The market sustained its uptrend for the eighth consecutive session, but closed off day's high and the Nifty failed to hold on to the psychological 12,000 mark on October 12. The announcements made by the finance minister to stimulate consumer spending and capital expenditure failed to cheer investors' mood.

The BSE Sensex was up 84.31 points at 40,593.80, while the Nifty50 gained 16.80 points to close at 11,931 and formed a small-bodied bearish candle on the daily charts as closing was lower than opening levels.

"Technically, this could be considered as a high wave type pattern which reflects high volatility in the market at the swing highs. Sometimes, such formation of high wave patterns could signal a reversal of current trend after the confirmation," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"Though Nifty stretched its uptrend for the eighth consecutive session on Monday, there is no confirmation of any reversal pattern at the highs. Hence, we expect minor consolidations for the 1-2 sessions and that could eventually result in an uptrend continuation pattern. In the last 11 sessions, Nifty has not showed any important reversal signals," he said.

The overall market breadth has been an area of concern for the benchmark Nifty over the last few sessions. The broad market indices like smallcap and midcap have continued to show underperformance and continued with minor weakness on Monday, which has resulted in a negative advance-decline ratio, he added.

The Nifty Midcap index was down 0.6 percent and Smallcap fell 0.4 percent. About two shares declined for every share rising on the BSE.

We have collated 14 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.Key support and resistance levels on the NiftyAccording to pivot charts, the key support levels for the Nifty is placed at 11,858.13, followed by 11,785.27. If the index moves up, the key resistance levels to watch out for are 12,012.93 and 12,094.87.

Nifty BankThe Bank Nifty ended a seven-day winning streak and lost 134 points to close at 23,712.80 on October 12. The important pivot level, which will act as crucial support for the index, is placed at 23,446.84, followed by 23,180.87. On the upside, key resistance levels are placed at 24,084.54 and 24,456.27.

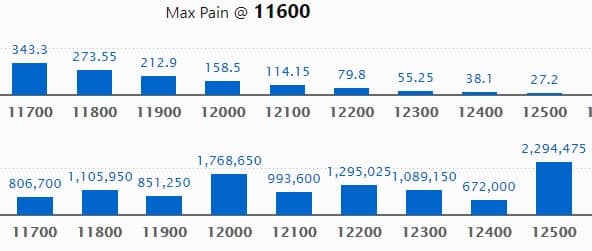

Maximum Call open interest of 22.94 lakh contracts was seen at 12,500 strike, which will act as crucial resistance in the October series.

This is followed by 12,000 strike, which holds 17.68 lakh contracts, and 12,200 strike, which has accumulated 12.95 lakh contracts.

Call writing was seen at 12,200 strike, which added 2.41 lakh contracts, followed by 12,500 strike which added 2.19 lakh contracts and 12,300 strike which added 1.87 lakh contracts.

Call unwinding was seen at 11,800 strike, which shed 61,650 contracts, followed by 11,700 strike, which shed 38,025 contracts and 11,600 strike which shed 36,450 contracts.

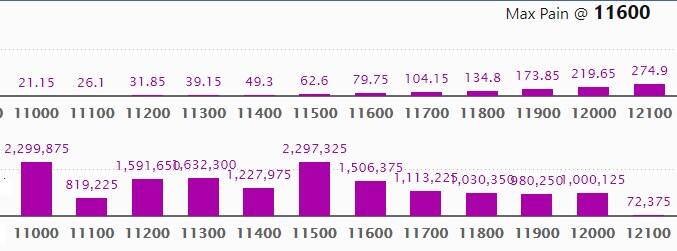

Maximum Put open interest of 22.99 lakh contracts was seen at 11,000 strike, which will act as crucial support in the October series.

This is followed by 11,500 strike, which holds 22.97 lakh contracts, and 11,300 strike, which has accumulated 16.32 lakh contracts.

Put writing was seen at 11,600 strike, which added 3.34 lakh contracts, followed by 11,900 strike, which added 2.78 lakh contracts and 12,000 strike which added 2.17 lakh contracts.

Put unwinding was witnessed at 11,300 strike, which shed 1.48 lakh contracts, followed by 11,000 strike which shed 1.02 lakh contracts.

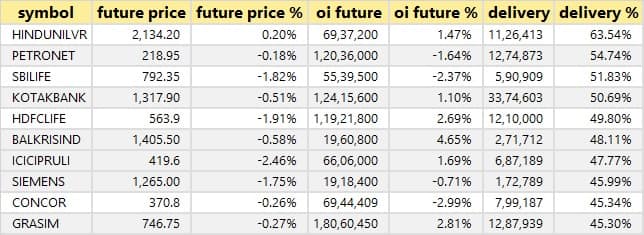

A high delivery percentage suggests that investors are showing interest in these stocks.

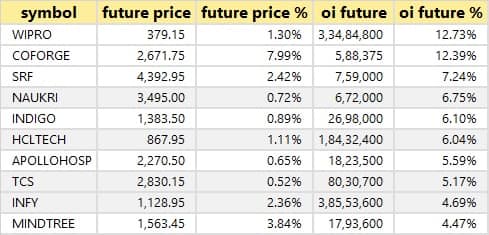

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

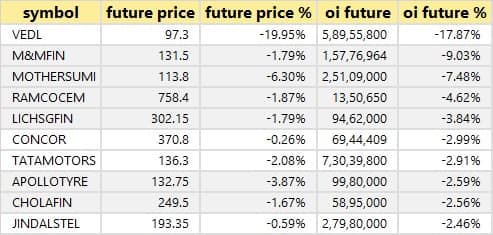

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

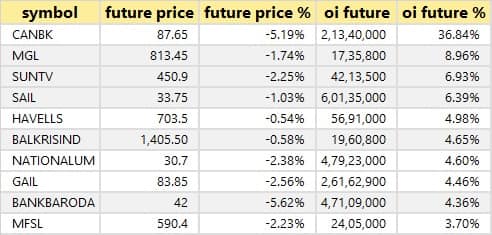

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are top 10 stocks in which short build-up was seen.

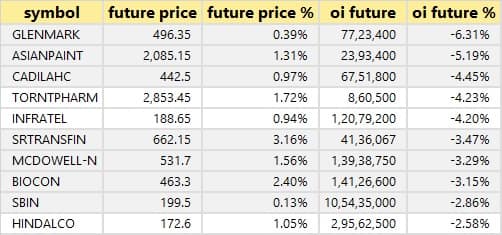

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

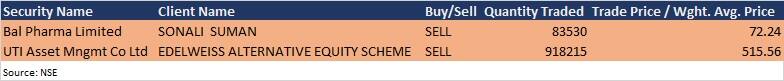

(For more bulk deals, click here)

Results on October 13Karnataka Bank, Tata Steel Long Products, California Software and Rudra Global Infra Products will announce quarterly earnings on October 13.

Stocks in the newsADF Foods: Ashish Kacholia bought 1.14 percent stake in the company in the September quarter.

DFM Foods: Ashish Kacholia increased stake in the company to 2.84 percent in the September quarter from 2 percent in the June quarter. Vanaja Sundar Iyer acquired 1.87 percent stake in the company.

Shalby: The company reported consolidated profit at Rs 24.5 crore in Q2FY21 against Rs 12.9 crore YoY, revenue fell to Rs 115.6 crore from Rs 125.7 crore YoY.

Cipla: Avenue Therapeutics Inc received a complete response letter from the FDA for new drug application IV Tramadol.

Shakti Pumps India: Investor AF Holdings sold 4.81 lakh shares (2.6 percent stake) in the company and cut stake to 6.3 percent.

Simplex Realty: LIC cut stake in the company to 16.78 percent from 18.87 percent earlier.

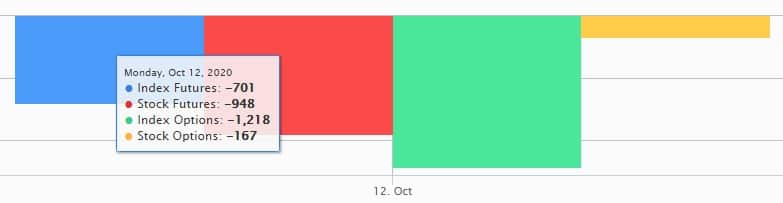

Fund flow

Foreign institutional investors (FIIs) net bought shares worth Rs 615.17 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,028.77 crore in the Indian equity market on October 12, as per provisional data available on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!