The Indian equity market remained in the positive territory for the week ended July 16, with benchmarks the Sensex and the Nifty rising over a percent each.

The Indian market benchmarks the Sensex and the Nifty hit their fresh record highs of 53,290.81 and 15,962.25, respectively, in intraday trade on July 16.

The coming week is a holiday-shortened one and global cues and earnings announcements are expected to dictate the trend. Besides, COVID-related updates and the progress of the monsoon will also remain in the focus.

"Indications are in favour of a steady uptrend and we expect Nifty to trade within the 15,750-16,150 range. We reiterate our view that the performance of the banking pack would play a critical role in Nifty regaining momentum else the rise could be gradual," said Ajit Mishra, VP Research. Religare Broking.

"Since all the sectors are participating in the move, traders should maintain their focus on stock selection and continue with the 'buy on dips' approach," said Mishra.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the NiftyAccording to pivot charts, the key support levels for the Nifty are placed at 15,883.27, followed by 15,843.13. If the index moves up, the key resistance levels to watch out for are 15,962.87 and 16,002.33.

Nifty BankThe Nifty Bank fell 156 points, or 0.43 percent, to 35,751.80 on July 16. The important pivot level, which will act as crucial support for the index, is placed at 35,625.1, followed by 35,498.4. On the upside, key resistance levels are placed at 35,928.2 and 36,104.6 levels.

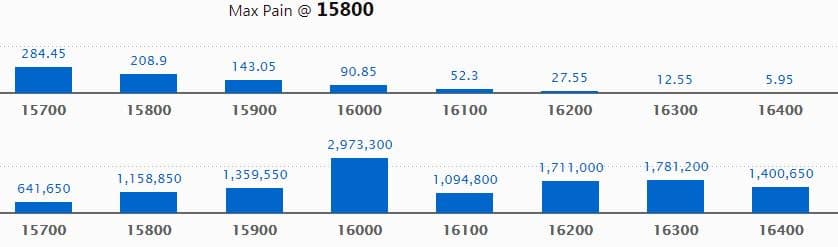

Maximum Call open interest of 29.73 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16,300 strike, which holds 17.81 lakh contracts, and 16,200 strike, which has accumulated 17.11 lakh contracts.

Call writing was seen at 16,300 strike, which added 4.86 lakh contracts, followed by 16,400 strike which added 4.33 lakh contracts and 16,000 strike which added 2.64 lakh contracts.

Call unwinding was seen at 15,700 strike, which shed 54,650 contracts, followed by 15,800 strike which shed 46,700 contracts, and 15,600 strike which shed 23,800 contracts.

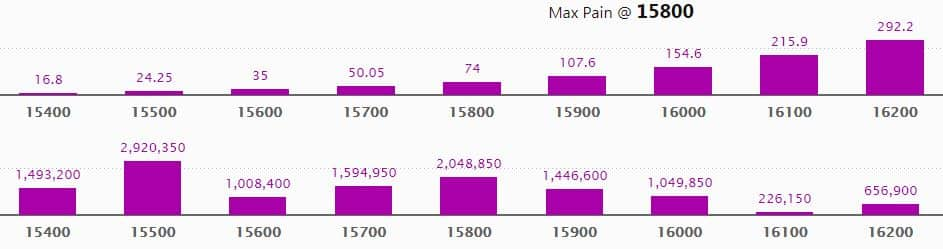

Maximum Put open interest of 29.20 lakh contracts was seen at 15,500 strike, which will act as a crucial support level in the July series.

This is followed by 15,800 strike, which holds 20.49 lakh contracts, and 15,700 strike, which has accumulated 15.95 lakh contracts.

Put writing was seen at 15,400 strike, which added 3.19 lakh contracts, followed by 15,500 strike which added 1.89 lakh contracts, and 15,900 strike which added 1.74 lakh contracts.

Put unwinding was seen at 15,700 strike, which shed 1.15 lakh contracts, followed by 15,400 strike which shed 2,200 contracts.

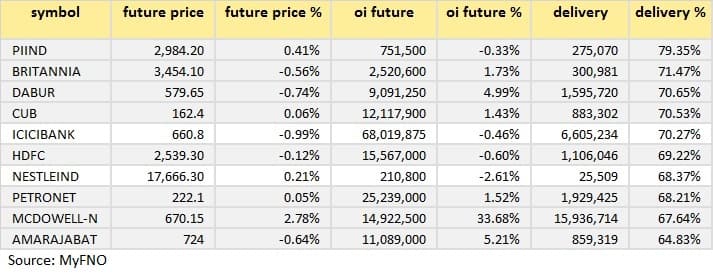

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

(For more bulk deals, click here)

Results on July 19, and Analysts/Investors MeetingResults on July 19: HCL Technologies, HDFC Life Insurance Company, ACC, Indian Bank, Mastek, Allsec Technologies, Alok Industries, Astron Paper & Board Mill, GTPL Hathway, Nippon Life India Asset Management, Plastiblends India, Ponni Sugars (Erode), PSP Projects, Supreme Petrochem, and Swaraj Engines will release quarterly earnings on July 19.

Indian Bank: To meet analysts and investors on July 19.

Eicher Motors: To meet AIA International on July 19.

Bajaj Auto: To meet analysts and institutional investors on July 22 to discuss Q1 FY22 results.

ICICI Prudential Life Insurance Company: To meet investors and analysts on July 20 to discuss the financial performance.

Persistent Systems: To meet investors and analysts on July 23.

SBI Cards and Payment Services: To meet investors and analysts on July 23.

Multi Commodity Exchange of India: To meet investors and analysts on July 26, to discuss financial results.

United Spirits: To meet analysts and investors on July 26, to discuss unaudited financial results.

Mahindra & Mahindra Financial Services: To meet analysts and investors on July 27, to comment on the financial results.

Torrent Pharmaceuticals: To meet investors and analysts on July 27 to discuss the financial performance.

Sun Pharmaceutical Industries: To meet investors and analysts on July 30 to discuss the financial performance.

Sonata Software: To meet analysts and investors on August 5.

Stocks in newsHDFC Bank: The bank reported a higher standalone profit at Rs 7,729.64 crore in Q1FY22 against Rs 6,658.62 crore in Q1FY21, net interest income rose to Rs 17,009 crore from Rs 15,665.42 crore YoY.

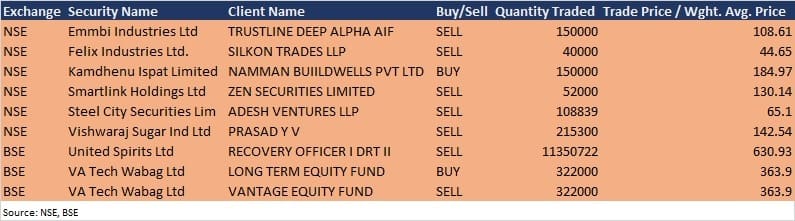

United Spirits: Recovery Officer I DRT II (Debt Recovery Tribunal) sold 1,13,50,722 equity shares in the company at Rs 630.93 per share on the BSE, the bulk deals data showed. The deal was worth Rs 716 crore.

Jindal Stainless (Hisar): India Ratings has upgraded the credit rating of the company's long-term bank facilities from 'A' to 'A+' and short-term facilities from 'A1' to 'A1+'.

Anjani Portland Cement: The company has purchased another 33,23,423 (2.38 percent) equity shares of Bhavya Cements from its existing shareholders at a price of Rs 52.59 per share. This has resulted in an increase in the company's shareholding in Bhavya Cements to 91.52 percent.

Spandana Sphoorty Financial: The company approved the issuance of secured non-convertible debentures up to Rs 290 crore on a private placement basis.

Just Dial: Reliance Retail Ventures, the subsidiary of Reliance Industries, will take a controlling stake in Just Dial for Rs 3,497 crore.

Nel Holdings South: The company has signed a Business Transfer Agreement with Ramky Estates and Farms (REFL) for the exit of the Melbourne Park project held with NHDPL South, the wholly-owned subsidiary of the company.

L&T Finance Holdings: The company reported profit at Rs 177.85 crore in Q1FY22 against Rs 148.31 crore in Q1FY21, revenue fell to Rs 3,140.12 crore from Rs 3,387.06 crore YoY.

Den Networks: The company reported lower consolidated profit at Rs 41.14 crore in Q1FY22 against Rs 58.65 crore in Q1FY21, revenue rose to Rs 302.97 crore from Rs 301.3 crore YoY.

Bajaj Hindusthan Sugar: Punjab National Bank sold a 2 percent stake in the company via open market transaction, reducing shareholding to 9.23 percent from 11.23 percent earlier.

Tata Power Company: The company joined hands with HPCL to set up electric vehicle charging stations at its petrol pumps across the country.

Fund Flow

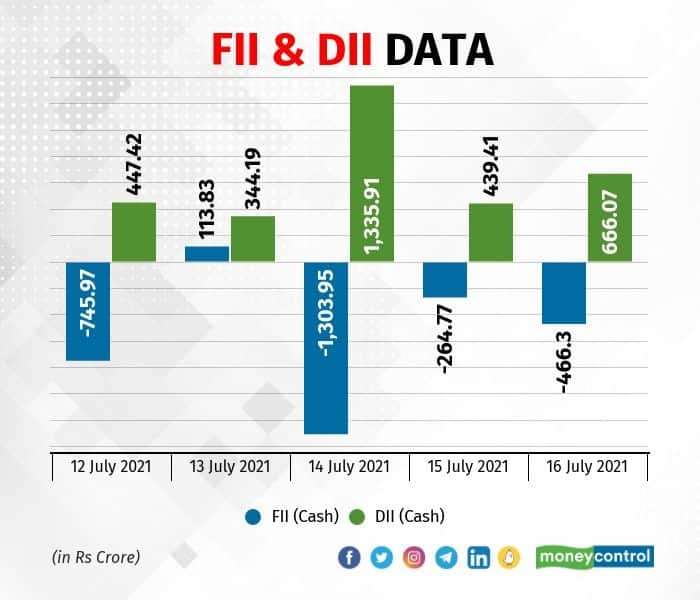

Foreign institutional investors (FIIs) net sold shares worth Rs 466.3 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 666.07 crore in the Indian equity market on July 16, as per provisional data available on the NSE.

Six stocks - Indiabulls Housing Finance, Vodafone Idea, NMDC, Punjab National Bank, SAIL, and Sun TV Network - are under the F&O ban for July 19. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!