Shabbir Kayyumi

OBV or on balance volume indicator is used for technical analysis to measure buying and selling pressure.

The technique, originally called "continuous volume" by Woods and Vignola, was later named "on-balance volume (OBV)" by Joseph Granville, who popularised the technique in his 1963 book ‘Granville's New Key to Stock Market Profits’.

What is an On Balance Volume (OBV)?

The On Balance Volume Indicator is regarded by the industry as one of the most popular momentum and leading indicators, and is best used to detect new trading opportunities.

OBV measures buying and selling pressure as a cumulative indicator that adds volume on up-days and subtracts volume on down-days.

Figure .1.Illustration of OBV Indicator

Figure .1.Illustration of OBV Indicator

The OBV is primarily traded on stocks as well as indices, commodities and Forex. It is a pure momentum oscillator, such as RSI, whereas pattern analysis can be combined with OBV to increase signal robustness.

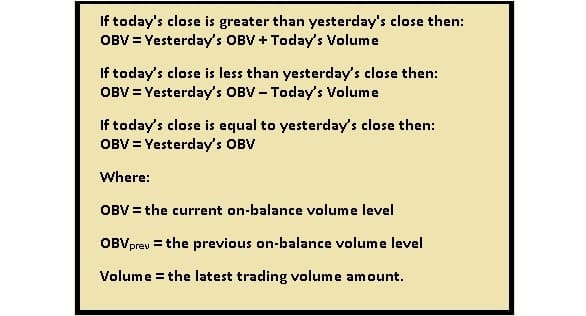

Construction of OBV Indicator

On Balance Volume (OBV) measures buying and selling pressure as a cumulative indicator that adds volume on up-days and subtracts volume on down days. When the security closes higher than its previous close, all of the day’s volume is considered up-volume. When the security closes lower than its previous close, all of the day’s volume is considered down-volume.

Figure .2.Construction of OBV Indicator

Figure .2.Construction of OBV Indicator

For example, a negative day with 10,00,000 volume is not as significant if the next up day has 50,00,000 in volume. The volume indicates buyers are very active in pushing the price up, and therefore OBV will move up over the two day period, even though one day was down and the other up.

Working of OBV Indicator

For traders, the value of OBV is not important, rather it is the rate of change in OBV which is used to help generate trade ideas. If the OBV is moving notably in one direction, it could give credence to the idea that a big move could be coming in that direction in price.

- When both price and OBV are making higher peaks and higher troughs, the upward trend is likely to continue.

- When both price and OBV are making lower peaks and lower troughs, the downward trend is likely to continue.

- During a trading range, if the OBV is rising, accumulation may be taking place -- a warning of an upward breakout.

Figure .3. Working of OBV Indicator

Figure .3. Working of OBV Indicator

- During a trading range, if the OBV is falling, distribution may be taking place—a warning of a downward breakout.

- When a price continues to make higher peaks and the OBV fails to make higher peaks, the upward trend is likely to stall or fail. This is called a negative divergence.

- When price continues to make lower troughs and OBV fails to make lower troughs, the downward trend is likely to stall or fail. This is called a positive divergence.

The actual OBV value is not important, since the number can be huge, near zero, negative or positive. Therefore the right axis of the OBV indicator can be ignored; however direction and trajectory is important.

Trading technique:

Trading with divergence:

Divergence occurs when the price movement is not confirmed by the indicator. In many cases, these divergences can indicate a potential reversal. Especially considering the premise behind the OBV indicator, which is positive and negative, volume swings precede changes in price.

- Bullish OBV Divergence occurs when price declines but OBV advances.

- Bearish OBV Divergence occurs when price advances but OBV declines.

- If the OBV shows a divergence from price movement, a price reversal is imminent. For instance, if the price is rising, but the OBV starts to drop, a possible selling opportunity may exist.

Trading with Trend line & EMA

Buying with OBV

1. OBV trading above EMA (20).

2. OBV trend line bullish break out.

3. Confirmation by bullish candlestick.

4. Positive Divergence will add better reversal; however it is not necessary.

Figure.4 OBV Buy & Sell Signals

Figure.4 OBV Buy & Sell Signals

Selling with OBV

- OBV trading below EMA (20).

- OBV trend line bearish break down.

- Confirmation by bearish candlestick.

- Negative Divergence will add better reversal; however it is not necessary.

Traders should use the OBV in conjunction with other technical indicators to maximize their odds of success.

Conclusion

- OBV shows crowd sentiment which can predict a bullish or bearish outcome.

- On-balance volume (OBV) is a leading technical indicator of momentum, using volume changes to make price predictions.

- Divergences between OBV and price indicates the price may be due for a reversal.

- Using trend lines can aid in spotting divergences and trading opportunities.

- OBV can also help forecast breakout directions in price.

(The author is Head - Technical & Derivative Research at Narnolia Financial Advisors.)Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.