The broader indices outperformed the main indices amid supportive global cues including falling crude oil prices after ceasefire in the Middle East, hopes of extension of Trump tariff deadline and the possibility of a soon-than-expected US Fed rate cut. Domestic factors, including favourable monsoon forecast, and moderating domestic inflation also added fuel in the market rally.

Among broader indices, the BSE Large and Midcap indices rose more than 2 percent each, while Small-Cap index surged 3.5 percent.

For the week, the BSE Sensex index rose 1650.73 points or 2 percent to end at 84,058.90, and Nifty50 added 525.4 points or 2.09 percent to close at 25,637.80. However, for the month of June, both the indices gained more than 3 percent each.

The Foreign Institutional Investors (FIIs) extended their buying in second week as they purchased equities worth Rs 4,423 crore in this week. On the other hand, Domestic Institutional Investors (DII) also continued their buying in tenth consecutive week as they bought equities worth Rs 12,390.17 crore.

On the sectoral, Nifty Metal index added nearly 4 percent, Nifty Media index rose 4.3 percent, Nifty Oil & Gas index gained 3.2 percent and Nifty PSU Bank index added 2.5 percent. However, Nifty Realty Index shed nearly 2 percent and Nifty Information Technology index shed 0.4 percent.

"In the last week, the benchmark indices witnessed a promising uptrend rally. The Nifty ends 2 percent higher, while the Sensex gained 1650 points. Among sectors, Capital Market and Metal Indices outperformed, both gaining over 5 percent. Despite strong market sentiment, profit booking was observed in the Reality and Defense indices, with Reality down 1.80 percent and Defense shed nearly 1 percent," said Amol Athawale, VP-Technical Research, Kotak Securities.

"During the week, the market successfully cleared the crucial resistance zone of 25,300/82700, and post-breakout, it intensified its positive momentum. Technically, on weekly charts, it has formed a long bullish candle, which is largely positive. Additionally, it is maintaining an uptrend continuation pattern on daily and intraday charts and is currently trading comfortably above short-term averages, which is also positive," he added.

"For trend-following traders, 25,500–25,300/83300-82700 would act as crucial retracement support zones. As long as the market remains above these levels, the uptrend is likely to continue on the higher side, with 25,850/84400 serving as the immediate resistance level for the bulls. Further upside could potentially lift the market up to 26,000/84800."

"In the short term, the market texture appears bullish, but buying on dips and selling on rallies would be the ideal strategy. However, if the market falls below 25,300/82700, the uptrend could become vulnerable."

"For Bank Nifty, a breakout formation on daily and weekly charts supports further uptrend from the current levels. In the short run, 57,000–56,700–56,500 would be key support zones, while 57,500–57,800–58,200 could serve as crucial resistance levels for traders," Athawale said.

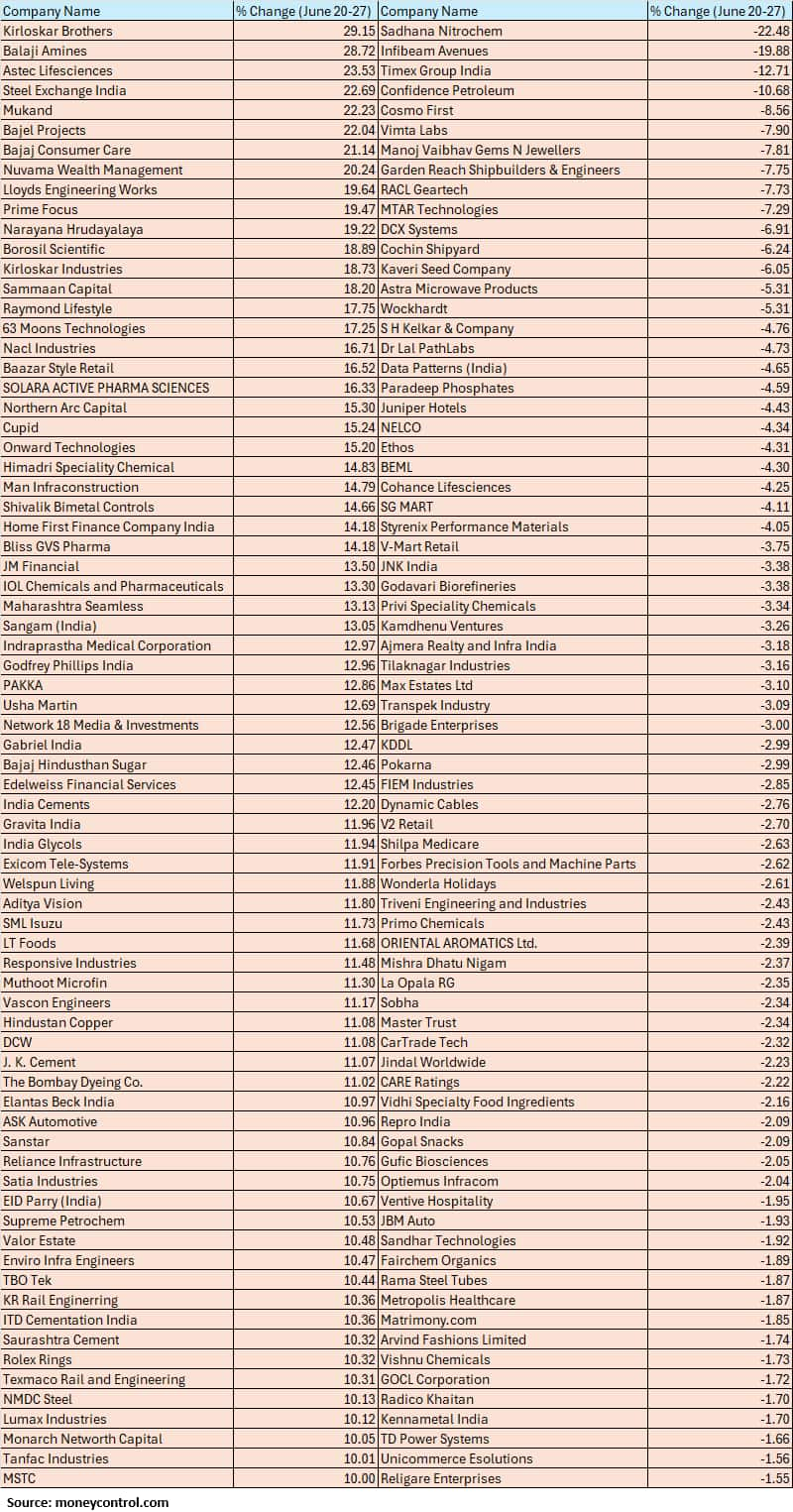

The BSE Small-cap index surged 3.5 percent with Kirloskar Brothers, Balaji Amines, Astec Lifesciences, Steel Exchange India, Mukand, Bajel Projects, Bajaj Consumer Care, Nuvama Wealth Management rising more than 20 percent each. However, Sadhana Nitrochem, Infibeam Avenues, Timex Group India, Confidence Petroleum fell between 10-22 percent.

On Friday, a long bull candle was formed on the daily chart which indicates uptrend continuation post decisive break out of the range movement. Nifty on the weekly chart formed a long bull candle after a range bound action of the last five weeks. This is positive indication and signals more upside for the near term.

The underlying trend of Nifty continues to be positive. The next upside to be watched around 25800-26000 levels by next week. Immediate support is placed at 25400.

Nandish Shah, Senior Derivative & Technical Research Analyst, HDFC Securities.Short term trend of the Nifty remains positive as it is placed above important short-term moving averages The Nifty has now entered the downward gap area of 25,640-25,740, created back on October 3rd, 2024.

Any decisive close above 25,740 could provide the impetus to push the index towards the next psychological and technical resistance of 26,000. On the downside, 25,317 now stands as a crucial immediate support level.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.