Suzlon Energy, a wind-turbine maker, has emerged as the investors' darling over the last year, with its stock price trebling in value.

The company's market capitalisation more than doubled in the last two months alone to Rs 22,500 crore.

However, the stock recently witnessed some profit booking and got locked in the lower circuit of 5 percent, ahead of a board meeting to raise funds this year, just one year after its rights issue. This has raised serious concerns about the company's balance-sheet health.

Back in October 2022, Suzlon Energy launched a Rs 1,200 crore rights issue, which was oversubscribed by 1.8 times. As part of its fund-raising plan, the company offered 240 crore rights or shares at Rs 5 per equity share. According to CNBC TV18, the company is now looking to raise around Rs 2,000 crore through the QIP route.

The company's board is scheduled to meet on July 7 to discuss its fund-raising plan.

Suzlon Energy has been in a favourable position since the country amended its wind energy policy and introduced a series of initiatives, including discontinuing reverse auctions, implementing wind-specific renewables purchase obligations (RPOs), and planning to auction 10GW per annum.

These policies are expected to provide tailwinds for the industry, and as Suzlon holds a significant market share of 33 percent in the domestic market, the company stands to benefit.

Globally, the company has 20 GW of operational wind power capacity and an existing order book of 1.5GW, which bodes well for execution over the next two years.

In fact, on June 29, 2023, ICICI Securities released an initiation report on the company, highlighting four factors: a slew of policy actions, emphasis on the wind business, a sharp improvement in the industry outlook, and a repaired balance sheet.

The brokerage suggested that the company is best equipped to benefit from the industry tailwinds and could experience a significant uptick in FY24 earnings.

Things working in favour of the company :

Let's address some of the concerns for the company:

Slower debt reduction pace in 2024

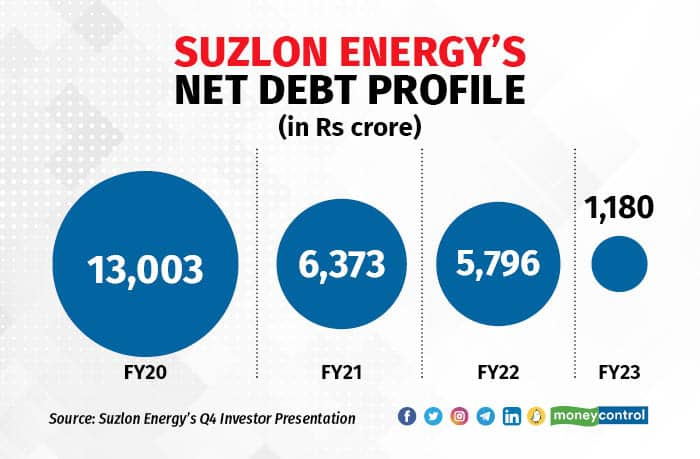

Suzlon has refinanced its existing debt in May 2022 ,replacing 16 lenders with two new ones. According to the management's comments in the March quarter concall, the company may not be able to reduce debt at the same pace as witnessed in the last few years. But it would like to utilise its cash flow to service debt.

Suzlon Energy's Debt Profile

Suzlon Energy's Debt Profile

Intense competition may lead to dwindling market share :

Suzlon remains a formidable competitor in the domestic market. However, a Chinese entrant, named Envision, has been able to ramp up and build a 2GW order book. Siemens Gamesa is also a strong competitor. This situation may pose a threat to Suzlon's market share, which has remained steady at over 30 percent in the domestic market.

Financial health of discoms :

Discoms are the ultimate buyers of electricity. However, the deteriorating financial health of discoms could lead to payment delays for wind developers, ultimately leading to reduced installations.

Other concerns

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.