The market rebounded smartly and held on to the psychological 21,000 mark at close on December 21. Going ahead, the current ongoing consolidation is expected to continue with near-term support at around 21,000, if the index closes below the same then a sharp correction can be seen, while on the higher side, 21,593 — the record high — is likely to be a key hurdle as the decisive crossing of the same can start another leg of the rally, experts said.

On December 21, the BSE Sensex climbed 359 points to 70,865, while the Nifty 50 rose 105 points to 21,255 and formed a bullish candlestick pattern on the daily charts, though there was a lower high, lower low formation.

"On the daily chart, while the Nifty has bounced back sharply and retraced some of the losses seen in the previous session, the short-term trend remains down," Subash Gangadharan, senior technical and derivative analyst, HDFC Securities said.

Momentum readings like the 14-day RSI (relative strength index), too, remain in decline mode and declining sharply from overbought levels on December 20. This is a negative signal for the near term, and it also implies that the Nifty remains in a short-term downtrend, he feels.

Subhash said the Nifty would need to cross the recent high of 21,593 to reverse the current downtrend. "Crucial supports to watch for re-emergence of weakness are at 20,976," he said.

The overall market breadth remained strong and indicates a firm market, as three shares advanced for every share falling on the NSE. "But Nifty still needs to surpass key levels for a continuation of the momentum. The immediate support for Nifty is placed around 21,000-20,950, while resistances are seen around 21,360 followed by the 21,500-21,600 zone," Ruchit Jain, lead research at 5paisa.com said.

He advised traders to look for stock-specific opportunities from a trading perspective and trade with proper risk management.

The broader markets have also seen a rebound after a more than 3 percent correction in the previous session. The Nifty Midcap 100 and Smallcap 100 indices gained 1.7 percent and 1.9 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 21,292 followed by 21,366 and 21,485 levels, while on the lower side, it can take support at 21,054, followed by 20,981 and 20,862 levels.

On December 21, the Bank Nifty also bounced back and closed 395 points higher at 47,840 on recovery in banking stocks. The banking index has formed a long bullish candlestick pattern on the daily timeframe, but there was a lower high, lower low formation.

Overall, the index has been volatile in a broader range between 47,000 and 48,000 zones. "Now it has to continue to hold above 47,500 levels to make an up move towards its recent lifetime high of 48,219 and then at higher zones, while on a downside support is expected at 47,500 and then at 47,250 levels," Chandan Taparia, senior vice president | analyst-derivatives at Motilal Oswal Financial Services said.

As per the pivot point calculator, the Bank Nifty is expected to see resistance at 47,951 followed by 48,190 and 48,577 levels, while on the lower side, it may take support at 47,177 followed by 46,938 and 46,551 levels.

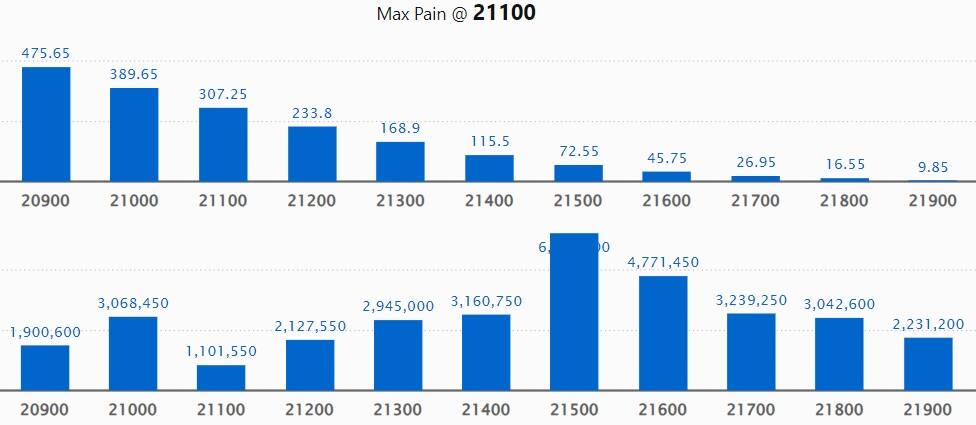

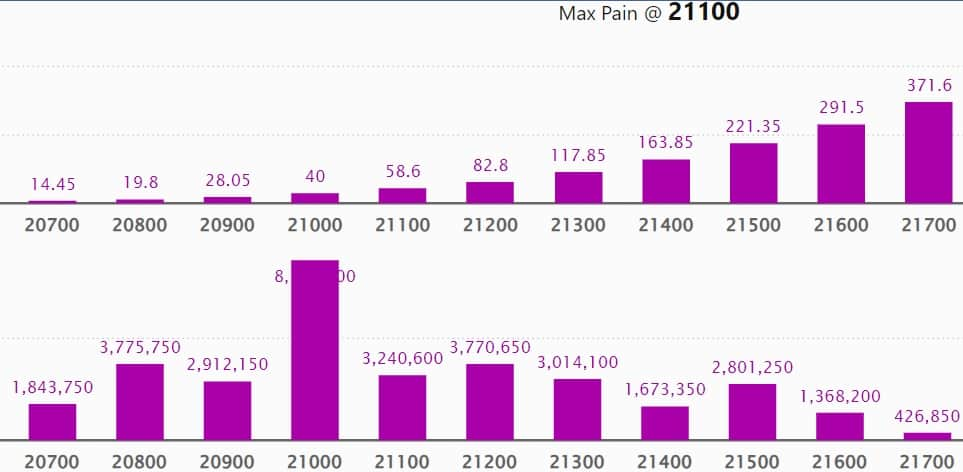

As per the weekly options data, the 22,000 strike owned the maximum Call open interest with 91.57 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 21,500 strike, which had 65.65 lakh contracts, while the 21,600 strike had 47.71 lakh contracts.

Meaningful Call writing was at the 22,000 strike, which added 46.75 lakh contracts followed by 22,500 and 22,200 strikes, which added 13.87 lakh and 12.42 lakh contracts.

The maximum Call unwinding was at the 21,400 strike, which shed 1.26 lakh contracts followed by 20,200 and 20,300 strikes, which shed 14,250 and 9,650 contracts.

On the Put front, the 21,000 strike owned the maximum open interest, which can act as a key support area for the Nifty with 87.78 lakh contracts. It was followed by 20,000 strike comprising 55.81 lakh contracts and 20,500 strike with 39.77 lakh contracts.

Meaningful Put writing was at 21,000 strike, which added 30.74 lakh contracts followed by 20,000 strike and 20,800 strike, which added 21.17 lakh contracts and 17.01 lakh contracts.

Put unwinding was at 21,400 strike, which shed 3.77 lakh contracts followed by 21,500 strike, which shed 3.61 lakh contracts and 21,600 strike, which shed 2.03 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Dabur India, Asian Paints, Syngene International, Godrej Consumer Products and Marico saw the highest delivery among the F&O stocks.

A long build-up was seen in 84 stocks, which included Coromandel International, Hindustan Copper, Britannia Industries, IRCTC and GMR Airports Infrastructure. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 9 stocks saw long unwinding, including Bajaj Auto, Ashok Leyland, Maruti Suzuki India, Mahindra & Mahindra and Dr Reddy's Laboratories. A decline in OI and price indicates long unwinding.

15 stocks see a short build-up

A short build-up was seen in 15 stocks, which were City Union Bank, Marico, ICICI Bank, Dabur India and Bandhan Bank. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 80 stocks were on the short-covering list. This included PI Industries, NALCO, Eicher Motors, Indiabulls Housing Finance and Godrej Properties. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, climbed to 1.11 on December 21, from 0.66 levels in the previous session. The above 1 PCR indicates that the traders are buying more Puts options than Calls, which generally indicates an increase in bearish sentiment.

For more bulk deals, click here

Stocks in the news

Life Insurance Corporation of India: LIC got an exemption from the Department of Economic Affairs to achieve the 25 percent minimum public shareholding threshold within 10 years of listing, which is in 2032. The department termed the decision was taken due to “public interest”.

GMR Airports Infrastructure: Subsidiary GMR Airports entered into a binding agreement with the National Investment and Infrastructure Fund (NIIF) to invest Rs 675 crore in the upcoming airport at Bhogapuram, Andhra Pradesh. This is NIIF’s second investment in a GMR Airport after their investment in Goa International Airport.

Bata India: The retail footwear company said Pankaj Gupta will resign as Head of Retail and franchisee Operations and move to a global position in Bata group effective from March 1, 2024. Badri Beriwal Chief Strategy & Business Development Officer of the company, will be additionally leading the retail business including Bata, Hush Puppies and Franchise operations of the company.

MOIL: The state-owned manganese ore mining company announced that production by December 20, crossed 16 lakh tonnes in CY2023. The company said this figure is 26 percent higher than the previous high in 2019.

Suven Pharmaceuticals: Himanshu Agarwal will be appointed as CFO of the company from January 2, 2024. He will be replacing Subba Rao Parupalli who tendered his resignation earlier. Himanshu Agarwal previously worked with Akzo Nobel India, Astra Zeneca Pharma and Bennett & Coleman.

360 ONE WAM: The company has entered into a share purchase agreement with MAVM Angels to acquire the rest of the 9 percent stake and make the company, a wholly-owned subsidiary of the company. 360 ONE WAM acquired a 91 percent stake in the company in November 2022.

Funds Flow (Rs crore)

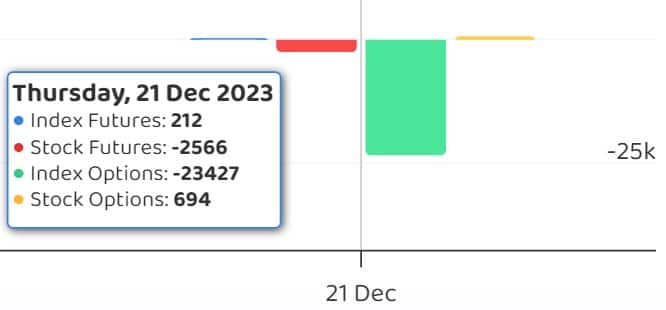

Foreign institutional investors (FIIs) net sold shares worth Rs 1,636.19 crore, while domestic institutional investors (DIIs) bought Rs 1,464.70 crore worth of stocks on December 21, provisional data from the National Stock Exchange (NSE) showed.

Stock under F&O ban on NSE

The NSE has added Hindustan Copper to its F&O ban list for December 22, while retaining Ashok Leyland, Balrampur Chini Mills, Delta Corp, India Cements, Manappuram Finance, RBL Bank and SAIL in the list. Indus Towers, National Aluminium Company and Piramal Enterprises were removed from the list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.