The stock prices of most the Housing Finance and NBFC companies witnessed heavy pressure and plunged by 10-40% intraday on Friday after the news spread that DSP MF was forced to sell commercial papers of DHFL (in the range of Rs 200-300 crore) in the secondary market at a higher yield.

The higher yield for the commercial papers is due to tight liquidity into the system. Investors raised concerns over the money market tightness amid continuing financial crisis at IL&FS.

Further, investors wanted to be risk-averse after the recent example of IL&FS, which dampened the overall market sentiment.

Other housing finance companies and NBFCs, too, witnessed sell-off, as borrowing cost for NBFCs, is expected to rise and they could face challenges in raising funds.

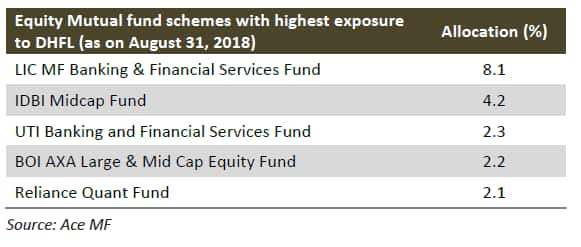

Market participants are linking this with other NBFCs and Housing Finance companies which hold commercial papers as one of their sources of funding. In the case of DHFL, commercial paper accounts for 6 percent of its borrowings.

The Management of DHFL has clarified that they have not defaulted on any bonds and also said that their commercial book stands at Rs 7,500cr.

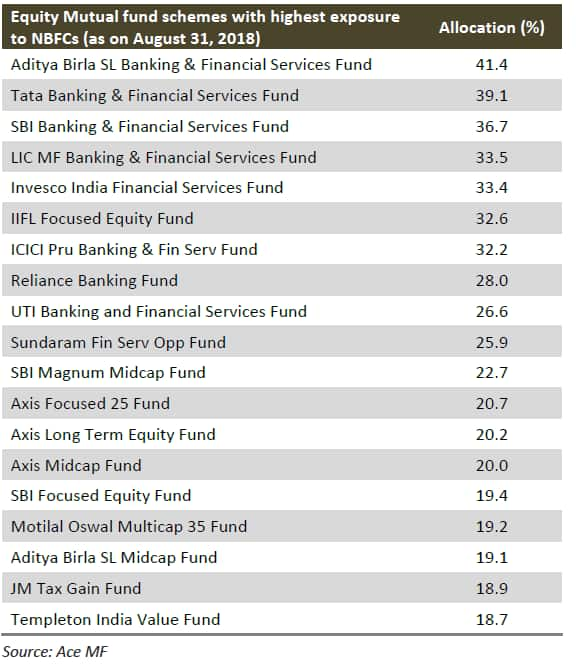

Many equity mutual funds schemes have significant exposure to NBFCs. The panic in NBFCs has not settled entirely. There are concerns over short-term liquidity in the market for commercial papers raised by NBFCs.

Therefore, we advise a client to reduce exposure to equity mutual fund schemes with significant exposure to NBFCs. Here is a list of mutual funds schemes with the highest exposure to DHFL and other NBFCs:

We recommend investors to invest in diversified equity mutual fund schemes having less exposure to NBFCs. In sector funds, we recommend investors to invest in IT and Pharma funds since both the sector have significant tailwinds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!