Indian equities ended with healthy gains on August 12 amid positive global cues as the risk appetite of investors improved after US inflation and UK GDP data showed improvement on the macro front.

Sensex closed 318 points, or 0.58 percent, higher at 54,843.98 and Nifty settled at 16,364.40, up 82 points or 0.50 percent. The BSE Midcap and smallcap indices closed 1.07 percent and 1.97 percent higher, respectively.

Nifty managed to close above 16,350 resistance level and any sustainable move above this level may lead to further rally towards 16,500 to 16,600 levels, said Santosh Meena, Head of Research, Swastika Investmart.

"On the downside, 16,200-16,170 is an immediate and strong demand zone while 16,000-15,950 will be a critical support area at any correction," he said.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the NiftyAccording to pivot charts, the key support levels for the Nifty are placed at 16,309.03, followed by 16,253.67. If the index moves up, the key resistance levels to watch out for are 16,397.63 and 16,430.87.

Nifty BankThe Nifty Bank climbed 0.36 percent to close at 35,937.05. The important pivot level, which will act as crucial support for the index, is placed at 35,760.63, followed by 35,584.16. On the upside, key resistance levels are placed at 36,055.84 and 36,174.57 levels.

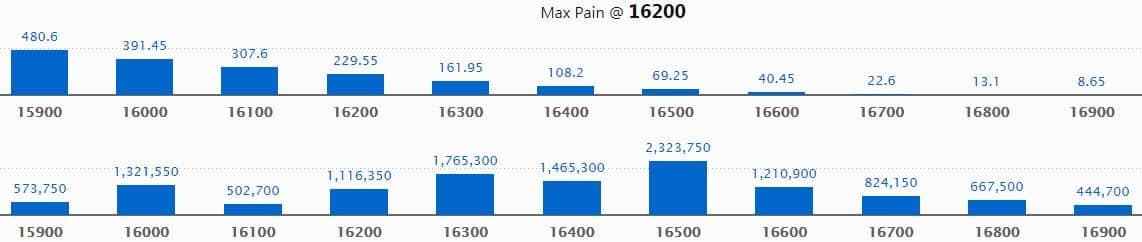

Call option dataMaximum Call open interest of 23.24 lakh contracts was seen at 16,500 strike, which will act as a crucial resistance level in the August series.

This is followed by 16,300 strike, which holds 17.65 lakh contracts, and 16,400 strike, which has accumulated 14.65 lakh contracts.

Call writing was seen at 16,600 strike, which added 1.91 lakh contracts, followed by 16,700 strike, which added 1.36 lakh contracts and 16,400 strike which added 1.17 lakh contracts.

Call unwinding was seen at 16,200 strike, which shed 1.76 lakh contracts, followed by 16,100 strike which shed 65,700 contracts, and 16,000 strike which shed 38,250 contracts.

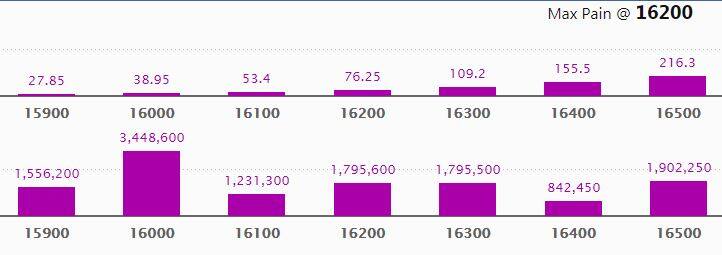

Maximum Put open interest of 34.49 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the August series.

This is followed by 16,500 strike, which holds 19.02 lakh contracts, 16,200 and 16,300 strikes, which have accumulated 17.96 lakh contracts each.

Put writing was seen at 16,300 strike, which added 7.17 lakh contracts, followed by 16,500 strike which added 3.95 lakh contracts, and 16,400 strike which added 2.97 lakh contracts.

No major Put unwinding was seen today.

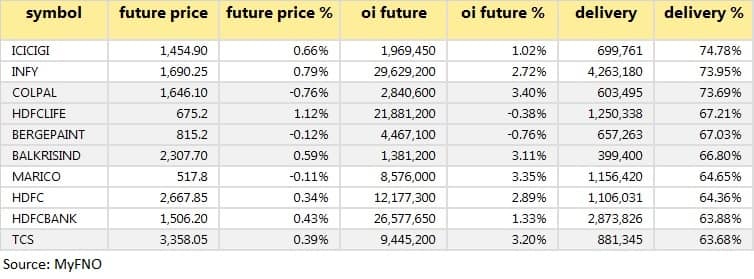

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

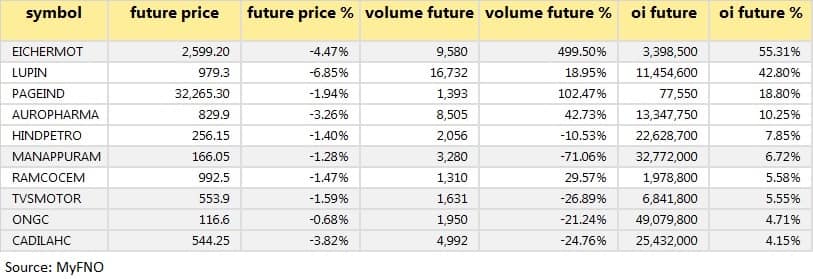

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

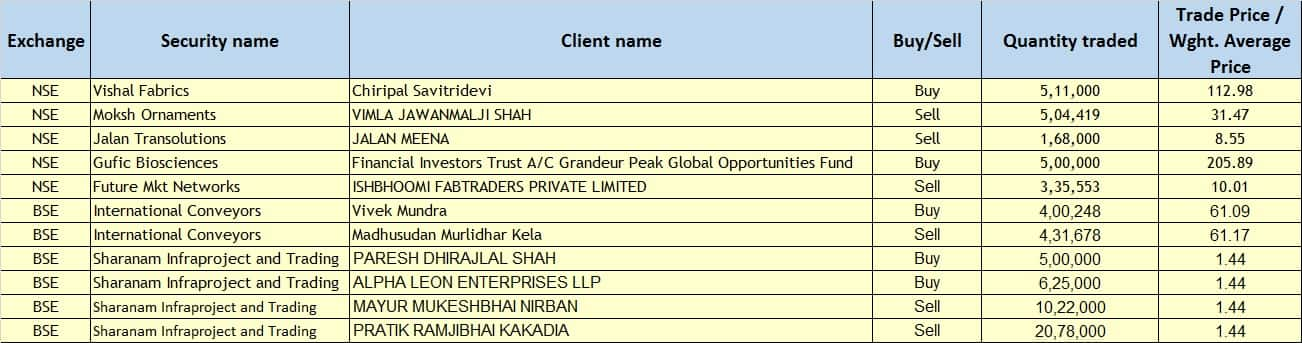

(For more bulk deals, click here)

Results on August 13Godrej Industries, Grasim Industries, NBCC (India), NHPC, Oil and Natural Gas Corporation, Hindustan Aeronautics, Indraprastha Gas, Inox Wind, Burger King India, Sun TV Network, Allcargo Logistics, Archies, D B Corp, Gayatri Projects, Glenmark Pharmaceuticals, Gujarat Mineral Development Corporation, GMR Infrastructure, Godfrey Phillips India, Indian Railway Finance Corporation, IL&FS Investment Managers, Inox Wind Energy, Jammu & Kashmir Bank, Jagran Prakashan, Madhucon Projects, Maharashtra Seamless, Mawana Sugars, Orbit Exports, Orchid Pharma, Petronet LNG, SEAMEC, Sintex Industries, Suven Pharmaceuticals, Suzlon Energy, Tide Water Oil (INDIA), Ucal Fuel Systems, Uttam Galva Steels, Visa Steel, Vivimed Labs and ZEE Learn will announce their results on August 13.

Stocks in NewsTata Steel: The company’s Q1 net profit at Rs 9,768.3 crore versus a loss of Rs 4,648.1 crore and revenue was at Rs 53,371.8 crore versus Rs 25,474.5 crore, YoY.

Ashok Leyland: The company’s Q1 net loss at Rs 282.3 crore versus loss of Rs 388 crore and revenue was at Rs 2,951 crore versus Rs 650.9 crore, YoY.

Hero MotoCorp: The company’s Q1 net profit was at Rs 365.4 crore versus Rs 61.3 crore and revenue was up 84.7 percent at Rs 5,487 crore versus Rs 2,971.5 crore, YoY.

Aurobindo Pharma: The company's Q1 net profit was down 1.7 percent at Rs 770 crore versus Rs 783.2 crore and revenue was down 3.8 percent at Rs 5,702 crore versus Rs 5,924.8 crore, YoY.

Page Industries: The company has posted a net profit at Rs 10.9 crore versus a loss of Rs 39.6 crore and revenue was up 76.1 percent at Rs 501.5 crore versus Rs 284.8 crore, YoY.

Jubilant Food Works: CRISIL reaffirmed its rating on the commercial paper programme of the company at CRISIL A1+.

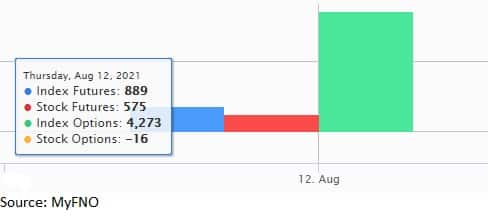

Fund flow

Foreign institutional investors (FIIs) net sold shares worth Rs 212.11 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 307.75 crore in the Indian equity market on August 12, as per provisional data available on the NSE.

Stocks under F&O ban on NSEFive stocks - Canara Bank, Indiabulls Housing Finance, Punjab National Bank, RBL Bank, and Sun TV Network - are under the F&O ban for August 13. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!