Key equity indices logged gains for the fourth consecutive session on December 28, led by financial stocks such as HDFC twins, ICICI Bank, Kotak Mahindra Bank and SBI.

Sensex closed 380 points, or 0.81 percent, higher at 47,353.75 while Nifty settled 124 points, or 0.90 percent, higher at 13,873.20.

Binod Modi, Head Strategy, Reliance Securities pointed out that the domestic equities continue to look good given the improved prospects of earnings recovery. Strong improvement in advance corporate tax data for 3Q and consistent improvement in high-frequency economic data indicate strong earnings recovery.

"Considering rich valuations of the markets and threat emerging from higher input costs, the market rally might not be broad-based and therefore investors are advised to focus on quality stocks which offer decent margins of safety and strong earning potential," he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 13,828.03, followed by 13,782.87. If the index moves up, the key resistance levels to watch out for are 13,901.83 and 13,930.47.

Nifty Bank

The Nifty Bank surged 478.75 points or 1.57 percent to close at 30,880.95 on December 28. The important pivot level, which will act as crucial support for the index, is placed at 30,636.37, followed by 30,391.83. On the upside, key resistance levels are placed at 31,027.27 and 31,173.63.

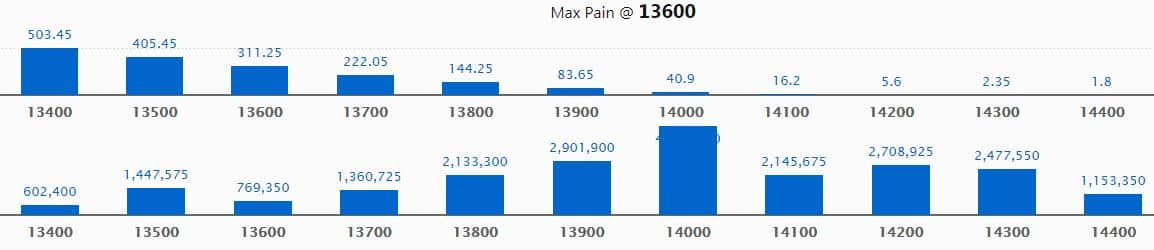

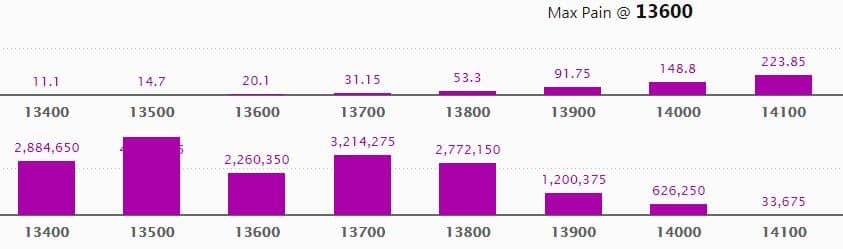

Call option data

Maximum Call open interest of 47.14 lakh contracts was seen at 14,000 strike, which will act as a crucial resistance level in the December series.

This is followed by 13,900 strike, which holds 29.02 lakh contracts, and 14,200 strike, which has accumulated 27.09 lakh contracts.

Call writing was seen at 14,200 strike, which added 10.14 lakh contracts, followed by 13,900 strike which added 9.93 lakh contracts and 14,300 strike which added 9.74 lakh contracts.

Call unwinding was seen at 13,700 strike, which shed 5.41 lakh contracts, followed by 13,800 strike which shed 3 lakh contracts.

Put option data

Maximum Put open interest of 41.75 lakh contracts was seen at 13,500 strike, which will act as a crucial support level in the December series.

This is followed by 13,700 strike, which holds 32.14 lakh contracts, and 13,400 strike, which has accumulated 28.85 lakh contracts.

Put writing was seen at 13,800 strike, which added 22.73 lakh contracts, followed by 13,700 strike, which added 10.04 lakh contracts and 13,900 strike which added 9.90 lakh contracts.

No major Put unwinding was seen on December 28.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

55 stocks saw long build-up

Based on the open interest future percentage, here are the 10 stocks in which a long build-up was seen.

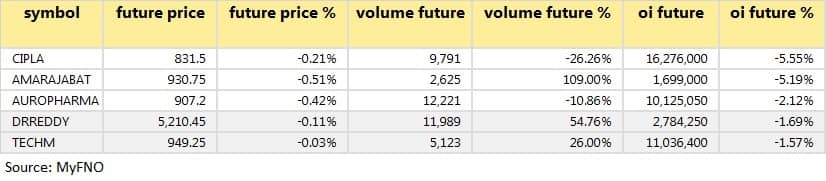

5 stocks saw long unwinding

11 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions.

66 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

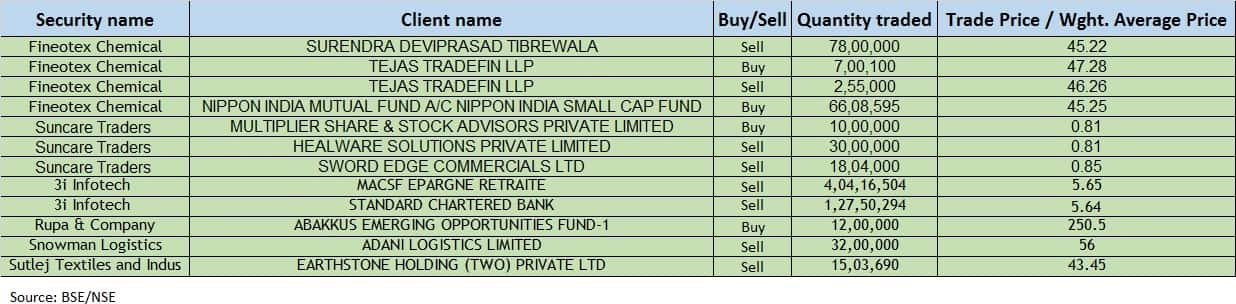

Bulk deals

(Click here for more bulk deals)

Board Meetings

Jindal Stainless:The board will meet on December 29 to discuss the scheme of arrangement.

Gateway Distriparks:The board will meet on December 29 to consider and approve the interim dividend.

Vikas Proppant & Granite:The board will meet on December 29 to consider and approve quarterly results.

Sarla Performance Fibers:The board will meet on December 29 for general purposes.

Stocks in the news

Biocon - The company expands its generic formulations portfolio with the launch of Tacrolimus capsules in the US.

3i Infotech - The company approved slump sale of the global software products business on a going concern basis to Azentio Software.

GE Shipping - The company has delivered its 2000 built Suezmax Crude Carrier “Jag Lateef” to the buyers.

SBI Life Insurance Company- The company approved the appointment of Shobinder Duggal as an additional director.

Sri Adhikari Brothers Television Network- 14th meeting of the Committee of Creditors of the company is scheduled to be convened on December 29, 2020.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,588.93 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,386.55 crore in the Indian equity market on December 28, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Canara Bank, Punjab National Bank and SAIL - are under the F&O ban for December 29. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!