Technically, the Nifty 50 is expected to be choppy in the short term with crucial hurdle on the higher at 21,850 and the support at 21,300, the low of this month. Hence, if the index breaks either side of this range, then the directional move can be seen in coming days, experts said.

On January 20, the additional trading session of the week, the BSE Sensex fell 260 points to 71,424, while the Nifty 50 was down 51 points to 21,572 and formed bearish candlestick pattern which resembles Bearish Engulfing kind of pattern on the daily charts, indicating the possibility of increase in bearish activity.

Nifty on the weekly chart closed with the formation of long bear candle, which is also indicating a formation of Bearish Engulfing pattern (not a classical one) on the weekly chart. The index was down 1.5 percent for the week.

Hence, "such bearish formation after a long time on the long-term chart signals an emergence of selling pressure in the market at the new highs," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

He feels the short-term trend of Nifty remains choppy. "Having faced weakness after a small rise at open on Saturday signal weak bias for the market ahead."

At the higher levels, he feels the market could encounter strong overhead resistance around 21,750-21,850 levels and on the downside could find support around 21,300 levels in the near term.

But, Rohit Srivastava, Founder of Strike Money Analytics and Indiacharts, looks bearish after the breaking of previous pattern of higher highs and lows. He feels the uptrend has halted. "We must consider the idea that the rally from the October low is over and a correction is setting in."

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 21,543, followed by 21,501, and 21,433 levels, while on the higher side, it may see an immediate resistance at 21,588 followed by 21,722 and 21,790 levels.

Meanwhile, on January 20, the Bank Nifty outperformed the benchmark Nifty 50, climbing above 46,000 mark. The banking index rose 357 points to 46,058 and formed small-bodied bullish candlestick pattern with long lower shadow on the daily charts.

"The recent decline in Bank Nifty appears impulsive so it means that a further decline maybe on the cards in the coming weeks," Rohit Srivastava, founder of Strike Money Analytics and Indiacharts said.

However, in the short term, "we are witnessing a bounce and that means that Bank Nifty may go higher before it heads back to the 200-day EMA (exponential moving average) at 44,555," he said.

As per the pivot point calculator, the Bank Nifty is expected to take support at 45,754, followed by 45,625 and 45,418 levels, while on the higher side, the index may see resistance at 46,108, followed by 46,296 and 46,504 levels.

On the weekly options data front, the 22,500 strike owned the maximum Call open interest, with 93.51 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,000 strike, which had 81.22 lakh contracts, while the 21,700 strike had 78.06 lakh contracts.

Meaningful Call writing was seen at the 21,700 strike, which added 20.79 lakh contracts followed by 22,400 and 21,900 strikes adding 19.25 lakh and 14.19 lakh contracts, respectively.

The maximum Call unwinding was at the 22,700 strike, that shed 5.07 lakh contracts followed by 22,600 and 21,400 strikes which shed 4.2 lakh and 1.73 lakh contracts.

On the Put front, the maximum open interest remained at 20,500 strike, which can act as a key support area for Nifty, with 73.26 lakh contracts. It was followed by 21,000 strike comprising 68.49 lakh contracts and then 21,500 strike with 65.93 lakh contracts.

Meaningful Put writing was at 21,000 strike, which added 9.25 lakh contracts followed by 21,100 strike and 20,800 strike adding 9.03 lakh contracts and 5.82 lakh contracts, respectively.

Put unwinding was seen at 20,600 strike, which shed 13.12 lakh contracts, followed by 20,200 strike which shed 7.76 lakh contracts, and 20,400 strike, which shed 4.15 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. PI Industries, SBI Life Insurance Company, SRF, Max Financial Services, and Hindustan Unilever saw the highest delivery among the F&O stocks.

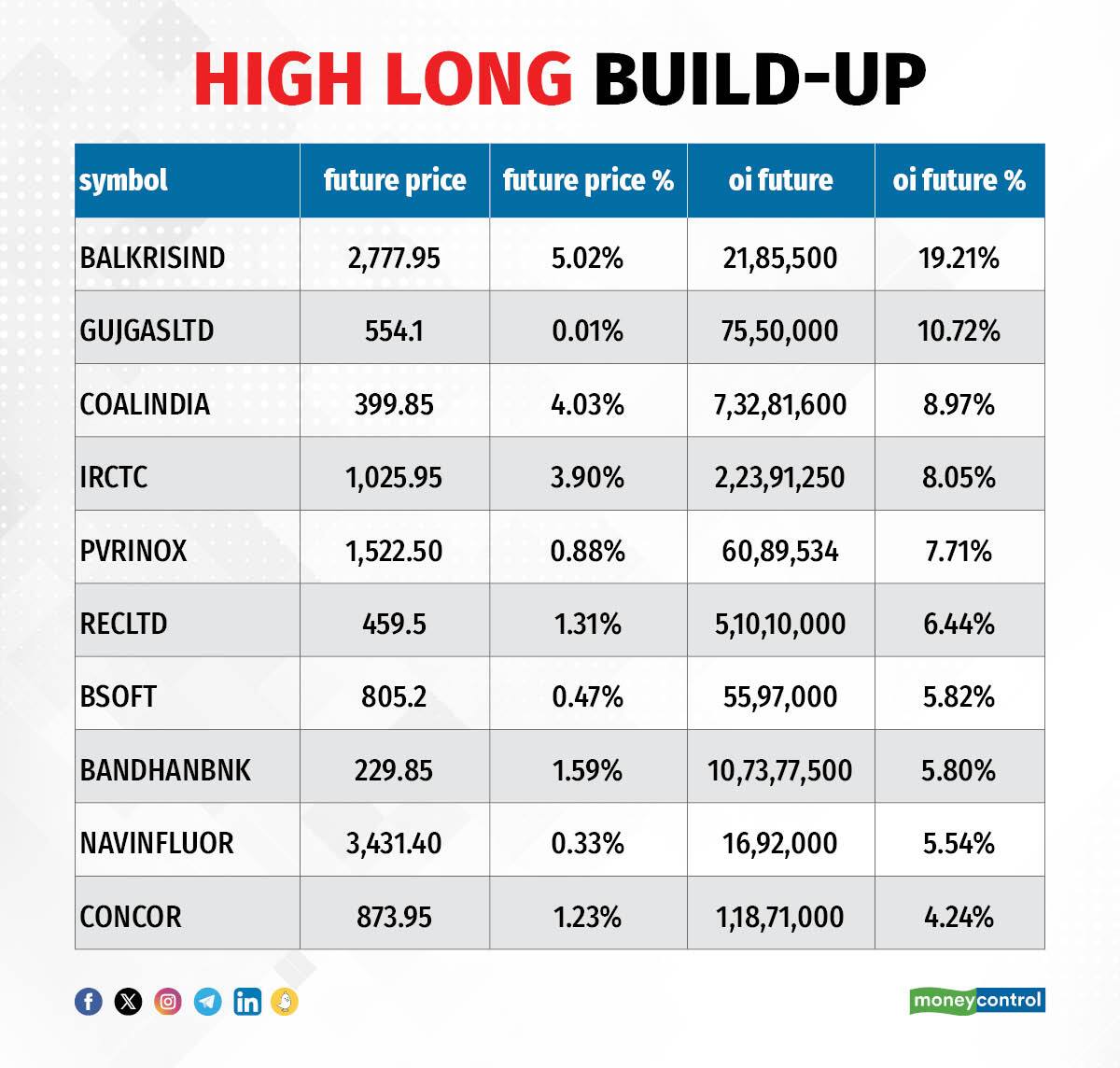

A long build-up was seen in 39 stocks, which included Balkrishna Industries, Gujarat Gas, Coal India, IRCTC, and PVR INOX. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 53 stocks saw long unwinding, including Oracle Financial Services Software, BHEL, UltraTech Cement, Chambal Fertilisers & Chemicals, and Aarti Industries. A decline in OI and price indicates long unwinding.

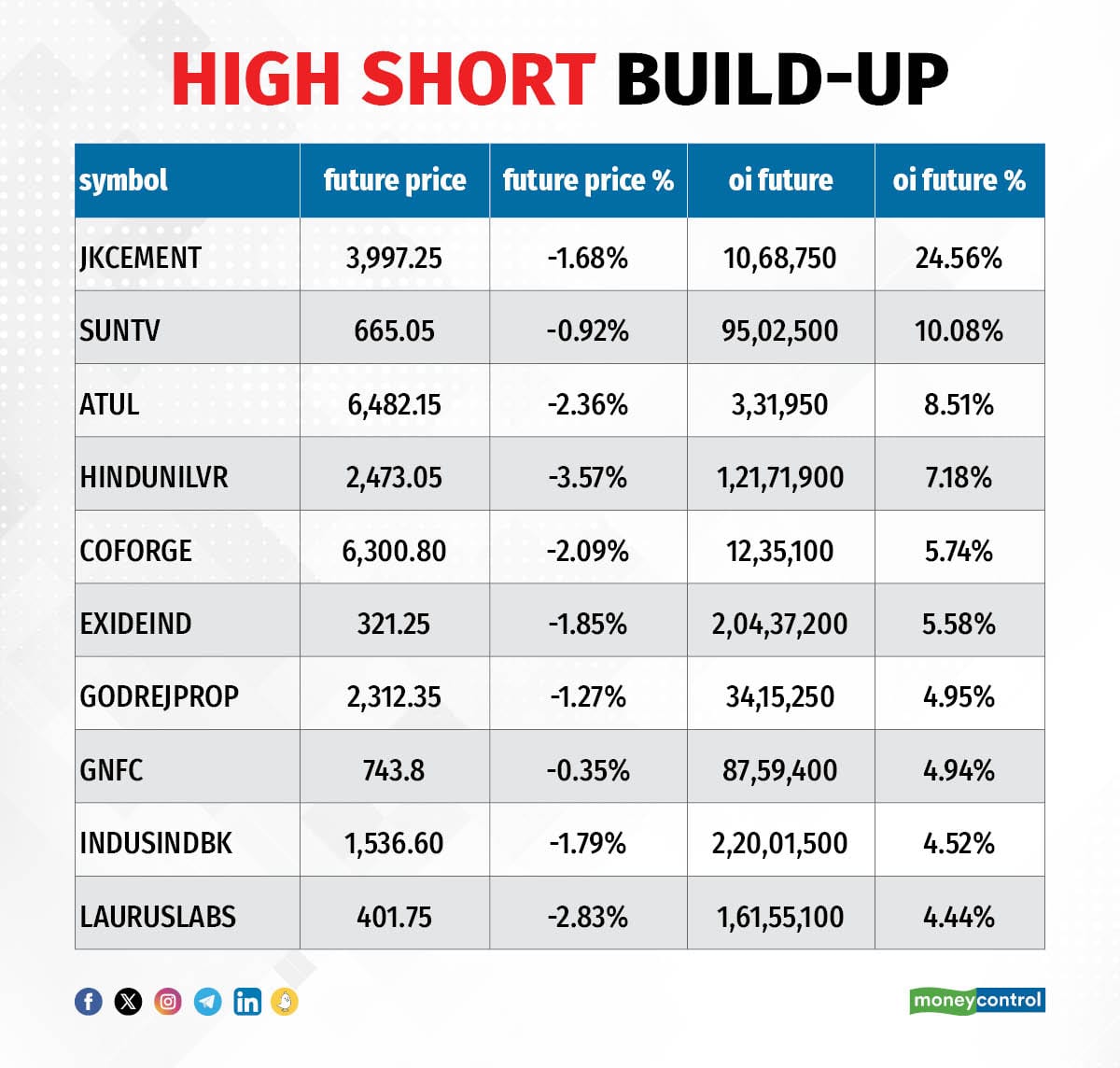

79 stocks see a short build-up

A short build-up was seen in 79 stocks including JK Cement, Sun TV Network, Atul, Hindustan Unilever, and Coforge. An increase in OI along with a fall in price points to a build-up of short positions.

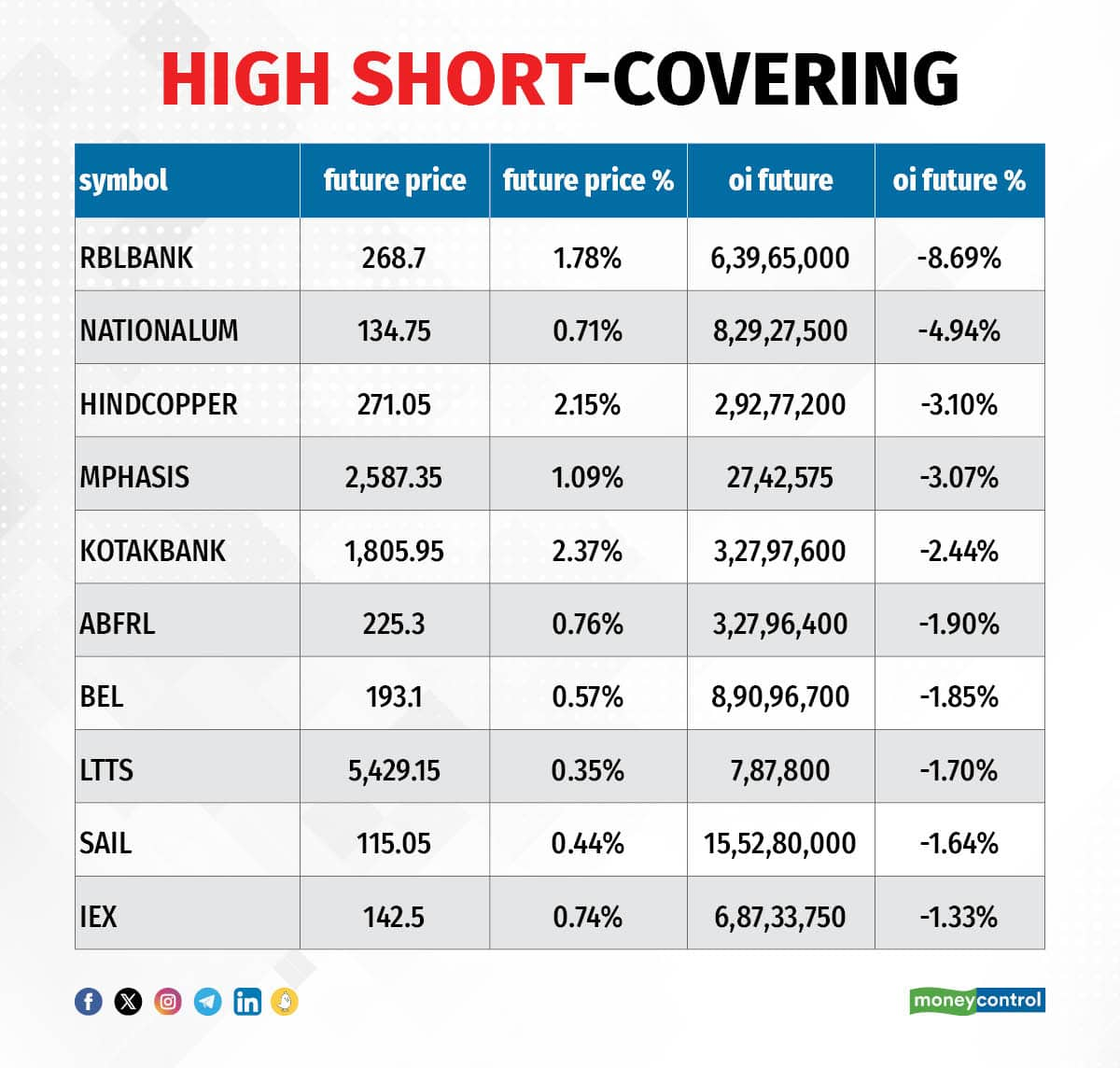

Based on the OI percentage, 16 stocks were on the short-covering list. This included RBL Bank, National Aluminium Company, Hindustan Copper, Mphasis, and Kotak Mahindra Bank. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, fell to 0.86 on January 20, from 0.96 levels in the previous session. The below 1 PCR indicates that the traders are buying more Calls options than Puts, which generally indicates an increase in bullish sentiment.

For more bulk deals, click here

Stocks in the news

Zee Entertainment Enterprises: Sony Group called off the December 22, 2021 agreement to merge Zee Entertainment and Culver Max Entertainment (CME), which was formerly known as Sony Pictures Networks India.

ICICI Bank: The private sector lender has recorded a 23.6 percent on-year growth in standalone net profit at Rs 10,271.54 crore for quarter ended December FY24 despite higher provisions. Net interest income grew by 13.4 percent YoY to Rs 18,678.55 crore for the quarter.

Persistent Systems: The Pune-based IT services company has registered a 8.7 percent QoQ growth in net profit at Rs 286.1 crore for October-December period of FY24, with strong operating margin performance, while revenue from operations grew by 3.6 percent sequentially to Rs 2,498.2 crore for the quarter.

Coforge: The IT solutions company has recorded a 31.5 percent quarter-on-quarter growth in net profit at Rs 238 crore for quarter ended December FY24, with healthy operating numbers. Revenue from operations increased by 2.1 percent QoQ to Rs 2,323.3 crore.

Colgate-Palmolive India: The oral care company has clocked a 36 percent on-year growth in net profit at Rs 330.11 crore for October-December FY24 quarter, backed by healthy operating numbers. Revenue from operations increased by 8 percent year-on-year to Rs 1,396 crore.

Tata Motors: The Tata Group company said it would increase prices of its entire passenger vehicle range by an average of 0.7 percent with effect from February 1.

Medi Assist Healthcare Services: The healthcare third-party administrator is set to list its equity shares on the bourses on January 23. The final issue price has been set at Rs 418 per share.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) continued to be net sellers for four days in a row, selling shares worth Rs 545.58 crore, while domestic institutional investors (DIIs) offloaded Rs 719.31 crore worth of stocks on January 20, provisional data from the NSE showed.

Stock under F&O ban on NSE

A total of 11 stocks are in the F&O ban list for January 23. The NSE has added IRCTC to the said list while retaining Aditya Birla Fashion & Retail, Balrampur Chini Mills, Delta Corp, Indian Energy Exchange, National Aluminium Company, Oracle Financial Services Software, Polycab India, RBL Bank, SAIL and Zee Entertainment Enterprises to the said list. Hindustan Copper was removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!