The recovery in last hour of trade helped the market report uptrend for the eighth consecutive session on August 18, led by buying in banking and financial services stocks.

The BSE Sensex has maintained 60,000 mark, rising 38 points to 60,298, while the Nifty50 rose 12 points to 17,956.5 amid volatility and formed bullish candlestick pattern on the daily charts.

"A reasonable positive candle was formed on the daily chart, which placed beside the long bull candle of previous session. Technically, this pattern indicate a sideways range movement in the market at the highs," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels a sustainable move above 17,900-18,000 levels in the short term is expected to open next upside target of 18,500-18,600 levels in the coming week. Crucial supports will be watched at 17,760 levels.

The Nifty Midcap 100 and Smallcap 100 indices gained 0.19 percent each, while the India VIX, which measures the expected volatility in the market, was down 1.85 percent to 17.35, favouring bulls.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,883, followed by 17,809. If the index moves up, the key resistance levels to watch out for are 17,999 and 18,042.

The Nifty Bank also continued uptrend for yet another session, rising 195 points to 39,656, and formed bullish candle on the daily charts on Thursday. The important pivot level, which will act as crucial support for the index, is placed at 39,397, followed by 39,138. On the upside, key resistance levels are placed at 39,809 and 39,963 levels.

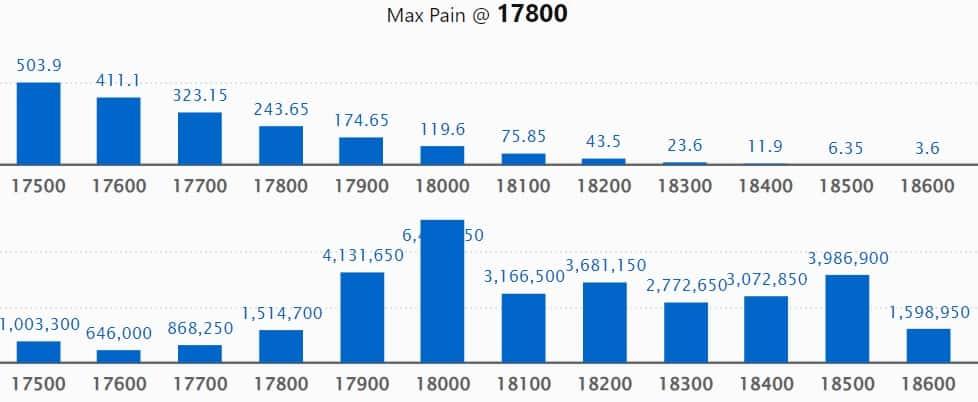

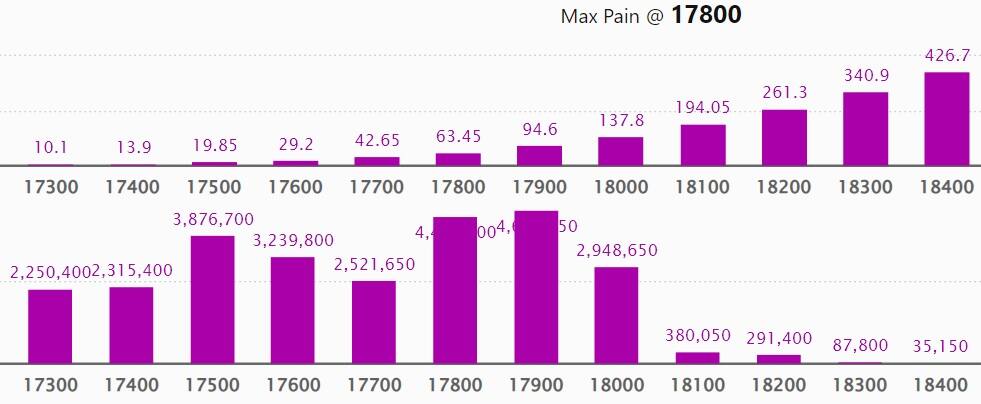

Maximum Call open interest of 64.76 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the August series.

This is followed by 19,000 strike, which holds 43.51 lakh contracts, and 18,500 strike, which has accumulated 39.86 lakh contracts.

Call writing was seen at 19,000 strike, which added 38.91 lakh contracts, followed by 18,000 strike which added 30.80 lakh contracts, and 17,900 strike which added 26.53 lakh contracts.

Call unwinding was seen at 17,600 strike, which shed 2.23 lakh contracts, followed by 17,700 strike which shed 1.84 lakh contracts and 17,400 strike which shed 29,400 contracts.

Maximum Put open interest of 59.71 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the August series.

This is followed by 17,900 strike, which holds 46.26 lakh contracts, and 17,800 strike, which has accumulated 44.22 lakh contracts.

Put writing was seen at 17,000 strike, which added 36.88 lakh contracts, followed by 17,900 strike, which added 28.72 lakh contracts and 17,800 strike which added 21.52 lakh contracts.

There was hardly any Put unwinding seen on Thursday.

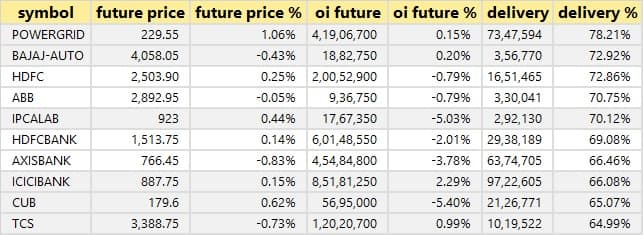

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Power Grid Corporation of India, Bajaj Auto, HDFC, ABB India and Ipca Laboratories, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Dixon Technologies, Firstsource Solutions, RBL Bank, United Breweries and Canara Bank, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Intellect Design Arena, Vedanta, Nippon Life India, HDFC Life Insurance Company, and Escorts, in which long unwinding was seen.

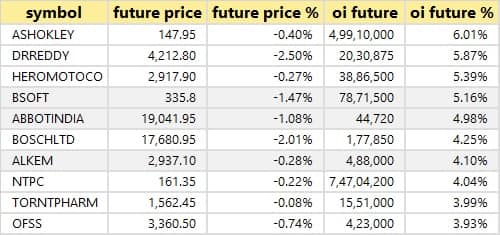

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Ashok Leyland, Dr Reddy's Laboratories, Hero MotoCorp, Birlasoft, and Abbottt India, in which a short build-up was seen.

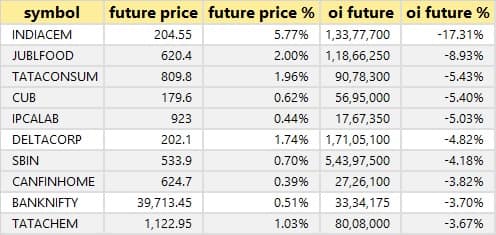

45 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including India Cements, Jubilant Foodworks, Tata Consumer Products, City Union Bank, and Ipca Laboratories, in which short-covering was seen.

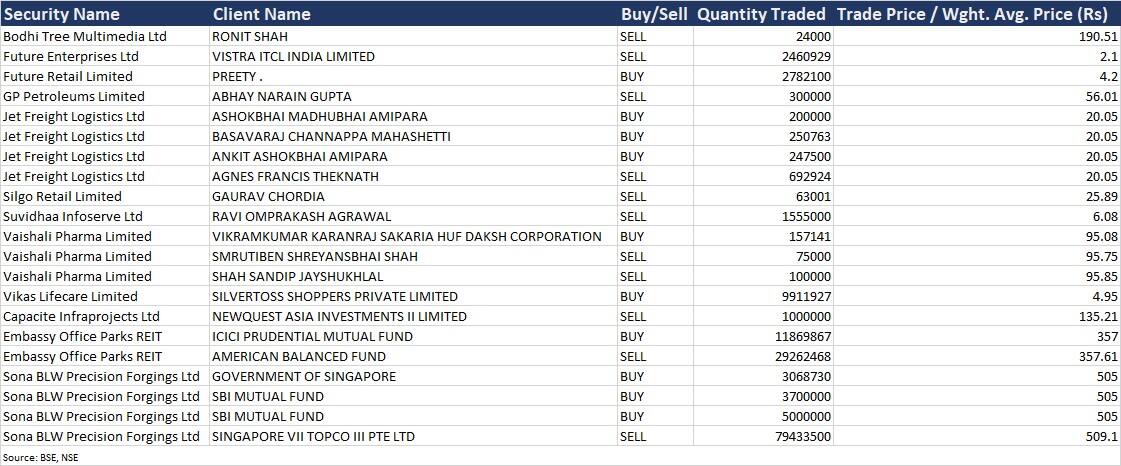

Sona BLW Precision Forgings: Government of Singapore acquired 30,68,730 equity shares in the company, while SBI Mutual Fund bought 87 lakh shares via open market transactions on Thursday. These shares were bought at an average price of Rs 505 per share. However, Singapore VII Topco III Pte Ltd, an affiliate of private equity firm Blackstone, sold 7,94,33,500 equity shares (13.6 percent stake) in the company at an average price of Rs 509.10 per share.

Capacite Infraprojects: Newquest Asia Investments II Limited sold 10 lakh shares in the company at an average price of Rs 135.21 per share.

(For more bulk deals, click here)

Investors Meetings on August 19

CG Power and Industrial Solutions: Officials of the company will meet Haitong Securities India.

Pidilite Industries, ONGC, Vijay Diagnostic Centre: Officials of the company will attend Edelweiss India Conference 2022 in Singapore.

Samvardhana Motherson International: Officials of the company will attend non-deal roadshows arranged by B&K Securities.

Timken India: Officials of the company will participate in IIFL Caravan in Bangalore.

Indigo Paints: Officials of the company will meet various investors/analysts in London which is organised by Kotak Securities.

MCX India: Officials of the company will meet JP Morgan Asset Management.

Hindware Home Innovation: Officials of the company will meet Sequent Investments.

Asian Paints: Officials of the company will meet Marcellus Investment Managers and participate in UBS India Virtual Consumer Corporate Day.

TeamLease Services: Officials of the company will meet Aquarius, Marcellus Investment, Sephira, AUM Fund Advisors, Bay Capital, IDFC MF, and Nine Rivers Capital.

IIFL Finance: Officials of the company will meet White Oak Capital.

Stocks in News

Wipro: The stock will be in focus as the IT services provider has received a multi-year contract to deliver Service integration and management (SIAM) services to HM Treasury (HMT). Wipro and HMT will collaborate to enable end-to-end SIAM services, from strategy, design, and implementation to running business-as-usual services such as day-to-day coordination of service integration across HMT’s vendors.

Max Healthcare Institute: HDFC Asset Management Company bought 0.4 percent equity stake in the company via open market transactions on August 16. With this, its shareholding in the company stands increased to 5.18 percent, up from 4.78 percent earlier.

Greenpanel Industries: Rating agency ICRA has upgraded the long term ratings of the company to A+ (stable) and short term ratings to A1+, from A and A1, respectively.

Metropolis Healthcare: Vijender Singh has resigned as the Chief Executive Officer of the company. The company has agreed to release him from the position of CEO from the closing of business hours of August 17.

Talbros Engineering: The company has commenced construction on land acquired admeasuring 2.2 acre in Faridabad for setting up of new production unit.

SecMark Consultancy: The company said the meeting of board of directors is scheduled to be held on August 23 to consider issue of bonus shares to the equity shareholders. The board will also approve the proposal of migration of company from SME platform of BSE to Main Board of BSE Limited as well as listing on the Main Board of National Stock Exchange.

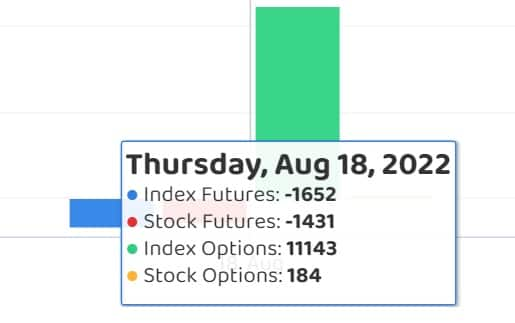

Fund Flow

Foreign institutional investors (FIIs) turned net sellers for the first time in current month, offloading shares worth Rs 1,706 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 470.79 crore on August 18, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Balrampur Chini Mills, and Delta Corp - are under the NSE F&O ban list for August 19. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.