Chandan Taparia

In the Chart Patterns one of the types is the Broadening Bottom and Broadening Top Pattern. The Pattern forms a megaphone-like appearance with higher highs and higher lows that widen over the time.

The Broadening Pattern has two major sub-types under Bottom and Top that includes Upward Breakouts and Downward Breakouts. There are five touch points in the megaphone appearance that lead to the pattern formation.

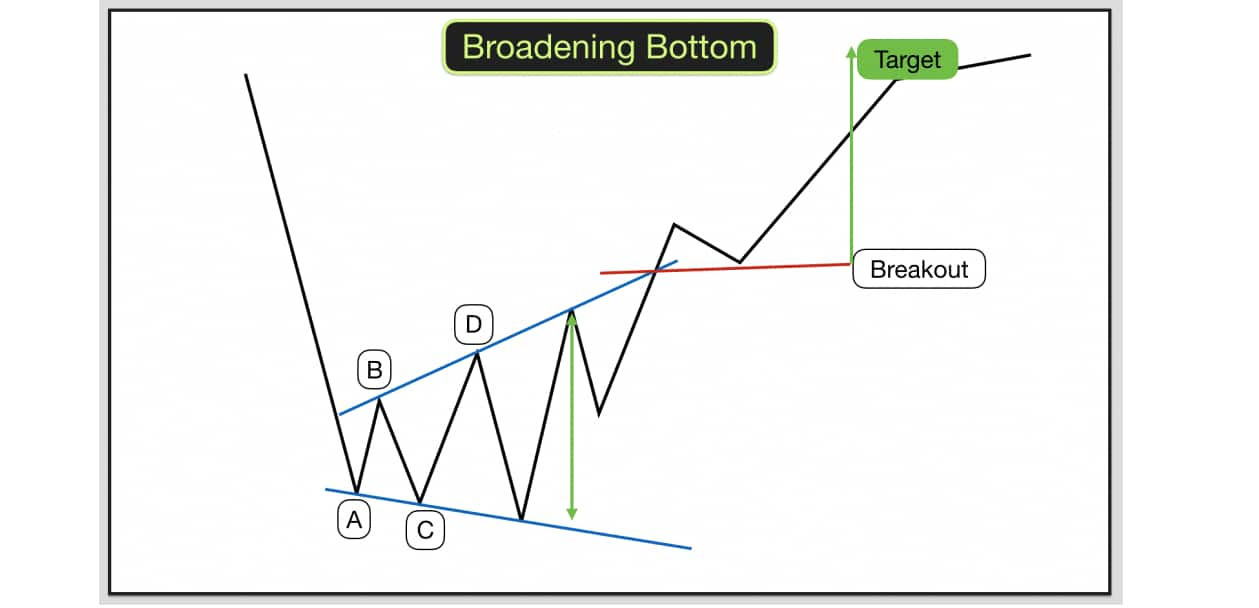

a) Broadening Bottom:

A downtrend leads to the formation of Broadening Bottom. It is further classified as an Upward Breakout and Downward Breakout; where the former is a short-term bullish reversal pattern while the latter is a short-term bearish continuation pattern.

The broadening bottom formation in terms of upward breakout; called as a five-point reversal pattern as it has the two minor lows and three minor highs.

The average width of this pattern is between one and two months long. If price pierces the trend line, then the penetration point becomes the breakout point, either ways upward or downward. Up breakouts do better when the volume trend is falling, and downward breakouts do better with a rising volume trend.

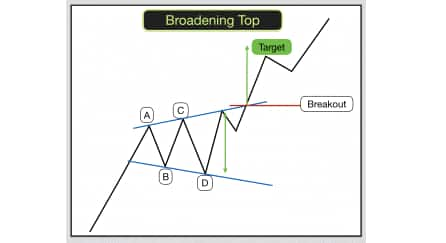

b) Broadening Top:

An uptrend leads to the formation of the Broadening Top. It is further classified as an Upward Breakout and Downward Breakout; where the former is a short-term bullish continuation pattern while the latter is a short-term bearish reversal pattern.

There should be at least two minor highs and two minor lows before the chart pattern becomes a broadening top. The average pattern length ranges in between 50 to 65 days. Patterns in bull markets do better with a falling volume trend.

Bear market patterns excel with a rising volume trend. A breakout happens when prices move outside the trend-line boundaries or follow a trend line for an extended time.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.