The equity market corrected for the first time in the last seven consecutive sessions on August 4, as traders maintained a cautious stance ahead of the interest rate decision by the Monetary Policy Committee of the RBI. Geopolitical tensions between China and Taiwan also dented sentiment.

Overall, the market was volatile and rangebound for yet another trading session. The BSE Sensex declined 52 points to 58,299, while the Nifty50 fell 6 points to 17,382 and formed a bearish candle on the daily charts.

"On the daily charts, the Nifty formed an Outside Day candle pattern at the major resistance zone indicating an increase in volatility in the market. The Nifty could not surpass the immediate hurdle of 17,415 level on the closing basis since last 3 days," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

Sawant further said the momentum indicator RSI (relative strength index) is moving flat at overbought levels which shows the Index is maintaining momentum.

As per the overall chart pattern, the market expert feels the Nifty is in the indecisive zone. "If the Nifty sustains above 17,415 levels then it will move towards 17,665 followed by 17,779 levels. However, if the Nifty breaches the 17,150 mark on the downside, then it may slip till 17,000 followed by 16,746 levels in the coming future," the market expert added.

The broader markets were mixed in trade as the Nifty Midcap 100 index gained 0.6 percent, and the Nifty Smallcap 100 index fell 0.4 percent.

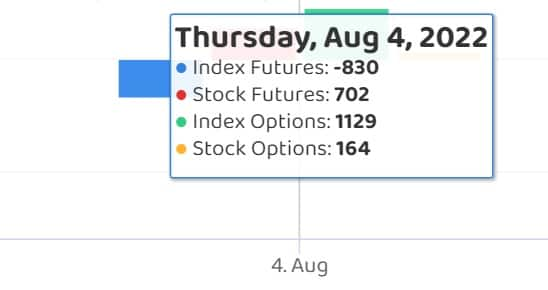

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,199, followed by 17,015. If the index moves up, the key resistance levels to watch out for are 17,528 and 17,674.

The Nifty Bank declined 234 points to 37,756 and formed a bearish candle on the daily charts on Thursday. The important pivot level, which will act as crucial support for the index, is placed at 37,259, followed by 36,763. On the upside, key resistance levels are placed at 38,242 and 38,728 levels.

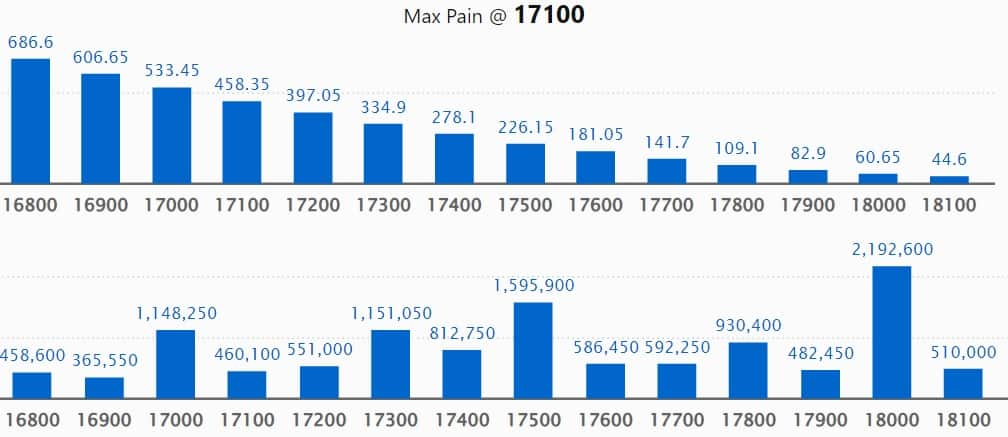

Maximum Call open interest of 21.92 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the August series.

This is followed by 17,500 strike, which holds 15.95 lakh contracts, and 17,300 strike, which has accumulated 11.51 lakh contracts.

Call writing was seen at 18,500 strike, which added 2.24 lakh contracts, followed by 18,200 strike which added 1.61 lakh contracts, and 18,400 strike which added 1.45 lakh contracts.

Call unwinding was seen at 17,300 strike, which shed 94,300 contracts, followed by 17,200 strike which shed 90,350 contracts and 17,500 strike which shed 86,900 contracts.

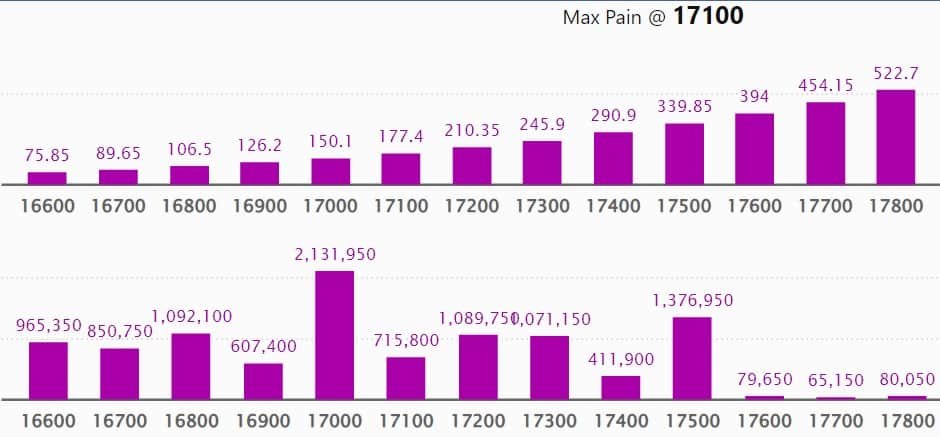

Maximum Put open interest of 24.25 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the August series.

This is followed by 17,000 strike, which holds 21.31 lakh contracts, and 17,500 strike, which has accumulated 13.76 lakh contracts.

Put writing was seen at 16,500 strike, which added 1.78 lakh contracts, followed by 17,400 strike, which added 64,250 contracts and 17,000 strike which added 61,150 contracts.

Put unwinding was seen at 17,200 strike, which shed 1.12 lakh contracts, followed by 17,100 strike which shed 64,450 contracts, and 17,300 strike which shed 47,350 contracts.

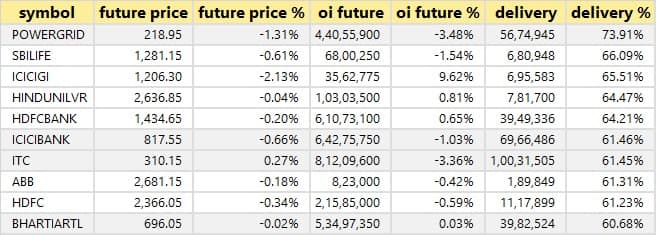

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Power Grid Corporation of India, SBI Life Insurance Company, ICICI Lombard General Insurance, Hindustan Unilever, and HDFC Bank, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Alkem Laboratories, Lupin, Ipca Laboratories, Apollo Tyres, and Dalmia Bharat, in which a long build-up was seen.

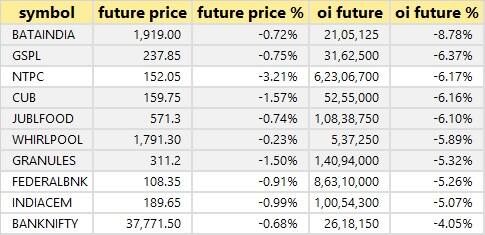

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Bata India, Gujarat State Petronet, NTPC, City Union Bank, and Jubilant Foodworks, in which long unwinding was seen.

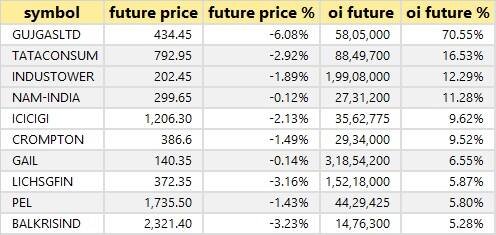

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Gujarat Gas, Tata Consumer Products, Indus Towers, Nippon Life India, and ICICI Lombard General Insurance, in which a short build-up was seen.

50 stocks witnessed short-covering

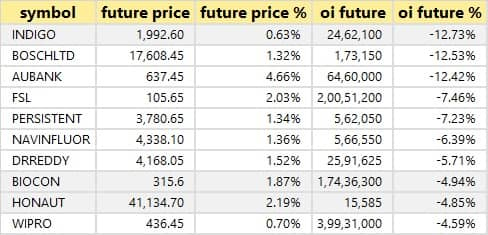

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including InterGlobe Aviation, Bosch, AU Small Finance Bank, Firstsource Solutions, and Persistent Systems, in which short-covering was seen.

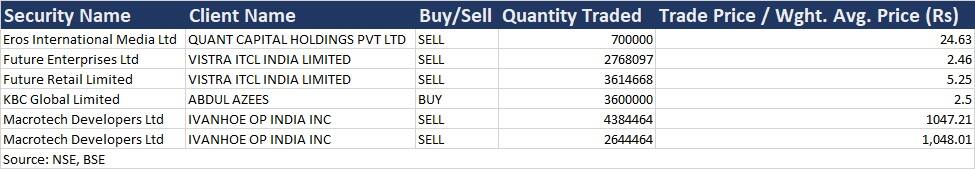

Macrotech Developers: Ivanhoe OP India Inc sold 43,84,464 equity shares in the real estate company via open market transactions at an average price of Rs 1,047.21 per share, and another 26,44,464 shares at an average price of Rs 1,048.01 per share.

(For more bulk deals, click here)

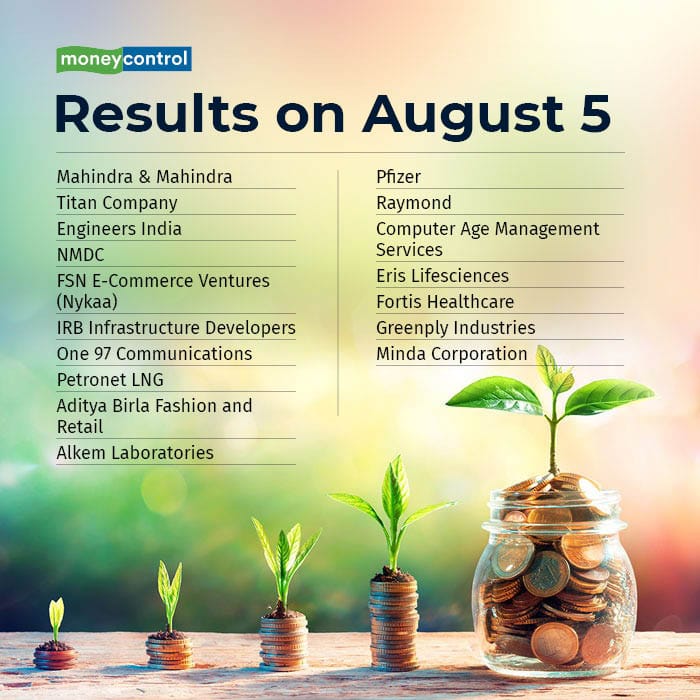

Results on August 5 and August 6

Results on August 5: Mahindra & Mahindra, Titan Company, Engineers India, NMDC, FSN E-Commerce Ventures (Nykaa), IRB Infrastructure Developers, One 97 Communications, Petronet LNG, Aditya Birla Fashion and Retail, Alkem Laboratories, Pfizer, Raymond, Computer Age Management Services, Eris Lifesciences, Fortis Healthcare, Greenply Industries, Minda Corporation, Indigo Paints, Motherson Sumi Wiring India, R Systems International, Shipping Corporation of India, Talbros Engineering, UCO Bank, and Zensar Technologies will be in focus ahead of their June quarter earnings on August 5.

Results on August 6: State Bank of India, Bharat Petroleum Corporation, Hindustan Petroleum Corporation, Marico, Advanced Enzyme Technologies, Affle (India), Amara Raja Batteries, Birla Corporation, Rossari Biotech, Skipper, Indo Rama Synthetics (India), Indian Overseas Bank, India Pesticides, Jagran Prakashan, Khadim India, Lumax Auto Technologies, Mahanagar Gas, Neogen Chemicals, Tarsons Products, Usha Martin, and West Coast Paper Mills will be in focus ahead of June quarter earnings on August 6.

Stocks in News

Gujarat State Petronet: The company reported a 11% year-on-year growth in consolidated profit at Rs 648.16 crore for the quarter ended June 2022, dented by higher input cost. Revenue grew by 63% YoY to Rs 5,670 crore for the FY23 quarter.

BEML: The company has an orderbook of Rs 9,100 crore as of June 2022 including order booking of Rs 571 crore during the quarter ended June 2022. The company posted consolidated loss at Rs 82.36 crore for the quarter ended June 2022, against loss of Rs 94 crore in same period last year, but revenue grew by 43% YoY to Rs 669.2 crore in Q1FY23.

Adani Ports: AD Ports Group has signed a Memorandum of Understanding (MoU) with Adani Ports and SEZ, for strategic joint investments in end-to-end logistics infrastructure and solutions, which include rail, maritime services, port operations, digital services, an industrial zone and the establishment of maritime academies in Tanzania.

Adani Enterprises: Subsidiary Adani Road Transport (ARTL) has entered into a definitive agreement to acquire Gujarat Road and Infrastructure Company (GRICL) and Swarna Tollway (STPL), for Rs 3,110 crore. ARTL will acquire 56.8% in GRICL and 100% stake in STPL from Macquarie Asia Infrastructure Fund, subject to regulatory approval. The transaction is expected to close in September 2022.

REC: The company clocked a 8.2% year-on-year increase in consolidated profit at Rs 2,454.2 crore for the quarter ended June 2022, partly due to decline in impairment on financial instruments. Revenue declined 0.55 percent YoY to Rs 9,497.5 crore for the June FY23 quarter.

Alembic Pharmaceuticals: The pharma company posted consolidated loss of Rs 65.88 crore for the quarter ended June 2022, against profit of Rs 164.52 crore in same period last year, impacted by lower top line. Revenue fell nearly 5% to Rs 1,262.14 crore compared to year-ago period.

Balkrishna Industries: The company recorded a 7.1% year-on-year decline in consolidated profit at Rs 307 crore for the quarter ended June 2022, impacted by higher input cost and freight & forwarding expenses. Revenue surged 45.3% YoY to Rs 2,619.43 crore for the June FY23 quarter.

Manappuram Finance: The company reported a 35.6% year-on-year decline in profit at Rs 282 crore for the quarter ended June 2022 as impairment on financial instruments remained elevated. Revenue from operations fell 4% to Rs 1,502 crore during the same period.

LIC Housing Finance: The housing finance company reported a 503% year-on-year growth in profit at Rs 925.5 crore for the quarter ended June 2022 as impairment on financial instruments declined sharply. Revenue from operations increased 9% YoY to Rs 5,285.5 crore for the June FY23 quarter.

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 1,474.77 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 46.79 crore on August 4, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added Escorts under its F&O ban list for August 5 as well. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.