The recent US-China agreement to ease tariffs may have dampened hopes of Indian solar equipment exporters looking to benefit from the China+1 narrative, but experts are confident that a robust domestic demand and newer markets will keep the share prices high.

Industry experts said emerging opportunities for Indian exporters after the UK FTA, along with a growing domestic demand could ensure continued momentum in shares of renewable sector companies, despite elevated valuations.

Over the last few days, shares of solar players like Waaree Energy, KPI Energy and Adani Green Energy have seen strong gains on strong quarterly results and capex guidance. Waaree Energy reported an 83% on-year (YoY) surge in consolidated net profit at Rs 93.76 crore. Waaree Solar Americas Inc, a wholly-owned subsidiary, also announced an additional $200 million investment for US operations, to focus specifically on Battery Energy Storage. The stock has risen around six percent over the last five trading sessions.

Similarly, shares of KPI Green Energy gained nearly 21 percent over the last five sessions, along with a 130 percent YoY rise in net profit from Rs 99.4 crore in the previous fiscal.

Also read: Makers of wind turbines, solar modules eye a slice of UK's $20 billion clean energy market

The Domestic Opportunity

India’s solar industry is still largely being driven by domestic demand, with over 100 GW of installed capacity and a planned clean energy target of 500 GW by 2030. The nation will need to add 35–40 GW of solar capacity annually to achieve this, creating a long-term runway for equipment made by local manufacturers.

“Currently, the total capacity across all major Indian solar players—both listed and unlisted, including companies like Waaree, Vikram Solar, and Adani—adds up to less than 100 GW. This shows that the domestic opportunity is massive and still largely untapped. Indian manufacturers are primarily focused on meeting this internal demand, which is more than enough to sustain growth over the next 5 to 10 years,” said Krishna Appala, Fund Manager at Capitalmind PMS. Schemes such as the Production Linked Incentive (PLI) and safeguard duties on imports continue to provide tailwinds for domestic manufacturers.

Exports – A Slow Grind

The rollback of US tariffs on Chinese solar products to historical levels (around 30%) is seen as a return to the normal, rather than a shift, experts have said. While this reduces the short-term advantage of Indian firms, the long-term export story is still believed to be intact.

Capitalmind PMS’ Appala said trade agreement with the UK is one such example. “The UK–India FTA is an important door opener but export gains won’t come automatically. India needs to meet quality benchmarks and offer globally competitive pricing,” Appala said.

Asit C Mehta's Head of Research, Siddarth Bhamre believes Indian manufacturers need to step up to capitalize on these avenues. "Everything is coming back to pre-Trump tariff levels. These FTAs—whether US-China, US-UK, or UK-India won’t meaningfully alter the global trade order. Just because an FTA is signed doesn’t mean companies will start importing substandard goods from one country or paying more just because tariffs are lower. Ultimately, economics and quality drive trade, not just agreements,” said Bhamre. India must stay focused on scaling up efficiently, he added.

“FTAs help settle nerves and open opportunities, but success depends on how well Indian firms can deliver at scale, with consistent quality and competitive costs. That’s when you become globally relevant. If you’re efficient, you don’t need an FTA to sell. If you’re not, even an FTA won’t help you,” Bhamre said.

The consensus view is that India needs to scale up not only production but technological sophistication as well. Elara Securities’ Senior Research Analyst Rupesh Sankhe said that with China leading in next-gen modules such as TopCon (Tunnel Oxide Passivated Contact) and HJT (Heterojunction Technology), which offer efficiencies of 24–25 percent, India must close the innovation gap to stay competitive.

Valuations High, but Backed by Fundamentals

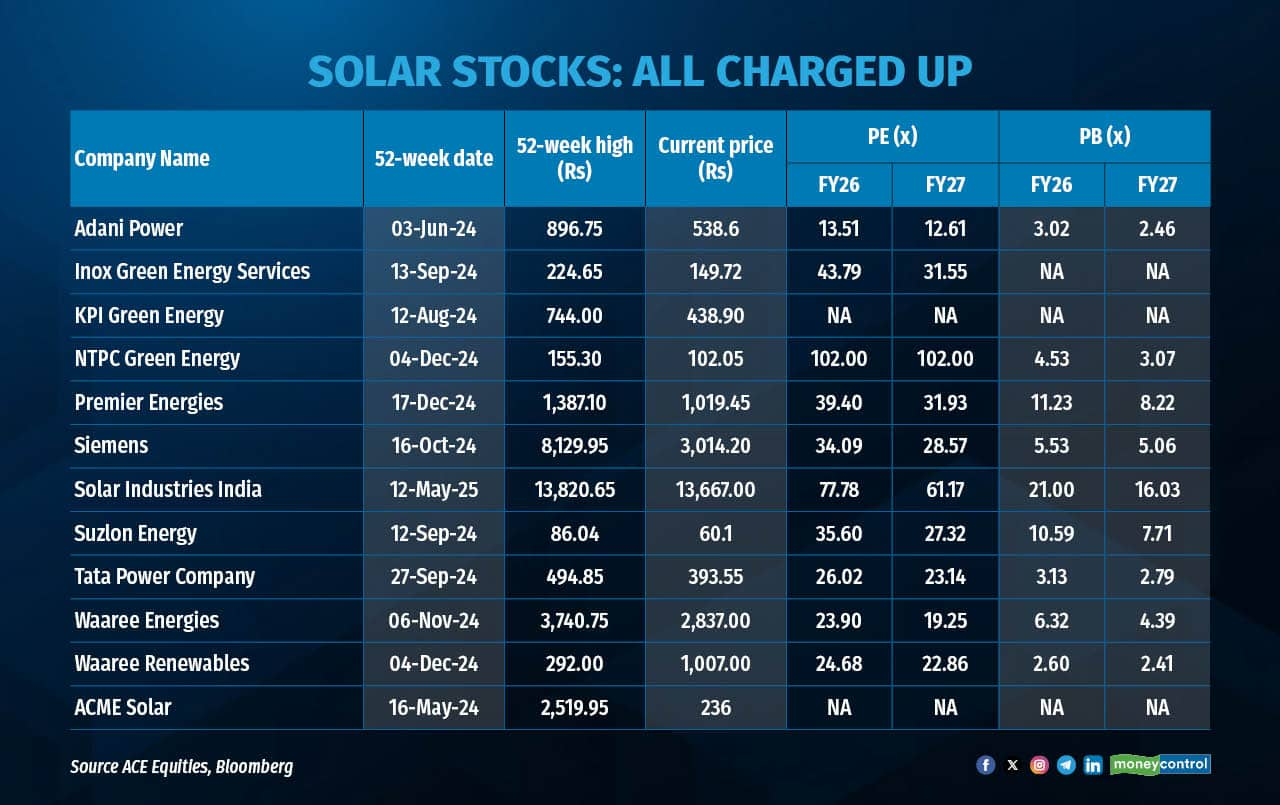

Overall, most analysts are bullish on Indian solar companies, even at premium valuations, reflecting long-term optimism. While there has been some correction in the past one year, companies like Adani Green Energy, Waree Renewables and ReNew Power still command higher multiples, backed by momentum from earnings, capex guidance and the overall opportunity.

While valuations are off by 25–30% from peak, they still remain high, hovering around 4x P/B, compared to 6-7x previously. "These companies are attractive long-term investments, thanks to the strong balance sheets, low-cost execution, and supportive government policies. It’s a future technology, long-term growth story,” Elara’s Sankhe said.

Capitalmind’s Krishna Appala too believes that shares of domestic solar equipment makers are pricier compared to global peers. “Valuations across the Indian solar sector remain rich, particularly relative to global renewable peers. While pricing has moderated from the exuberance of 2021–2022, multiples continue to reflect robust growth expectations," said Appala, adding that policy support, export growth and long-term earnings visibility is keeping the multiples high.

Appala sees beneficiaries across the value chain, ranging from EPC contractors to module manufacturers and component suppliers. Those with strong execution, integrated models, or backward linkages are better-placed to capitalize on both domestic growth and global diversification away from China, said the Capitamind PMS fund manager.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.