The market extended rally with strong gains with the Nifty50 surpassing 17,500 mark for the first time on September 15 as bulls charged by the government announcement of Rs 26,058 crore production linked incentive for auto sector and moratorium of four years for the payment of aggregated gross revenue (AGR) dues for telecom companies.

Banks, auto, IT, metals, telecom and pharma stocks aided the rally. The benchmark indices hit fresh record highs and ended at record closing high. The BSE Sensex rose 476.11 points to 58,723.20, while the Nifty50 climbed 139.50 points to 17,519.50 and formed bullish candle on the daily charts.

"The daily price action has formed a sizable bullish candle and closed above its past six sesions' multiple resistance zone of 17,450 levels indicating further strength," said Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

He further said, "The next higher levels to be watched are around 17,550 levels. Any sustainable move above 17,550 levels may cause momentum towards 17,600-17,700 levels."

On the downside, any violation of an intraday support zone of 17,480 levels may cause profit booking towards 17,400-17,350 levels, he added.

The broader markets strengthened further as the Nifty Midcap 100 index was up 1.02 percent and Smallcap 100 index rose 0.65 percent.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the NiftyAccording to pivot charts, the key support levels for the Nifty are placed at 17,426.63, followed by 17,333.87. If the index moves up, the key resistance levels to watch out for are 17,572.43 and 17,625.46.

Nifty BankThe Nifty Bank climbed 239.20 points to 36,852.25 on September 15. The important pivot level, which will act as crucial support for the index, is placed at 36,582.3, followed by 36,312.4. On the upside, key resistance levels are placed at 37,035.9 and 37,219.6 levels.

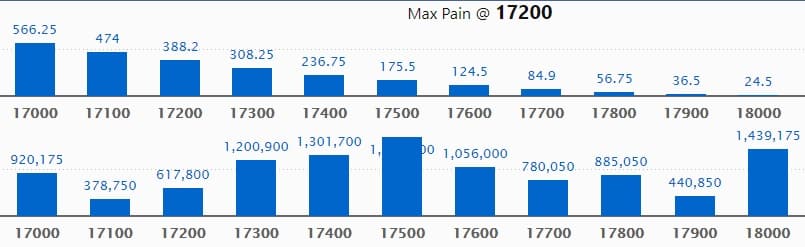

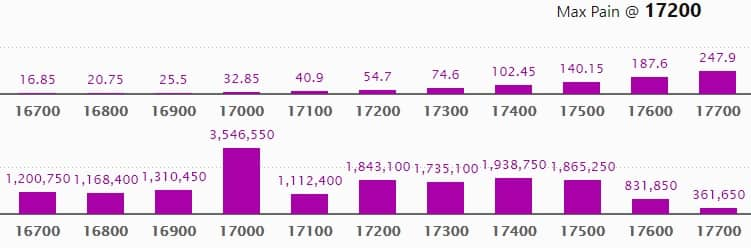

Maximum Call open interest of 16.92 lakh contracts was seen at 17500 strike, which will act as a crucial resistance level in the September series.

This is followed by 18000 strike, which holds 14.39 lakh contracts, and 17400 strike, which has accumulated 13.01 lakh contracts.

Call writing was seen at 17600 strike, which added 3.02 lakh contracts, followed by 17700 strike, which added 1.39 lakh contracts and 17800 strike which added 1.34 lakh contracts.

Call unwinding was seen at 17300 strike, which shed 2.89 lakh contracts, followed by 17400 strike, which shed 2.61 lakh contracts, and 17000 strike which shed 1.1 lakh contracts.

Maximum Put open interest of 35.46 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the September series.

This is followed by 17400 strike, which holds 19.38 lakh contracts, and 17500 strike, which has accumulated 18.65 lakh contracts.

Put writing was seen at 17500 strike, which added 10.17 lakh contracts, followed by 17600 strike which added 6.54 lakh contracts, and 17400 strike which added 2.59 lakh contracts.

Put unwinding was seen at 17000 strike, which shed 5.41 lakh contracts, followed by 16800 strike which shed 2.6 lakh contracts and 16700 strike which shed 2.44 lakh contracts.

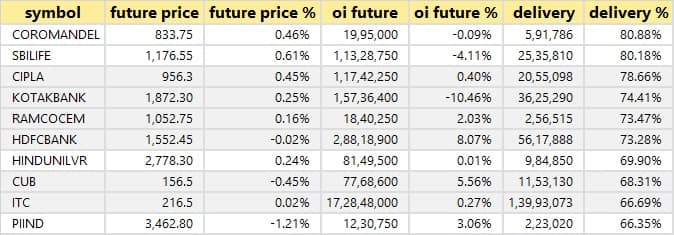

A high delivery percentage suggests that investors are showing interest in these stocks.

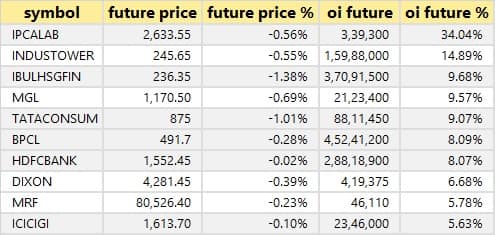

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

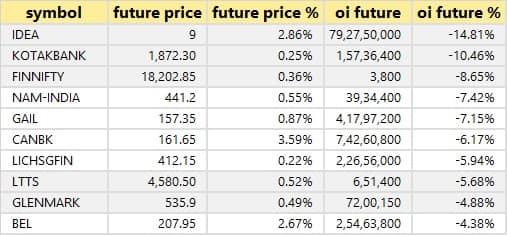

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

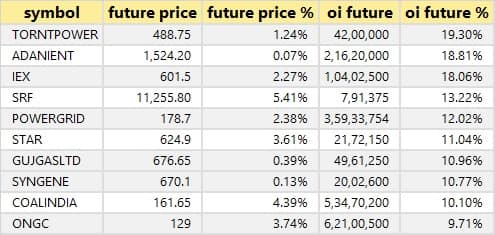

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

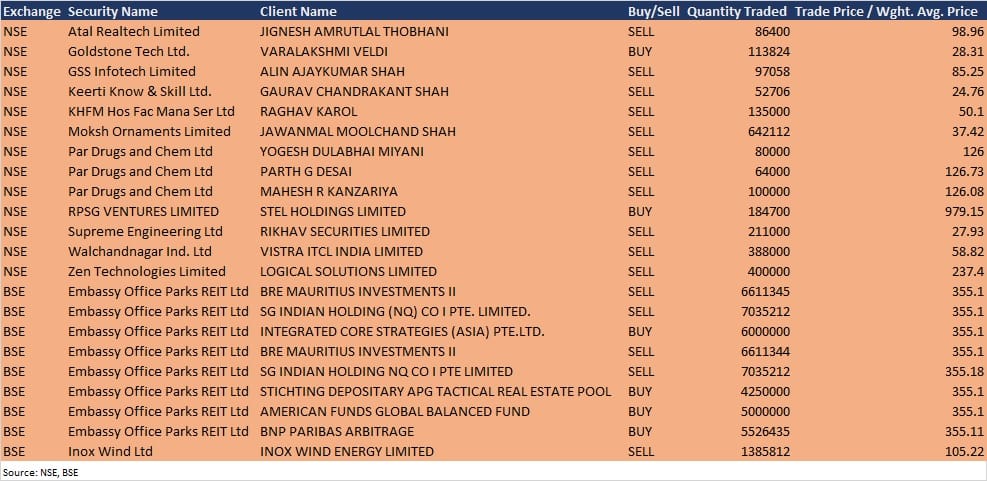

RPSG Ventures: STEL Holdings acquired 1,84,700 equity shares in the company at Rs 979.15 per share on the NSE, the bulk deals data showed.

Walchandnagar Industries: Vistra ITCL India sold 3.88 lakh equity shares in the company at Rs 58.82 per share on the NSE, the bulk deals data showed.

Zen Technologies: Logical Solutions sold 4 lakh equity shares in the company at Rs 237.4 per share on the NSE, the bulk deals data showed.

Embassy Office Parks REIT: Integrated Core Strategies (Asia) Pte Ltd acquired 60 lakh units in the company, Stichting Depositary APG Tactical Real Estate Pool bought 42.5 lakh units, and American Funds Global Balanced Fund acquired 50 lakh units in the company at Rs 355.1 per unit on the BSE. BNP Paribas Arbitrage also bought 55,26,435 units at Rs 355.11 per unit, whereas BRE Mauritius Investments II sold 1,32,22,689 units in the company, and SG Indian Holding (NQ) CO I PTE. Limited sold 7,035,212 units at Rs 355.1 per unit, and 70,35,212 units at Rs 355.18 per unit on the BSE, the bulk deals data showed.

Inox Wind: Inox Wind Energy sold 13,85,812 equity shares in the company at Rs 105.22 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors MeetingPuravankara: The company's officials will meet Motilal Oswal Financial Services on September 16.

Saregama India: The company's officials will meet institutional investors between September 16 to September 24.

Nitin Spinners: The company's officials will meet Equirus Securities on September 20.

Phillips Carbon Black: The company's officials will meet institutional investors on September 16.

Dalmia Bharat: The company's officials will meet analysts/investors in JP Morgan India Investor Summit 2021 during September 20-23.

Stocks in NewsGabriel India: HDFC Asset Management Company acquired 2.02% stake in the company via open market transaction on September 14, increasing shareholding to 7.04% from 5.02% earlier.

HealthCare Global Enterprises: Care has upgraded rating for the bank facilities of HealthCare Global Enterprises to A/Stable from A-/Stable.

HG Infra Engineering: The company has received the letter of award from National Highways Authority of India for two HAM projects.

Wipro: The company received multi-year IT managed services contract from Kuala Lumpur- headquartered Maxis Broadband Sdn Bhd, a leading converged solutions provider.

Fineotex Chemical: The company has entered into a strategic collaboration with Eurodye-CTC, Belgium, to commercialize specialty chemicals for the Indian market.

JSW Energy: JSW Renew Energy Two Limited, a project SPV formed by JSW Future Energy (100% subsidiary of JSW Energy) has signed Power Purchase Agreements with Solar Energy Corporation of India (SECI) for the cumulative contracted capacity of 450 MW awarded against Tariff based Competitive bid invited by SECI.

Fund flow

Foreign institutional investors (FIIs) net bought shares worth Rs 232.84 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 167.67 crore in the Indian equity market on September 15, as per provisional data available on the NSE.

Stocks under F&O ban on NSENine stocks - Canara Bank, Escorts, Exide Industries, Vodafone Idea, IRCTC, LIC Housing Finance, NALCO, Sun TV Network and Zee Entertainment Network - are under the F&O ban for September 16. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!