Equity benchmarks -- Sensex and Nifty -- ended almost flat on August 5 amid volatility as participants preferred to book some profits at higher levels.

The session began on a positive note, tracking firm global cues. However, caution ahead of the Monetary Policy Committee (MPC) meeting outcome triggered profit-taking as the day progressed, which eliminated all the gains.

The Sensex settled 25 points, or 0.07 percent, lower at 37,663.33 and the Nifty ended at 11,101.65, up 6 points, or 0.06 percent.

"Participants are keeping a close eye on monetary policy outcome, which is scheduled for August 6 and that would set the tone for the rest of the day as well. While the expectations are mixed on key rates, we feel commentary on the moratorium and future outlook would hold importance. We would suggest maintaining extra caution before the event and advise preferring hedged bets," said Ajit Mishra, VP - Research, Religare Broking.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 11,035.23, followed by 10,968.77. If the index moves up, the key resistance levels to watch out for are 11,196.93 and 11,292.17.

Nifty Bank

The Nifty Bank index closed 0.09 percent higher at 21,509.95. The important pivot level, which will act as crucial support for the index, is placed at 21,326.7, followed by 21,143.5. On the upside, key resistance levels are placed at 21,814.8 and 22,119.7.

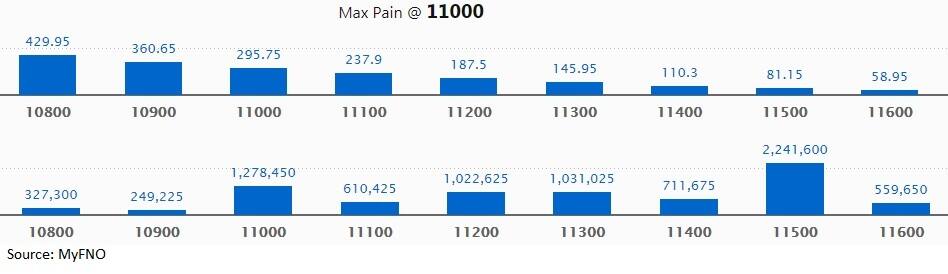

Call option data

Maximum call OI of nearly 22.42 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the August series.

This is followed by 11,000, which holds 12.78 lakh contracts, and 11,300 strikes, which has accumulated 10.31 lakh contracts.

Call writing was seen at 11,400, which added 1.25 lakh contracts, followed by 11,500 strikes, which added 1.09 lakh contracts.

Call unwinding was seen at 11,000, which shed 1.76 lakh contracts, followed by 11,100 strikes, which shed 52,275 contracts.

Put option data

Maximum put OI of 29.72 lakh contracts was seen at 11,000 strike, which will act as crucial support in the August series.

This is followed by 11,100, which holds 11.71 lakh contracts, and 11,200 strikes, which has accumulated 10.53 lakh contracts.

Put writing was seen at 11,100, which added 64,350 contracts, followed by 10,600 strikes, which added 48,000 contracts.

Put unwinding was witnessed at 11,000, which shed 2 lakh contracts, followed by 10,800 strikes, which shed 70,050 contracts.

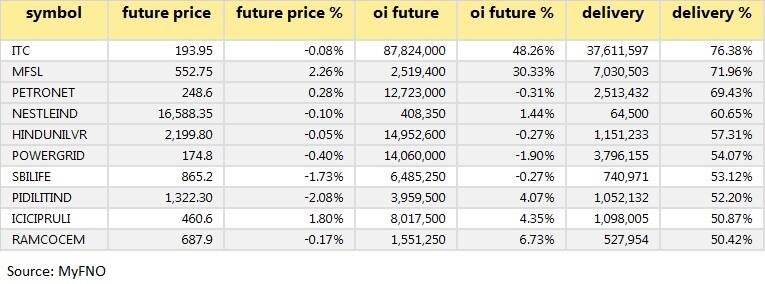

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

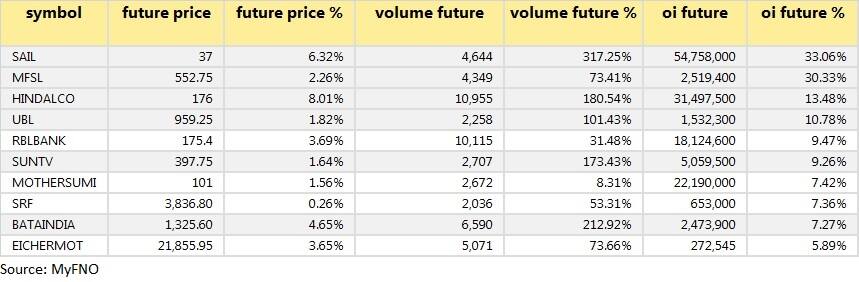

50 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

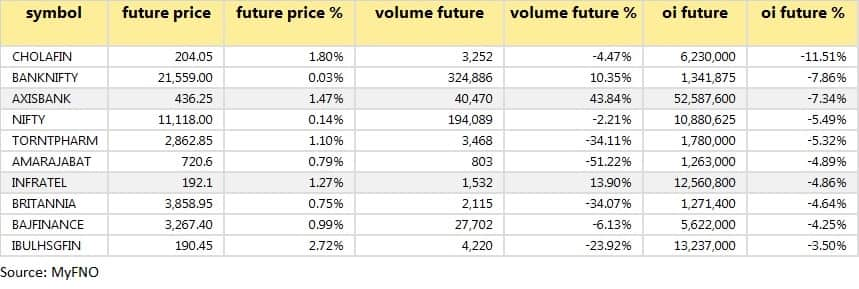

18 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

28 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

40 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

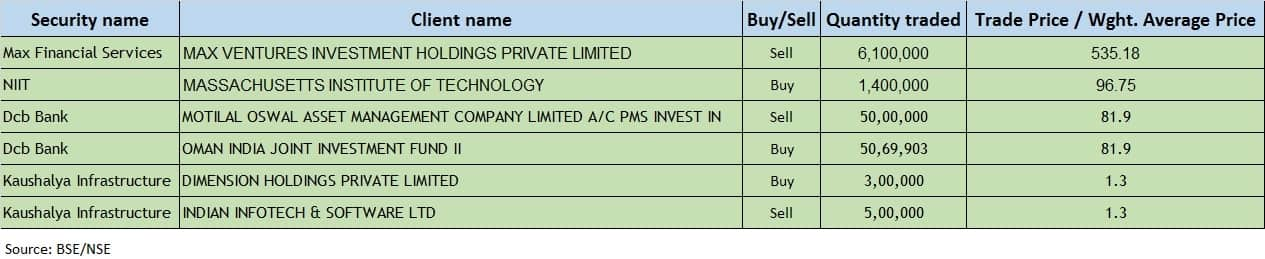

Bulk deals (For more bulk deals, click here)

(For more bulk deals, click here)

Results on August 6 Lupin, HPCL, Adani Enterprises, Adani Power, Vodafone Idea, Apar Industries, BASF India, Bayer Cropscience, Blue Star, Dalmia Bharat, Deepak Nitrite, Embassy Office Parks REIT, Gujarat Pipavav Port, Gujarat State Petronet, HCL Infosystems, Honeywell Automation, Indian Hotels, JK Tyre, Lemon Tree Hotels, Matrimony.com, Novartis India, Pidilite Industries, Talbros Engineering, TD Power Systems, Torrent Power, Whirlpool of India, etc.

Stocks in the news JK Lakshmi Cement: Q1 profit at Rs 48.9 crore versus Rs 49.8 crore, revenue at Rs 911.5 crore versus Rs 1,136.3 crore YoY.

VIP Industries :Q1 loss at Rs 51.3 crore versus a profit of Rs 35.1 crore, revenue at Rs 40.3 crore versus Rs 564.2 crore YoY.

Inox Leisure: Q1 loss at Rs 73.64 crore versus profit of Rs 27.01 crore, revenue at Rs 0.25 crore versus Rs 493 crore YoY.

Adani Gas:Q1 profit at Rs 38.91 crore versus Rs 79.31 crore, revenue at Rs 206.6 crore versus Rs 479 crore YoY.

Vivimed Labs: The company received an export order for the supply of 'Favulous' tablets 200 mg (Favipiravir) that is used for the treatment of mild to moderate cases of COVID-19.

Canara Bank Q1: Profit at Rs 406.24 crore versus Rs 329.07 crore, revenue at Rs 6,095.55 crore versus Rs 3,240.61 crore YoY.

Birlasoft appointed Chandrasekar Thyagarajan as Chief Financial Officer.

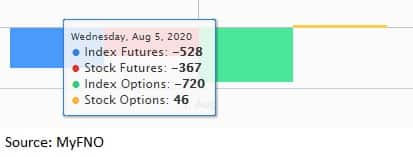

Fund flow

FII and DII data

Foreign institutional investors (FIIs) and domestic institutional investors (DIIs) sold shares worth Rs 60.18 crore and Rs 425.98 crore, respectively, in the Indian equity market on August 5, as per provisional data available on the NSE.

Stock under F&O ban on NSE

There is no stock under the F&O ban for August 6. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!