The stock market witnessed healthy performance and closed at a four-month high on August 11 following a decline in US inflation for July, but overall it was a rangebound session.

The BSE Sensex rallied more than 500 points to 59,333, while the Nifty50 rose 124 points to 17,659 and formed a bearish candle on the daily charts as the closing was higher than opening levels.

"A small negative candle was formed on the daily chart at the highs with a gap up opening. This pattern indicates a continuation of upside momentum in the market with rangebound action. Though Nifty placed at the highs, still there is no indication of any reversal pattern unfolding at the highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities

He feels the short-term trend of the Nifty continues to be positive and one may expect further upside in the short term.

"Our near-term upside target remains intact around 17,800-17,900 levels and there is a possibility of selling pressure emerging from the highs. Immediate support is placed at 17,550 levels," the market expert said.

The broader markets also participated in the run-up with the Nifty Midcap 100 and Smallcap 100 indices rising 0.87 percent each, whereas the India VIX, the fear index declined 6.29 percent to 18.36 levels.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,621, followed by 17,583. If the index moves up, the key resistance levels to watch out for are 17,708 and 17,757.

The Nifty Bank outpaced benchmark indices, rising 592 points to 1.55 percent to 38,880 and formed a bullish candle on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 38,708, followed by 38,537. On the upside, key resistance levels are placed at 38,992 and 39,103 levels.

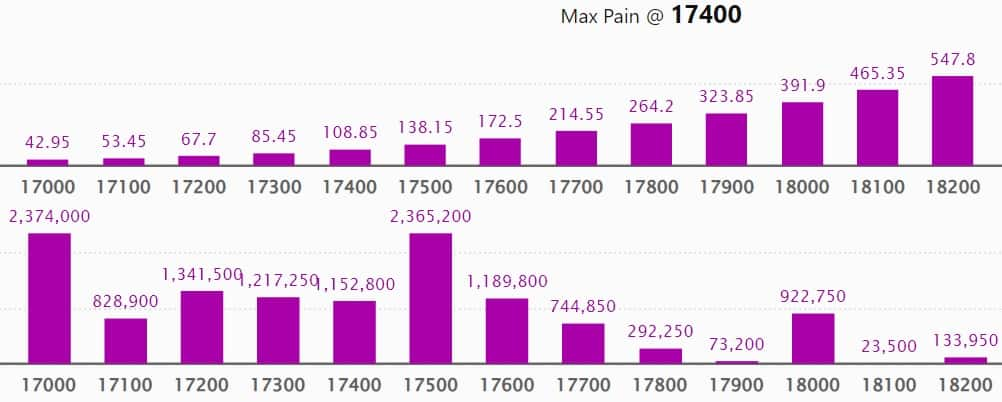

Maximum Call open interest of 23.33 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the August series.

This is followed by 17,500 strike, which holds 15.92 lakh contracts, and 17,700 strike, which has accumulated 13.68 lakh contracts.

Call writing was seen at 17,700 strike, which added 6.2 lakh contracts, followed by 18,300 strike which added 2.9 lakh contracts, and 18,400 strike which added 1.88 lakh contracts.

Call unwinding was seen at 17,500 strike, which shed 3.58 lakh contracts, followed by 17,400 strike which shed 2.2 lakh contracts and 17,000 strike which shed 82,150 contracts.

Maximum Put open interest of 23.78 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the August series.

This is followed by 17,000 strike, which holds 23.74 lakh contracts, and 17,500 strike, which has accumulated 23.65 lakh contracts.

Put writing was seen at 17,600 strike, which added 9.18 lakh contracts, followed by 17,700 strike, which added 6.23 lakh contracts and 16,600 strike which added 3.03 lakh contracts.

Put unwinding was seen at 17,000 strike, which shed 1 lakh contracts, followed by 17,300 strike which shed 24,200 contracts, and 18,200 strike which shed 12,900 contracts.

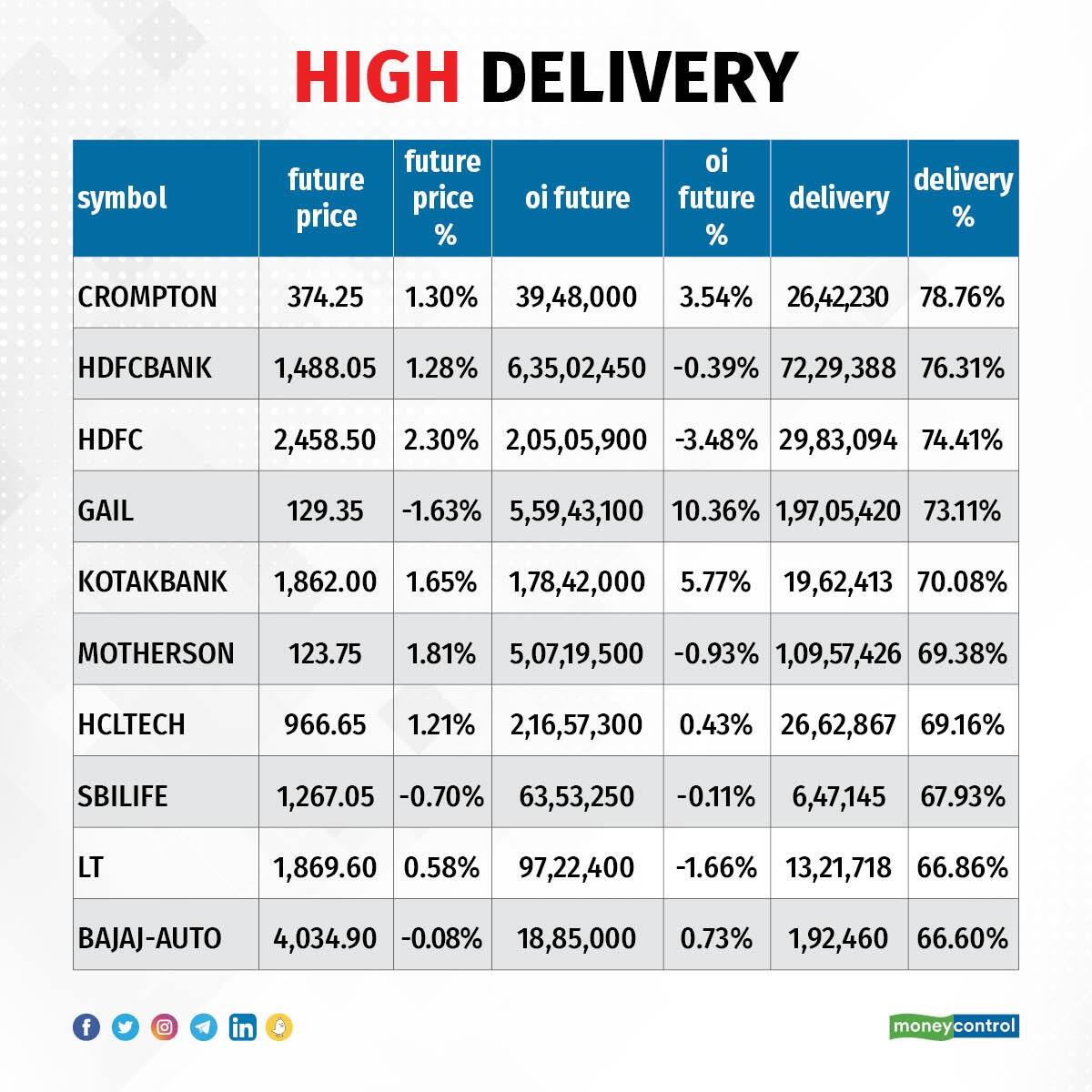

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Crompton Greaves Consumer Electricals, HDFC Bank, HDFC, GAIL India, and Kotak Mahindra Bank, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Jubilant Foodworks, Gujarat Gas, Bank Nifty, Bata India, and Chambal Fertilisers, in which a long build-up was seen.

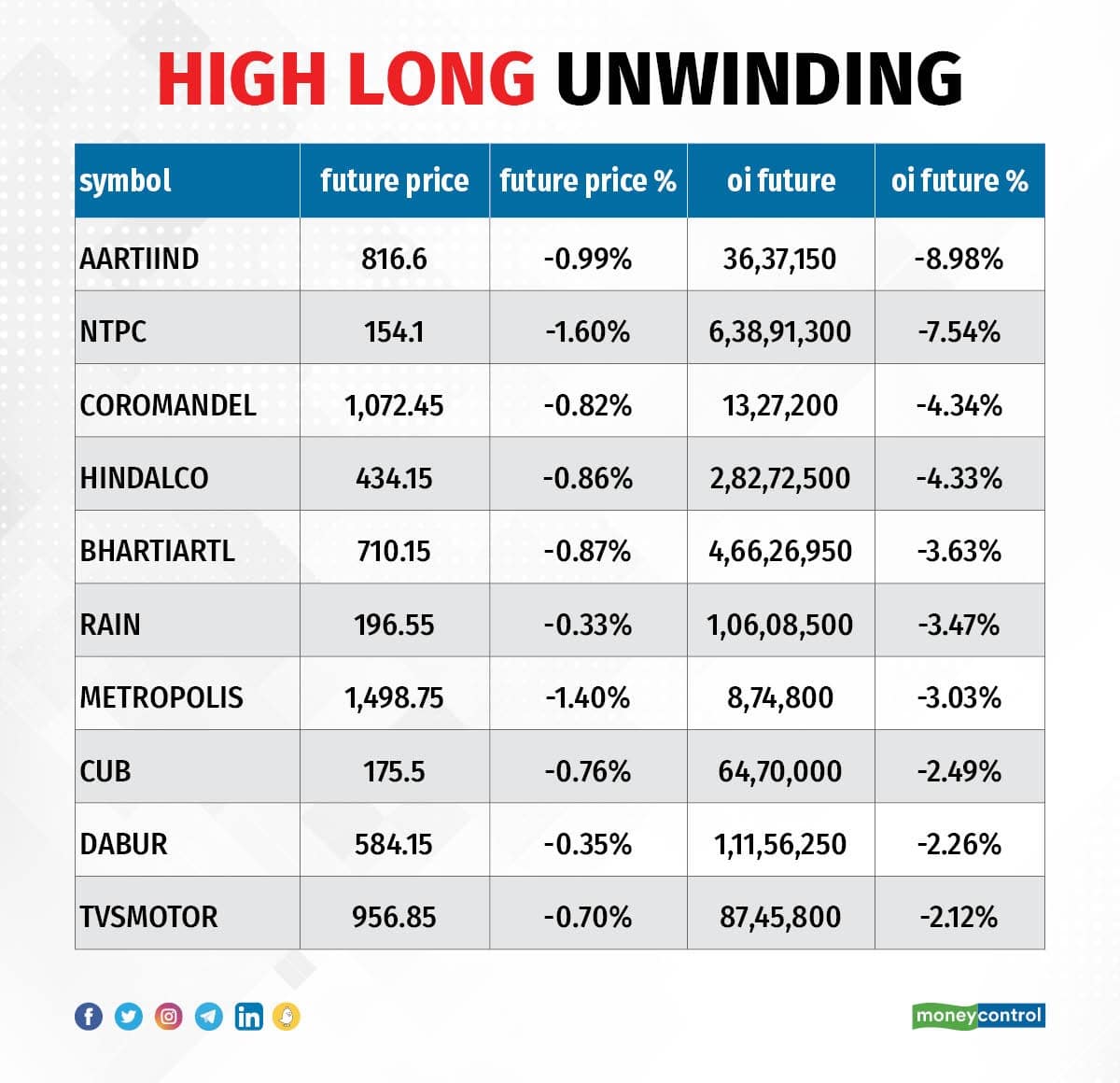

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Aarti Industries, NTPC, Coromandel International, Hindalco Industries, and Bharti Airtel, in which long unwinding was seen.

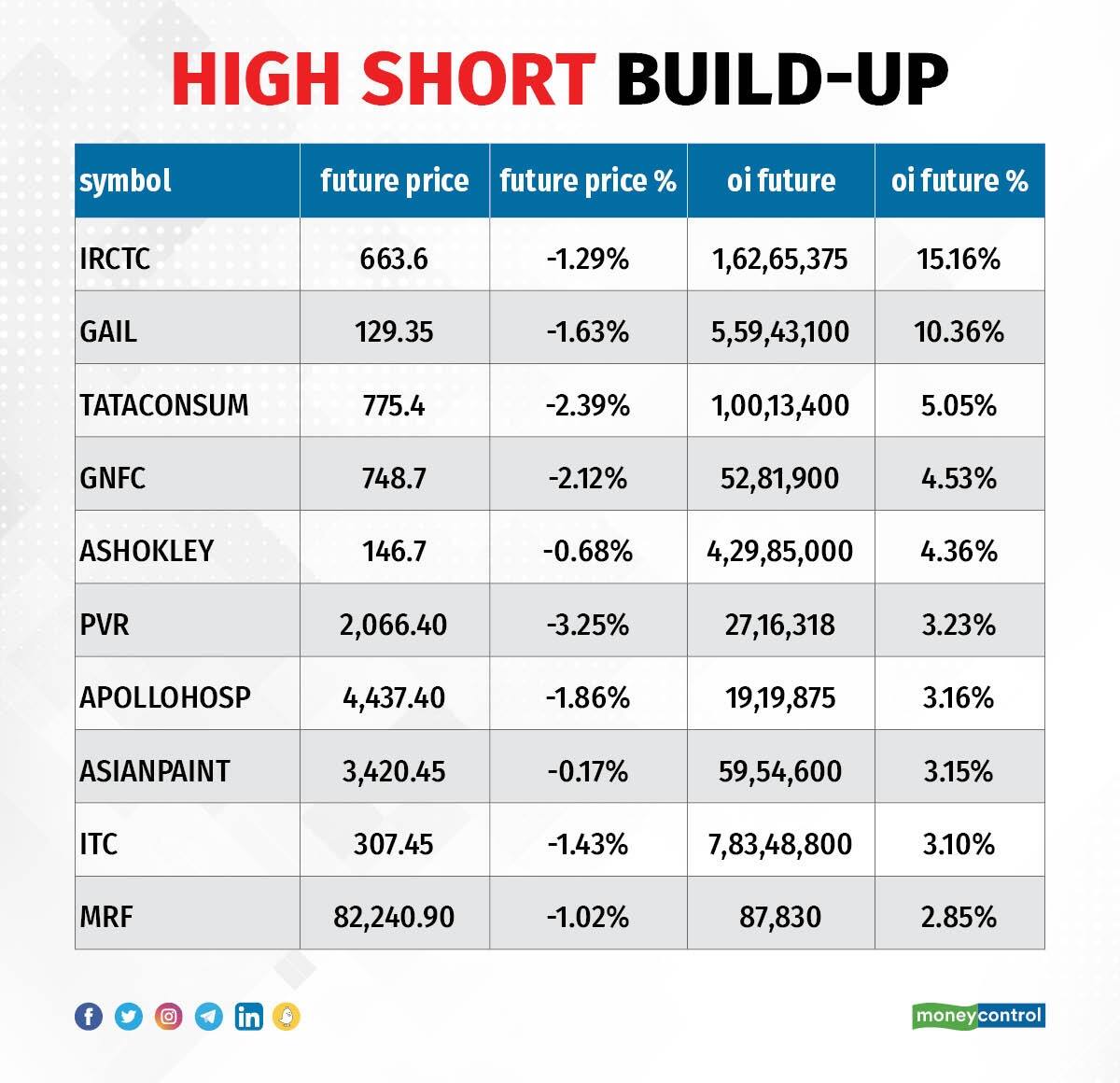

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including IRCTC, GAIL India, Tata Consumer Products, GNFC, and Ashok Leyland, in which a short build-up was seen.

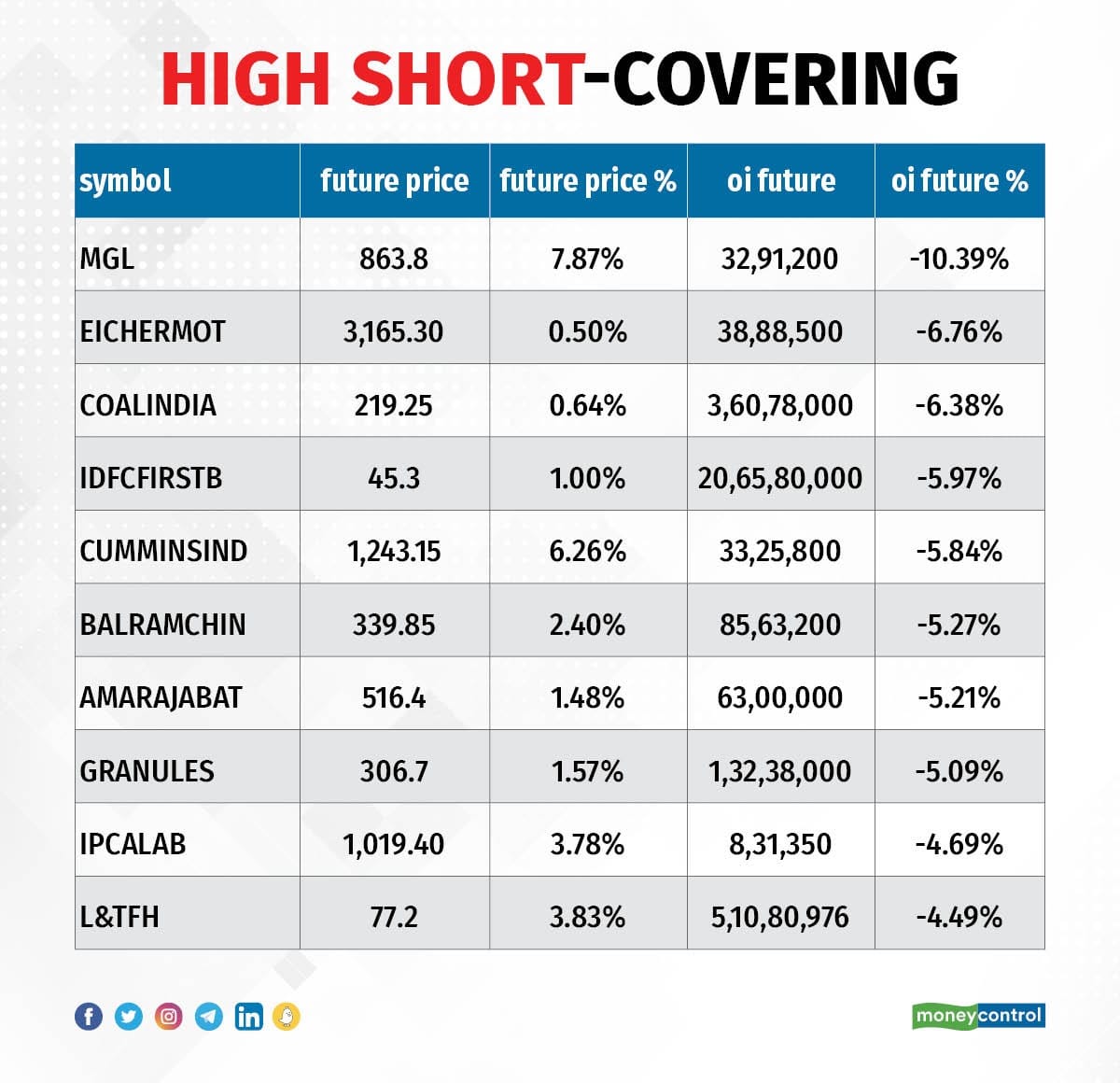

74 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Mahanagar Gas, Eicher Motors, Coal India, IDFC First Bank, and Cummins India, in which short-covering was seen.

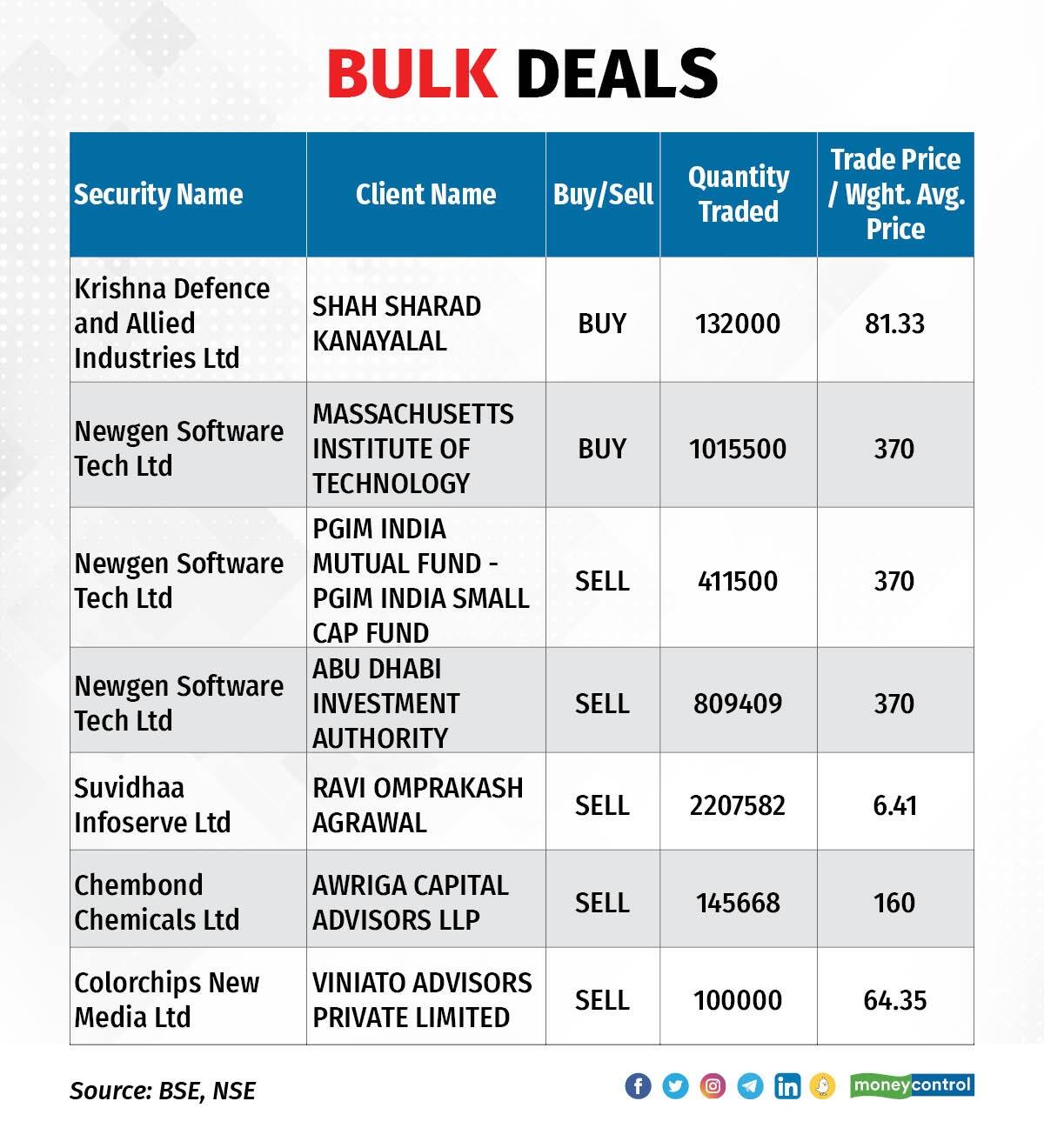

Newgen Software Technologies: Massachusetts Institute of Technology acquired 10,15,500 equity shares in the company via open market transactions at an average price of Rs 370 per share. However, PGIM India Mutual Fund sold 4,11,500 shares and Abu Dhabi Investment Authority offloaded 8,09,409 shares at same price.

(For more bulk deals, click here)

More than 700 companies including ONGC, Life Insurance Corporation of India, Hero MotoCorp, Grasim Industries, Divis Labs, Zee Entertainment Enterprises, Aegis Logistics, Ahluwalia Contracts, Apollo Tyres, Astral, Bajaj Electricals, Bajaj Healthcare, Bajaj Hindusthan Sugar, Balaji Amines, Bharat Dynamics, Campus Activewear, Dilip Buildcon, Dhani Services, Finolex Cables, Godrej Industries, Hindustan Aeronautics, Indiabulls Real Estate, India Cements, Kolte-Patil Developers, Muthoot Finance, Info Edge India, Power Finance Corporation, SJVN, Sun TV Network, Supriya Lifescience, Timken India, Varroc Engineering, Voltamp Transformers, and Wockhardt will be in focus ahead of their June quarter earnings on August 12.

Stocks in News

Aurobindo Pharma: The pharma company reported a 32.4% year-on-year growth in consolidated profit at Rs 520.4 crore for the quarter ended June FY23, impacted by lower other income and operating income. Revenue grew by 9.4% to Rs 6,236 crore compared to year-ago period, with US formulations business increasing 10.8%, but Europe formulation business fell 2.2% mainly due to euro currency depreciation.

Sterling and Wilson Renewable Energy: Promoter Shapoorji Pallonji and Company is going to sell up to 23.7 lakh shares or 1.25% stake via offer for sale on August 12 and August 16. The floor price of the offer will be Rs 270 per share.

Balaji Amines: Subsidiary Balaji Speciality Chemicals has filed a draft red herring prospectus with the Sebi for fund raising via initial public offering. The offer consists of a fresh issue of equity shares worth Rs 250 crore and an offer for sale of 2.6 crore shares by certain existing and eligible shareholders of Balaji Speciality Chemicals. Balaji Amines will not be participating in the proposed offer.

KSB: The company reported a 74.3% year-on-year increase in consolidated profit at Rs 47.40 crore in the quarter ended June FY23, driven by higher top line, operating income and other income. Low base in Q1FY22 also supported earnings. Revenue grew by 48% to Rs 448.40 crore compared to year-ago period.

Aster DM Healthcare: The company reported a 35% year-on-year increase in consolidated profit at Rs 79.77 crore in the quarter ended June FY23, driven by operating performance, other income and top line. Revenue grew by 12% to Rs 2,662 crore compared to year-ago period.

Gujarat Ambuja Exports: The company recorded a 0.7% year-on-year rise in consolidated profit at Rs 114.60 crore for the quarter ended June FY23 impacted by higher input cost and fall in operating income. Consolidated revenue grew by 24.2% to Rs 1,272.86 crore compared to year-ago period.

Apollo Hospitals Enterprise: The healthcare services provider reported a 35.3% year-on-year decline in consolidated profit at Rs 323.8 crore for the June FY23 quarter on a high base. Revenue increased by 0.94% to Rs 3,795.60 crore compared to corresponding period last fiscal.

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 2,298.08 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 729.56 crore on August 11, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Balrampur Chini Mills, and Delta Corp - are under NSE F&O ban for August 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.