The Indian market suffered losses on the last day of July futures and options (F&O) series, amid weak global cues, as concerns over accelerating coronavirus cases weighed on investor sentiment.

The Sensex closed 335 points, or 0.88 percent, down at 37,736.07 and the Nifty ended 101 points, or 0.9 percent, lower at 11,102.15 levels.

“Nifty closed the July series with gains of 7.9 percent. On a provisional basis, rollovers stood at 71.3 percent as against 78.93 percent in June and its three-month average of 75.3 percent. The index settled with a negative rollover cost of 0.16 percent," said Chandan Taparia, Derivative & Technical Analyst, Motilal Oswal Financial Services.

He feels the medium-term trend remains bullish till the Nifty holds 10,550 levels.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- months data and not of the current month only.

Key support and resistance levels for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 11,024.8, followed by 10,947.4. If the index moves up, the key resistance levels to watch out for are 11,239.8 and 11,377.4.

Nifty Bank

The Nifty Bank closed 1.95 percent lower at 21,646.85. The important pivot level, which will act as crucial support for the index, is placed at 21,400.47, followed by 21,154.13. On the upside, key resistance levels are placed at 22,072.87 and 22,498.93.

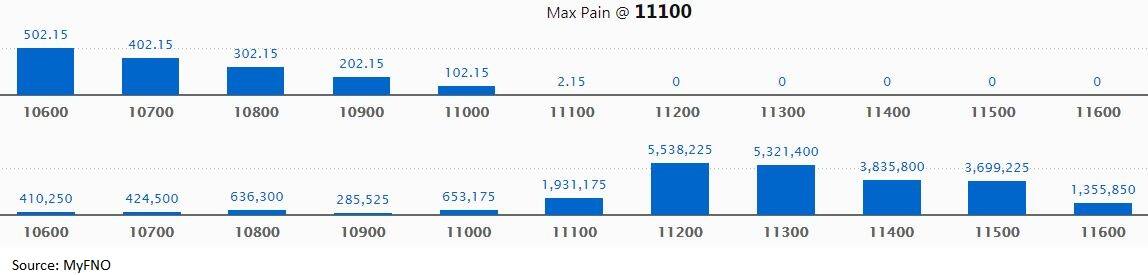

Call option data

Maximum call OI of 55.38 lakh contracts was seen at 11,200 strike, which will act as crucial resistance in the August series.

This is followed by 11,300, which holds 53.21 lakh contracts, and 11,400 strikes, which has accumulated 38.36 lakh contracts.

Significant call writing was seen at the 11,200, which added 28.58 lakh contracts, followed by 11,100 strikes, which added 7.43 lakh contracts.

Call unwinding was witnessed at 11,500, which shed 13.06 lakh contracts, followed by 11,600 strikes, which shed 4.95 lakh contracts.

Put option data

Maximum put OI of 49.84 lakh contracts was seen at 11,100 strike, which will act as crucial support in the August series.

This is followed by 11,000, which holds 34.46 lakh contracts, and 10,600 strikes, which accumulated 21.96 lakh contracts.

Significant put writing was seen at 11,100, which added 24.3 lakh contracts.

Put unwinding was seen at 11,200, which shed 16.34 lakh contracts, followed by 11,000 strikes, which shed 6.23 lakh contracts.

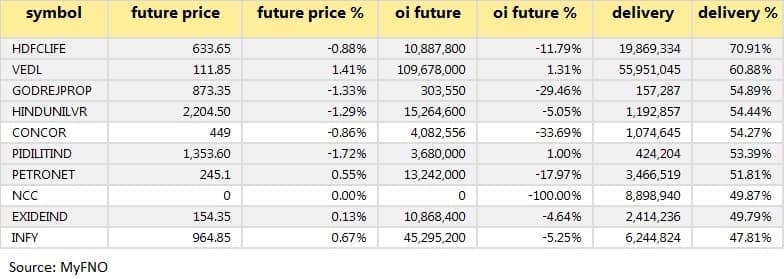

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

9 stocks saw long build-up

91 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

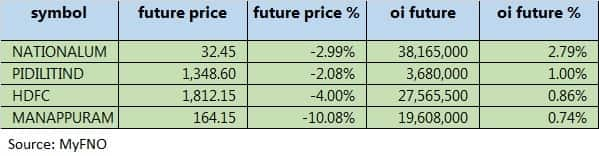

4 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions.

34 stocks saw short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering.

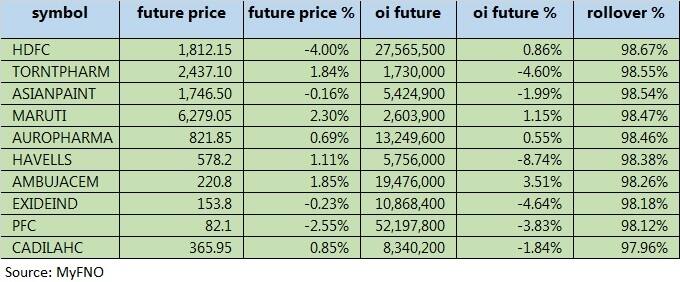

Rollovers

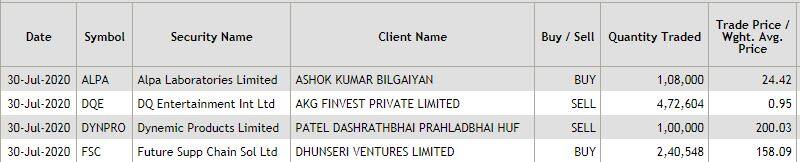

Bulk deals

(For more bulk deals, click here)

Results on July 31 State Bank of India, Tata Motors, Sun Pharmaceutical Industries, Indian Oil Corporation, UPL, 63 moons technologies, Aarey Drugs, BF Utilities, Binani Industries, Birla Tyres, Deepak Fertilisers, Future Lifestyle Fashions, Future Supply Chain Solutions, Godrej Agrovet, Jagran Prakashan, JSW Energy, Just Dial, Dr Lal PathLabs, McLeod Russel, MEP Infrastructure Developers, Mahindra Holidays & Resorts, Motilal Oswal Financial Services, Nelco, NIIT, Reliance Communications, Reliance Capital, Reliance Home Finance, RPG Life Sciences, Tata Chemicals, Tata Metaliks, Thyrocare Technologies, UCO Bank, Ujjivan Small Finance Bank, Vakrangee, VA Tech Wabag, etc.

Stocks in the news Reliance Industries: The company reported a consolidated profit of Rs 13,248 crore in Q1FY21. Consolidated revenue stood at Rs 1,00,929 crore.

Torrent Pharma: Q1 profit stood at Rs 321 crore versus Rs 216 crore, revenue at Rs 2,056 crore versus Rs 2,022 crore YoY.

Kesoram Industries: Board approved raising up to Rs 2,000 crore via equity, debt.

Indian Overseas Bank: Board approved raising up to Rs 500 crore via equity and Rs 1,500 crore in Tier II capital.

Rain Industries:Q1 profit at Rs 34.4 crore versus Rs 146.7 crore, revenue at Rs 2,360 crore versus Rs 3,341 crore YoY.

Adani Power:Competition Commission of India approved the company's 49 percent stake buy in Odisha Power.

Alpa Laboratories:Ashok Kumar Bilgaiyan bought 1,08,000 shares in the company at Rs 24.42 per share.

DQ Entertainment: AKG Finvest sold 4,72,604 shares in the company at Rs 0.95 per share.

Dynemic Products: Patel Dashrathbhai Prahladbhai HUF sold one lakh shares in the company at Rs 200.03 per share.

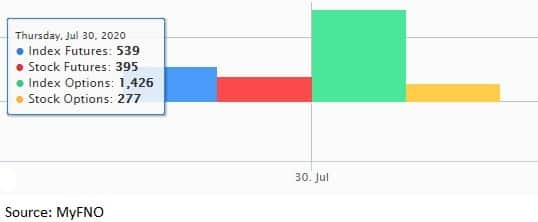

Fund flow picture

FII & DII data

Foreign institutional investors (FIIs) bought shares worth Rs 207.3 crore while domestic institutional investors (DIIs) sold shares worth Rs 387.24 crore in the Indian equity market on July 30, as per provisional data available on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!