It was yet another positive session for the market on July 7 as the Nifty50 decisively surpassed the psychological 16,000 mark despite volatility, backed by positive global cues after Fed minutes and a fall in oil prices. All sectors, barring FMCG, led a rally in the trade.

The BSE Sensex gained 427 points to close at 54,178, while the Nifty50 climbed 143 points to 16,133, forming a Doji kind of indecisive pattern on the daily charts.

The rally was also seen in broader space as the Nifty Midcap and Smallcap 100 indices reported more than 1.3 percent gains each, while a decline in India VIX, the volatility index, below 20 levels at 19.20, down 5.25 percent also supported bulls.

"A small positive candle was formed with a long lower shadow. Technically, this pattern indicates a continuation of up move post upside breakout of the crucial overhead resistance at 15,900 levels," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

After the upside breakout of the hurdle at 15,900 levels recently, the market is now advancing towards another hurdle of the previous opening downside gap of June 13 at 16,175 levels. Hence a sustainable move above 16,200 levels could open further sharp up move ahead, he said, adding immediate support is placed at 16,000 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,069, followed by 16,005. If the index moves up, the key resistance levels to watch out for are 16,174 and 16,214.

Nifty Bank rallied 596 points to 34,920 on Thursday, forming yet another bullish candle on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 34,660, followed by 34,400. On the upside, key resistance levels are placed at 35,073 and 35,226 levels.

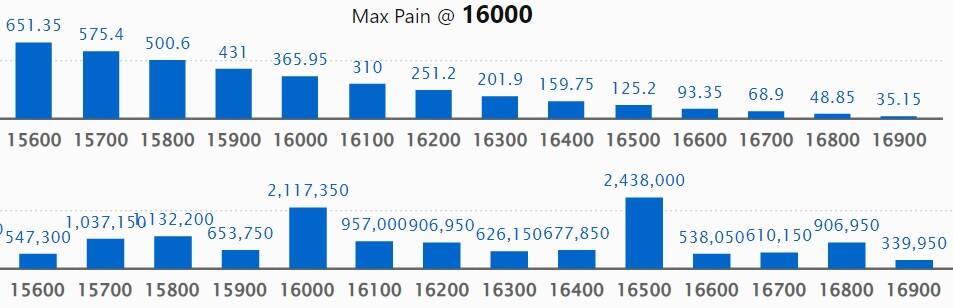

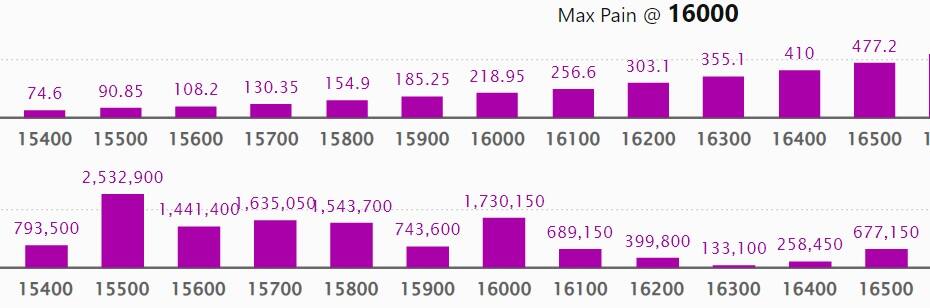

Maximum Call open interest of 24.38 lakh contracts was seen at 16,500 strike, which will act as a crucial resistance level in the July series.

This is followed by 17,000 strike, which holds 21.76 lakh contracts, and 16,000 strike, which has accumulated 21.17 lakh contracts.

Call writing was seen at 16,100 strike, which added 4.77 lakh contracts, followed by 16,900 strike which added 81,750 contracts and 17,200 strike which added 75,850 contracts.

Call unwinding was seen at 15,900 strike, which shed 3.85 lakh contracts, followed by 15,800 strike which shed 2.34 lakh contracts and 15,700 strike which shed 1.99 lakh contracts.

Maximum Put open interest of 35.54 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the July series.

This is followed by 15,500 strike, which holds 25.32 lakh contracts, and 14,500 strike, which has accumulated 22.66 lakh contracts.

Put writing was seen at 16,100 strike, which added 5.36 lakh contracts, followed by 16,000 strike, which added 4.11 lakh contracts and 15,100 strike which added 1.93 lakh contracts.

Put unwinding was seen at 14,500 strike, which shed 5.22 lakh contracts, followed by 15,900 strike which shed 2.76 lakh contracts, and 15,800 strike which shed 2.35 lakh contracts.

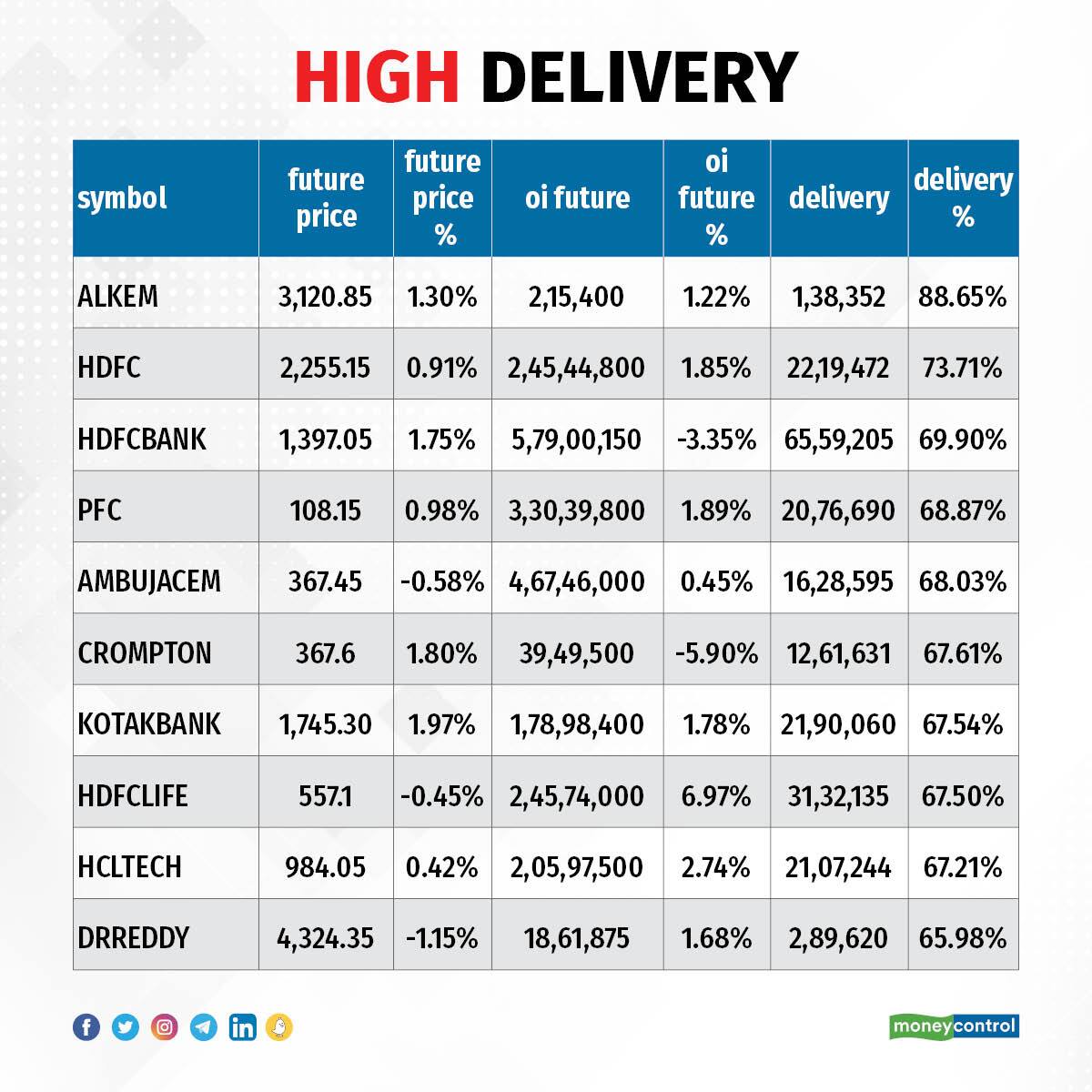

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Alkem Laboratories, HDFC, HDFC Bank, PFC, and Ambuja Cements, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including ABB India, Nifty Financial, Gujarat Gas, Birlasoft, and IndiaMART InterMESH, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Bajaj Finance, Bajaj Finserv, Coforge, Bata India, and Coromandel International, in which long unwinding was seen.

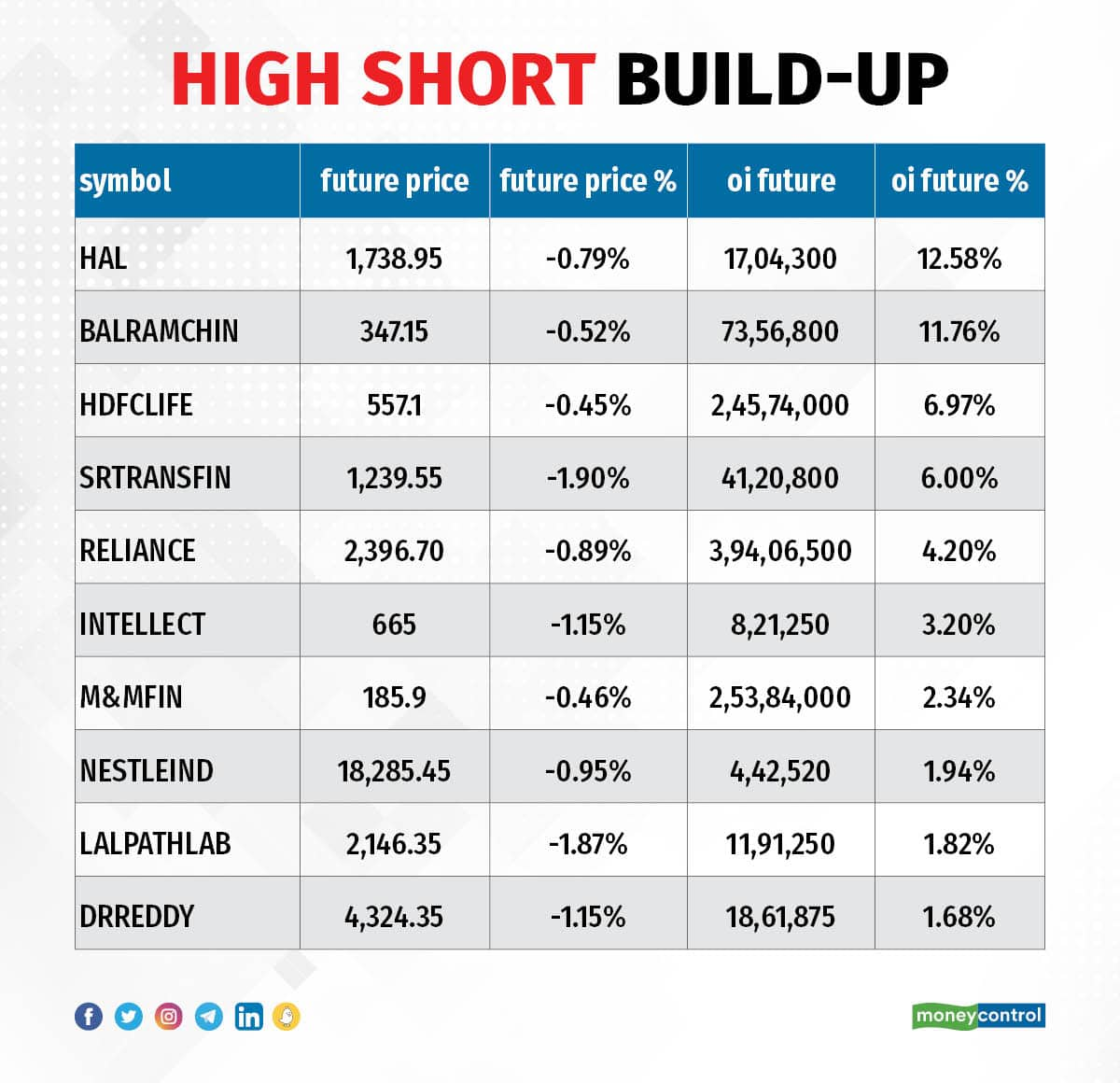

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks including Hindustan Aeronautics, Balrampur Chini Mills, HDFC Life Insurance Company, Shriram Transport Finance, and Reliance Industries, in which a short build-up was seen.

79 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Dalmia Bharat, Nifty, Federal Bank, Crompton Greaves Consumer Electricals, and Bank Nifty, in which short-covering was seen.

(For more bulk deals, click here)

Tata Consultancy Services, Brahmaputra Infrastructure, Kohinoor Foods, MMTC and Spectrum Foods will be in focus ahead of their quarterly earnings on July 8.

Avenue Supermarts, Gradiente Infotainment and Scandent Imaging will release their quarterly scorecard on July 9.

Stocks in News

Tata Motors: UK-based Jaguar Land Rover reported sales volumes at 78,825 units for three-month period ended June 2022, down 37% YoY and flat compared to previous quarter. Despite a record order book of 2 lakh units, sales continued to be constrained by the global chip shortage, compounded by the run out of the prior model Range Rover Sport, with deliveries just starting, and the impact of Covid lockdowns in China.

Kalpataru Power Transmission: The subsidiary in Sweden - Kalpataru Power Transmission Sweden AB (KPT Sweden) has completed the acquisition of remaining 15% equity stake of Linjemontage i Grastrop AB, a Swedish EPC company (LMG) headquartered in Grastrop, by paying $11.5 million. LMG also has two subsidiaries.

Response Informatics: The company said the board will hold a meeting on July 14 to consider the proposal for acquisition of Technologia Corporation, Jersey, USA. Hence, the trading window for dealing in the securities of the company will be closed for all the directors', designated persons of the company and their immediate relatives during July 8-16, 2022.

Xelpmoc Design and Tech: The company will invest Rs 21.5 lakh in Xperience India, the special purpose vehicle proposed to be incorporated in Madhya Pradesh, for 43% stake, which is engaged in business of tourism with the help of technologies to be developed related to travel and tourism sector. The company already received contract from Madhya Pradesh State Tourism Development Corporation. Xelpmoc will also invest nearly Rs 25 lakh in IT firm Firstsense Technology, in one or more tranches, for 32.26% stake. The transaction is expected to be completed by end of September 2022.

Pricol: The company has entered into Licensing Agreement with BMS PowerSafe SAS, France, for providing battery management system to the original equipment manufacturers in Indian market and international markets, across all vehicle segments. BMS PowerSafe is the brand of Startec Development Group.

Vedanta: The company will be undertaking acquisition of Athena Chhattisgarh Power which is a 1200MW coal-based power plant at Jhanjgir Champa district, Chhattisgarh, and is under liquidation process. The acquisition, which is estimated to be completed in FY23, will fulfill the power requirement at Vedanta aluminium business. The acquisition cost is Rs 564.67 crore.

Vakrangee: The company has clocked profit at Rs 4.53 crore in quarter ended June 2022, down significantly from Rs 23.33 crore in corresponding quarter last year as gross margins impacted primarily due to the launch of additional franchisee incentive schemes. It said profit margins have bottomed out and it is confident to deliver improved profitability & sustainable growth in the subsequent quarters. However, revenue from operations increased sharply to Rs 226.03 crore in Q1FY23 as against Rs 154.02 crore in same period last year.

Fund Flow

Foreign institutional investors (FIIs) have offloaded shares worth Rs 925.22 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 980.59 crore on July 7, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock under its F&O ban list for July 8 as well. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.