This smallcap technology company has investors in awe. Datamatics Global Services Ltd has shot up 100 percent in the past three months. Investors have got a return of more than 1,100 percent from the stock in the past three years, and over the decade, it has sprinted from Rs 26.50 to Rs 590, as of June 14, 2023.

The upmove in Datamatics comes when Nifty IT has lost about a percent in three months. The larger sentiment in the IT sector is that domestic IT companies are vulnerable to global headwinds. Datamatics, however, has defied the broader sectoral trend.

What does Datamatics do?

Datamatics, with a market capitalisation of nearly Rs 3,500 crore, is a Mumbai-based technology solutions and services company with a customer base consisting of banking, financial services, and insurance (BFSI), manufacturing, hospitality, publishing, and international organisations, among others.

The company is engaged in three key segments―digital operations, digital experience, and digital technology. It has operations across India, the USA, the UK, and Europe.

What makes the tech firm so special?

Datamatics has a first-mover advantage in the robotic process automation (RPA) segment and a strong focus on developing an automatic fare collection (AFC) system for several mega rapid transit projects such as the Mumbai Metro in India and Memphis Area Transit in the US, highlighted HDFC Securities in a research report.

Besides, acquisitions by the company over time have helped add to its basket of services. Datamatics has acquired two companies in the past five years.

Also Read: CDSL falls 4% after a large block deal; BSE likely seller

The company’s digital operations segment, which contributed 43 percent in FY23, is seen as reporting high volumes of new work in the next five years, including industry-vertical-oriented operations and enterprise back office operations, pointed out HDFC Securities.

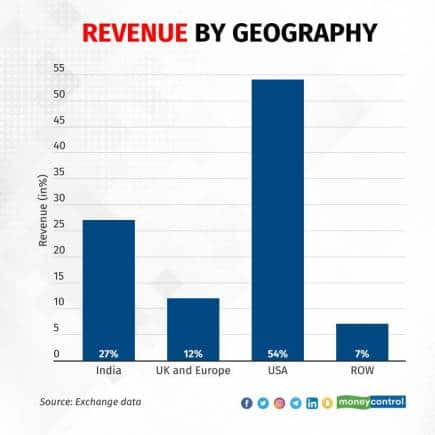

Although Datamatics has several ongoing major projects in India in its kitty, 54 percent of its revenue came from the US, according to the company’s latest investor presentation.

The overall demand environment looks positive, while the deal pipeline for the next year remains strong. Also, the company is likely to add clients going forward, some analysts said.

HDFC Securities explained, "Datamatic’s strong order inflow, stable financial profile led by steady revenue growth, strong liquidity profile, healthy internal accrual generation, comfortable capital structure, and extensive experience of promoters in the IT and ITeS (Information Technology-enabled Services) industry give us comfort."

ICRA, too, underlined the strong order book as one of the strengths of Datamatics. "The company’s order pipeline remains strong with TCV2 of deal wins worth $126 million in FY2022 and $48.3 million in H1 FY2023, which provides revenue visibility over the medium term," the credit rating agency said in a note dated January 5, 2023.

Technical view

Kkunal Parar, Vice President of Research, at Choice Broking, said that the stock has already shown good movement from Rs 289 to Rs 585.

"If the stock price touches Rs 590 and sustains its position for a week, you may see a further rise in the band of Rs 686-805," Parar added.

Meanwhile, HDFC Securities has set a bull case target of Rs 641 over the next two-to-three quarters. It expects the company to report 16.5 percent and 15 percent revenue growth in FY24 and FY25, respectively.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!