In this section we will be discussing about different types of Doji pattern.

A Doji candlestick is a significant signal in technical analysis. If prices finish very close to the same level so that no body or a very small real body is visible then that candle can also be read as a Doji.

IntroductionA Doji represents a supply/demand equilibrium or basically a tug-of-war where neither the bulls nor bears are winning.

As significant as the pattern is, one should not trade on the Doji alone and always wait for the next candlestick to confirm before taking any action.

There are different types of Doji candlesticks namely Long-Legged, Dragonfly and Gravestone.

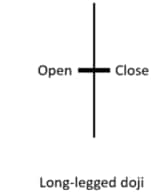

Long-Legged DojiThis indicates a strong battle between the "bulls" and the "bears" like dragging the price with a strong resistance all the way to where they wanted but lost control to the opposing force.

A Long-Legged Doji shows that the market traded at a wide range for a specific period. It is characterized by long twin shadows above and below its body.

This simply states that the bulls lost in battle, somehow, buyers dominated most of the session but caught off guard by sellers suddenly resurfacing pushing the price to where it opened.

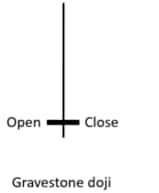

Since there are no lower shadows or wicks, buyers still supported the price indicating that the sell pressure is not enough to break the price level.

Gravestone Doji is formed when the price traded higher but ended the period back down near or on its open price.

This is the reverse of the Gravestone Doji where sellers were able to drag the price down but a sudden surge in buy orders weakened their grip.

This indicator shows that the "bulls" are building up force and starts applying pressure upwards, a very long bottom shadow Dragonfly Doji can be interpreted as a bullish signal, due to the fact that the price has been dragged all the way down, but still managed to re-surface back to its opening price, only a very strong surge in buy volume can generate this kind of movement.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.