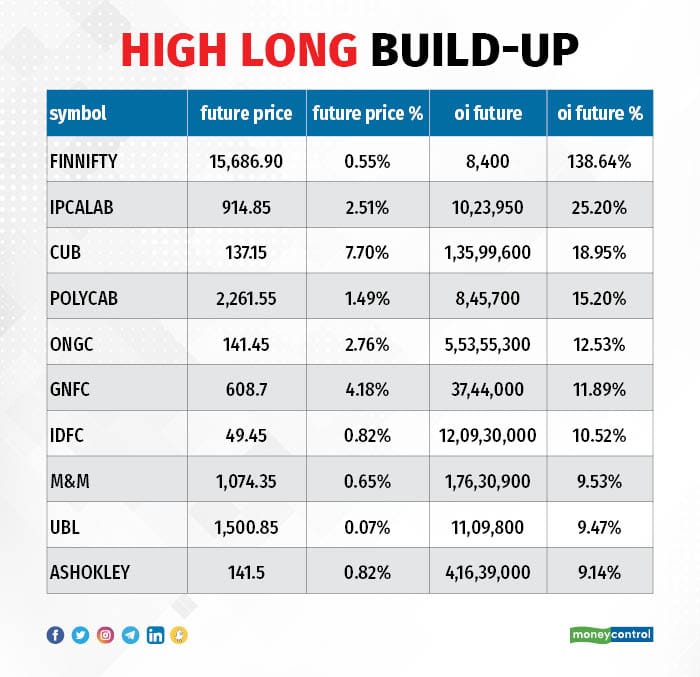

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Ipca Laboratories, City Union Bank, Polycab India, and ONGC, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Voltas, Strides Pharma Science, Hero MotoCorp, Balrampur Chini Mills and Colgate Palmolive, in which long unwinding was seen.

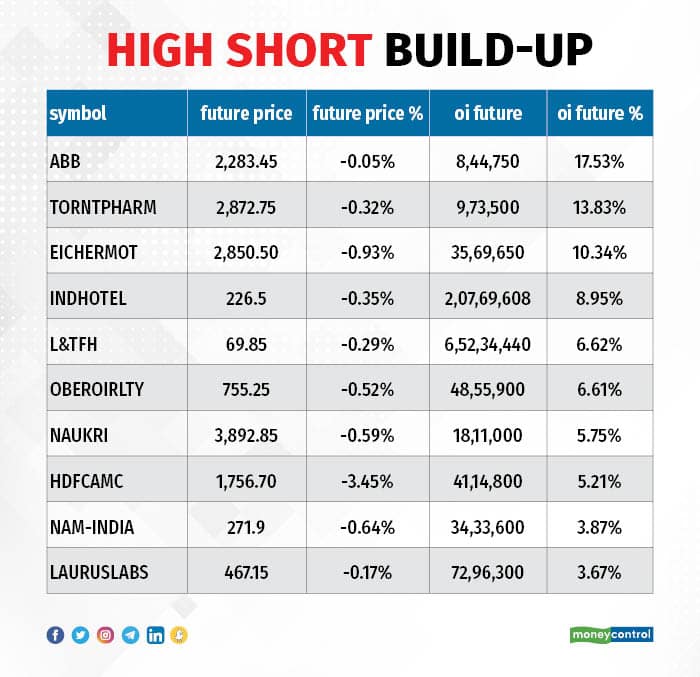

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including ABB India, Torrent Pharma, Eicher Motors, Indian Hotels, and L&T Finance Holdings, in which a short build-up was seen.

77 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Alembic Pharma, Ramco Cements, Bosch, AU Small Finance Bank, and Hindustan Copper, in which short-covering was seen.

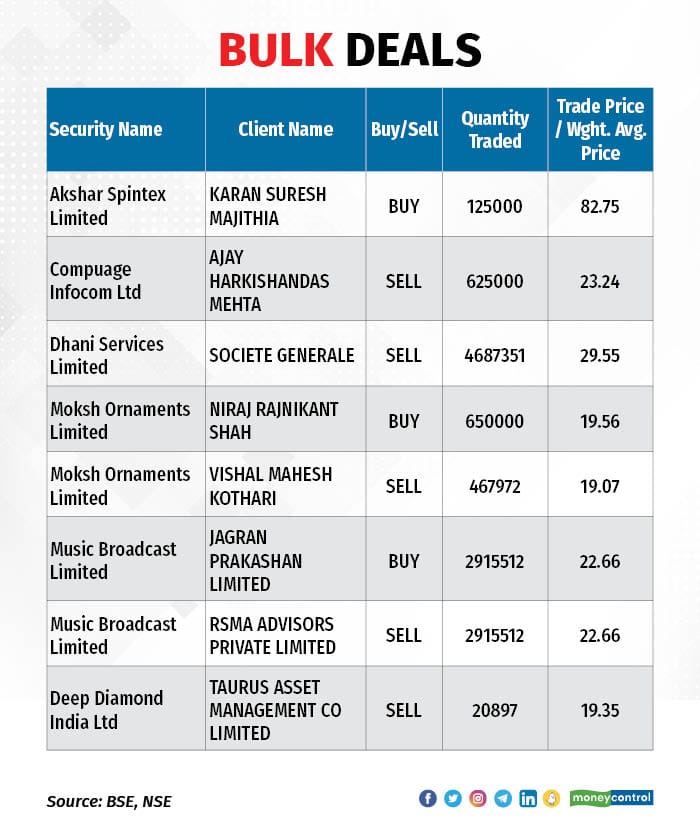

Dhani Services: Societe Generale sold 46,87,351 equity shares in the company via open market transactions. These shares were sold at an average price of Rs 29.55 per share.

(For more bulk deals, click here)

Investors Meetings on June 28:

Tata Steel: Officials of the company will meet Jefferies India, and JP Morgan.

Dr Lal PathLabs: Officials of the company will meet HSBC Securities.

Radico Khaitan: Officials of the company will meet Nippon Mutual Fund.

MCX India: Officials of the company will meet SageOne Investments.

Dodla Dairy: Officials of the company will meet Ambika Fincorp, Union MF, PhillipCapital, Geosphere India Advisors, and Equentis Wealth Advisory.

Mahindra & Mahindra: Officials of the company will meet several funds and investors in non-deal roadshow in New York.

Greaves Cotton: Officials of the company will attend Kotak Securities Investor Conference, and Arihant Capital Investor Conference.

Va Tech Wabag, Sansera Engineering, Chemplast Sanmar: Officials of the company will participate in Arihant Rising Star Summit 2022.

Polycab India: Officials of the company will meet Axis Capital.

Stocks in News

Sterling Tools: Subsidiary Sterling Gtake E-mobility (SGEM) forayed into E-LCV segment. With this development, SGEM continues to grow its presence across various E-mobility segments. Starting with supplies to a single Electric 2W customer a year back, the company now has confirmed orders from more than 10 customers.

Bilcare: The company said the board has appointed Shreyans Bhandari as Additional Director and Chairman & Managing Director of the company. He is the son of Mohan Bhandari, earlier Chairman and MD, who is now appointed as Chief Executive Officer.

Star Health and Allied Insurance: The health insurance company has signed a Corporate Agency agreement with IDFC FIRST Bank, for distribution of its health insurance solutions to the bank's customers.

Capri Global Capital: APV Tradesol Pvt Ltd and PACs sold 2.055 percent stake in the company via open market transactions. With this, their shareholding in the company stands reduced to 6.102 percent, down from 8.156 percent earlier.

Brigade Enterprises: Brigade Group has signed joint development agreement to develop 2.1 million square feet of residential apartments in Chennai. Brigade targets revenue of Rs 6,000 crore from its residential business over the next 5 years in the city.

Indian Card Clothing: The company said the board has declared special interim dividend of Rs 25 per share on face value of Rs 10 each for the financial year 2022-23. The board has also given approval for acquiring balance 40% equity stake in Garnett Wire, UK – foreign subsidiary of the company, from the Joint Venture Partner – Joseph Sellers & Son Limited.

Fund Flow

Foreign institutional investors (FIIs) have net sold Rs 1,278.42 crore worth of shares, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 1,184.47 crore worth of shares on June 27, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Delta Corp and Sun TV Network - are under the NSE F&O ban for June 28. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.