Bears were in full action on February 22, pulling down the market by more than 1.5 percent after Russia's new nuclear warning against the West and ahead of FOMC minutes.

The BSE Sensex plunged 928 points, the biggest single-day fall since December 23 last year, to 59,745, while the Nifty50 tanked 272 points, the largest single-day fall since January 27 this year, to 17,554 and formed a long bearish candle on the daily charts, ahead of monthly expiry of February derivative contracts.

"A long bear candle was formed on the daily chart with

a gap-down opening. Technically, this pattern indicates the strengthening of downside momentum in the market. The present weakness has also reversed the short-term uptrend into downside," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

The index has been making lower highs and lower lows for the fourth consecutive session and closed below the 200-day EMA (exponential moving average) of 17,592.

Previously, the market has witnessed a meaningful upside bounce after violating this moving average support. This EMA has also acted as a significant reversal point on either side in the past.

Shetti says the short-term trend of the Nifty is weak and there is a possibility of some more weakness in the short term. Having placed near the important support zone of around 17,400-17,300 levels, there is a possibility of an upside bounce from the lows, the market expert said.

The broader markets were also caught in the bear trap with the Nifty Midcap 100 and Smallcap 100 indices falling over 1.1 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.Key support and resistance levels on the Nifty

As per the pivot charts, the Nifty has support at 17,526, followed by 17,469 and then 17,376. If the index moves up, the key resistance levels to watch out for are 17,712, followed by 17,769 and 17,862.

The Nifty Bank remained under pressure for the fifth straight session, declining 678 or 1.67 percent to 39,996, which is near to its 200-day EMA (40,007). The index has formed a long bearish candlestick pattern on the daily charts, making lower highs and lower lows for the fourth straight session.

"The index is now trading in an oversold territory, and if sustains above 40,000 it can witness a pull-back rally towards 40,600-40,800 levels," Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities said.

The important pivot level, which will act as a support, is at 39,901, followed by 39,752 and 39,511. On the upside, key resistance levels are 40,382, followed by 40,531, and 40,772.

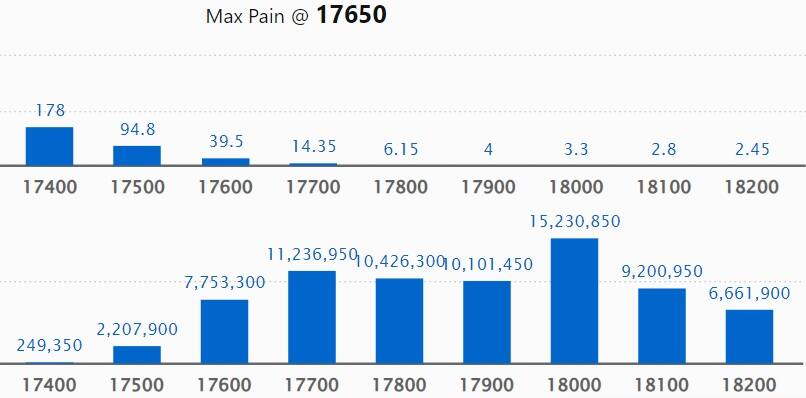

On a monthly basis, we have seen the maximum Call open interest (OI) at 18,000 strike, with 1.52 crore contracts, which may be a crucial resistance level for the Nifty in coming sessions.

This is followed by a 17,700 strike, comprising 1.12 crore contracts, and a 17,800 strike, where there are more than 1.04 crore contracts.

Call writing was seen at 17,700 strike, which added 1.03 crore contracts, followed by 17,600 strike which added 70.15 lakh contracts and 17,800 strike which added 68.74 lakh contracts.

We have seen Call unwinding in 18,500 strike, which shed 17.04 lakh contracts, followed by 18,100 strike, which shed 13.35 lakh contracts, and 18,400 strike which shed 11.76 lakh contracts.

On a monthly basis, the maximum Put OI was seen at 17,500 strike, with 85.71 lakh contracts, which is expected to act as a crucial support zone for the Nifty50 in coming sessions.

This is followed by the 17,000 strike, comprising 65.75 lakh contracts, and the 17,400 strike, where we have 63.98 lakh contracts.

Put writing was seen at 17,400 strike, which added 27.82 lakh contracts, followed by 17,000 strike, which added 18.25 lakh contracts, and 17,100 strike which added 13.94 lakh contracts.

We have seen Put unwinding at 17,800 strike, which shed 48.21 lakh contracts, followed by 17,900 strike which shed 21.87 lakh contracts, and 17,700 strike which shed 18.22 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Infosys, Container Corporation of India, Power Grid Corporation of India, Colgate Palmolive, and HDFC, among others.

An increase in open interest (OI) and an increase in price mostly indicate a build-up of long positions. Based on the OI percentage, 10 stocks, including Syngene International, GAIL, Persistent Systems, Samvardhana Motherson International, and Glenmark Pharma, saw a long build-up.

A decline in OI and a decrease in price, in most cases, indicate long unwinding. Based on the OI percentage, 104 stocks including Torrent Power, JK Cement, MCX India, Ramco Cements, and Polycab India, witnessed a long unwinding.

63 stocks see a short build-up

An increase in OI accompanied by a decrease in price mostly indicate a build-up of short positions. Based on the OI percentage, 63 stocks, including Sun TV Network, Jubilant Foodworks, Bharat Electronics, Container Corporation of India, and Navin Fluorine International, saw a short build-up.

A decrease in OI along with an increase in price is an indication of short-covering. Based on the OI percentage, 16 stocks were on the short-covering list. These included Voltas, Alkem Laboratories, Bajaj Auto, Ipca Laboratories, and Cummins India.

Delhivery: Internet Fund III Pte Ltd sold over 1.23 crore equity shares in the logistics company via open market transactions at an average price of Rs 335.06 per share. These shares were worth Rs 414.2 crore.

(For more bulk deals, click here)

Investors meetings on February 23

Advanced Enzyme Technologies: Officials of the company will interact with Catamaran Ventures.

PVR, Persistent Systems, Asian Paints: The officials of these companies will participate in Kotak Chasing Growth 2023 Conference.

FSN E-Commerce Ventures: Officials of the company will interact with Mondrian Investment Partners.

Crompton Greaves Consumer Electricals: The company's officials will meet Amansa Capital.

Tata Motors: Officials of the company will interact with Mondrian Investment, and SMBC Nikko Securities Investment.

Eicher Motors: The company's officials will interact with Fullerton Investment.

Cummins India: Officials of the company will interact with Aditya Birla Sun Life Asset Management, Axis Asset Management Company, DSP Blackrock Investment Managers, HSBC Global Asset Management, ICICI Prudential Life Insurance Company, Nippon Life Asset Management, Premji Invest, SBI Funds Management, SBI Life Insurance Company, and Templeton Investment.

The Phoenix Mills: The company's officials will meet with SMBC Nikko.

Stocks in the news

Mahindra CIE Automotive: The automotive components supplier has recorded a massive 153 percent year-on-year growth in consolidated profit at Rs 195 crore for the quarter ended December 2022, led by strong operating performance and exceptional gain. Consolidated revenue for the quarter at Rs 2,247 crore grew by 35 percent over a year-ago period. On the operating front, EBITDA increased by 62.2 percent YoY to Rs 292.4 crore with a margin expansion of 221 bps for the quarter. The company has an exceptional gain of Rs 37.87 crore against a loss of Rs 12.8 crore YoY.

Biocon: The biopharmaceutical company has fulfilled its payment obligation and has fully redeemed the commercial papers of Rs 2,250 crore.

Gujarat Gas: Raj Kumar, Chief Secretary, Government of Gujarat is appointed as Chairman of Gujarat Gas. The appointment of Kumar has been made in view of the letter received from the Energy & Petrochemicals Department, Government of Gujarat.

Barbeque-Nation Hospitality: UTI Mutual Fund has bought an additional 0.14 percent stake or 54,829 equity shares in the casual dining chain via open market transactions on February 21. With this, its shareholding in the company increased to 9.1753 percent, up from 9.0346 percent earlier.

Lemon Tree Hotels: The company has signed a licence agreement for a 47-room property in Bhopal under its brand 'Lemon Tree Hotel'. The hotel is expected to be operational by December 2023. This hotel will feature 47 well-appointed rooms, a restaurant, a banquet, a gym and other public areas. Subsidiary Carnation Hotels will be operating this hotel.

Orient Cement: Adani Power Maharashtra (APML) has requested the company not to pursue the venture further, for setting up a cement grinding unit, as they are not able to obtain the required MIDC clearances for sub-leasing the parcel of land required for the cement grinding unit, due to some legal issues. Also, the timelines as agreed upon as per the Memorandum of Understanding (MoU) have crossed. The company has accepted the position of APML and accordingly, the said non-binding MoU stands terminated. In September 2021, the CK Birla Group company has entered into a non-binding MoU with APML for exploring the possibility of establishing a cement grinding unit at Tiroda in Maharashtra.

HG Infra Engineering: The company has been declared as Ll bidder by Rail Vikas Nigam Limited, Chandigarh for a project in Himachal Pradesh. The project includes the construction of foundations, substructure and superstructure along with river training/protection work, earthwork and allied works for viaduct 1 & 2 in between chainage, in connection with the Bhanupali-Bilaspur-Beri new railway line in Bilaspur of Himachal Pradesh. The bid project cost by HG Infra is Rs 466.11 crore and the construction period is 30 months.

Sarda Energy & Minerals: South Eastern Coalfields has issued a Letter of Acceptance to the company against its bid for the re-opening, salvaging, rehabilitation, development and operation of Kalyani underground mines, in Chhattisgarh on a revenue sharing of 4.5 percent basis. The necessary agreements will be executed in due course as per the terms of the Letter of Acceptance.

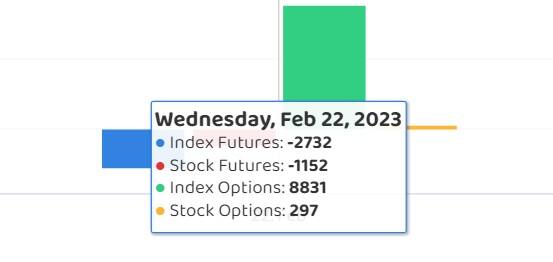

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 579.82 crore, whereas domestic institutional investors (DII) bought shares worth Rs 371.56 crore on February 22, the National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has retained Vodafone India on its F&O ban list for February 23. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.