Systematic Transfer Plan (STP) is a strategy where an investor transfers a fixed amount of money from one scheme to another, usually from debt funds to equity funds.

If an investor wants to invest Rs 10 lakh in an equity fund through STP, he will have to first select a debt/ liquid fund which allows STP to invest in that particular equity fund. Generally, both the funds are managed by the same fund house. After selecting the debt fund, one has to invest all the money i.e. Rs 10 Lakhs in the debt fund. A fixed amount can be transferred from debt fund to equity fund.

Types of STP:

Fixed STP – In this type of Systematic Transfer Plan, the transferable amount will be fixed and predetermined by the investor at the time of investment.

Capital Appreciation – The capital appreciated gets transferred to the target fund and the capital part remains invested in the scheme.

Flexi STP – Under Flexi STP unit investor have a choice to transfer a variable amount. The fixed amount will be the minimum amount and the variable amount depends upon the volatility in the market. If the NAV of the target fund falls, investment can be increased to take benefit of falling prices and if the market moves up, the minimum amount of transfer is invested to take advantage of increasing prices. Transfer facility is available on a daily, weekly monthly and quarterly interval.

STP in Different Time Periods

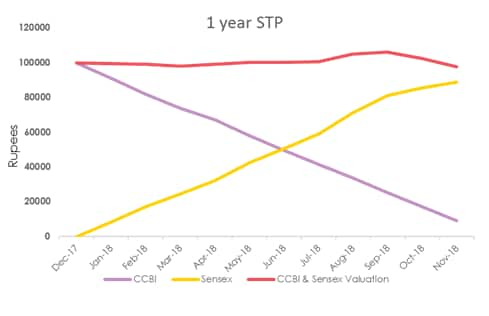

As a representative of asset classes, we have taken Crisil Composite Bond Fund Index (CCBI)/ Crisil Liquid Fund Index (CLFI) & Sensex as a proxy for Debt & Equity respectively.

The chart for a one-year investment with a 1STP done weekly is given as compared to a Lumpsum investment of Rs 1 lakh made in the individual indices for the same period. The 2STP gave returns of -0.77 percent, while CCBI gave 2.37 percent and Sensex gave 5.39 percent.

Chart 2 shows the 2STP of Rs 1 Lakh from Crisil Composite Bond Index (CCBI) into Sensex for 1 year. In an STP, the debt portion reduces while the equity portion increases proportionately. Using short term data points, weekly STP is marginally better as compared to monthly STP.

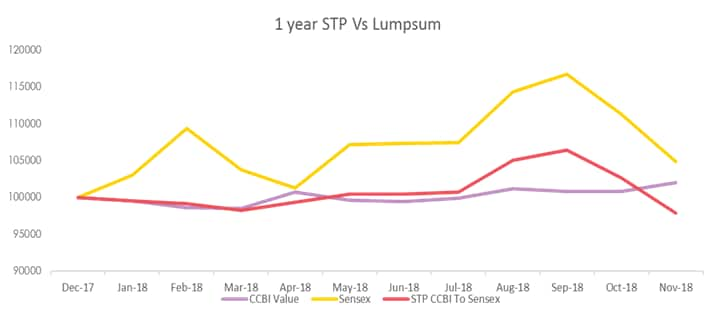

The chart below shows the valuation of Rs 1 Lakh, if invested lump sum in both the indices as compared to STP done from CCBI to Sensex gave -2.12 percent. The CCBI gave 1.98 percent, while the Sensex index would have given 4.87 percent.

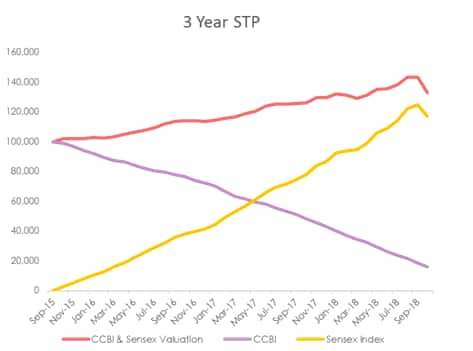

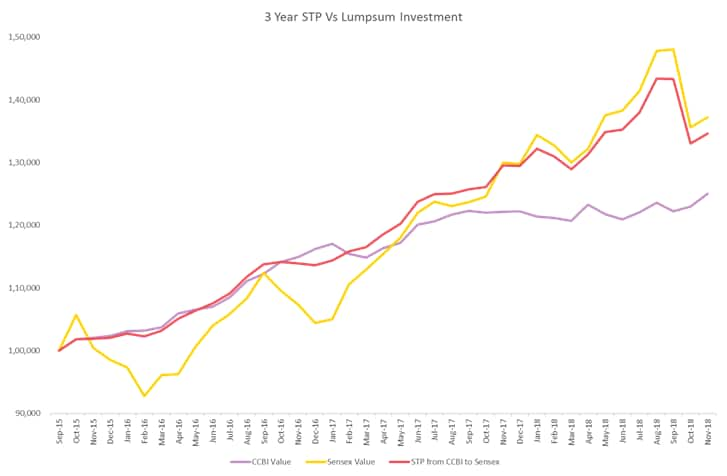

The chart shows the 1STP of Rs 1 lakh from Crisil Composite Bond Fund (CCBI) into Sensex for 3 years.

The 3 year STP would have given returns of 3-year CAGR returns were 9.56 percent.

If Rs 1 lakh was invested lump sum in both the indices, the CCBI would have given CAGR of 7.56 percent, while the Sensex index would have given 10.25 percent. As represented in the chart below.

From the chart, we can observe that the 3 year STP is limiting the downside with the help of debt exposure as well as giving higher returns due to the equity exposure.

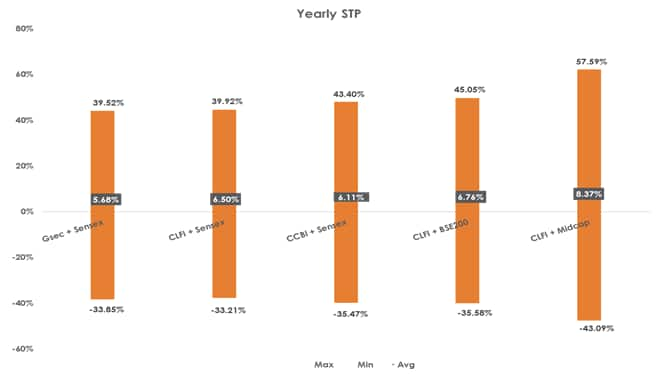

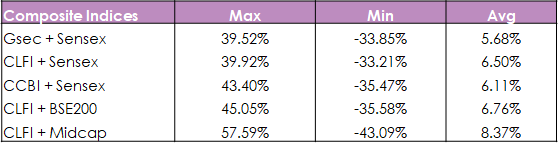

The chart above shows the minimum, maximum and average returns for year on year STP done from various combination of indices of debt to equity. The chart is from 2008 to 2018.

We can observe from above, that average and maximum returns of Crisil Liquid Fund Index plus S&P Midcap Index are greater than the rest. At the same time, the minimum returns are more, confirming high-risk high reward. GSec plus Sensex doesn't seem to be an efficient mix, as compared to others.

The data shows CLFI can be a preferred debt class from where one can start an STP to an equity asset class. The preferred equity asset class to put the STP in is S&P Midcap with higher variance in returns.

(The author is a Head – Sales and Marketing, IDFC AMC)

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.