The market ended a rangebound and volatile session on a mixed note with the Nifty50 managing to hold 17,500 levels on August 10. It was supported by metal, select banks and auto stocks.

The BSE Sensex fell 36 points to 58,817, while the Nifty50 gained 10 points at 17,535 and formed a Hanging Man-kind of pattern on the daily charts.

"On the daily charts, the Nifty maintained its higher top- higher bottom formation and sustained above 17,500 mark, which indicates strong positive undertone of the index for the short to medium term," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

The momentum indicator also supports the positive move by RSI (relative strength index) which shows bullish momentum in the prices.

As per the overall chart pattern, Sawant says the Nifty gave a consolidation breakout a couple of days back. Now the Nifty is ready to move up towards 17,663 followed by 17,843 in the coming future, he said, adding the bullish view would be negated if it sustains below 17,175 levels on the downside.

The broader markets closed in negative terrain with the Nifty Midcap 100 and Smallcap 100 indices falling 0.16 percent and 0.35 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,463, followed by 17,391. If the index moves up, the key resistance levels to watch out for are 17,586 and 17,638.

The Nifty Bank also saw volatility on Wednesday, rising 50 points to 38,288 and forming a Doji pattern on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 38,161, followed by 38,034. On the upside, key resistance levels are placed at 38,409 and 38,530 levels.

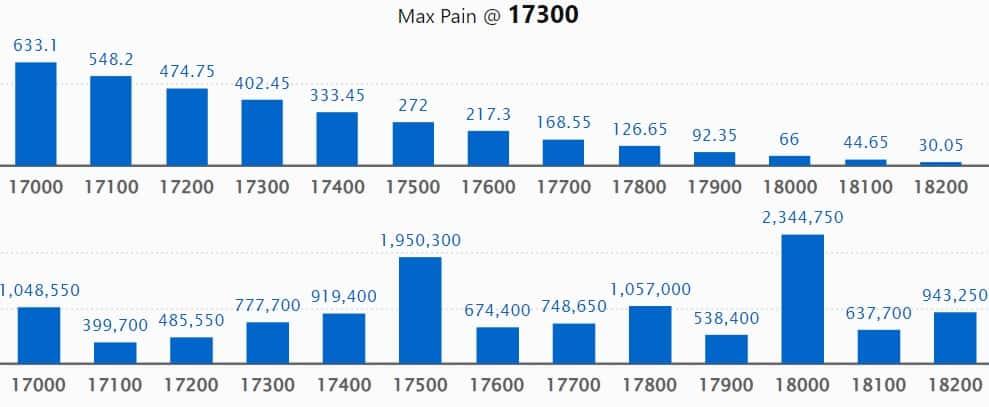

Maximum Call open interest of 23.44 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the August series.

This is followed by 17,500 strike, which holds 19.5 lakh contracts, and 17,800 strike, which has accumulated 10.57 lakh contracts.

Call writing was seen at 18,200 strike, which added 1.93 lakh contracts, followed by 18,400 strike which added 89,950 contracts, and 17,700 strike which added 89,450 contracts.

Call unwinding was seen at 17,400 strike, which shed 1.94 lakh contracts, followed by 17,300 strike which shed 89,100 contracts and 17,600 strike which shed 55,500 contracts.

Maximum Put open interest of 24.74 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the August series.

This is followed by 16,500 strike, which holds 23.34 lakh contracts, and 17,500 strike, which has accumulated 21.81 lakh contracts.

Put writing was seen at 17,000 strike, which added 2.78 lakh contracts, followed by 17,500 strike, which added 2.37 lakh contracts and 16,300 strike which added 1.52 lakh contracts.

Put unwinding was seen at 17,400 strike, which shed 1.45 lakh contracts, followed by 17,300 strike which shed 57,500 contracts, and 16,100 strike which shed 45,700 contracts.

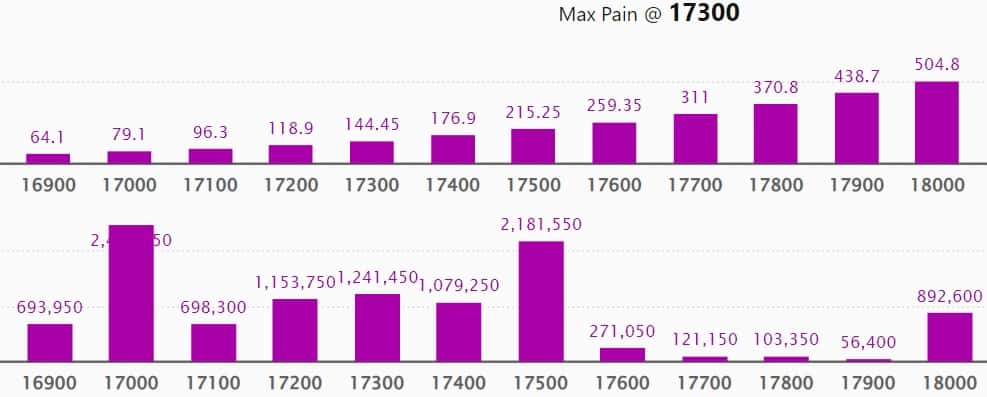

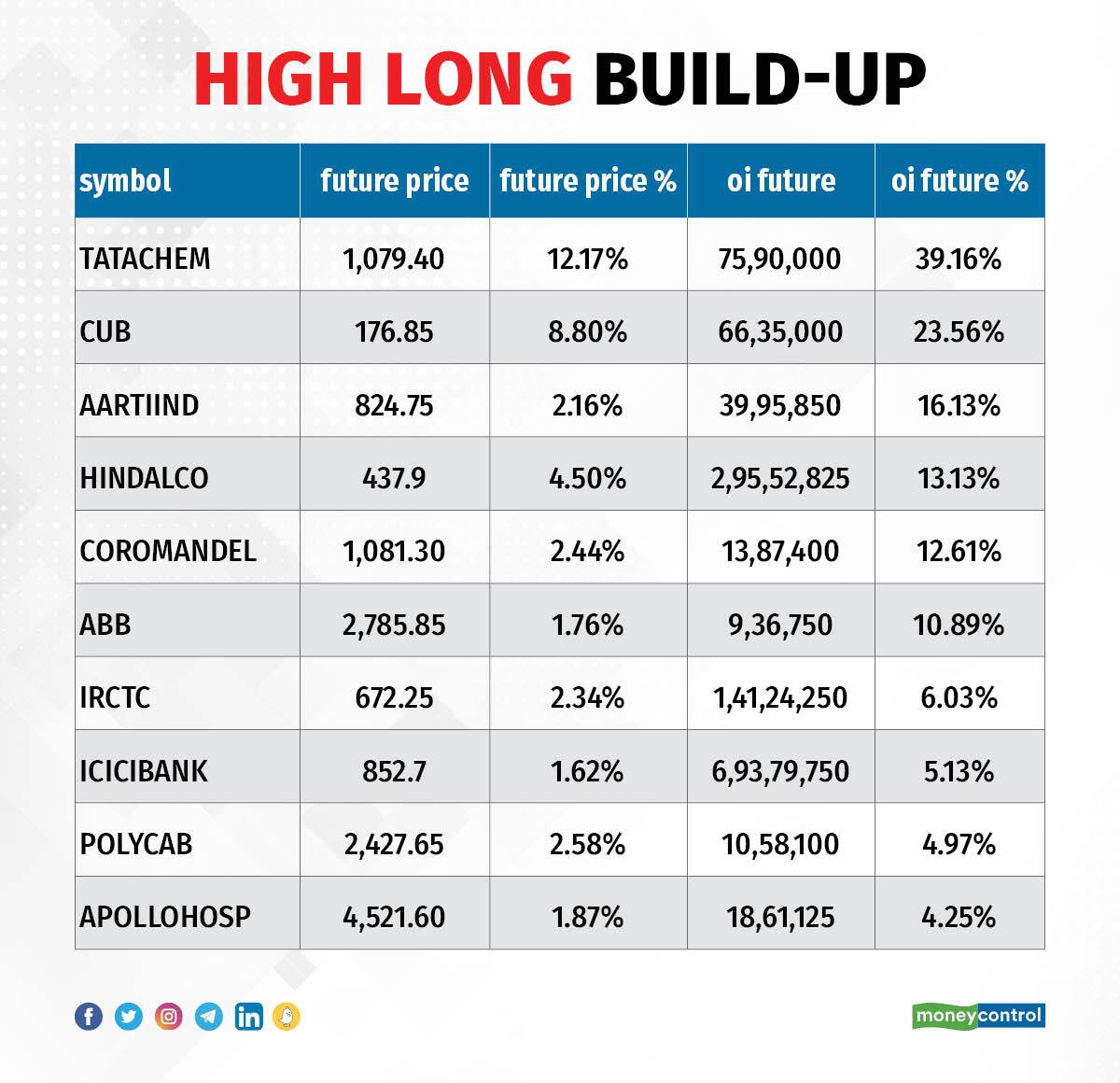

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Indian Oil Corporation, HDFC Bank, TCS, HCL Technologies, and Ambuja Cements, among others.

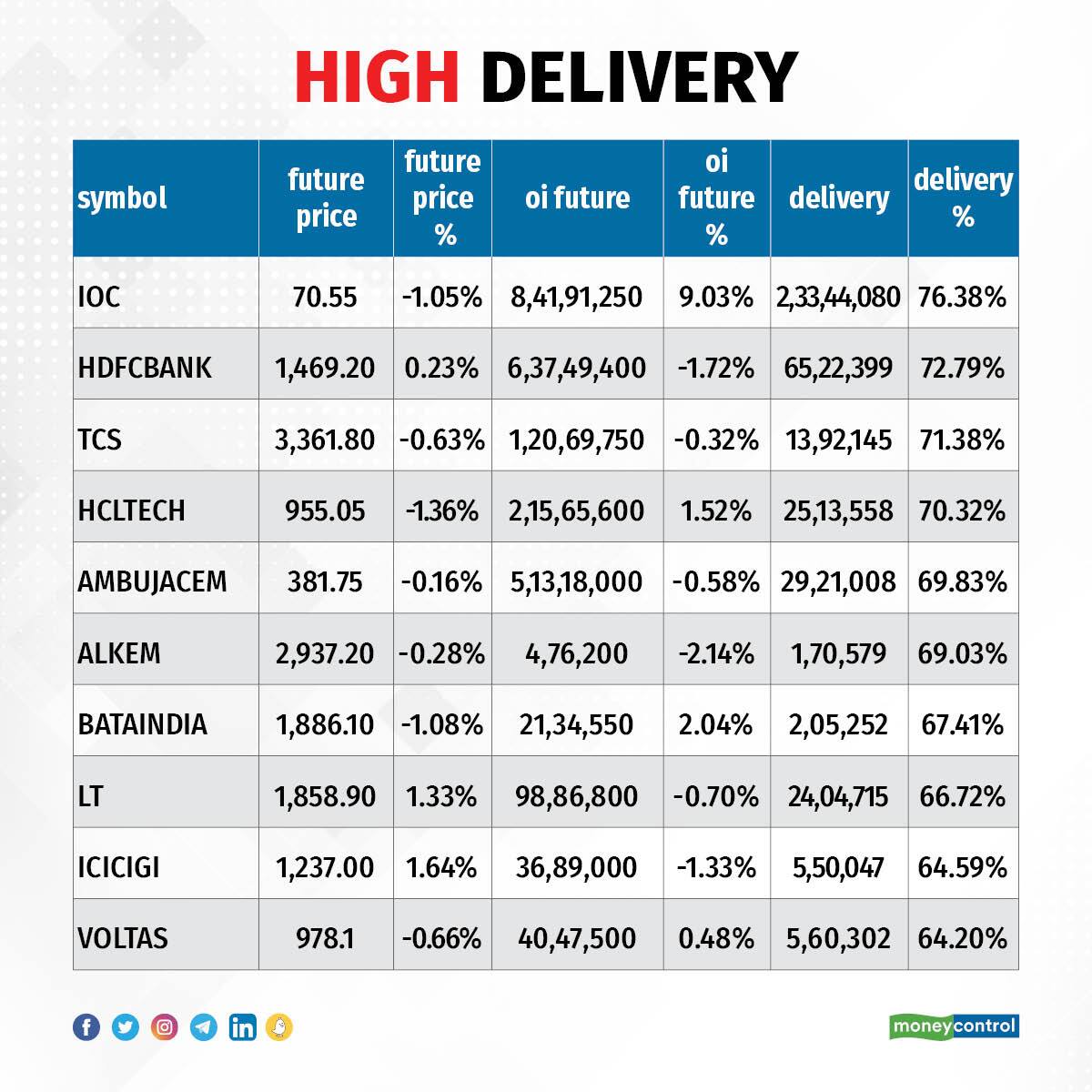

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Tata Chemicals, City Union Bank, Aarti Industries, Hindalco Industries, and Coromandel International in which a long build-up was seen.

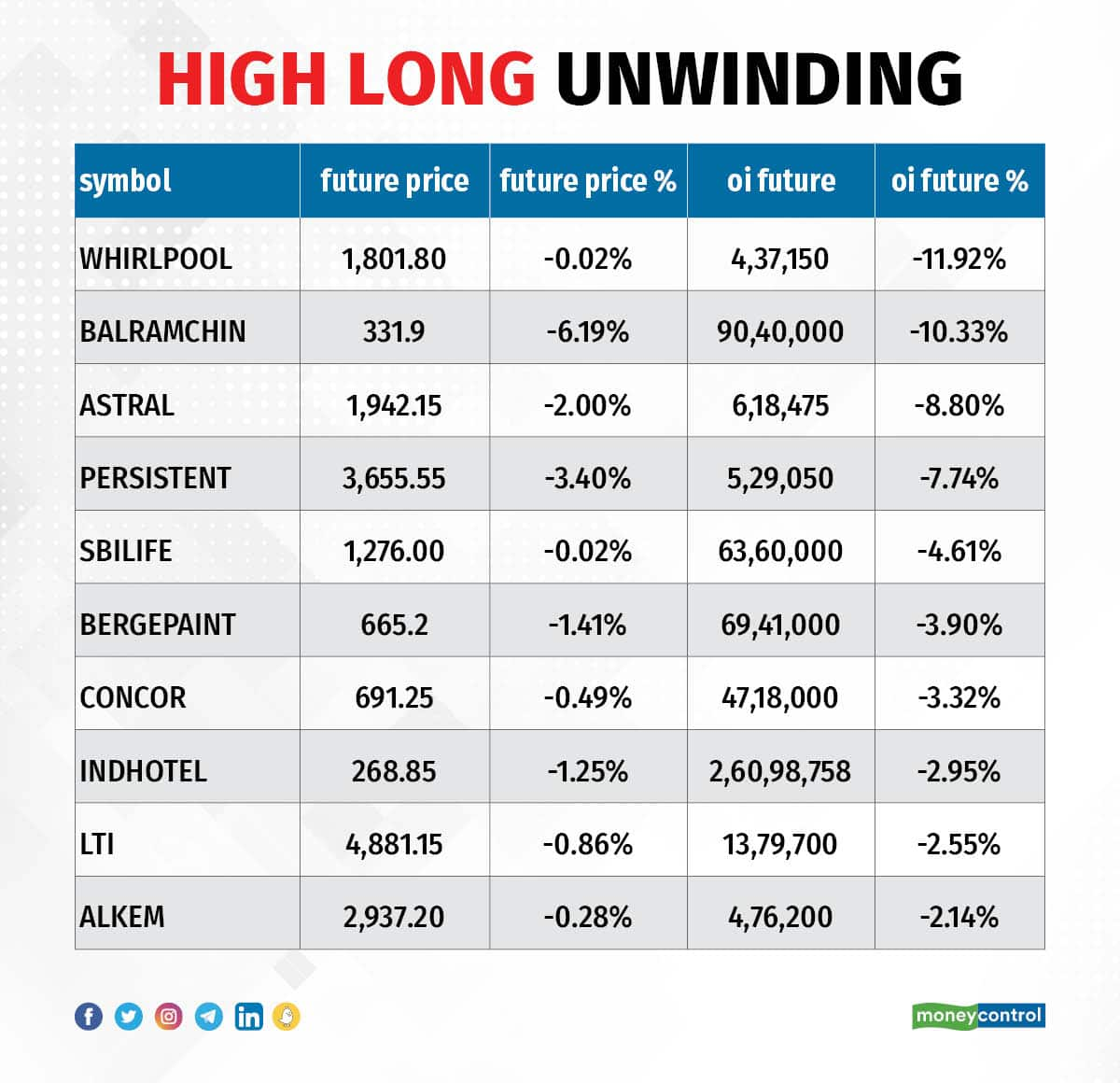

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Whirlpool of India, Balrampur Chini Mills, Astral, Persistent Systems, and SBI Life Insurance Company, in which long unwinding was seen.

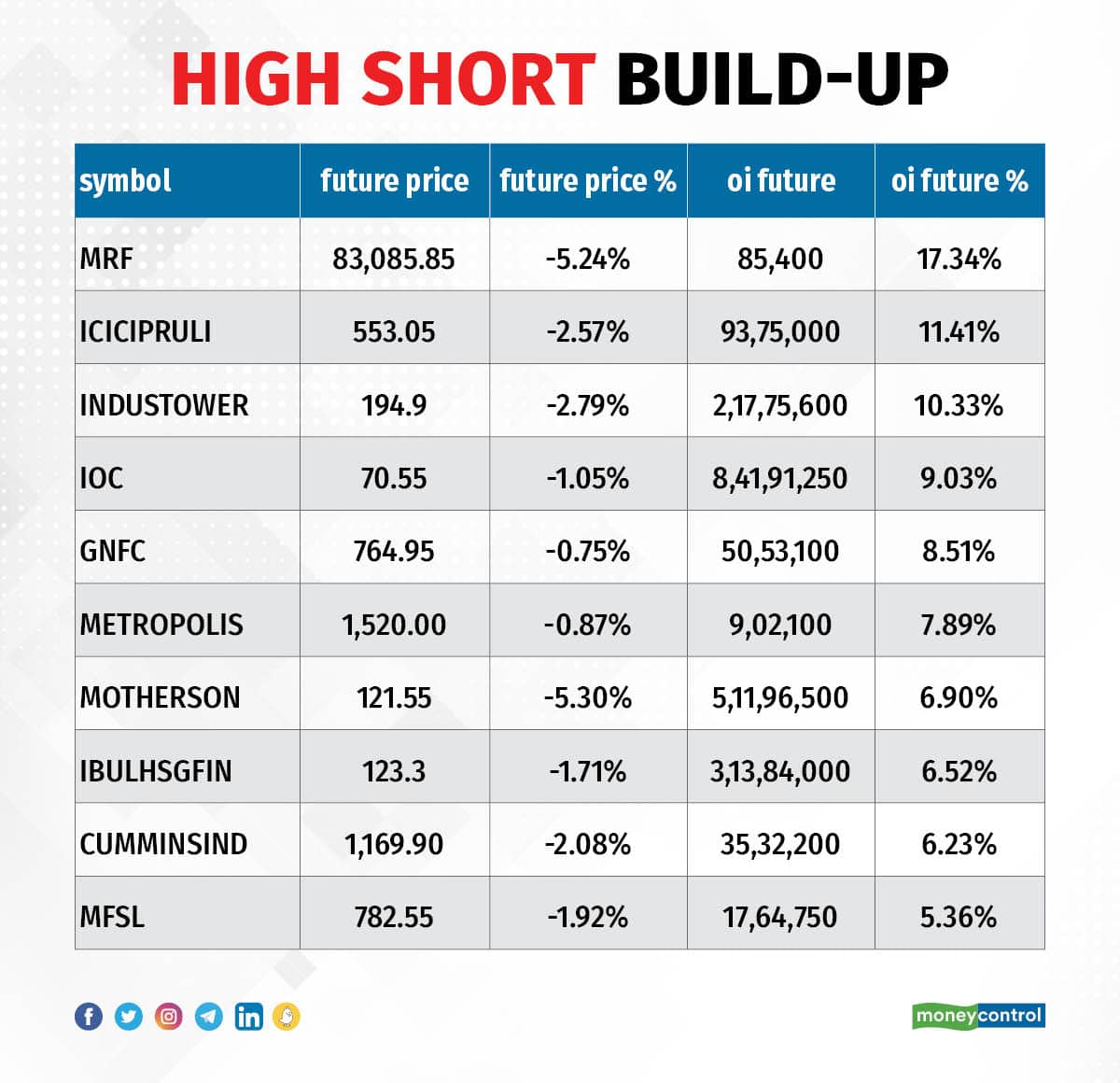

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including MRF, ICICI Prudential Life, Indus Towers, Indian Oil Corporation, and GNFC, in which a short build-up was seen.

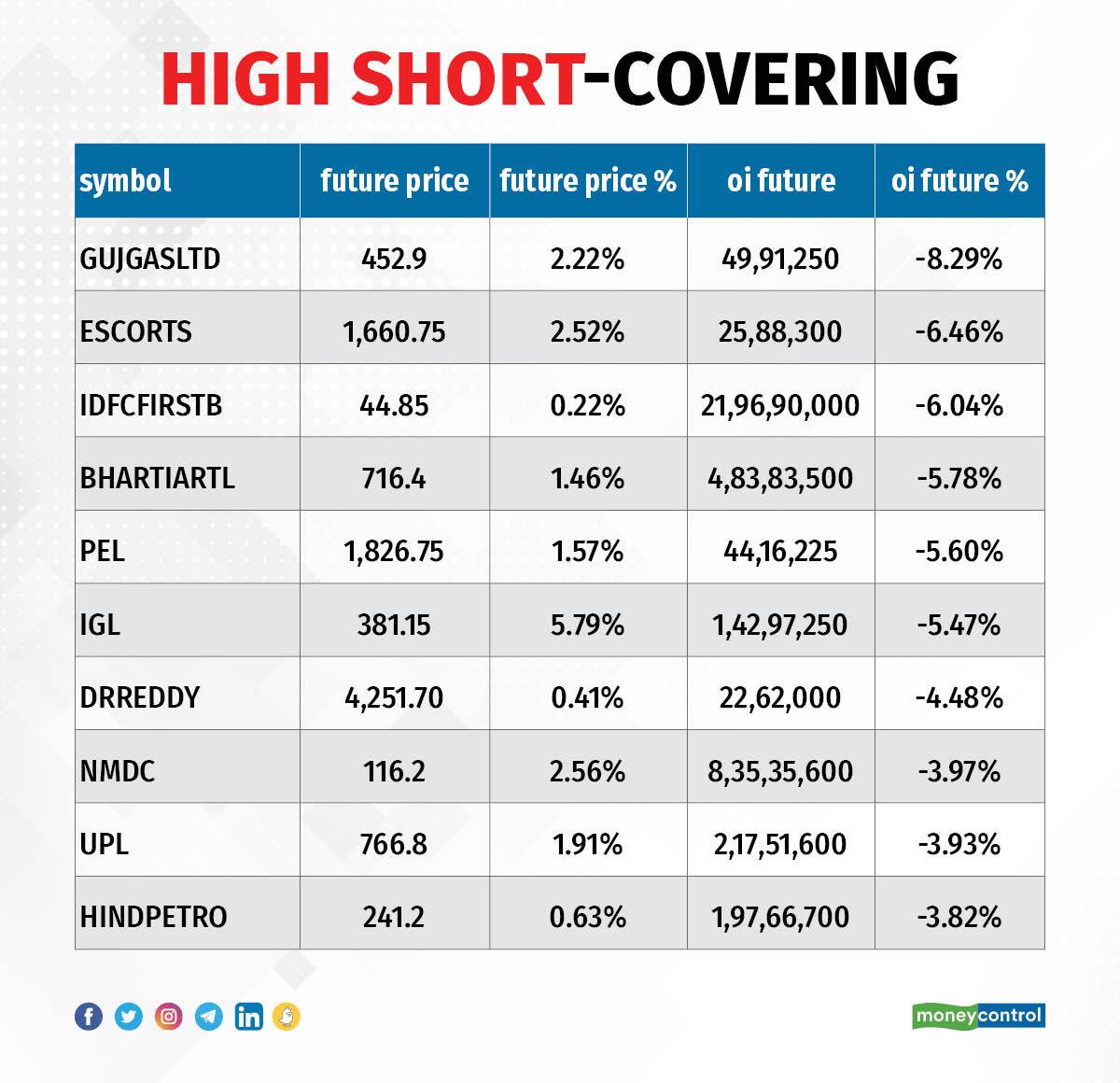

41 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Gujarat Gas, Escorts Kubota, IDFC First Bank, Bharti Airtel, and Piramal Enterprises, in which short-covering was seen.

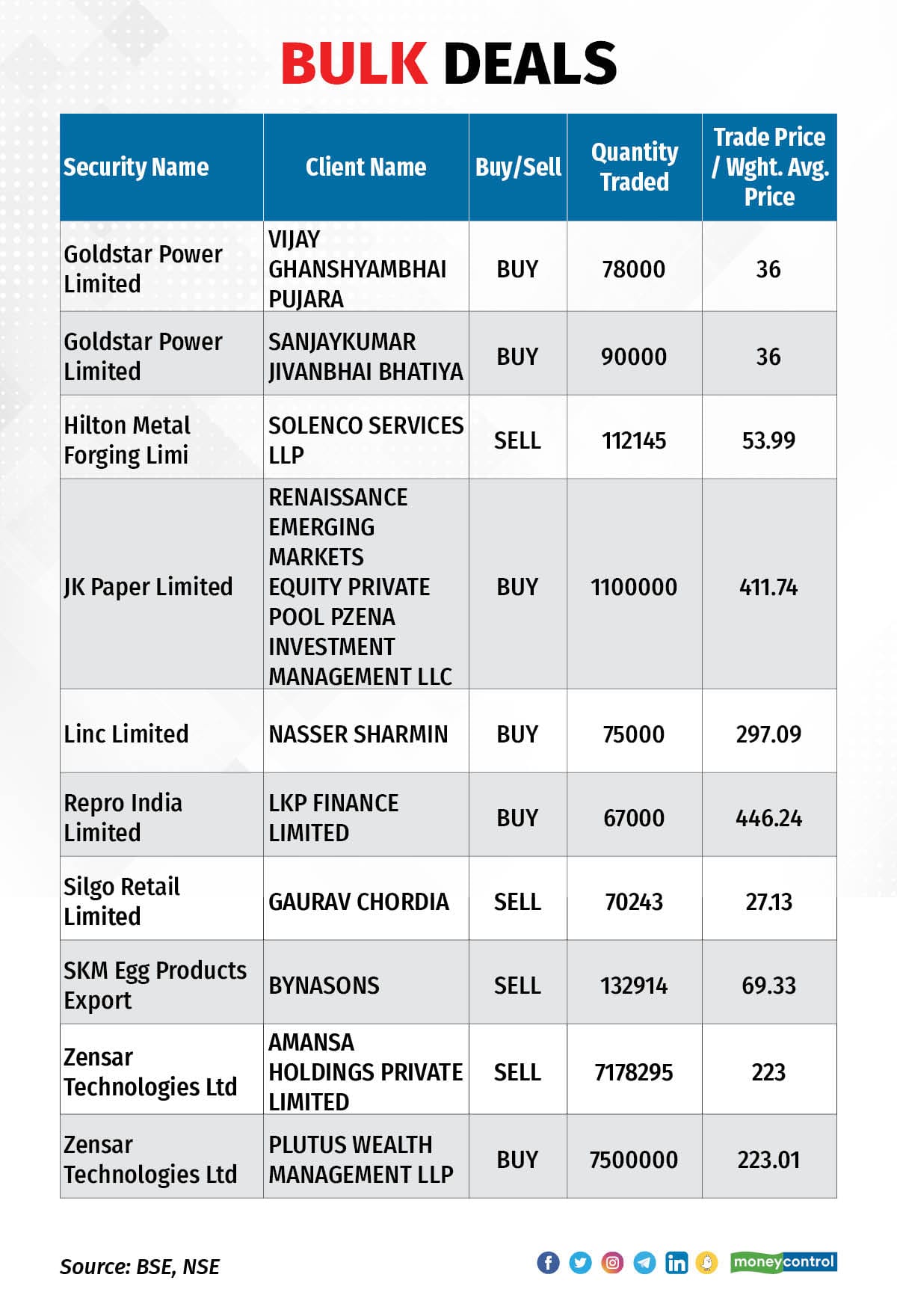

(For more bulk deals, click here)

Apollo Hospitals Enterprise, Aster DM Healthcare, Aurobindo Pharma, Bata India, Bharat Forge, Gujarat Ambuja Exports, Greaves Cotton, Garden Reach Shipbuilders & Engineers, Himadri Speciality Chemical, KNR Constructions, Page Industries, The Phoenix Mills, Puravankara, Quess Corp, Sapphire Foods India, Shilpa Medicare, Spencers Retail, Sunteck Realty, Trent, Vipul Organics, and Wonderla Holidays will be in focus ahead of June quarter earnings on August 11.

Stocks in News

Coal India: The state-owned company clocked a 178 percent year-on-year growth in consolidated profit at Rs 8,834.22 crore for the quarter ended June FY23 on a low base. The June quarter FY22 earnings were affected by the second COVID wave. Revenue increased 39 percent to Rs 35,092 crore compared to the same period last year. The country's largest coal mining company produced 159.75 million tonnes of raw coal, up 29 percent YoY and its offtake of raw coal increased by 10.6 percent YoY to Rs 177.49 million tonnes for the quarter ended June FY23.

Tata Consumer Products: The Tata Group company recorded a 38% year-on-year growth in profit at Rs 277 crore for the quarter ended June FY23, with revenue rising 11 percent to Rs 3,327 crore and EBITDA increasing 14 percent to Rs 460 crore compared to the year-ago period. Revenue in constant currency terms increased 10 percent YoY.

Eicher Motors: The two-wheeler and commercial vehicle maker reported a 157.5 percent year-on-year growth in consolidated profit at Rs 610.66 crore for the quarter ended June FY23 supported by a low base. The Q1FY22 earnings were affected by the second COVID wave. Revenue grew by 72 percent to Rs 3,397.5 crore compared to the corresponding period last fiscal.

Oil India: The company reported a 166 percent year-on-year growth in consolidated profit at Rs 3,230 crore in the quarter ended June FY23. Revenue grew by 86.5 percent to Rs 11,567 crore in Q1FY23, compared to Rs 6,202 crore in the same period last year.

Indian Railway Catering and Tourism Corporation: The company clocked a 198 percent year-on-year growth in profit at Rs 245.52 crore for the quarter ended June FY23 with normalisation of business, aided by a low base. The year-ago quarter was affected by the second COVID wave. Revenue jumped 250 percent to Rs 852.60 crore compared to the corresponding period last fiscal.

Mahindra & Mahindra: Life Insurance Corporation of India sold 2 percent stake or 2.49 crore equity shares in the automobile company via open market transactions. With this, LIC's stake in the company reduced to 6.42 percent, down from 8.43 percent earlier.

CESC: The company reported a 6 percent year-on-year growth in consolidated profit at Rs 297 crore for the quarter ended June FY23, impacted by the cost of fuel and electricity purchased, but aided by revenue, regulatory income and lower tax cost. Revenue increased by 27.5 percent to Rs 4,102 crore compared to the year-ago period.

PB Fintech: The Policybazaar operator recorded a consolidated loss of Rs 204.33 crore for the quarter ended June FY23, widening from a loss of Rs 110.84 crore in the corresponding period last fiscal due to weak operating performance. The company has reported a significant increase in employee expenses, and advertising and promotion expenses for the quarter. EBITDA loss more than doubled to Rs 234.3 crore for the June FY23 quarter, against a loss of Rs 118.35 crore in the corresponding period last fiscal, and revenue from operations came in at Rs 505.2 crore, increasing 112.5 percent over Rs 238 crore reported in the year-ago period.

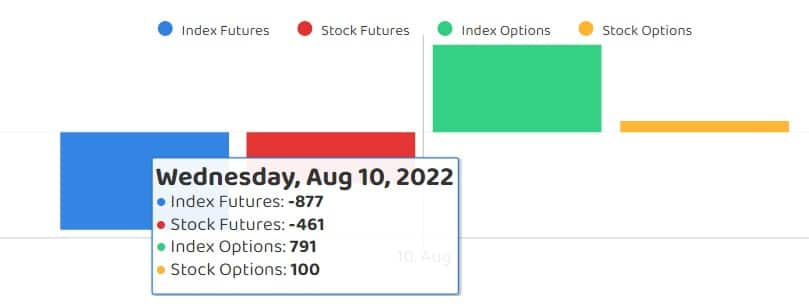

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 1,061.88 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 768.45 crore on August 10, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Balrampur Chini Mills, and Delta Corp - are under NSE F&O ban for August 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.